Source: Coinbase; Compiled by: Baishui, Golden Finance

The different classifications of ETH's roles raise certain questions about its position in a portfolio. We clarify some of the narratives and potential drivers of the asset in the coming months.

Summary

Despite Ethereum's poor performance year-to-date, we believe its long-term positioning remains strong. We believe it has the potential to surprise upside later in the cycle.

We also believe that Ethereum has some of the strongest sustained demand drivers in the crypto space and retains unique advantages in its expansion roadmap.

ETH's historical trading patterns suggest that it benefits from a combination of the "store of value" and "technical token" narratives.

The approval of the US spot Bitcoin ETF reinforces Bitcoin's store of value narrative and its position as a macro asset. On the other hand, unanswered questions remain about ETH’s fundamental positioning in the cryptocurrency space. Competing Layer 1s like Solana have weakened Ethereum’s positioning as the “go-to” network for decentralized application (dApp) deployment. The growth of Ethereum’s Layer 2 and the reduction of ETH burn also appear to have largely affected the asset’s value accumulation mechanism.

Nevertheless, We still believe that Ethereum’s long-term positioning remains strong and that it has important advantages that significantly differentiate it from other smart contract networks. These include the maturity of the Solidity developer ecosystem, the proliferation of EVM platforms, ETH’s utility as DeFi collateral, and the decentralization and security of its mainnet. In addition, we believe that advances in tokenization in the short term may have a more positive impact on ETH relative to other L1s.

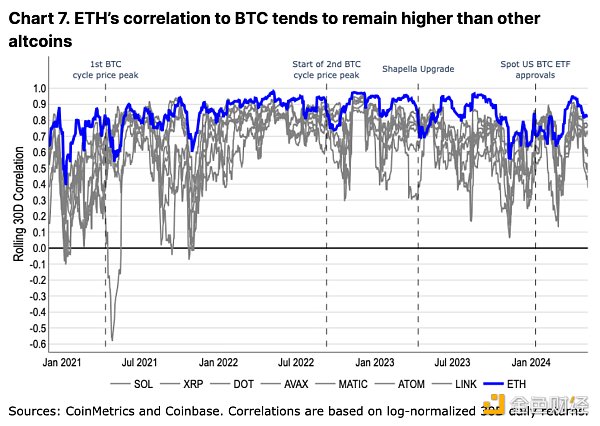

We find that ETH’s ability to capture both the store of value and tech token narratives is demonstrated by its historical trading patterns. ETH trades with a high correlation to BTC, exhibiting behavior consistent with BTC’s store of value model. At the same time, it has also decoupled from BTC during periods of long-term BTC price appreciation, trading like a tech-oriented cryptocurrency, like other altcoins. We believe that despite its poor year-to-date performance, ETH will continue to fulfill these roles and has room to outperform in the second half of 2024.

Addressing the Counter-Narrative

ETH has been categorized in a variety of ways, from being classified as an “ultrasonic currency” due to its supply destruction mechanism to being classified as an “internet bond” due to its non-inflationary staking yield. As L2s expand and re-collateralize, narratives such as “settlement layer assets” or the more esoteric “general purpose work tokens” have also emerged. Ultimately, however, we believe these characteristics alone do not fully capture the dynamism of ETH. In fact, we believe the growing complexity of ETH’s use cases makes it difficult to define a single metric for value capture. Conversely, the convergence of these narratives may even appear negative as they can distract from each other — distracting market participants from the positive drivers of the token.

Spot ETH ETFs

Spot ETFs provide regulatory clarity and new avenues for capital inflows, which are critical for BTC. These ETFs structurally change the industry and, in our view, challenge the previous cyclical pattern of capital moving from Bitcoin to Ethereum to higher beta altcoins. There is a barrier between capital allocated to ETFs and that allocated to centralized exchanges (CEXs), which only have access to a wider range of crypto assets. The potential approval of a spot ETH ETF removes this barrier for ETH, opening ETH up to the same pool of capital currently enjoyed by only BTC. We believe this may be the biggest near-term overhang for ETH, especially given the current challenging regulatory environment.

While there is uncertainty regarding timely approval due to the SEC’s apparent silence on issuers, we believe the existence of a US spot ETH ETF remains a question of when, not if. In fact, The primary rationale for approving a spot BTC ETF applies equally to a spot ETH ETF. That is, the correlation between the CME futures product and the spot rate is high enough that “CME’s monitoring could reasonably be expected to detect misconduct in… [the spot market].” The correlation study period in the spot BTC approval notice began in March 2021, one month after the launch of CME ETH futures. We believe this evaluation period was intentionally chosen so that similar reasoning could be applied to the ETH market. Indeed, correlation analysis previously presented by Coinbase and Grayscale suggests that the spot and futures correlations in the ETH market are similar to those of BTC.

Assuming the correlation analysis holds, we believe the remaining possible objections are likely to stem from differences between the nature of Ethereum and Bitcoin. In the past, we have discussed some of the differences in the size and depth of the ETH vs. BTC futures markets as a possible factor in the SEC’s decision. But among the other fundamental differences between ETH and BTC, the one we believe is most relevant to the approval question is Ethereum’s Proof of Stake (PoS) mechanism.

With no clear regulatory guidance on the treatment of staking assets, we think it is unlikely that a spot ETH ETF that supports staking will be approved in the near term. The complexity of slashing conditions, differences between validator clients, potentially ambiguous fee structures for third-party staking providers, and unstaking liquidity risks (and exit queue congestion) are very different from Bitcoin. (It is worth noting that there are some ETH ETFs in Europe that include staking features, but in general, European exchange-traded products are different from those offered in the United States.) That said, we do not think this will affect the status of unstaked ETH.

The Challenge of Alternative L1s

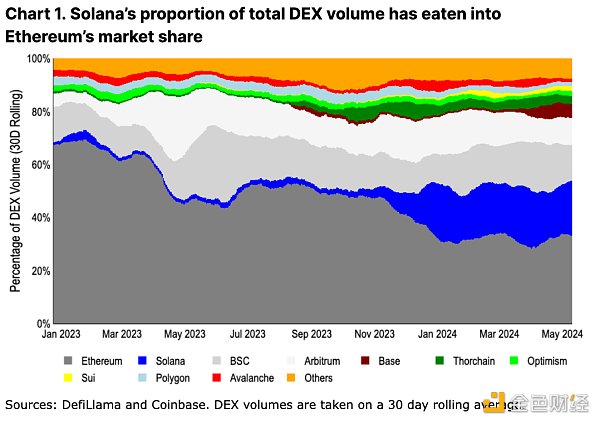

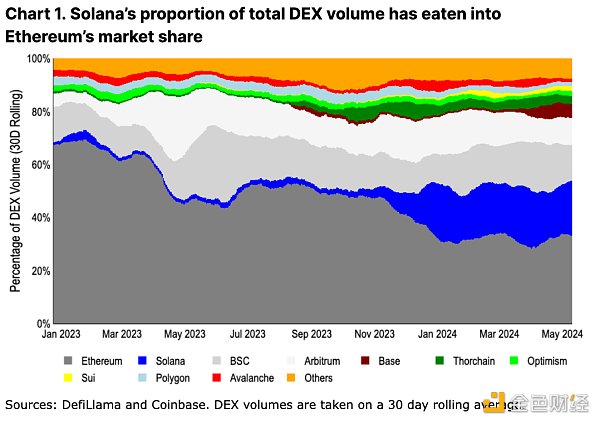

On an adoption level, the rise of highly scalable integrated chains (particularly Solana) appears to be eating into Ethereum's market share. High throughput and low-fee transactions have moved the center of trading activity away from the Ethereum mainnet. Notably, over the past year, Solana’s ecosystem has grown from only 2% of decentralized exchange (DEX) volume to now 21%.

We believe that alternative L1s also now offer more meaningful differentiation from Ethereum than in previous bull cycles. Moving away from the Ethereum Virtual Machine (EVM) and forcing dApps to be redesigned from scratch has resulted in unique user experiences (UX) across different ecosystems. Additionally, an integrated/single approach to scaling enables more cross-application composability and prevents issues with bridging UX and liquidity fragmentation.

While these value propositions are important, we believe it is premature to extrapolate incentivized activity metrics as confirmation of success. For example, the number of transacting users on some Ethereum L2s is down over 80% from their airdrop mining peak. Meanwhile, Solana’s percentage of total DEX volume grew from 6% to 17% between Jupiter’s airdrop announcement on November 16, 2023, and the first claim date on January 31, 2024. (Jupiter is the leading DEX aggregator on Solana.) Jupiter still has 3 of 4 airdrops to complete, so we expect the increase in Solana DEX activity to continue for some time. In the interim, assumptions about long-term activity retention remain speculative.

That said, the proportion of trading activity on leading Ethereum L2s such as Arbitrum, Optimism, and Base currently represents 17% of total DEX volume (Ethereum accounts for 33%). This may provide a more appropriate comparison for ETH demand drivers vs. alternative L1 solutions, as ETH is used as the native gas token on all three L2s. MEV and other additional demand drivers for ETH on these networks are also untapped, which also provides room for future demand catalysts. We believe this is a more equivalent comparison for DEX activity taking an integrated scaling approach vs. a modular scaling approach.

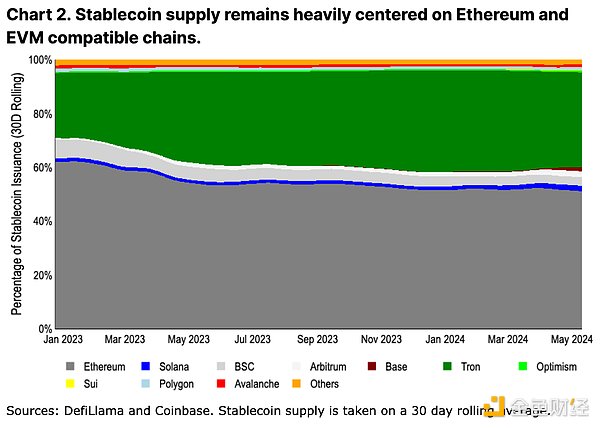

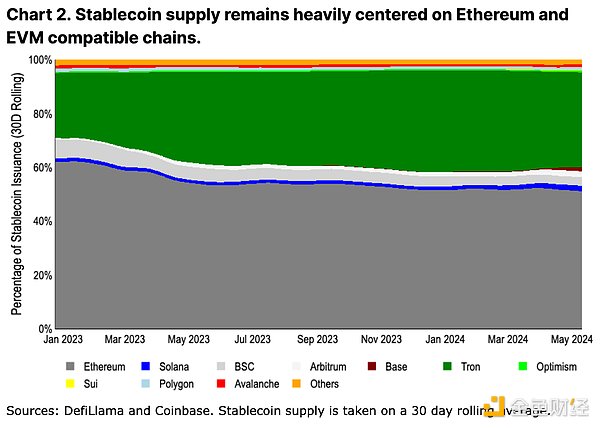

Another, more “sticky” measure of adoption is stablecoin supply. Stablecoin issuance tends to change more slowly due to bridging and issuance/redemption frictions. (See Figure 2, with the same color scheme and sorting as Figure 1, with Thorchain replaced by Tron.) Activity, as measured by stablecoin issuance, remains dominated by Ethereum. We believe this is because the trust assumptions and reliability of many new chains are still insufficient to support large amounts of capital, especially capital locked in smart contracts. Large capital holders are generally indifferent to Ethereum’s higher transaction costs as a proportion of scale, and prefer to reduce risk by reducing liquidity downtime and minimizing bridge trust assumptions.

Even so, among chains with higher throughput, stablecoin supply on Ethereum L2 is growing faster than Solana. Arbitrum surpasses Solana in stablecoin supply by early 2024 (currently $3.6 billion and $3.2 billion respectively), while Base has increased its stablecoin supply from $160 million to $2.4 billion year-to-date. While the final conclusion of the scaling debate is far from clear, early signs of stablecoin growth may actually benefit Ethereum L2 rather than replace L1.

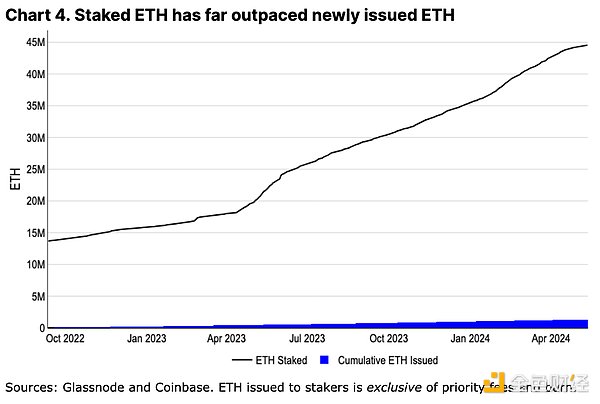

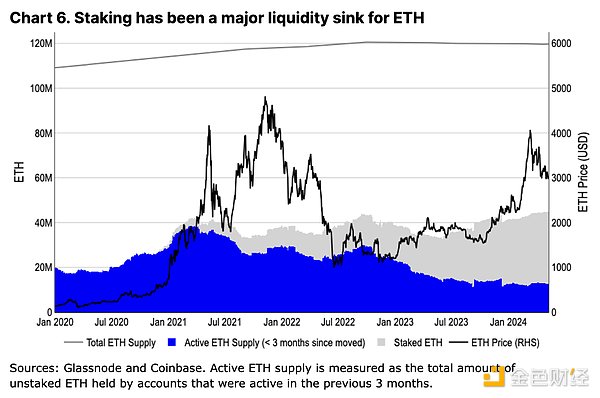

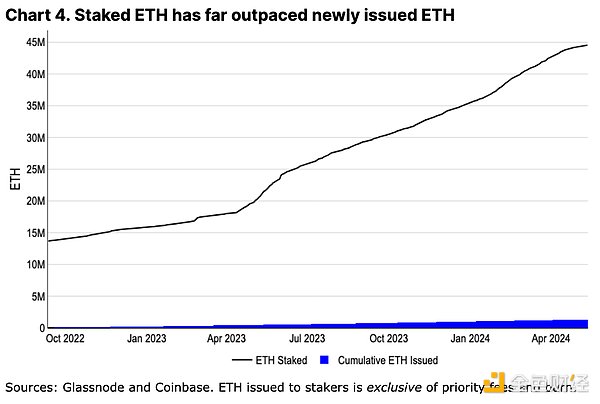

The growing popularity of L2s has raised concerns that they are actually cannibalizing ETH - they reduce the demand for L1 block space (and thus reduce transaction fee consumption), and may also support non-ETH gas tokens in their ecosystems (further reducing ETH consumption). In fact, ETH's annualized inflation rate is at its highest level since its transition to proof-of-stake (PoS) in 2022. While inflation is often considered a structurally important component of BTC supply, we do not believe this applies to ETH. All ETH issuance is owned by stakers, and the total balance of stakers far exceeds the cumulative issuance of ETH since the merger (see Figure 4). This is in stark contrast to Bitcoin's Proof of Work (PoW) miner economics, where the competitive hashrate environment means miners need to sell a large portion of newly issued BTC to finance operations. While miners' BTC holdings are tracked across cycles to prevent their inevitable sell-offs, the minimal operating cost of staking ETH means that stakers can continue to accumulate their positions in perpetuity. In fact, staking has become a sink for ETH liquidity - staked ETH has grown 20x faster than the ETH issuance rate (even excluding burns).

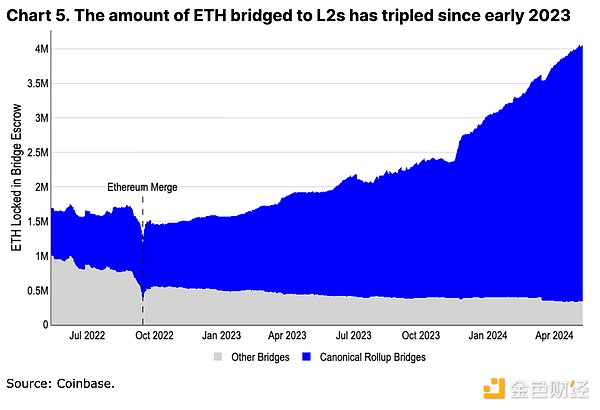

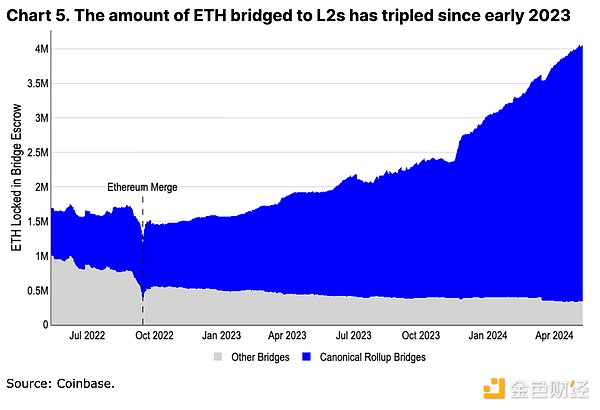

L2 itself is also a meaningful demand driver for ETH. More than 3.5 million ETH have been connected to the L2 ecosystem, which is another liquidity slot for ETH. In addition, even if the ETH bridged to L2 is not directly destroyed, the remaining native tokens manage to pay transaction fees through new wallets, and their reserve balances constitute a soft lock for more and more ETH tokens.

In addition, we believe that even as L2 layers scale, a core set of activities will always remain on the Ethereum mainnet. Restaking activities such as EigenLayer or governance actions of major protocols such as Aave, Maker, and Uniswap remain firmly rooted in L1. Users with the highest security concerns (usually with the largest capital) may also keep funds on L1 until fully decentralized sorters and permissionless fraud proofs are deployed and tested - a process that may take years. Even if L2 innovates in different directions, ETH will always be a component of its treasury (used to pay L1 "rent") and native account unit. We firmly believe that the growth of L2 is not only good for the Ethereum ecosystem, but also for ETH as an asset.

Ethereum’s Edge

Beyond the commonly covered metric-driven narratives, we believe Ethereum has other advantages that are harder to quantify, but nonetheless important. These may not be short-term tradable narratives, but represent a core set of long-term advantages that could sustain its current dominance.

Original Collateral and Unit of Account

One of ETH’s most important use cases is its role in DeFi. ETH is able to leverage across Ethereum and its L2 ecosystem and minimize counterparty risk. It serves as a form of collateral in money markets such as Maker and Aave, and is also the base trading unit for many on-chain DEX pairs. The expansion of DeFi on Ethereum and its L2 has led to additional liquidity absorption in ETH.

While BTC remains the more dominant store of value asset more broadly, the use of wrapped BTC introduces bridging and trust assumptions on Ethereum. We do not believe WBTC will replace the use of ETH in Ethereum-based DeFi - WBTC supply has remained flat for over a year and is over 40% below its previous high. Instead, ETH can benefit from the utility of its L2 ecosystem diversity.

Continuous Innovation in Decentralization

An often overlooked component of the Ethereum community is that it is able to continue to innovate even though it is decentralized. Ethereum has been criticized for its long launch times and development delays, but few acknowledge the complexity of balancing the goals and objectives of different stakeholders to achieve technological progress. Developers of more than five executions and four consensus clients need to coordinate designing, testing, and deploying changes without causing any downtime to the mainnet execution.

Since Bitcoin’s last major Taproot upgrade in November 2021, Ethereum has enabled dynamic transaction destruction (August 2021), transitioned to PoS (September 2022), enabled staking withdrawals (March 2023), and created blob storage for L2 scaling (March 2024) — among many other Ethereum Improvement Proposals (EIPs). While many alternative L1s appear to be able to evolve faster, their single clients make them more fragile and centralized. The path to decentralization inevitably leads to a degree of rigidity, and it is unclear whether other ecosystems are capable of creating similarly effective development processes if they ever begin that process.

Fast L2 Innovation

This is not to say that Ethereum is innovating slower than other ecosystems. On the contrary, we believe that innovation around execution environments and developer tooling is actually outpacing competitors. Ethereum benefits from the rapid centralization of L2 development, all of which pay settlement fees to L1 in ETH. The ability to create different platforms with different execution environments (such as Web Assembly, Move, or the Solana Virtual Machine), or other features such as privacy or increased staking rewards, means that L1’s slower development timeline does not hinder ETH’s adoption in more technologically comprehensive use cases.

Meanwhile, efforts in the Ethereum community to define different trust assumptions and definitions around sidechains, validation, Rollups, etc. have increased transparency in the space. Similar efforts (such as L2Beat) are not yet evident in the Bitcoin L2 ecosystem, for example, whose L2 trust assumptions vary widely and are generally not well communicated or understood by the broader community.

EVM Proliferation

Innovation around the new execution environment does not mean that Solidity and the EVM will become obsolete in the near future. On the contrary, the EVM has been widely diffused to other chains. For example, many Bitcoin L2s are adopting research on Ethereum L2. Most of Solidity's shortcomings (e.g., prone to reentrancy vulnerabilities) now have static tool checkers to prevent basic vulnerabilities. In addition, the popularity of the language has created a well-established audit sector, a large number of open source code examples, and detailed guides on best practices. All of this is important in building a large developer talent pool.

Although the use of the EVM did not directly lead to the demand for ETH, changes to the EVM are rooted in Ethereum's development process. These changes were subsequently adopted by other chains to maintain EVM compatibility. We believe that the core innovations of the EVM are likely to remain rooted in Ethereum or be adopted by L2 soon, which will focus developer attention and thus new protocols in the Ethereum ecosystem. Tokenization and the Lindy Effect We believe that the push for tokenized projects and increased global regulatory clarity in this space may also benefit Ethereum (among public blockchains) the most. Financial products often focus on technical risk mitigation rather than optimization and feature richness, and Ethereum has the advantage of being the longest-running smart contract platform. We believe that moderately higher transaction fees (dollars instead of cents) and longer confirmation times (seconds instead of milliseconds) are secondary issues for many large tokenized projects.

In addition, for traditional companies looking to expand on-chain business, hiring a sufficient number of development talent becomes a key factor. Here, Solidity becomes the obvious choice as it constitutes the largest subset of smart contract developers, which echoes the early point above about the proliferation of the EVM. Blackrock's BUIDL fund on Ethereum and JPM's proposed ERC-20 compatible Onyx Digital Asset Fungible Asset Contract (ODA-FACT) token standard are early signs of importance.

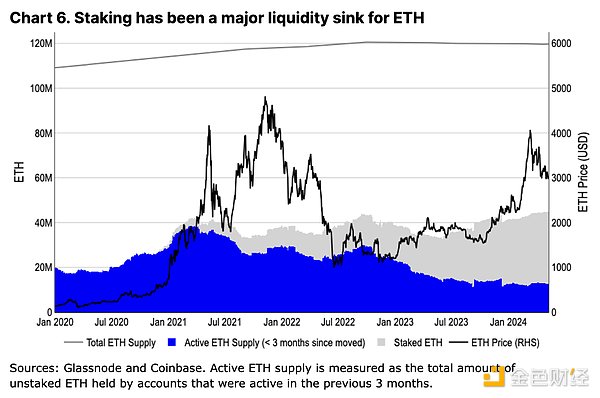

Structural Supply Mechanism

The changes in active ETH supply are very different from those of BTC. Despite the price increase since Q4 2023, ETH's 3-month circulating supply has not increased significantly. In contrast, we observe a nearly 75% increase in active BTC supply over the same timeframe. Unlike increases in circulating supply from long-term ETH holders (as seen in the 2021/22 cycle when Ethereum was still operating under PoW), an increasing portion of ETH supply is being staked. This reaffirms our view that staking is a key liquidity sink for ETH and minimizes structural sell-side pressure on the asset.

Evolving Trading Regime

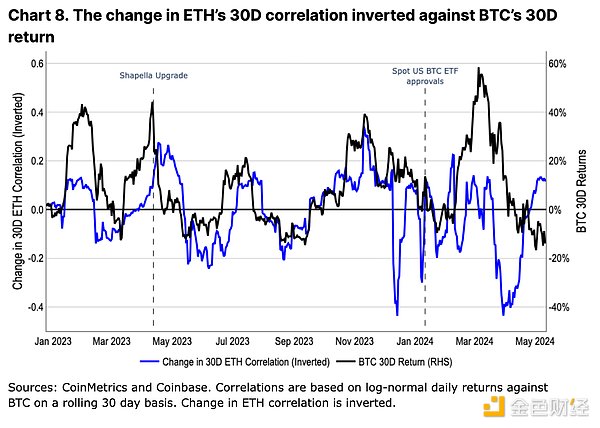

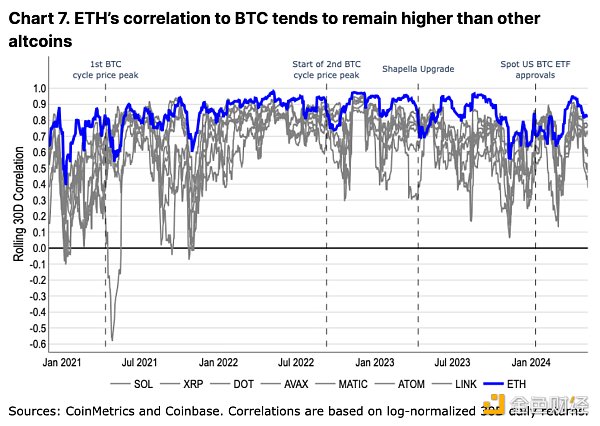

Historically, ETH has traded more in line with BTC than any other altcoin. At the same time, it also decoupled from BTC during bull market peaks or special ecosystem events - similar patterns are also observed in other altcoins, although to a lesser extent (see Figure 7). We believe this trading behavior reflects the market's relative valuation of ETH as a store of value token and technical utility token.

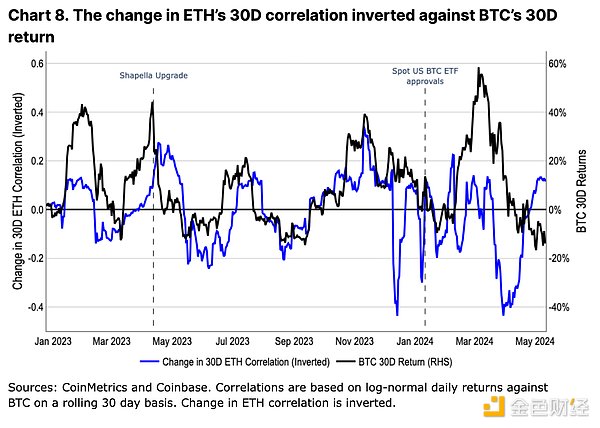

Throughout 2023, changes in ETH's correlation with BTC have been inversely correlated with changes in BTC prices (see Figure 8). That is, as BTC appreciates in value, ETH's correlation with it decreases, and vice versa. In fact, changes in BTC price appear to be a leading indicator of changes in ETH's correlation. We believe this is an indicator of a boom in the altcoin market led by BTC price, which in turn boosts their speculative performance (i.e., altcoins trade differently in bull markets, but correspond to BTC's performance in bear markets). However, this trend has somewhat stalled following the approval of the spot US BTC ETF. We believe this highlights the structural impact of ETF-based inflows, where a whole new capital base can only use BTC. The new market of registered investment advisors (RIAs), wealth managers, and brokerage firms may have a very different view of BTC in their portfolios than many long-term crypto holders or retail traders. While Bitcoin is the least volatile asset in a pure crypto portfolio, it is often viewed as a small diversification asset in more traditional fixed income and equity portfolios. We believe this shift in BTC’s utility has had an impact on its trading patterns relative to ETH, and that a similar shift (and recalibration of trading patterns) may be in the cards for ETH in US ETH ETF spot trading.

Summary

We believe ETH may still have the potential to surprise to the upside in the coming months. ETH does not appear to have supply-side excess issues, such as token unlocking or miner selling pressure. Instead, both staking and L2 growth have proven meaningful, and the absorption of ETH liquidity continues to increase. We believe that ETH’s position as the hub of DeFi is also unlikely to be displaced due to the widespread adoption of the EVM and its L2 innovations.

That said, the importance of a potential US Ethereum spot ETF cannot be underestimated. We think the market may be underestimating the timing and likelihood of potential approval, leaving room for surprise to the upside. In the interim, we believe ETH’s structural demand drivers and the technological innovation within its ecosystem will allow it to continue to span multiple narratives.

JinseFinance

JinseFinance