Author: Revc, Golden Finance

SKY——MakerDAO’s brand upgrade

MakerDAO has changed its name to Sky and will launch a new product, Sky.money, and a new DeFi application on September 18. Users can redeem USDS on Sky and get SKY token rewards. Complete registration and participate in related activities to get double SKY token rewards. However, users in some jurisdictions (such as the United States) may still not be able to get SKY token rewards through Sky.money after this upgrade.

The established MakerDAO tokens DAI and MKR will continue to circulate, and users will be free to decide whether to redeem them for new tokens. The main functions of the new token are as follows:

SKY: An upgraded version of MKR, used to govern the Sky ecosystem.

USDS: The corresponding stable currency of DAI. Holding USDS can get SKY token rewards.

After the news was announced, MKR immediately rose by more than 4%. However, affected by the overall market, MKR has fallen back by 8.2%.

The deep meaning behind MakerDAO's name change to "Sky"

In his article "Reconciling Two Opposing Paths to Decentralized Stablecoins," Christensen pointed out that decentralized stablecoins, especially projects such as those represented by MakerDAO, are under a severe regulatory environment. Especially in the United States, regulators are increasingly tightening their supervision of cryptocurrencies. Against this background, MakerDAO chose to change its name to "Sky", in addition to aiming to expand the protocol to a scale comparable to stablecoins such as Tether, or even larger. It can also be understood for the following reasons:

Adapting to regulatory changes: The name change helps MakerDAO to draw a clear line with its past identity and provide greater flexibility for future development under a stricter regulatory environment.

Simplify brand recognition: The name "Sky" is simpler and easier to understand than "MakerDAO", and is more easily accepted by the general public, which helps to expand the user base.

Expand the user base: A brand name that is easier to remember can attract more users who are not familiar with cryptocurrencies, thereby promoting the popularity of stablecoins.

In addition to the name change, MakerDAO is also actively making improvements in other aspects, such as:

Optimize smart contracts: Improve the security, efficiency and reliability of the system.

Improve the governance mechanism: Enhance community participation and improve decision-making efficiency.

Enhance system scalability: Meet the growing user needs in the future.

Stablecoin Market Analysis

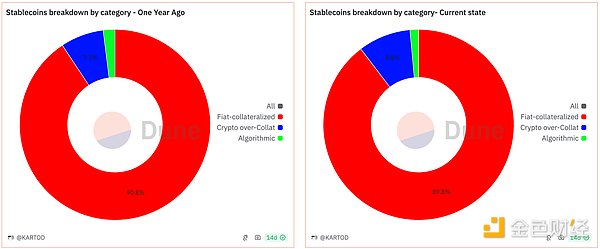

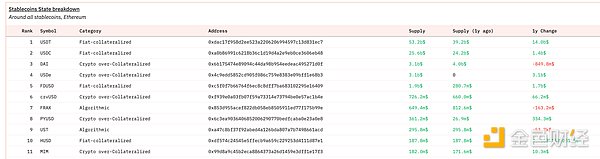

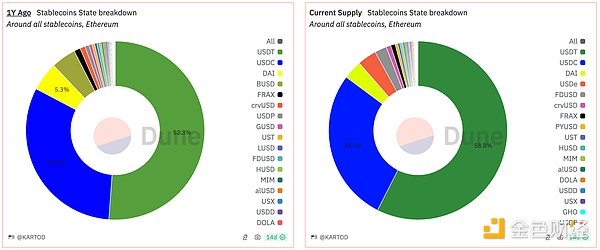

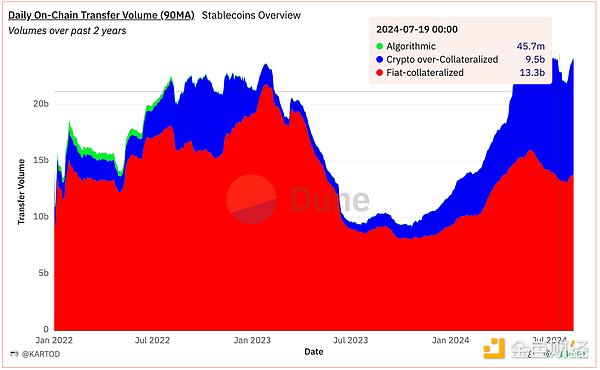

Maker's SKY upgrade is aimed at the $100 billion stablecoin market. According to data provided by @KARTOD analyst on Dune, the market share of stablecoins supported by over-collateralized cryptocurrencies (Figure 1 below) has not only failed to grow in the past year, but the total supply of DAI has also decreased by nearly $800 million (Figure 2 below). Against the backdrop of low regulation and encryption popularity, the performance of the stablecoin market supported by cryptocurrencies is also a microcosm of the development of DeFi, and Maker's transformation this time is obviously intended to break this situation.

However, although the market share of stablecoins with over-collateralized cryptocurrencies is relatively low (Figure 1 below), the circulation rate has unique advantages, especially in combination with DeFi application scenarios. Since the beginning of this year, the on-chain transaction volume of stablecoins supported by over-collateralized cryptocurrencies has increased significantly (Figure 2 below).

MainstreamStablecoinCharacteristicsComparison

Stablecoins supported by over-collateralized cryptocurrency

Features: Users deposit excess cryptocurrency as collateral, and the system mints stablecoins based on the collateral rate. The process is usually managed by smart contracts, with a high degree of transparency and decentralization. In addition, it is not easily controlled by a single institution and is more resistant to censorship. It can be deeply integrated with the DeFi ecosystem to derive more financial products.

Disadvantages: Price fluctuations of collateral assets will affect the value of stablecoins and may lead to liquidation risks. The technical implementation is relatively complex and may be difficult for ordinary users to understand. Due to its innovativeness, regulatory policies are not yet perfect and face policy risks.

Fiat-backed stablecoins

Features: The issuer holds a fiat currency reserve (liabilities and net assets) equal to the amount issued. The process is usually issued and managed by a centralized institution. Due to the anchoring of fiat currency, the price fluctuation is small. Users are more likely to accept it. It is relatively easier to obtain regulatory approval.

Disadvantages: Issued by a centralized institution, there are regulatory risks and credit risks. The transparency of the proof of reserves may not be sufficient, and users have limited understanding of the reserve situation. If there is a problem with the issuer, it may trigger a run risk.

Comparison of USDT and DAI data

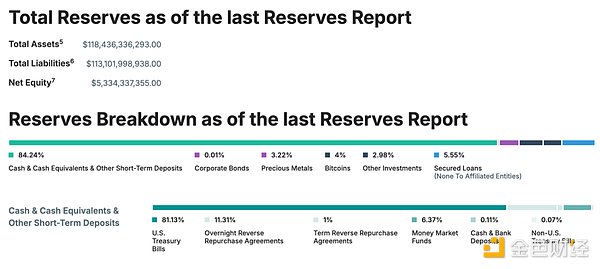

According to the report disclosed on the official website of USDT (Tether) (Figure 1 below), as of June 30, 2024, Tether's reserves are mainly composed of cash and cash equivalents, mainly US Treasury bills. This indicates a relatively conservative investment strategy aimed at minimizing risks and ensuring the stability of Tether tokens.

The inclusion of a small amount of precious metals and Bitcoin in the reserves indicates that Tether may be exploring such investments, on the one hand to hedge against inflation or market volatility, and most importantly to gain recognition from crypto natives and obtain more crypto application scenarios.

MakerDAO and its stablecoin DAI occupy an important position in the field of decentralized finance (DeFi). Compared with other stablecoins, DAI is unique in that it does not rely on centralized institutions or fiat currency reserves, but is decentralized through smart contracts and community governance. The stability of DAI comes from the excess cryptocurrency collateral provided by users to ensure that the system always remains solvent. At the same time, MakerDAO uses mechanisms such as stability fees and DAI savings rates to dynamically adjust the system to maintain the peg between DAI and the US dollar. The most important thing is that the governance of MakerDAO is jointly determined by MKR holders and has a high degree of community participation.

The key to DAI's success is to provide stable value in the turbulent crypto market and become the underlying asset for a variety of DeFi applications. It supports multiple collaterals, constantly adapts to market needs, and integrates with many DeFi protocols. It is community-driven and transparent in decision-making, which enhances the resilience and adaptability of the system. It has shown good resilience in multiple market fluctuations and won the trust of the market. At present, DAI is also the largest decentralized stablecoin.

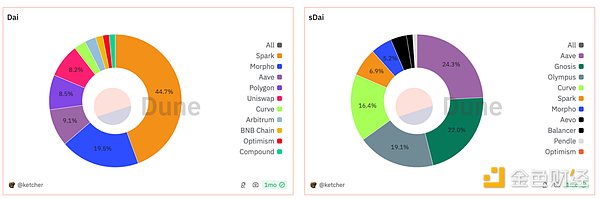

As shown in the figure, the Spark protocol is currently the main circulation market for DAI. Spark is a decentralized lending protocol built on the MakerDAO ecosystem, which aims to improve the liquidity and utilization of DAI and promote the further development of the MakerDAO ecosystem. The main product SparkLend supports multiple lending modes, including efficiency mode (eMode) and isolation mode. Improve the utilization rate of DAI and expand the application scenarios of DAI. The Spark protocol combines MakerDAO's stablecoin DAI with the innovation of the DeFi world to provide users with more flexible and efficient financial services.

Summary

SKY is a bold attempt by MakerDAO to push the protocol to a new stage of development. DAI or USDS can better integrate DeFi application scenarios, which is a unique advantage compared to USDT, while decentralized stablecoins are more flexible in terms of collateral support and can attract more users through the DeFi reward mechanism. In the competition with stablecoins such as Tether, it is expected to compete for a larger market share.

At the same time, MakerDAO should also be cautious about the problems exposed in catering to supervision. For example, if the freezing function is introduced in subsequent upgrades, it will cause resistance from the crypto community.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Dante

Dante JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph