Author: David Han Source: coinbase Translation: Shan Ouba, Golden Finance

Summary

While on-chain innovation has reached unprecedented levels, which is beneficial to the cryptocurrency sector in the long run, we believe that macro factors may play a more important role in the short term.

Key Points

Historically, Bitcoin halvings tend to kick off bullish trends, but these cyclical upticks are usually accompanied by additional positives from other ecosystem catalysts.

The growing talent pool, maturing development tools, and improving blockchain scalability make it possible for a range of verticals to become catalysts for this cycle, although the liquidity channel for inflows appears to have shifted from venture capital to spot ETF inflows.

In the near term, we expect Bitcoin’s dominance to remain elevated as the broader macro environment shifts toward risk-off and liquidity inflows via ETFs are unlikely to shift to high-beta assets.

Beyond the Bitcoin halving, which we have previously detailed, the market is looking for new catalysts to sustain the Q1 rally sparked by the approval of a spot Bitcoin ETF in the U.S. The continued growth in stablecoin issuance and the growth in total value locked (TVL) in DeFi protocols indicate continued strong on-chain activity. Meanwhile, continued platform innovation at both the layer 1 (L1) and layer 2 (L2) levels, coupled with improved wallet tools for a better user experience, underpin some of the narratives we believe will be most relevant in the coming months.

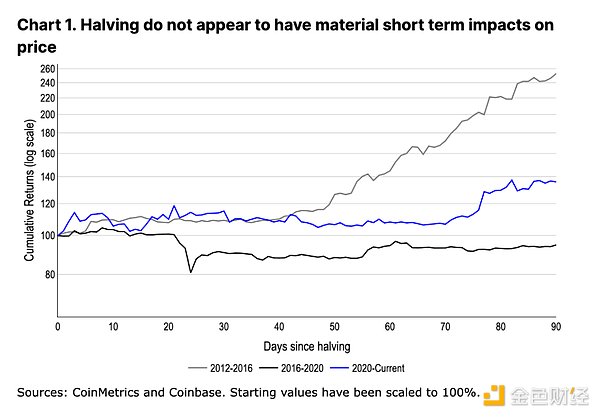

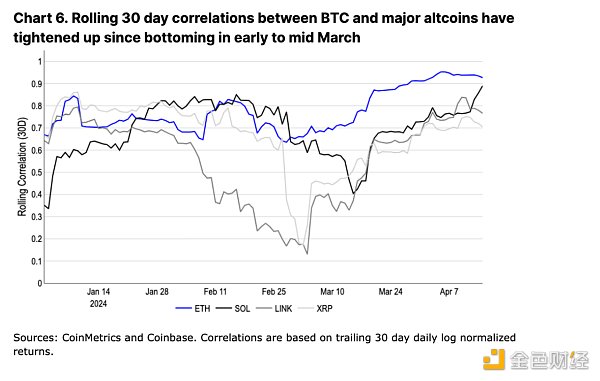

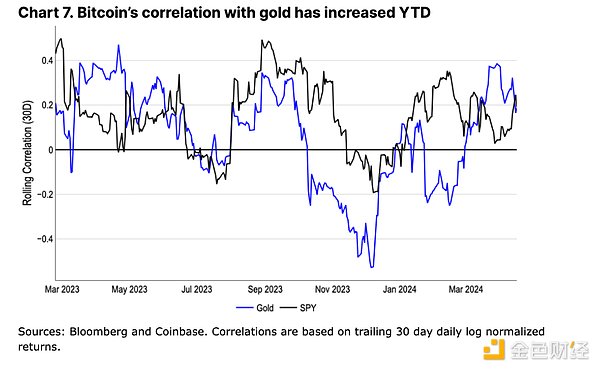

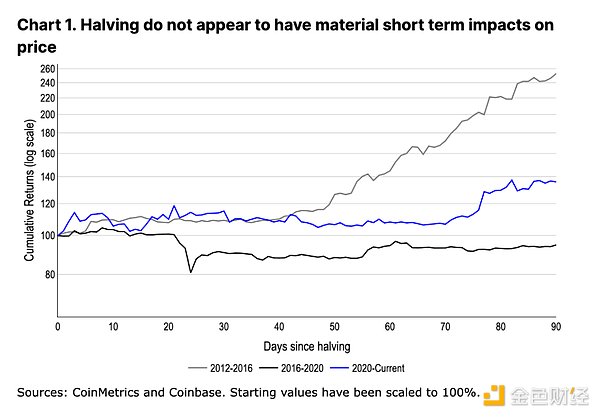

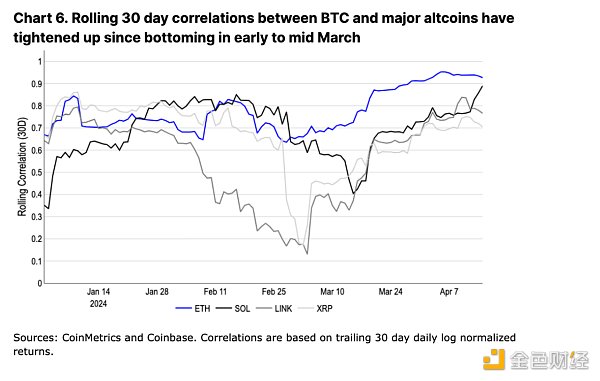

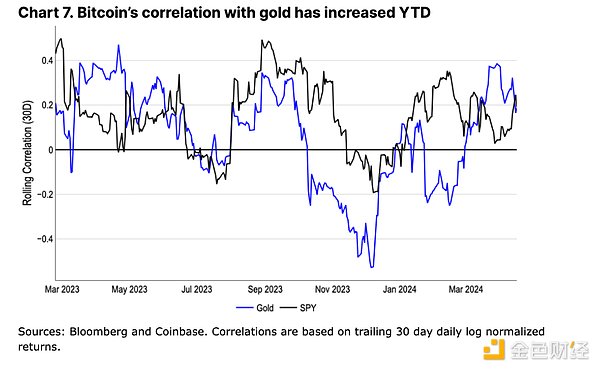

That said, we believe short-term activity is more likely to be driven by macro factors, even though crypto fundamentals remain strong overall. These factors are largely exogenous to crypto and include rising geopolitical tensions, rising long-term interest rates, reflation, and rising Treasury debt. Indeed, this is highlighted by the recent rise in altcoin correlations with BTC, demonstrating BTC’s anchoring role in the space even as BTC solidifies its position as a macro asset. While cryptocurrencies have historically been largely viewed as a risk-on asset class, we believe Bitcoin’s continued resilience and the approval of spot ETFs has created a polarized investor base (particularly for Bitcoin) – one that views Bitcoin as a purely speculative asset, and another that views Bitcoin as “digital gold” and a hedge against geopolitical risk. We believe the growth of the latter camp partially explains the reduced magnitude of pullbacks we have seen so far in this cycle given the broader macro risks. Post-Halving Patterns Previous halvings have often been seen as triggering cyclical bullish trends, although the immediate impact of the halving appears to be largely immaterial in the short term. In fact, BTC fell 19% in the month following the 2016 halving, while remaining largely unchanged in the more than two months following the 2020 halving (see Figure 1). Likewise, we do not expect the upcoming halving to be a trading-heavy story, though we believe its relevance in flows has therefore been overlooked - at $63,000 BTC, the halving equates to a $10.3B reduction in annual BTC issuance, with net inflows of $12.4B to date to US spot BTC ETFs, offsetting BTC outflows by a similar amount.

Indeed, we believe that increased access to a broader capital base via spot ETFs, coupled with new supply-side dynamics, is constructive for the asset class in the long term. However, if previous cycles are any indication, this may take several months to fully materialize. Post-halving tops occur between 350 and 550 days after the event (see Figure 2), although the timing of this cycle has changed. With Bitcoin reaching a new all-time high more than a month before the halving on the back of spot ETF inflows, we expect Bitcoin to deviate further from the prior time trend. However, halvings are not only good for Bitcoin. Constructive narratives in parallel cryptocurrency verticals often occur after halvings as the industry matures. The initial coin offering (ICO) boom following the 2016 halving carried the market’s euphoria into 2017. Similarly, the 2020 DeFi summer kicked off the rise of decentralized applications (dApps) like Uniswap and Maker, ushering in nearly two years of experimentation in DeFi primitives and other early products.

Sources of Liquidity

The number of crypto verticals today has swelled tenfold as new tools and use cases emerge. Blockspace has never been cheaper, and the number of on-chain “things to do” has never been greater. Social apps like Farcaster are poised for early adoption, while a host of well-designed blockchain games are starting to come online. Wallet improvements are enabling developers to deploy a more seamless onboarding journey, and DeFi primitives continue to expand into areas like liquidity rehypothecation and novel on-chain derivatives. Meanwhile, tokenization projects across different financial products and jurisdictions are making significant progress, and the overlap between on-chain financialization and off-chain real assets continues to grow. This is driven in large part by the incredible growth in the infrastructure infrastructure built during the bear market.

We believe this may lead to a different pattern this cycle, with more diverse sub-sectors outperforming simultaneously (rather than sectors converging on one or two major themes). Particularly in a world of standalone applications (which abstract blockchain components from users) with increasing technical complexity, the differentiation between tokens and revenue models is becoming greater. This breadth is giving rise to new forms of revenue streams that were often unavailable in prior cycles. For example, BonkBot, a Telegram bot that works with the BONK community, regularly generates over $100,000 in fees per day (with a peak single-day fee revenue of $1.4 million).

We further believe that the differentiation between crypto verticals this cycle may lead to a more pronounced rotation of capital between sectors. Indeed, we have already seen some signs of this through the early focus on artificial intelligence (AI) projects and the subsequent hyperfocus on memecoins and rehypothecation.

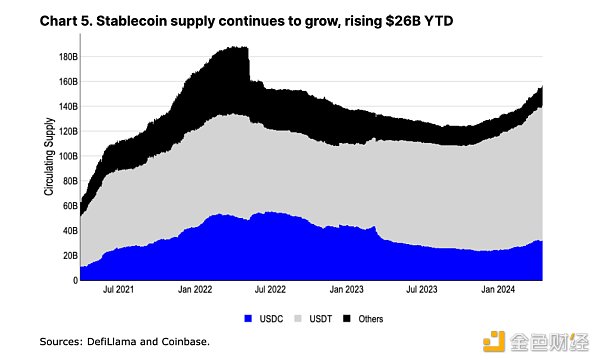

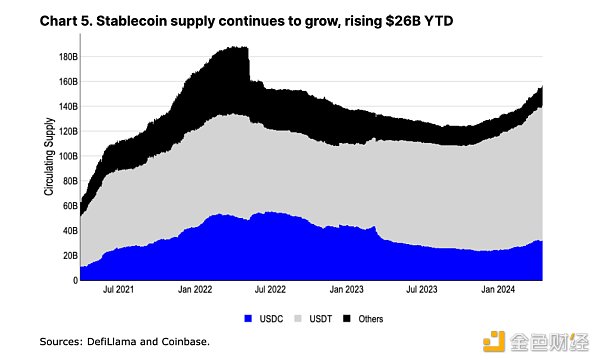

The depressed levels of crypto funding (relative to prior cycles) support this view. It reduces the main avenue of new liquidity for high-beta assets. Average fundraising in 2024 is still below $1 billion per month, even below the level of 2017-18, and about a quarter of that in 2021-22. The decline in funding is both a byproduct of the severe impact of the previous cycle and part of a macro correction. The private equity market generally shrank in 2023, with the total amount of funds raised by venture capital funds hitting the lowest level in 6 years, down 60% since 2022. The relative lack of financing raises the question of how to inject liquidity into the field. Spot ETFs are undoubtedly one of the main avenues we have discussed before. They can access a wider pool of capital, from registered investment advisors (RIAs) to potential allocations from other managed funds. For example, BlackRock has laid out plans to include a spot Bitcoin ETF in its Global Allocation Fund. However, these capital inflows are limited to BTC (and possibly ETH in the future) and are unlikely to flow further down the risk curve. Absent a major change in this market structure, we believe Bitcoin’s dominance will remain elevated for some time. On the other hand, we believe the primary means of injecting liquidity into altcoins (besides leverage) comes from net growth in stablecoins. Stablecoins participate in the majority of 65% of the $2.6B in daily average trading activity on decentralized exchanges (DEXs), and are further used as trading pairs on many centralized exchanges (CEXs). Although the total stablecoin market capitalization is still below its 2022 peak, the total issuance of USDC and USDT has broken through all-time highs and continues to climb. If we exclude the impact of the now-defunct TerraUSD on total market capitalization, stablecoins as a whole are actually close to their previous all-time highs.

Macro Thinking

While we expect the rise of endogenous catalysts for cryptocurrencies in the future, we believe that macro conditions will play a more important role in the near term. In fact, after previous halvings, macro tailwinds were also important, and perhaps even more important than crypto-native catalysts. The main impact of the 2012 halving was driven by the Fed's quantitative easing program and the U.S. debt ceiling crisis. Similarly, in 2016, Brexit and the contentious U.S. election may have triggered fiscal concerns in the U.K. and Europe. The COVID-19 pandemic in early 2020 also led to unprecedented levels of stimulus, driving a significant increase in liquidity.

We believe this cycle is no different and today’s macro environment is just as important for Bitcoin and the broader cryptocurrencies. The recent sharp decline in leverage following the intensification of conflict in the Middle East has reset funding rates to near zero. The ongoing war on the Ukrainian and Russian fronts and tensions in the South China Sea also paint a global picture of uncertainty. We believe the growing importance of global geopolitics within the broader trends of deglobalization and reshoring is likely to be a defining macro feature of this cycle. This is particularly true in a risk-off environment. Following the lack of clarity on market direction, the correlation between Bitcoin and most other cryptocurrencies has consolidated upwards after some decoupling during the Q1 rally in 24.

Bitcoin’s correlation with gold has been rising in March and April due to concerns about rising inflation, which also shows that Bitcoin’s position as a sensitive macro asset is growing in the absence of cryptocurrency-specific catalysts such as spot ETF approval. This behavior is promising given Bitcoin’s claim as a store of value, although we believe that this claim has actually been strengthened in the recent bear market.

Bitcoin saw strong bids during the uncertainty surrounding the US debt ceiling in January 2023 and the ensuing regional banking crisis in March of that year. Compressed price appreciation (like that experienced over the past 6 months) can distort this signal somewhat as it introduces an element of speculation and excitement. Nonetheless, we continue to believe that Bitcoin’s value as a geopolitical hedge has so far contributed to more aggressive dip buying, with the maximum retracement limited to 18% (compared to retracements of more than 30% in previous cycles). Separately, rising levels of US national debt are another topic of concern for Bitcoin supporters. The Congressional Budget Office predicts that $870B will be spent on paying down the national debt in 2024, up from $658B recorded in 2023. Of course, we think this is worrisome and is driving the bond yield curve inversion - higher rates for a long time may not be fiscally sustainable as US Treasuries need to be refinanced. That said, even with the accelerating pace of the US debt burden, it is possible that the US can grow out of debt (or balance the budget by reducing spending or raising taxes, although this seems unlikely in the short to mid-term with the upcoming election). Stronger-than-expected GDP growth and high employment figures could increase overall tax revenues. While we do not think the current growth rate can fully offset the increased debt burden, it is also impossible to fully discount it. Risks such as geopolitics, inflation, and national debt together form the macro backdrop for this cycle.

Conclusion

All else being equal, the Bitcoin halving is an inherently constructive event, though we believe the macro environment and tangentially breaking out of crypto verticals have historically played a significant role in catalyzing cyclical bull runs. While this process has historically taken several months, it will vary from cycle to cycle – and we believe that shifting market structure with major ETF inflows and VC investment reductions may contribute to some of the uniqueness of this cycle.

We further believe that the last cycle solidified Bitcoin’s sensitivity to global liquidity following the COVID-19-induced stimulus. However, global liquidity no longer appears to be increasing by the same magnitude and has taken a back seat to more substantial instability both domestically and abroad. In light of this, we believe the upcoming cycle will be focused on testing Bitcoin’s store of value narrative, supported by more broadly dispersed crypto catalysts across different verticals.

Jixu

Jixu