Author: Tanay Ved & Matías Andrade Source: Coin Metrics Translation: Shan Ou Ba, Golden Finance

Introduction

In this special edition of "Network Overview", we will use a data-driven approach to review the major events that affected the digital asset industry in the first quarter of 2024.

Source: Coin Metrics Reference Rate

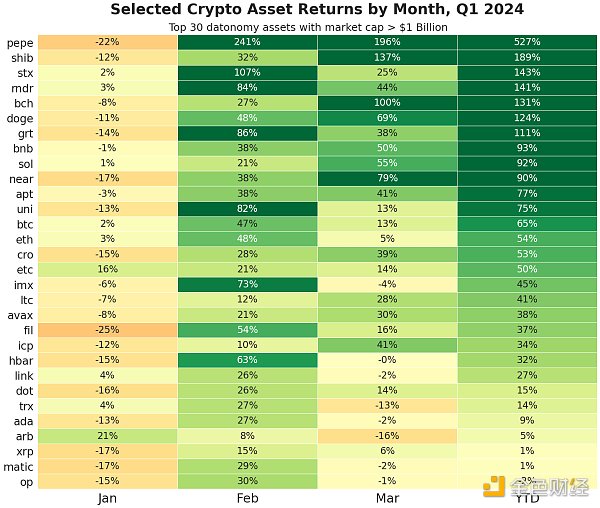

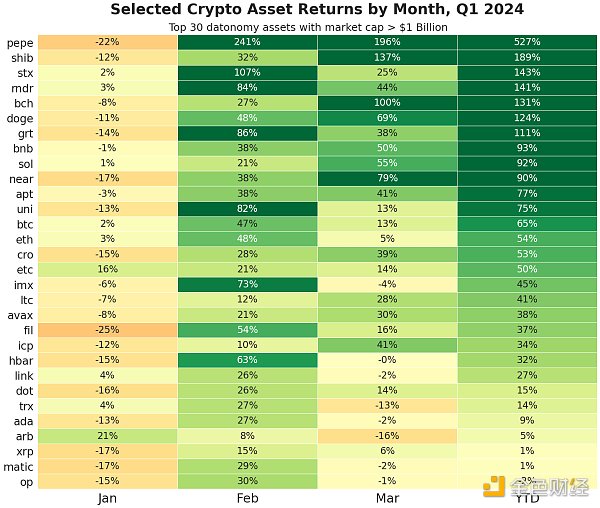

The first quarter of 2024 saw significant growth in the digital asset market, thanks to the United States finally approving a decade-long effort for spot Bitcoin exchange-traded products. In stark contrast to the uncertainty that has filled the crypto asset market in the past few quarters, the first quarter marked a turning point for the industry. During this period, we saw the total market value of digital assets climb above $2 trillion again, and Bitcoin (BTC) hit a record high of $73,000, with a year-to-date increase of 66%.

This momentum is also reflected in various other crypto assets and sectors, such as layer 1 blockchains such as Solana (SOL +92%) and Near (NEAR +90%), meme coins such as Pepe (PEPE +527%), and projects that combine artificial intelligence and computing applications such as Render Network (RNDR +141%). In addition, we are seeing various forms of tools, infrastructure, and applications being implemented, injecting innovation momentum and optimism into the entire blockchain ecosystem. Below we will highlight the key developments that will shape the digital asset landscape in the first quarter of 2024.

Bitcoin hits all-time highs

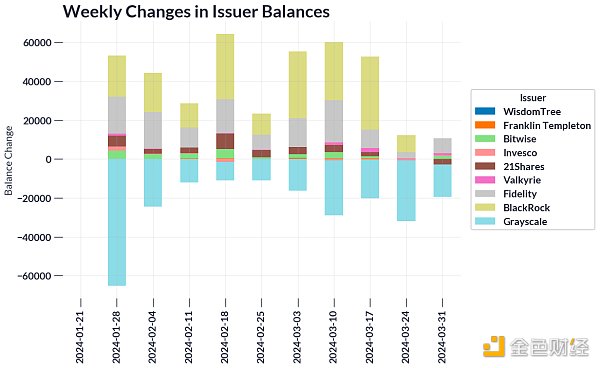

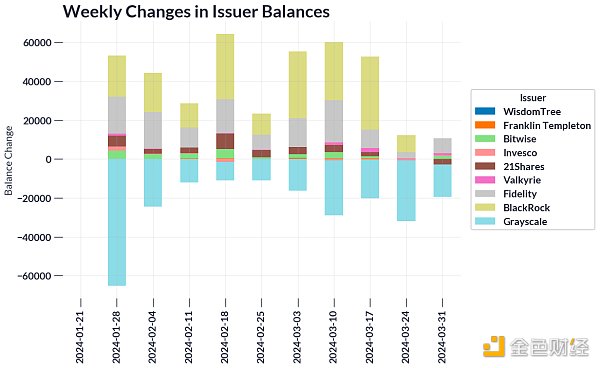

This quarter, the launch of the spot Bitcoin ETF became a major catalyst for the digital asset market, a highly anticipated event that expanded investment channels for Bitcoin. This development attracted retail and traditional investors, providing them with a familiar investment tool with a competitive cost and fee structure to allow them to gain exposure to the largest digital asset. With 11 issuers joining the fray, including giants like BlackRock and Fidelity, the launch marks a sign of wider acceptance of digital assets.

Source: Coin Metrics ATLAS Coin Metrics ATLAS

Demand for Bitcoin exchange-traded products has been strong, with unprecedented inflows that have surprised many, making it the fastest-growing ETF in history. In just one quarter since its launch, around $12 billion has flowed into these instruments, holding around 4% of Bitcoin’s current supply. Of the 11 issuers, BlackRock’s IBIT is the clear winner, having accumulated close to 250,000 bitcoins (about $17 billion) since its inception, with several other issuers also gaining market share. Conversely, Grayscale’s GBTC has seen significant outflows due to high fees and the fallout from the Genesis and FTX bankruptcies.

While investment flows occasionally fluctuate, with some days seeing unusually high activity, there is no doubt that the launch of spot Bitcoin ETFs is fundamental to the broader upside across the digital asset market. The first quarter saw strong demand for these products, however, participants will be eager to see the lasting appeal and impact of the addition of derivatives ETFs.

Ethereum Dencun Upgrade Launched

With the successful completion of the Dencun hard fork on March 13, Ethereum achieved another important milestone on its roadmap, completing a major infrastructure upgrade to improve the scalability of the blockchain. The upgrade was anticipated not only by Ethereum users, who have faced high transaction fees during periods of network congestion, but also by Layer 2 (L2) solutions, which have been facing rising costs associated with storing or settling processed off-chain data that ultimately makes its way back to Ethereum’s Layer 1. However, the introduction of “blobs” via EIP-4844 alleviates these bottlenecks, laying the foundation for improving the economic viability of the network for all stakeholders.

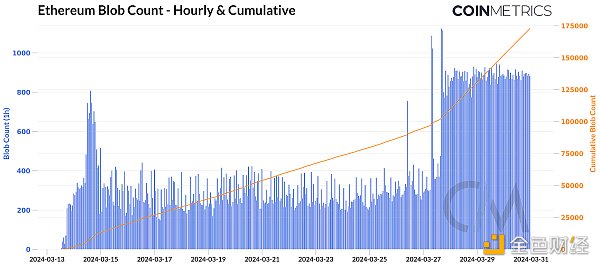

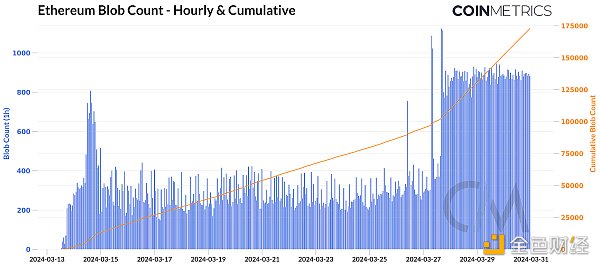

Blobs land on Ethereum mainnet

Source: Coin Metrics Network Data Professional Edition, Dencun Metrics

EIP-4844 solves Ethereum's scalability problem by creating a data "blob" space. Compared with calldata, blobs are a more efficient form of data storage, and Layer 2 can use blob space to settle transactions to Ethereum's Layer 1, which acts as a data availability and settlement layer. Since the upgrade, as of March 31, the network has processed more than 209,000 blobs. This is made possible through “blob transactions,” a new transaction type that involves the use of blobs, which are stored for approximately 18 days — unlike calldata, which is stored permanently. The temporary nature of blobs allows them to be priced at a lower cost, significantly reducing L2’s data availability (DA) costs.

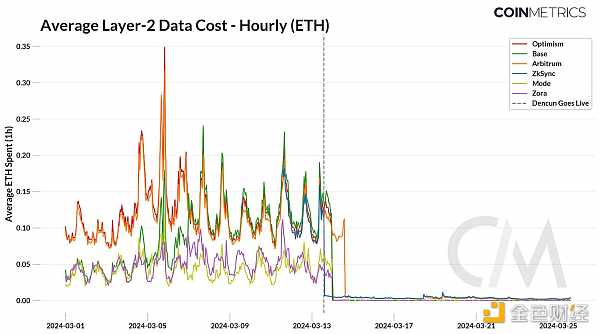

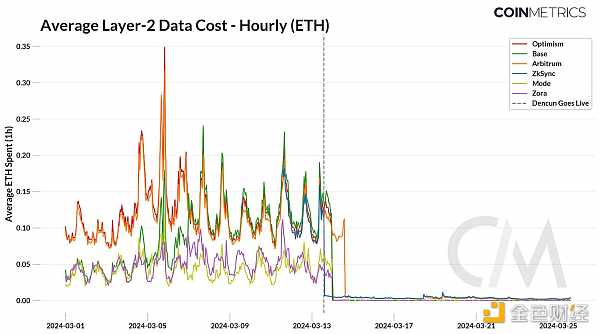

The Impact of Blob Adoption

Several rollups, including Arbitrum, Optimism, and ZkSync, began adopting blobs soon after the upgrade, and data costs fell dramatically. The average cost, in ETH, of the corresponding L2 sequencer (which is responsible for ordering and processing transactions on L2 and submitting them to L1 for settlement) dropped significantly from 0.15 ETH to about 0.0005 ETH, representing a 60% to 90% reduction in user transaction fees. As costs fall and transaction volume increases (e.g. through applications such as decentralized exchanges (DEXs)), L2s are likely to benefit from higher profit margins.

Source: Coin Metrics ATLAS

Against this backdrop, the impact of network demand on blob fee pricing dynamics will be a critical metric to monitor. EIP-4844 creates a new blob gas market that operates similarly to EIP-1559, with fees varying based on supply and demand. Currently, the network targets 3 blobs per block, with a maximum of 6 blobs. Therefore, when the number of blobs in a block exceeds this target, the base fee for a blob increases. We have seen this happen several times, demonstrating its importance for stress testing the network under conditions of high blob space utilization. For example, Coinbase’s L2 Base experienced a surge in transaction fees as the memecoin craze sweeping Solana also spread to Base.

In addition, on March 27, an influx of blob data inscriptions (“blobscriptions”) caused average hourly blob fees to spike from virtually nothing to over $60. This increased blob activity also caused the Ethereum network’s block count to drop. Therefore, as rollup adoption and its blob capacity increase, it will be critical to monitor fee dynamics and network health. Despite some early issues, it is clear that the Dencun upgrade has brought greater accessibility to users, rollups, and applications.

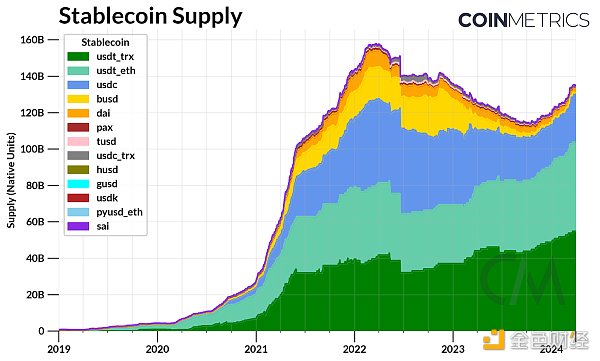

Stablecoin Growth and Landscape

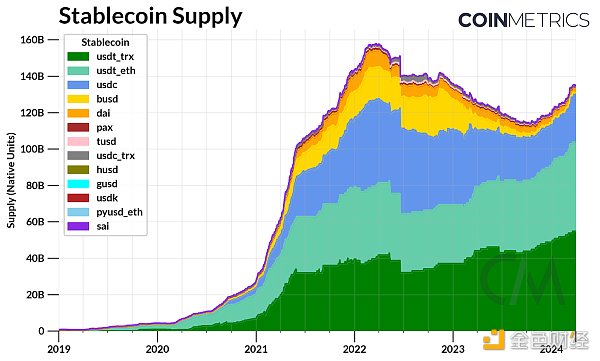

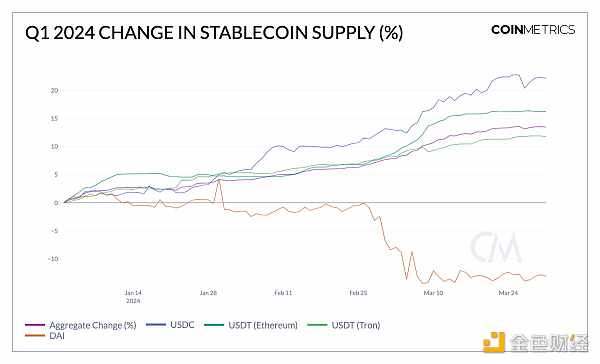

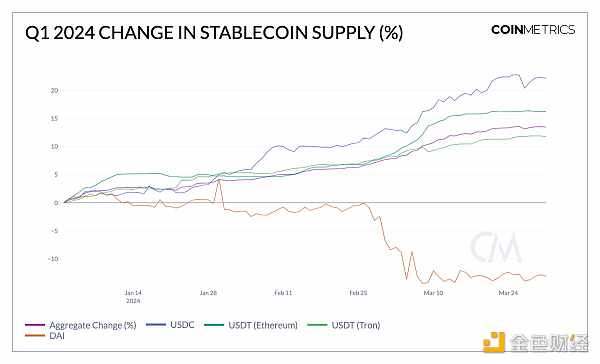

Stablecoins also resumed expansion in the first quarter as digital asset market valuations grew. The supply of stablecoins pegged to the U.S. dollar exceeded $135 billion, a cumulative increase of 13.5% throughout the quarter. Stablecoin giant Tether (USDT) surpassed $100 billion in circulation, with circulation on the Ethereum network growing 16% and on the Tron network growing 11%. Circle's USDC had a strong start to the first quarter, with supply growing 22% to $27 billion, close to levels seen during last year's regional banking crisis. While USDT has dominated trading volume on centralized exchanges, USDC trading pairs have also gained a growing share in the spot market as liquidity improves. In addition, the deactivation of BUSD issued by Paxos and the overall increase in demand for digital assets also partially explain the growth in market share of the two leading stablecoins.

Source: Coin Metrics Network Data

Meanwhile, MakerDAO’s token supply fell 13% in the first quarter to 3.2 billion. With interest rates near their peak in the United States, demand for yield on crypto-collateralized lending outweighed the yield appeal offered by U.S. Treasuries, which make up the majority of the collateral backing Dai. Competition from high-yield new entrants, such as Ethena’s USDe (collateralized by staked ETH and perpetual futures positions in derivatives markets), also prompted changes in interest rates across the ecosystem. To prevent demand shocks for Dai and improve its reserve liquidity, Maker increased the Dai savings rate from 5% to 15% to incentivize adoption of Dai. Affected by these factors, stablecoin interest rates across the decentralized finance market have soared to nearly 15%, and increased the cost of borrowing and leverage across the ecosystem.

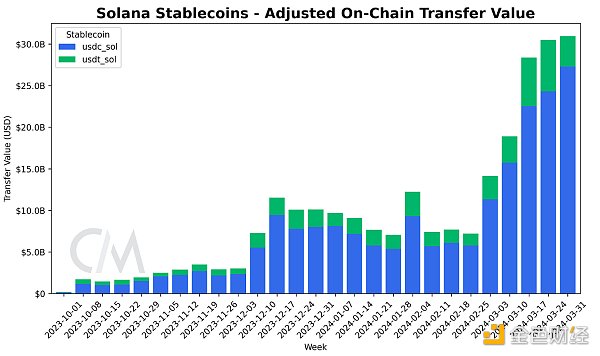

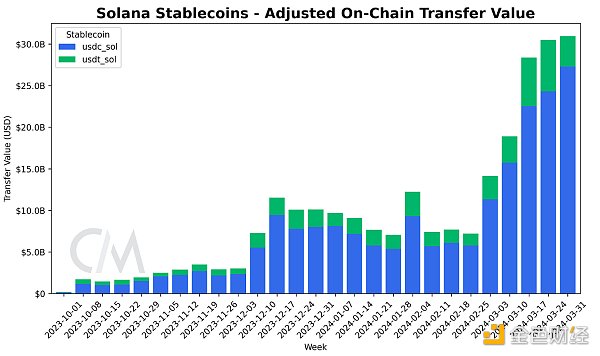

Coin Metrics Formula Generator

As liquidity increases, the stablecoin landscape has become more diverse. For example, PayPal's PYUSD faced challenges at the beginning of the year, with supply falling 28% since January; Societe Generale's euro-backed EURCV; and protocol-native stablecoins such as Aave's GHO. Recently, we have also seen the launch of the "BlackRock USD Institutional Digital Liquidity Fund" (BUIDL), a tokenized money market fund based on Ethereum. These products vary not only in terms of collateral backing and risk, but also in the issuers, including financial institutions and DeFi protocols. In addition, stablecoin issuance and transfer volume also expanded to Layer 1 networks such as Solana, as well as Layer 2 networks such as Tron and Ethereum, demonstrating their use across the ecosystem.

Conclusion

As the first quarter came to a close, the digital asset space experienced profound growth and key developments, marking the market's increasing maturity and diversification. Despite the market's speculation and excitement, progress has been made on many fronts, from the launch of spot Bitcoin ETFs to infrastructure upgrades and adoption of Layer 1 and Layer 2 ecosystems, paving the way for broader accessibility and innovative use cases.

With SBF being sentenced, the first quarter also marks a significant shift in market sentiment as we move away from the shadow that has shrouded the industry. Looking ahead, there are also various developments that could impact the digital asset industry. The reopening of the Coinbase case with the U.S. Securities and Exchange Commission (SEC), the potential launch of an Ethereum ETF, and Bitcoin’s upcoming fourth halving will undoubtedly keep participants paying attention.

Edmund

Edmund