Original source: CoinbaseGlassnode Original compilation: Yanan, BitpushNews

This guide is a research report jointly created by Coinbase Institutional and Glassnode, which provides institutional investors with an in-depth analysis of the most critical encryption market indicators and trends.

Market Overview

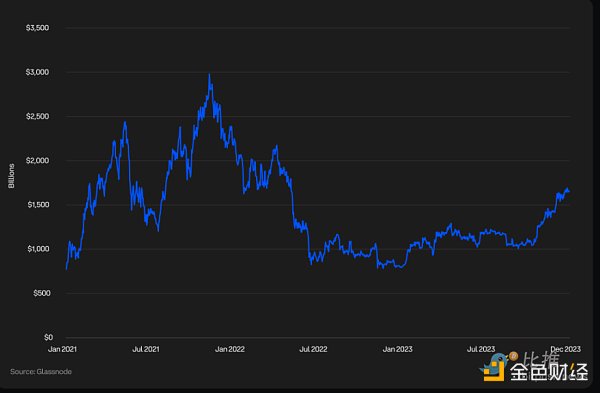

Total cryptocurrency market capitalization

The total market value of cryptocurrency is an important indicator reflecting the market value of global digital assets, covering Bitcoin (BTC), Ethereum (ETH), tokens and stablecoins. In 2023, the total cryptocurrency market capitalization grew by more than 108%, driven by the strong performance of Bitcoin and Ethereum.

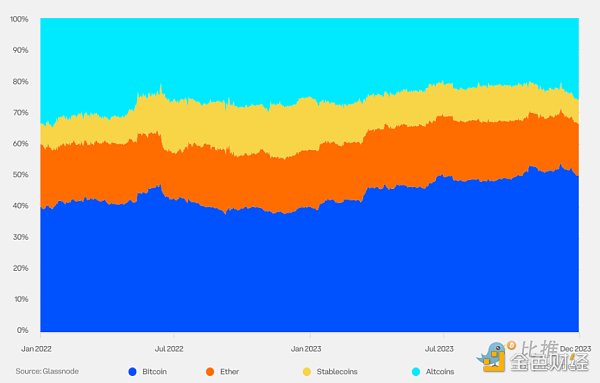

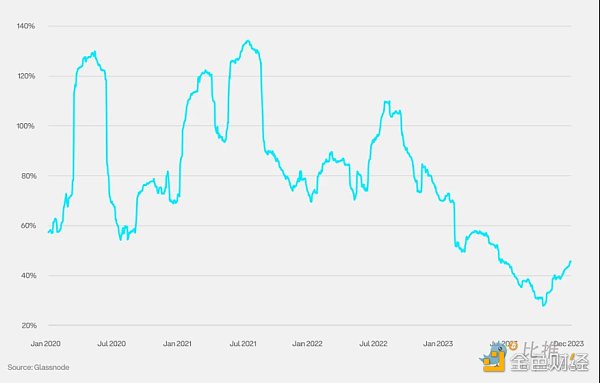

Cryptocurrency dominance

Cryptocurrency dominance measures the market capitalization of a specific cryptocurrency Percentage of total market capitalization of all cryptocurrencies. Bitcoin’s dominance has grown in 2023 as markets grow increasingly bullish on the prospect of a Bitcoin spot ETF approval and funds move toward quality assets. Some market participants also view Bitcoin’s April 2024 halving as a potential price increase catalyst.

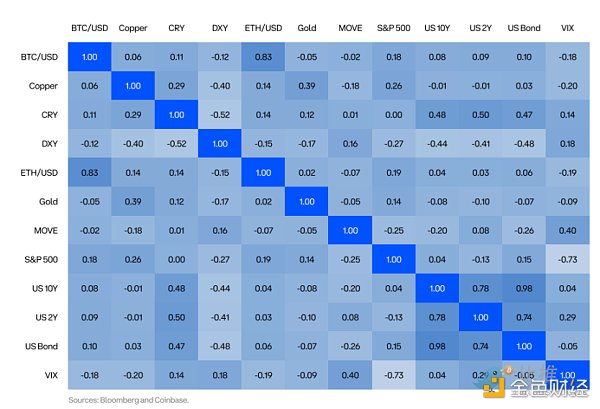

Correlation

Historically, cryptocurrencies have been correlated with traditional asset classes lower. 2022 was an exception, when almost all assets fell in tandem, but markets returned to historical norms in 2023, suggesting that cryptocurrencies will become one of the sources of non-systemic risk.

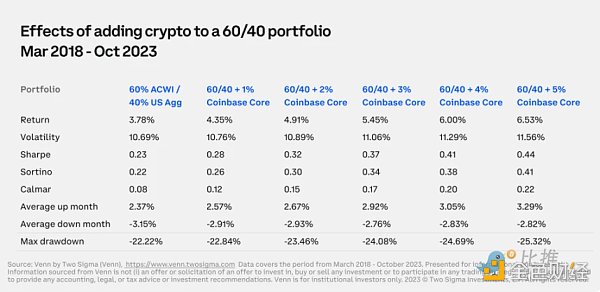

Portfolio Diversification

Allocation to cryptocurrencies can help traditional portfolios diversify risk and Increase revenue. In this table, we analyze the 60% MSCI ACWI (Translator's Note: MSCI ACWI is a global stock index launched by Morgan Stanley Capital International (MSCI), the full name is MSCI All Country World Index.) and 40% The effect of a small allocation to the Coinbase Core Index (COINCORE) in a portfolio composed of the US Agg (Translator's Note: refers to a broad index of the US bond market, the full name is "Bloomberg Barclays US Aggregate Bond Index".). COINCORE is a market cap-weighted cryptocurrency index that is rebalanced quarterly, with Bitcoin and Ethereum weighting 65.3% and 28.7%, respectively, and a combined total of nearly 94%. The set period is from March 2018 to October 2023, covering the two main volatility cycles in the cryptocurrency market. The results show that adding COINCORE improves both absolute and risk-adjusted returns of the portfolio.

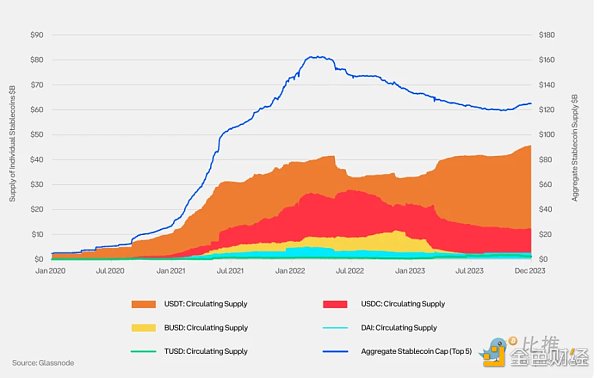

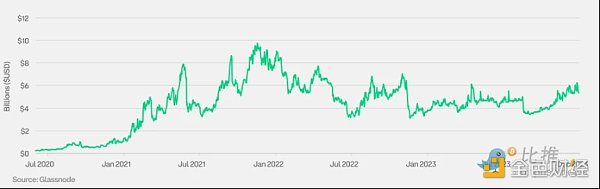

Stablecoin circulating supply

A stablecoin is a digital currency designed to maintain a stable value. They are typically pegged to the U.S. dollar or other fiat currencies at a fixed exchange rate of 1:1 and hold corresponding reserve assets. Stablecoins backed by fiat currencies dominate the stablecoin market. When evaluating stablecoins, market participants should focus on the quantity and type of reserve assets.

Bitcoin

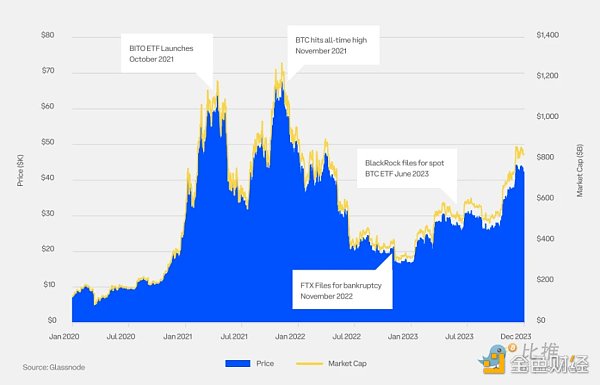

BTC Price Vs. Market capitalization

In 2023, the price of Bitcoin will increase by more than 155% . Market participants are encouraged by a number of factors, including a slowing pace of inflation and an increased likelihood of approval for spot cryptocurrency exchange-traded funds (ETFs).

BTC price performance since cycle low

Bitcoin has gone through four complete bull and bear cycles. In this chart, we can observe how the current market cycle, which begins in 2022, compares to previous cycles.

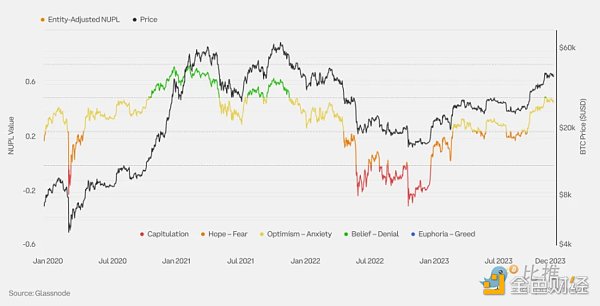

Bitcoin entity holdings adjusted net unrealized profit and loss (NUPL)

Net unrealized profit or loss (NUPL) is the difference between relative unrealized profits and relative unrealized losses. Adjusted NUPL excludes transactions between addresses of the same entity ("internal" transactions) to more accurately measure real economic activity and provide more optimized market signals than unadjusted NUPL.

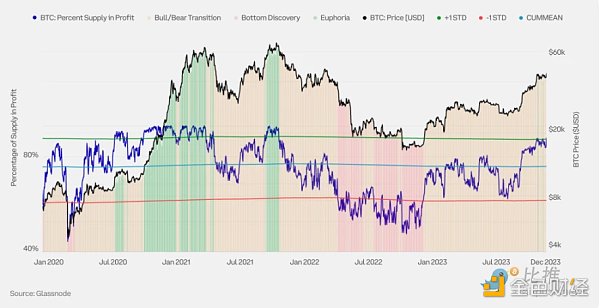

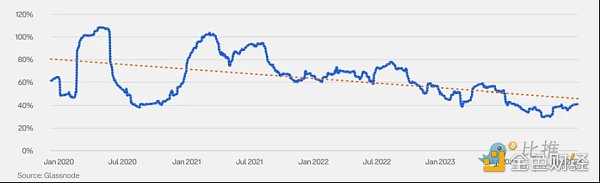

BTC supply profitability

Crypto The circulating supply of a currency is made up of the losing supply (all coins with a cost basis above the current spot price) and the profitable supply (all coins with a cost basis below the current spot price). Observing supply profitability can help reveal where cryptocurrency prices are in the current market cycle. Previous cryptocurrency market cycles have been characterized by three phases:

Bottom discovery phase: the final phase of a bear market, when long-term price depreciation leads to losses in supply When the proportion increases (profit supply percentage < 55% ).

Mania: During a bull market, when prices show a parabolic upward trend, the proportion of profitable supply dominates (% of profitable supply > 95 % ).

Bull-bear transition period: The transitional period between the bottom discovery period and the mania period, when supply profitability is closer to equilibrium (profitable supply percentage between 55% and 95%).

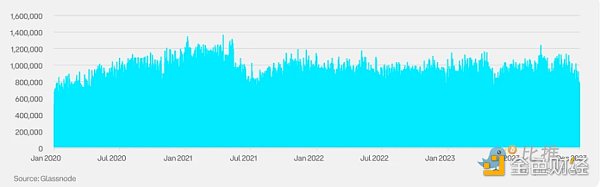

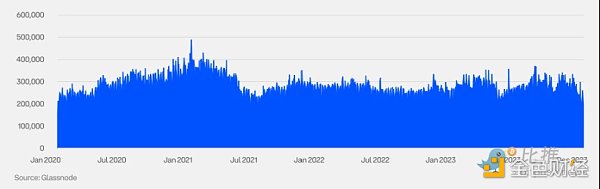

BTC daily active addresses

The number of active addresses refers to the number of unique addresses that remain active as senders or receivers in the network. This indicator is crucial for measuring user acceptance, network conditions, and economic activity.

BTC daily active entities

Although the number of active addresses is an important metric, a single entity can have multiple addresses, so we also need to pay attention to the number of active entities. An entity is defined as a set of address clusters controlled by the same network entity, and these address clusters are estimated through advanced heuristics and Glassnode's proprietary clustering algorithm. Here, "advanced heuristics" refer to a sophisticated method or technique based on experience, knowledge, and observation patterns for making estimates or decisions with incomplete information.

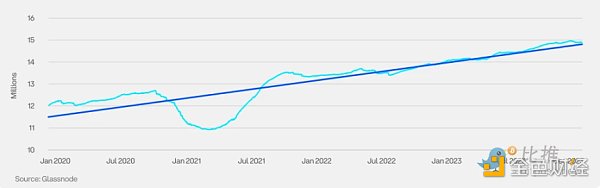

Total supply of BTC held by long-term holders

Glassnode defines long-term holders (LTHs) as investors who have held cryptocurrencies for at least 155 days. This holding period usually means the assets are less likely to be sold. Therefore, observing the activity patterns of long-term holders can be an effective indicator of predicting cyclical fluctuations in the cryptocurrency market, helping to identify potential peaks and troughs.

BTC annualized 3-month volatility

As cryptocurrencies mature as an asset class and institutional participation increases, their volatility has shown a steady downward trend.

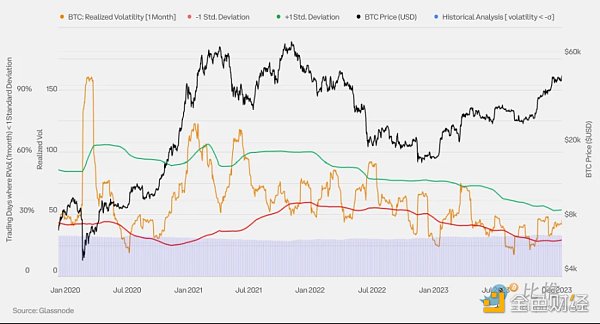

BTC Monthly Realized Volatility Band

This chart uses Bollinger Bands to analyze one-month realized volatility to identify potential volatility turning points. If volatility deviates more than one standard deviation from the one-month mean, a reversal is more likely.

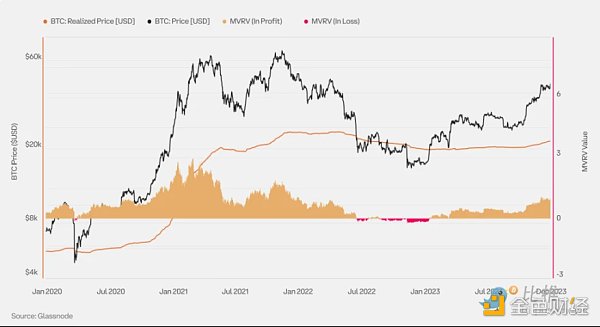

BTC Realized Price and MVRV

Realized price refers to the average price of a cryptocurrency’s supply, calculated as the value of each coin on the day it was last traded on-chain; it is often considered the market’s on-chain cost basis. MVRV is the abbreviation of Market Value to Realized Value; it represents the ratio between market value (spot price) and realized value (realized price). An MVRV of 2.0 means the current price is twice the market's average cost basis (twice the average holder's profit).

An MVRV of 1.0 means that the current price is equal to the market's average cost basis (the average holder is at the break-even point).

An MVRV of 0.50 means the current price is 50% below the market's average cost basis (the average holder loses 50% ).

Extreme MVRV values can reveal periods of overheating or undervaluation, as well as periods when investor profits are well above or below the average (i.e., realized price) .

BTC MVRV Momentum

This chart Shown is the MVRV ratio along with the six-month simple moving average (SMA) used as a momentum indicator. Periods in which the MVRV is above the six-month SMA typically describe an uptrend in macro markets, while periods below that line typically describe a downtrend.

Cycle turning points typically manifest as a strong breakout of MVRV above the six-month SMA. A strong breakout above the SMA indicates large amounts of BTC were acquired at levels below the current price, while a strong breakout below the SMA indicates large amounts of BTC were acquired at levels above current price.

BTC Derivatives

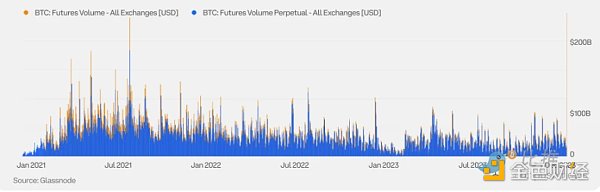

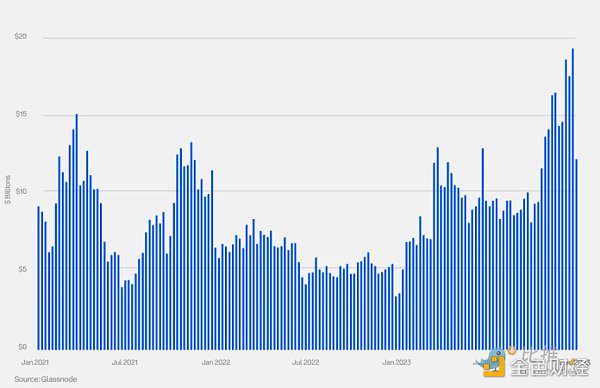

BTC Futures Trading volume

Crypto futures trading volume is divided into traditional futures (also known as period or calendar futures) and perpetual futures (perps), which are cryptocurrency unique. Perpetual futures have no expiration date, so holders do not need to roll over.

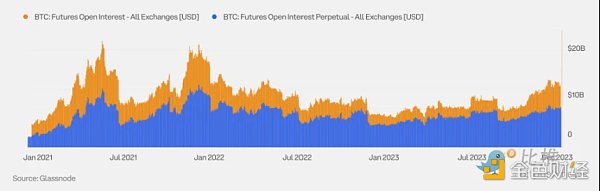

BTC Futures Open Interest

Although perpetual futures are the mainstay of BTC futures trading, traditional futures still occupy an important position in BTC futures open contracts due to their wide application in hedging and spot arbitrage trading.

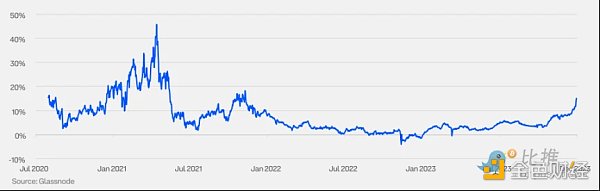

BTC futures annualized rolling basis (3 M)

Basis in the cryptocurrency market has historically been positive (except for market dislocations). Extreme swings in basis, whether positive or negative, are often associated with large swings in market sentiment.

BTC perpetual futures funding rate

Perpetual futures have no set expiration date, so holders do not need to perform rollover operations. In order to maintain a reasonable gap between the price and the spot price, perpetual futures introduces a funding rate mechanism. This rate periodically shifts between longs and shorts: longs pay shorts when the funding rate is positive; shorts pay longs when the funding rate is negative.

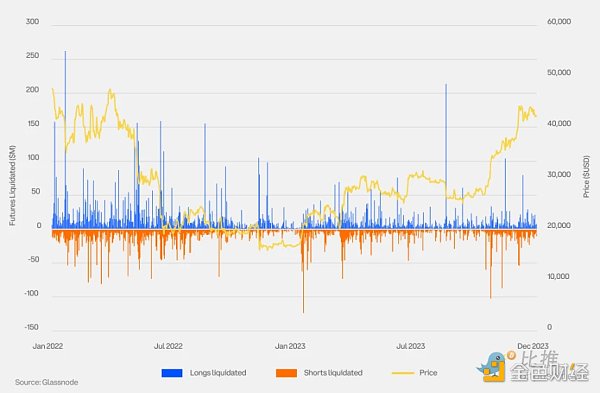

BTC Perpetual Futures Liquidation

Liquidation refers to the forced liquidation of a futures position by an exchange due to a partial or complete loss of the initial margin. Massive liquidations could signal the top or bottom of a sharp price move.

BTC Options Open Interest

Options open interest increased in 2023 as institutional investors increasingly enter the space In October 2023, BTC options’ open interest exceeded BTC futures for the first time.

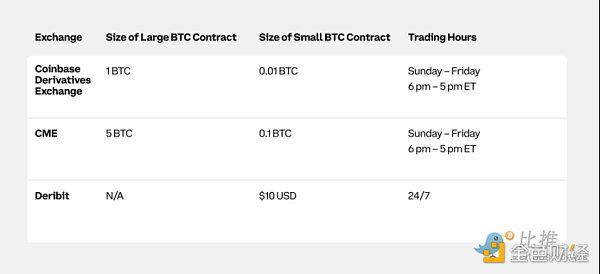

BTC Traditional Futures Specifications

Bit Coin futures are offered by multiple exchanges and come in different sizes and denominations.

The next market event that BTC will face: Bitcoin halving

We predict that the upcoming Bitcoin halving in Q2 2024 may boost token performance. Still, this association is speculative because supporting evidence is limited. There have only been three halvings in history, and a completely clear pattern has yet to emerge, especially given that previous events were affected by a variety of factors, including global liquidity measures.

Ethereum

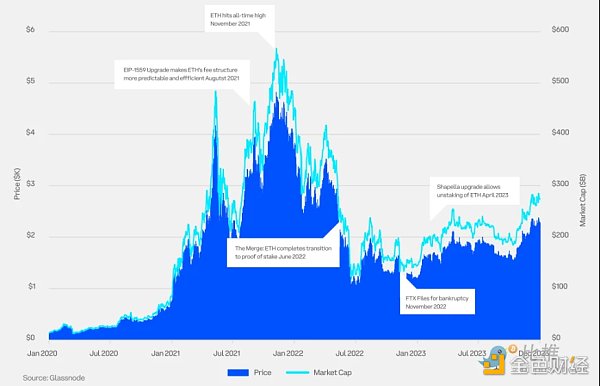

Ethereum (ETH) price and market capitalization

In 2023, the price of Ethereum (ETH) rose by more than 90% This was due to the success of the Shapella upgrade and the approval of the cryptocurrency spot trading open-end index fund (ETF) Market participants are encouraged by the increasingly clear prospects.

Price performance since cycle low

Ethereum has gone through two complete bull and bear cycles. In this chart, we can observe how the current market cycle, which begins in 2022, compares to previous cycles.

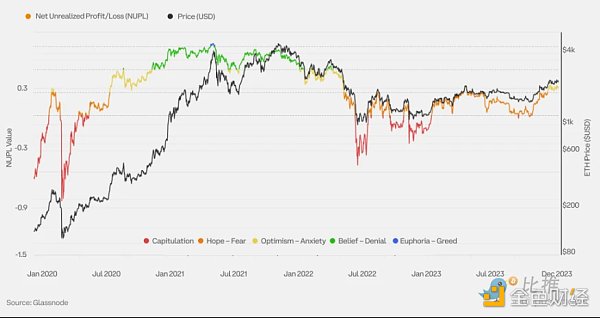

Ethereum Unrealized Net Profit and Loss (NUPL)

Net unrealized profit and loss refers to the difference between relative unrealized profits and relative unrealized losses.

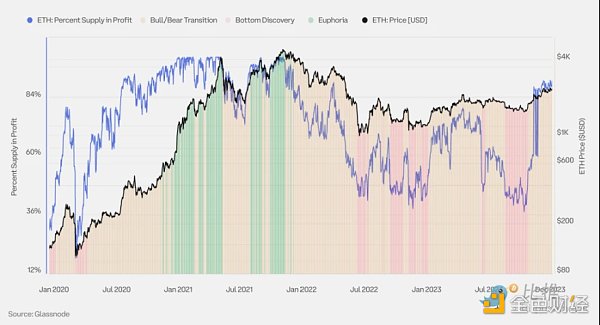

Ethereum (ETH) supply profitability status

The circulating supply of a cryptocurrency is made up of a losing supply (all coins with a cost basis higher than the current spot price) and a profitable supply (all coins with a cost basis lower than the current spot price). Observing supply profitability can help reveal where cryptocurrency prices are in the current market cycle. Previous cryptocurrency market cycles have been characterized by three phases:

Bottom-finding phase: the final phase of a bear market, when long-term price depreciation results in a losing proportion of supply When rising (profit supply percentage <55%), the market enters the bottom discovery phase.

Mania phase: When a parabolic price uptrend occurs during a bull market, the proportion of profitable supply dominates (% of profitable supply > 95% ;), the market enters a frenzy stage.

Bull-bear transition phase: This is the transition period between the bottom discovery phase and the mania phase, when the profitable state of supply is closer to equilibrium (profitable supply The percentage is between 55% and 95%).

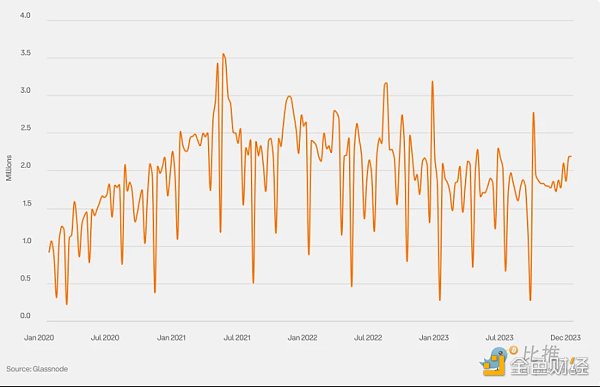

Ethereum (ETH) weekly active addresses

The number of active addresses refers to the number of unique addresses participating in activities as senders or receivers in the network. It is an important indicator of user adoption, network health, economic activity, and more.

Ethereum annualized 3-month volatility

Volatility has been on a steady downward trend as cryptocurrencies mature as an asset class and institutional participation increases.

Ethereum monthly realized volatility band

This chart uses Bollinger Bands to analyze one-month realized volatility to identify potential volatility turning points. If volatility deviates more than one standard deviation from the one-month mean, a reversal is more likely.

Ethereum (ETH) Realized Price and MVRV

Realized price refers to the average price of a cryptocurrency's supply, calculated as the value of each currency on the day it was last traded on-chain; it is often considered the market's on-chain cost basis. MVRV is the abbreviation of Market to Realized Value, which represents the ratio between market capitalization (spot price) and realized value (realized price).

An MVRV of 2.0 means the current price is twice the market's average cost basis (the average holder is twice as profitable).

An MVRV of 1.0 means that the current price is equal to the market's average cost basis (the average holder is at the break-even point).

An MVRV of 0.50 means the current price is 50% below the market's average cost basis (the average holder loses 50% ).

Extreme MVRV values help identify periods of overheating or undervaluation in the market, as well as periods when investor profitability deviates significantly from the mean (realized price).

Ethereum (ETH) MVRV Momentum

This chart shows the MVRV ratio along with the six-month simple moving average (SMA) used as a momentum indicator. Periods in which MVRV is above the six-month SMA typically describe an uptrend in macro markets, while periods in which it is below typically describe a downtrend.

Cycle turning points are often characterized by a strong breakout of MVRV above the six-month SMA. A strong breakout above the SMA indicates a large amount of ETH was purchased below the current price, while a strong breakout below the SMA indicates a large amount of ETH was purchased above the current price.

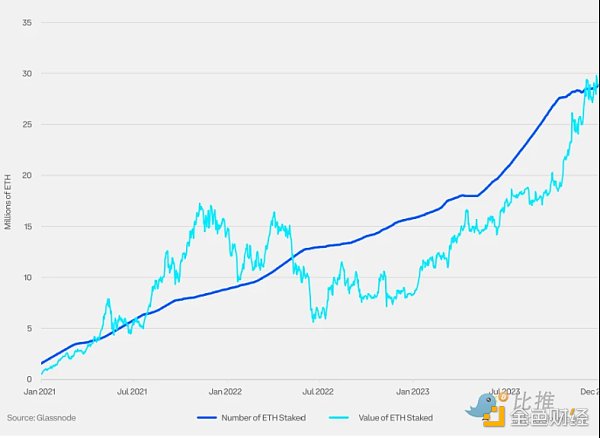

Ethereum (ETH) total pledge value

Staking is an investment method in Proof-of-Stake (PoS) blockchains, where token holders pledge assets to secure the network and receive additional tokens as rewards. In order to stake ETH, holders need to stake at least 32 ETH and run a validator node.

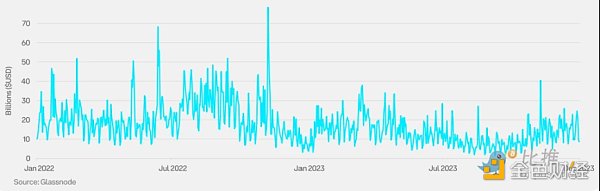

The total locked value of Ethereum (ETH) in DeFi

Total Locked Value (TVL) is the total value of assets locked by smart contracts on the Ethereum blockchain or deposited in decentralized applications, covering ETH, stablecoins and various tokens. It is an important indicator for evaluating financial activities and liquidity within the Ethereum ecosystem.

Ethereum (ETH) derivatives

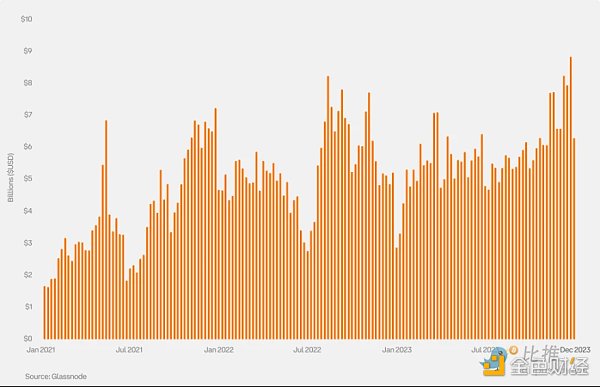

Ethereum perpetual futures trading volume

Crypto futures trading volume is divided into traditional futures (also known as period or calendar futures) and perpetual futures (perps) , the latter is unique to cryptocurrencies. Perpetual futures have no expiration date, so holders do not need to roll over. The trading volume of Ethereum futures is dominated by perpetual futures.

Ethereum perpetual futures positions

Ethereum futures positions are mainly concentrated in perpetual futures, while the trading volume of traditional futures is relatively small.

Ethereum futures annualized rolling basis (3 M)

Basis in crypto markets is generally positive. Its extreme fluctuations, whether positive or negative, are often closely linked to dramatic changes in market sentiment.

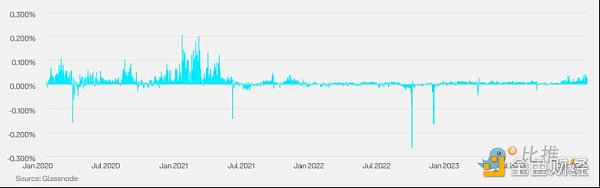

Ethereum perpetual futures funding rate

In order to maintain a reasonable gap between the price and the spot price, perpetual futures introduces a funding rate mechanism. This rate periodically shifts between longs and shorts: longs pay shorts when the funding rate is positive; shorts pay longs when the funding rate is negative.

Ethereum (ETH) options open interest (weekly)

Ethereum options open interest hit an all-time high in the fourth quarter of 2023 as market participants became increasingly bullish on the prospects of spot ETFs and the development of Ethereum in 2024.

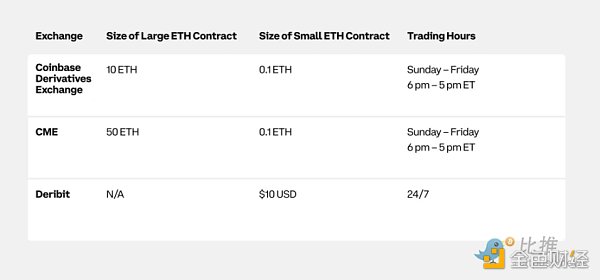

Ethereum (ETH) traditional futures specifications

Ethereum futures are offered by multiple exchanges and come in different sizes and denominations.

The next market events that Ethereum (ETH) will face

After the successful completion of the Shapella upgrade, the Ethereum community is eagerly awaiting the arrival of the Cancun ("Decun") upgrade, which is expected to be implemented in the first quarter of 2024. The Cancun upgrade will mainly enhance the scalability and security of the Ethereum network by introducing Proto-Danksharding. The design goal of Proto-Danksharding is to significantly reduce the fees for second-layer transactions and significantly increase the transaction processing capacity per second of the Ethereum network.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Financial Times

Financial Times Cointelegraph

Cointelegraph