Author: Ryan Y Yi, Head of Investment, CoinbaseVentures; Michael Atassi, Chartered Financial Analyst, Coinbase; Translator: Jinse Finance xiaozou

Key Points:

While L2’s lower gas fees/increased throughput make them the center of on-chain activity and account for a significant portion of the ETH economy, they may be subject to pressure to maintain decentralized characteristics and alignment with ETH L1.

Builders who want to experiment and customize their own applications and align distribution with L2 are now choosing to build L3 - application chains based on the underlying L2.

The focus of this article is to establish a common understanding of L3.

1. Introduction

(1) What is L3?

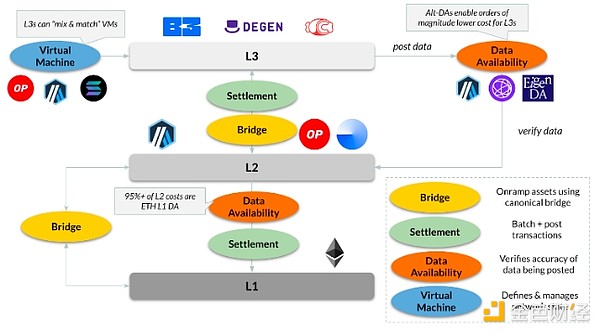

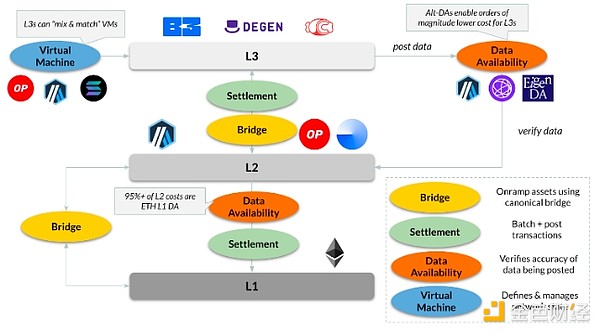

If L2 is the on-chain hub, then L3 can be thought of as “on-chain servers” that have isolated state environments and fee markets, but are based on the underlying L2 and leverage its deposit/distribution mechanisms. This provides applications with customizable block space while still leveraging L2’s existing liquidity and user base.

Cost: 1000x lower due to a combination of 1) lower entry costs (directly from centralized exchanges to L2), 2) slightly lower settlement/execution costs (trades settle to L2 instead of L1), and most importantly 3) fungible data availability (DA), which is how chains verify data accuracy (DA is 95%+ of the total cost of L2 using ETH L1 data). Gas fees are also more predictable because L3 has its own fee market (e.g., on L2, a surge in activity for one application will increase fees for all other applications).

Customizability: L3 adopts a lower standard of decentralization than L2, which unlocks the ability to experiment with new token economics (i.e. custom gas tokens), virtual machines (i.e. Solana VM on ETH L2), and alt-DAs (i.e. Celestia instead of ETH L1).

(2)What is the difference between L3 and L2?

L3 is a rollup, so it has many similarities to the way people understand L2.

Settlement:Similar to how L2 settles to L1, L3 settles to L2.

Bridging:Just like how assets are typically (or third-party) bridged from L1 to L2, so are assets bridged from L2 to L3.

Virtual Machines:The software used by L3 does not necessarily need to run on the same tech stack as its underlying L2. For example, many existing L3s run on Arbitrum Nitro, but ultimately settle using Base (which runs on the OP Stack). Additionally, most L3s are modified versions of existing popular L2s. For example, Arbitrum (Nitro) and OP Stack have released tech stacks that have been adjusted to the needs of L3 builders.

Data Availability:This is the biggest differentiator. L3 will choose to use alternative DA layers (e.g. Celestia, EigenDA, Arbitrum AnyTrust), while L2 must use ETH L1 for alignment/decentralization. Therefore, L3 achieves an extremely low-cost gas environment.

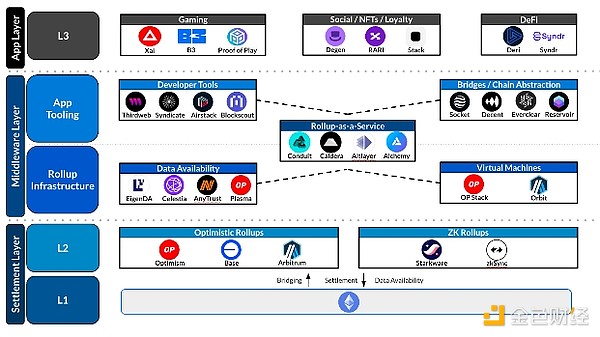

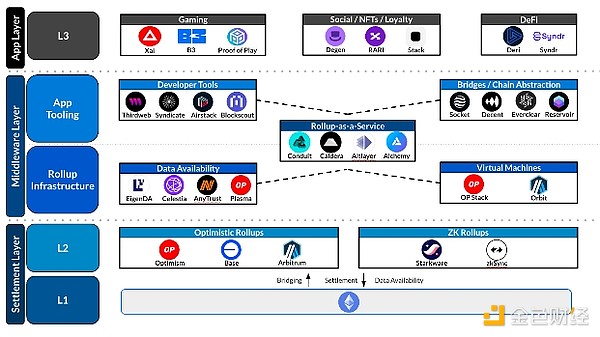

(3) How to release L3?

Since L3 mainly utilizes a permissionless open source technology stack, developers can: 1) run the technology stack/infrastructure themselves, 2) use RaaS (Rollup-as-a-Service) providers that provide management services (e.g. Conduit, Caldera) to deploy and host L3, or 3) consult a white label service provider (e.g. Syndicate), which will "subcontract" to various infrastructure providers (e.g. RaaS, Bridges, DevTools).

(4) Will there be L4?

Because L3 provides dedicated block space and the ability to natively bridge to L2 "hubs" liquidity/users, we believe this will cover all real on-chain use cases.

Even if L2 transaction costs fall, L3 may be the "last" frontier for vertical scaling (i.e. without L4).

Integration with L2 - The core assumption of L3 is to be able to leverage the liquidity/users of the underlying L2 "hubs". If “L4” is created, it will be further away from L2 and deviate from the original goal.

No cost improvement - alternative DA is to reduce costs. Moving up the technology stack will not really change the settlement/execution cost structure.

2. Ecosystem Impact

(1) L3 will become another preferred direction for on-chain builders, which may lead to a situation where a few L2 “hubs” have millions of L3 “servers”.

For on-chain developers, L3s represent a potential paradigm shift as they break down potential barriers to entry and lower the bar for developing mainstream-scale on-chain applications, potentially leading to an “app store” moment with millions of L3s.

L3s provide builders with an experimental platform that is ideal for high-throughput/low-cost applications - which can then leverage the underlying L2 hubs to support liquidity/onboarding/distribution.

The likely outcome is that there are tens to hundreds of L2 hubs, while there could be millions for L3s.

(2) From a cost perspective, L3s have the potential to bring an “AWS” moment.

One observation is that L2s are becoming their own on-chain hubs. Due to L2’s proximity to L1, the cost of operating L2 is often high, with annual costs ranging from seven to eight figures in USD.

On the other hand, L3 is much cheaper, with annual costs ranging from $25,000 to $50,000.

(3) L3 developers will drive the popularity of frameworks other than Solidity/Vyper, leading to a multi-VM environment.

There are projects attempting to deploy alternative frameworks on Ethereum (e.g. MoveVM, SolanaVM, Arbitrum Stylus). The goal is to expand the range of developer products while leveraging existing network effects, liquidity, and Ethereum’s deposit methods.

This may first occur at L2 — but we can foresee these frameworks being deployed as L3, with the goal of leveraging L2 hubs like Base.

The end result is that L2 can attract a broad range of developers at the L3 level while maintaining its own chain on the EVM (rather than trying to integrate multi-VMs directly into L2).

(4) L3 value flows will rely on the application layer

The KPIs for a single L3 are users, transactions, and token utility, not sorter fees. The average value created by a single L3 may be small - but as the number of L3s increases, this will generate network effects.

The growth of L3s generally benefits value creation on the software side (e.g., development tools, RaaS) and value creation on the protocol side (data availability, chain abstraction), but can only scale with a large number of L3s.

We can foresee that a single issuer/project may launch multiple L3s, thereby forming its own L3 ecosystem. For example, an on-chain gaming ecosystem might offer one L3 per game, with the emerging ecosystem providing the remaining value to be shared with other stakeholders.

(5) L3s require smoother interoperability and chain abstraction to succeed

If the intended purpose of L3s is to leverage the user experience of L2 users, and we expect there will be more and more L3s per application use case, then interaction with these L3s needs to become seamless at the user level.

Similar to L2, L3 bridging can be achieved in two ways: native L3 to L2 settlement, or through third-party vendors. Due to the experimental nature of the L3 technology stack, third-party vendors are more suited to L3, which may result in a bridging layer that is neither uniform nor flexible.

At the same time, L3s may only prioritize interoperability with canonical L2 settlement chains, without aiming for full interoperability with all other chains. Therefore, they will focus on enhancing the functionality and features of the bridge, such as reducing latency and providing one-stop liquidity to improve the overall user experience.

Protocol R&D is ongoing around how to introduce native concepts at the sorter level.

3. Future Prospects

In summary, the L2 ecosystem will witness the growth of L3 builders who want to create isolated on-chain application experiences while leveraging the underlying L2 hubs.

JinseFinance

JinseFinance