Author: Lian Ping Source: Wall Street Journal

Today's Political Bureau of the CPC Central Committee pointed out that a moderately loose monetary policy should be implemented.

In September, Lian Ping, chief economist of Guangkai Chief Industry Research Institute and chairman of the China Chief Economist Forum, published an article entitled "It is recommended that the tone of monetary policy be adjusted to "moderately loose"". Lian Ping suggested that a more scientific and reasonable definition of the tone of monetary policy should be made. Adjusting the tone of monetary policy to "moderately loose" will create a suitable policy environment for implementing more aggressive reserve requirement ratio cuts and interest rate cuts.

In the article, Lian Ping reviewed the practice of my country's monetary policy over the past 30 years. The central bank only implemented a "moderately loose" monetary policy during 2009-2010.

The following is the full text of Lian Ping's article:

Since 2011, my country has implemented a "prudent" monetary policy tone for 14 years. The current domestic and international economic situation has undergone major changes, especially the relatively severe demand shortage, deflation and downward pressure faced by China, while the monetary policies of the United States and Europe are turning to easing. Against this background, should my country's monetary policy continue to maintain a "prudent" tone? Or should it be adjusted in a timely manner to send a more positive and clear policy signal to the market, so that monetary policy can better play the role of counter-cyclical regulation? This article will discuss and put forward opinions.

1. Flexible adjustment of monetary policy should be the norm

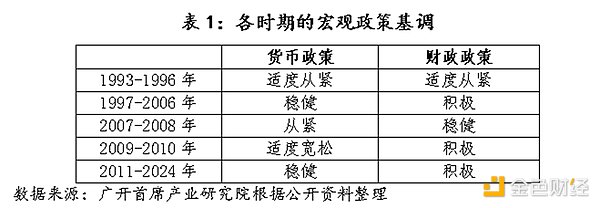

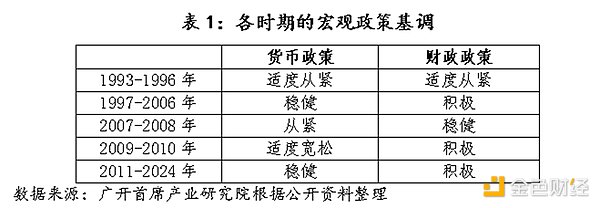

Looking back at the practice of my country's monetary policy over the past 30 years, the tone of monetary policy can be divided into "tight", "moderately tight", "prudent", "moderately loose" and "loose" intervals from tight to loose. The monetary authorities, based on changes in the objective situation, take "prudent" as the core and flexibly adjust between "tight" and "loose" to achieve the purpose of stabilizing the economy and counter-cyclical regulation.

In 1993, my country's economy was overheated and inflation was serious. The central government adopted a moderately tight monetary policy. By the end of 1996, inflation that had lasted for three years had dropped sharply. In 1997, my country faced a situation of sluggish domestic demand, coupled with the severe external shock brought by the outbreak of the Asian financial crisis, which led to a deflationary situation. In response to internal and external pressures, the tone of monetary policy shifted from "moderately tight" to "prudent", maintaining the stability of the RMB by appropriately increasing the money supply, and using credit leverage to promote the expansion of domestic demand and increase exports. At the end of 2007, in order to prevent economic growth from turning from fast to overheating, the Central Economic Work Conference set the tone of monetary policy in 2008 as "tight". In September 2008, with the bankruptcy of Lehman Brothers Bank as a symbol, the US subprime mortgage crisis accelerated and my country's economy was also affected by the unprecedented financial crisis in a century. The central government decided to implement an active fiscal policy and a moderately loose monetary policy, which continued until 2010. Since 2011, in order to prevent inflation, asset price bubbles, "hot money" movements and financial risks, my country has returned to the tone of "prudent" monetary policy. Since then, about 14 years have passed, and the tone of my country's monetary policy has not changed much, but there is a tendency to be loose or tight in actual operation. Among them, the prudent monetary policy from 2011 to 2013 was generally tight, emphasizing the prevention of inflation; the prudent monetary policy from 2014 to 2019 returned to "prudent neutrality", emphasizing neither looseness nor tightness; the prudent monetary policy from 2020 to 2024 was essentially loose, highlighting the flexibility, moderation, precision and power of monetary policy.

Looking back, there are several points worth noting in the practice of my country's monetary policy tone:

First, when the economy faces a severe shock, the tone of monetary policy will often be adjusted in a directional or large-scale manner.From historical experience, when the economy is overheated or under the threat of inflation, the tone of monetary policy will usually be adjusted quickly in a tight direction. For example, in 1993, the monetary policy was “moderately tight”, and in 2008, the monetary policy was “tight”. In the context of the contraction shock, the monetary policy tone will be adjusted in a timely manner to the direction of looseness. This adjustment may be one or two steps. For example, in 1997, the monetary policy tone shifted from “moderately tight” to “sound”. In 2009, the monetary policy tone skipped “moderately tight” and “sound” and directly jumped to “moderately loose”.

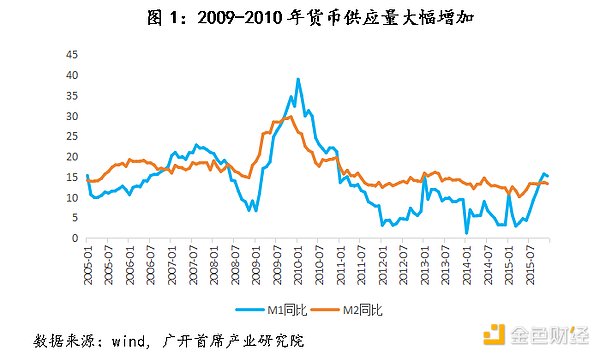

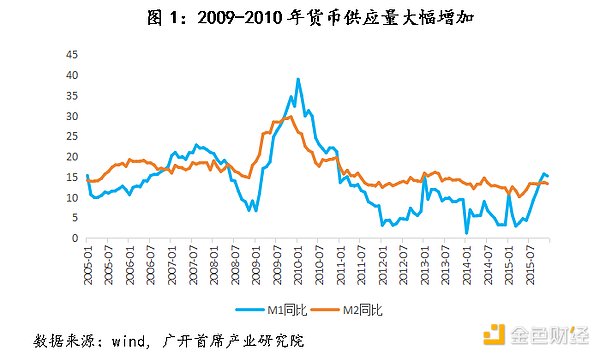

Second, the monetary policy tone sometimes appears to be “not worthy of the name” in actual operation. Among the five major tones, “tight”, “moderately tight”, “sound” and “moderately loose” have all appeared at different times, but “loose” is the only one missing. But this does not mean that the “loose” tone is really absent. During 2009-2010, my country's monetary credit grew rapidly, especially from the end of 2009 to the beginning of 2010, when the year-on-year growth rate of M1 reached 38.96%, the growth rate of M2 was close to 30%, and the growth rate of various RMB loan balances exceeded 34% for several consecutive months; matching the rapid growth of credit, local financing platforms sprang up like mushrooms after rain, and some regions even established more than ten financing platforms in a short period of time. It can be seen that the tone of monetary policy at that time was far from the nominal "moderate easing", but a real "easing". Similarly, "prudent" sometimes means "moderate easing" (such as in 1997), and sometimes "moderately tight" (such as in 2011-2013). Often its expression is inversely related to the tone of the previous policy, and it is necessary to grasp its relative looseness and tightness changes based on the actual situation.

Third, the tone of monetary policy in recent years has been insufficiently flexible. Before 2011, the tone of monetary policy switched between "tight", "moderately tight", "prudent" and "moderately loose" in a timely manner according to changes in the objective situation and the needs of regulatory targets; after 2011, although the economic operation also underwent significant changes and fluctuations at different stages, the flexibility of the tone of monetary policy was obviously insufficient, and the "prudent" tone was continuously used for 14 years. In fact, over the past 14 years, the Chinese economy has experienced a series of fluctuations. For example, the economic downturn and capital outflows in 2015-2016; the trade war launched by the United States against China in 2018-2019; the impact of the epidemic in 2020-2022, and so on. But the overall tone of monetary policy has not changed. This is obviously not conducive to the counter-cyclical adjustment of monetary policy according to the needs of the real economy. Of course, the spillover effect of the Federal Reserve's monetary policy has brought certain constraints to my country's monetary policy, but the Federal Reserve's monetary policy has undergone several rounds of major adjustments in the past 14 years.

Second, it is necessary and possible to adjust the current monetary policy tone to "moderate easing"

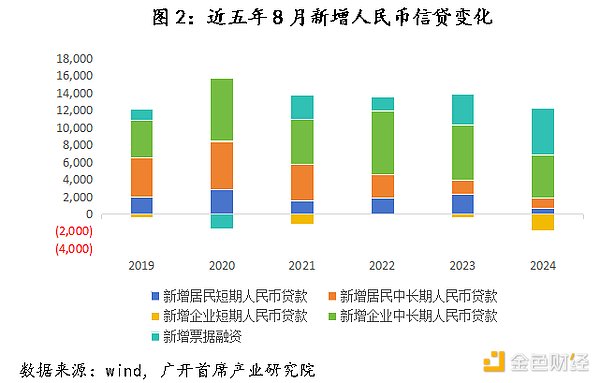

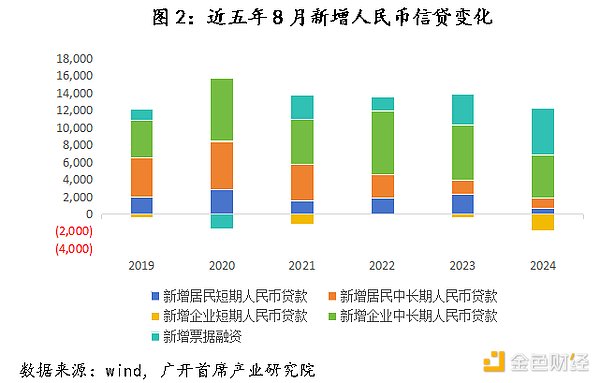

First, from the perspective of the domestic environment, macroeconomic and financial indicators are relatively weak, and monetary policy is urgently needed to further support. In August 2024, my country's manufacturing purchasing managers' index (PMI) was 49.1%, down 0.3 percentage points from the previous month. The manufacturing boom continued to decline and was below the boom-bust line for the fourth consecutive month. Since the beginning of this year, the manufacturing PMI has only briefly stood above the boom-bust line in March and April, and the remaining six months were less than 50%; and in 2023, there were only four months above the boom-bust line, and eight months were less than 50%. In other words, my country's manufacturing industry has been in a state of recession for most of the past two years. From the perspective of financial data, the year-on-year growth rate of the broad money (M2) balance in August was 6.3%, which has been below 8% for five consecutive months; the narrow money (M1) balance fell by 7.3% year-on-year. In July, the new RMB loans increased by only 260 billion yuan. If the 558.6 billion bill financing is excluded, the actual new loans are negative; although the new RMB loans in August rebounded to 900 billion yuan, there is still a big gap compared with the 1220 billion to 1360 billion yuan in the same period of 2021-2023. From the sub-item data, the scale of short-term and medium-term loans for residents and enterprises has declined significantly, and the factors leading to the decline in credit due to insufficient demand may exceed seasonal factors. In addition, indicators such as prices, real estate, and consumption are also in a state of continuous downturn.

Secondly, there is a clear gap between the current "prudent" monetary policy tone and market psychological expectations. Since 2020, even in the face of major external shocks such as the COVID-19 pandemic and insufficient domestic demand, the tone of monetary policy has only been slightly adjusted from the "prudent neutral" tone to the "flexible and moderate", "flexible and precise, reasonable and moderate", "precise and effective" and other loose directions of maintaining a prudent monetary policy, but the overall tone remains "prudent". Since 2023, the central bank has adjusted the LPR interest rate several times, such as the 1-year LPR interest rate was lowered by 10 basis points in June 2023, August 2023 and July 2024, and the 5-year LPR interest rate was lowered by 10, 25 and 10 basis points in June 2023, February 2024 and July 2024, respectively. Except for the 5-year LPR rate, which was reduced from 4.2% to 3.95% in February 2024, the other interest rate cuts were very small. Compared with the continuous interest rate cuts of 25-50 basis points in Europe and the United States, or even a single maximum reduction of 100 basis points, this has more symbolic significance than practical significance, and there is a clear gap with market expectations. Therefore, a small interest rate cut is unlikely to have a significant impact on the market. From the perspective of strengthening expectation management and effectively guiding market expectations, making reasonable and appropriate adjustments to the tone of monetary policy as soon as possible will help boost market confidence and change the current situation of generally weak market expectations.

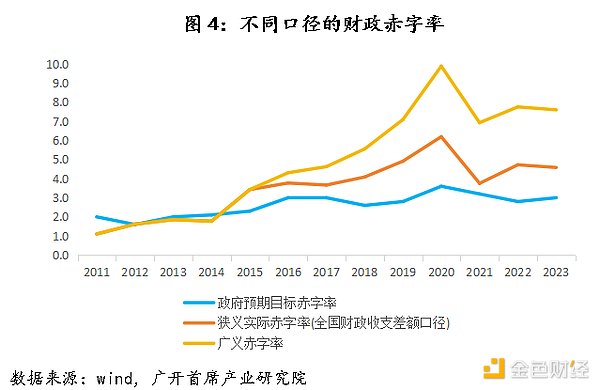

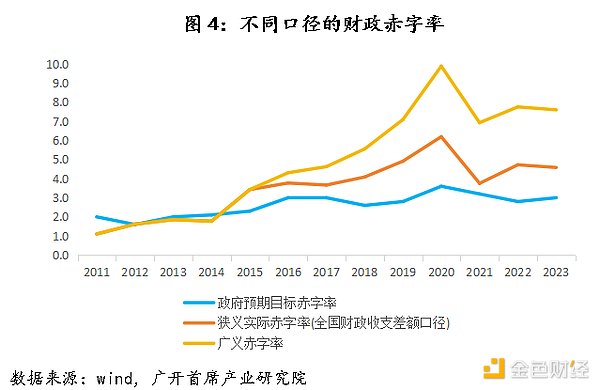

Thirdly, from the perspective of policy coordination, in order to enhance the countercyclical adjustment effect, it is necessary for monetary policy to better cooperate with fiscal policy and implement a "double easing" combination. In the process of countercyclical regulation, the government usually uses expansionary fiscal policy to stimulate total social demand through measures such as debt, deficit, tax cuts and increased government spending. However, due to the side effect of the "crowding-out effect" of expansionary fiscal policy itself, that is, when government spending increases, the demand for money will increase accordingly. Under the given money supply, interest rates will rise, resulting in the suppression of private sector investment. At this time, it is often necessary to match expansionary monetary policy to suppress the upward trend of interest rates by increasing the money supply. In recent years, the tone of my country's fiscal policy has been clearly positioned as "active fiscal policy", and it has been proposed to "increase efforts and improve efficiency", with an overall tendency towards expansion. The national fiscal budget deficit in 2023 was initially set at 3%. In October 2023, the budget was adjusted, and 1 trillion yuan of ultra-long-term treasury bonds were added, and the final fiscal deficit rate reached 3.8%. In 2024, my country's budget deficit rate will continue to be set at 3%, and the quota of local government special bonds will be arranged at 3.9 trillion, which is a further increase from last year. At the same time, it is decided to issue ultra-long-term special treasury bonds on a large scale for several consecutive years starting this year. While the tone of fiscal policy is obviously expanding, monetary policy is bound to actively cooperate, including increasing liquidity supply and further lowering interest rates. At this time, it is necessary to make corresponding adjustments to the tone of monetary policy, from "prudent" to substantial "moderate easing".

Finally, changes in the external environment provide a time window for my country to adjust the tone of monetary policy. On August 23, Federal Reserve Chairman Powell delivered a speech at the Global Central Bank Governors Conference, officially confirming that "the time for policy adjustment has come." The market generally believes that the Federal Reserve's announcement of a rate cut in September is a foregone conclusion. We expect that this round of the Federal Reserve's rate cut cycle may last for 14-16 months, with 6-8 rate cuts and a cumulative rate cut of 150-200 basis points. It is undeniable that in recent years, under the circumstances of increasing downward pressure on the economy and deflationary pressure, the tone of my country's monetary policy has not been adjusted. A very important reason is that the high interest rate policy implemented by the Federal Reserve has constrained my country's economy and finance. At present, a new round of interest rate cuts by the Federal Reserve is imminent. Against this background, my country's monetary policy tone has obtained a rare adjustment time window and has room to promote a new round of reserve requirement ratio cuts and interest rate cuts. The tone of "moderately loose" monetary policy is between "prudent" and "loose". Its implementation in the current situation has three positive significances: First, compared with the tone of "prudent" monetary policy, it is more proactive and can match the greater use of aggregate, price and structural monetary policy tools, inject sufficient liquidity into the market, and promote a significant decline in real interest rates. Second, compared with the tone of "loose" monetary policy, it is relatively more prudent. Since the easing intensity is relatively moderate, it can avoid the sequelae of "flooding" and severe inflation. Third, compared with the current monetary policy tone, which is called "prudent" but is actually loose, its greatest positive significance is that it can send a clearer and more explicit policy signal to the market, so that all parties in the market can better understand the easing intention of the policy, form consistent and positive expectations for subsequent policies, and enhance confidence in the economic recovery. Since the reserve requirement ratio and interest rate cuts and structural tools have been frequently adjusted in the direction of easing in recent years, and the direction of countercyclical adjustment will not change in the future, why can't we realistically adjust the "prudent" tone to the "moderately loose" tone in a timely manner? Comprehensively considering all aspects, the conditions for implementing a truly "moderately loose" monetary policy tone are ripe.

Three, related policy recommendations

Recommendation 1: Define the tone of monetary policy in a more scientific and reasonable way. Policymakers should comprehensively sort out and standardize the monetary policy tone system and related definitions, especially the boundaries between "loose" and "moderately loose", "tight" and "moderately tight", and explain what specific changes will occur in monetary policy goals and operating tools under different policy tones, how to refine the trigger conditions for entering and exiting each policy tone, and how to match the monetary policy tone with the fiscal policy tone.

Suggestion 2: Further strengthen expectation management and send clear monetary policy signals to the market. While the monetary policy tone system is being standardized, it is recommended that the monetary authorities use a more rigorous and accurate policy tone that better reflects current needs, so that all parties in the market can better understand the monetary policy orientation and form a positive feedback of resonance. As the central bank leader pointed out, "When the transparency of monetary policy is improved, the comprehensibility and authority of the policy will be enhanced, the market will spontaneously form stable expectations for the future monetary policy trends, and rationally optimize its own decision-making, so that monetary policy regulation will be more effective."

Suggestion 3: Adjust the tone of monetary policy to "moderate easing" to create a suitable policy environment for implementing more drastic reserve requirement ratio and interest rate cuts. From the perspective of the possibility of reserve requirement ratio cuts, the weighted average deposit reserve ratio of small banks in my country has dropped to around 5.0%, and there is relatively little room for further reduction in the short term, but this does not mean that it cannot be further reduced; the weighted average deposit reserve ratio of medium-sized banks is 6.5%, and the weighted average deposit reserve ratio of large banks is 8.5%. If the monetary authorities implement a new round of reserve requirement ratio cuts, they may consider mainly targeted reserve requirement ratio cuts for large state-owned commercial banks and national joint-stock commercial banks. Given that relevant banking institutions account for 60% of deposits in my country's banking industry, if the targeted reserve requirement ratio is reduced by 0.5 percentage points, it is estimated that more than 600 billion yuan of liquidity can be released to the market. Given that the current domestic actual interest rate is still high, it is also necessary to further reduce interest rates. It is recommended to concentrate policy resources and implement a relatively large interest rate cut of about 50 basis points at the end of this year or early next year. At the same time, considering that among the structural monetary policy tools, the carbon emission reduction support tool, the inclusive small and micro loan support tool, and the inclusive pension special re-loan will all expire at the end of this year, it is also possible to further add new quotas to the relevant structural monetary policy tools at the beginning of next year, and lower the agricultural support re-loan, small business support re-loan and rediscount interest rates by 0.5 percentage points each, so as to facilitate the cooperation in green finance, inclusive finance, pension finance and other articles.

JinseFinance

JinseFinance