Source: Liu Jiaolian

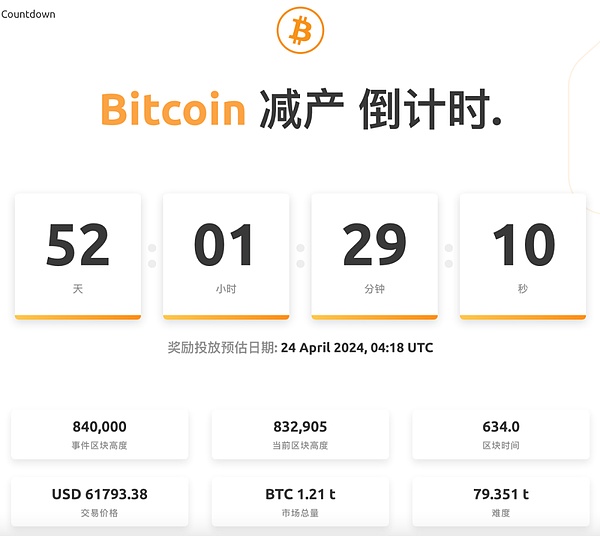

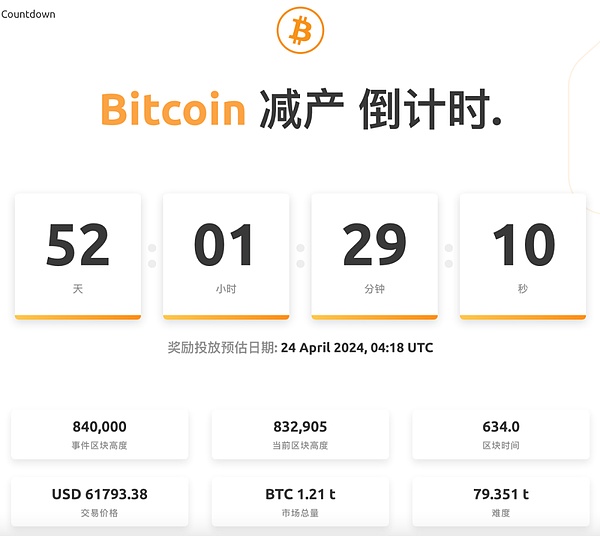

Tick-tock, tick-tock, the fourth Bitcoin production halving is approaching!

Halving is Bitcoin’s most successful meme one. Its simplicity is stunning, its aesthetics mesmerizing, its candidness contemptuous, and its power surprising.

Jiaolian introduces "halving" like this:

"How is the number of rewarded Bitcoins determined? This is related to the number of the ledger. The ledger is from The books were stacked up from bottom to top, so Satoshi Nakamoto made an agreement with everyone in advance in the code. The first ledger will be rewarded with 50 Bitcoins, and the second ledger will still be rewarded with 50 Bitcoins. ,..., the 210,000th ledger, 50 Bitcoins, the 210,000+1 ledger, halved to 25 Bitcoins,...

< p>

“Like this, the number of rewards will be halved every 210,000 ledgers (about 4 years). After about 32 halvings (131 years), by around 2140, the rewards for each block will be reduced. to less than 1/100 millionth of a Bitcoin, that is, less than 1 Satoshi (a unit of Bitcoin named by netizens after Satoshi Nakamoto, 1 Satoshi is equal to 1/100 millionth of a Bitcoin). At this time, it can be considered that there are no more Bitcoin can be mined, and almost the entire reserve of Bitcoin has been mined, about 21 million coins."These two paragraphs essentially describe the following extremely simple and Elegant mathematical formula:

Sum(0.5^n) x 50 x 210000 = 21 million

At the same time:

210000 x 10 / 60 / 24 / 365 = 4 years

This is the “monetary policy” of Bitcoin’s “algorithmic central bank”. Extremely simple, extremely elegant, extremely open and extremely transparent.

One of the core "invariants" of the Bitcoin system.

Half the eternal things, knowing the gains and losses.

On May 14, 2020, Jiaolian decided to have a dialogue across time and space with Bitcoin inventor Satoshi Nakamoto on the extremely important "eternal event" of halving.

In the conversation, Satoshi Nakamoto explained: “This design allows us to escape the risk of arbitrary inflation of a centrally controlled currency, because the total circulation of Bitcoin is limited to 21 million. .”

The market never seems to fully price in the halving.

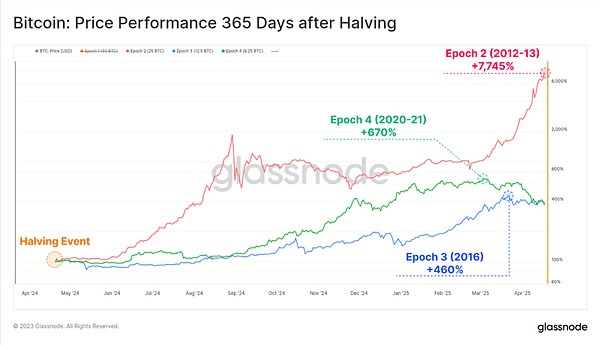

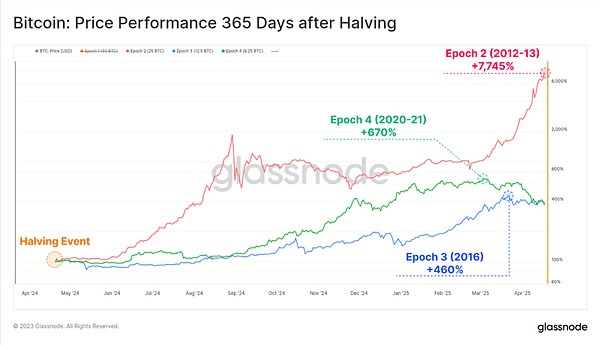

So we have a clear view: after the first halving, BTC increased by a maximum of 7745% within a year; for the second halving, BTC increased by a maximum of 460% within a year; for the third halving , BTC has increased by up to 670% in one year.

Some people seem to have discovered some kind of "wealth code" after tasting.

As Jiaolian once wrote: “The halving promoted the bull market , rather than the other way around. This is almost certain. Halving is an endogenous mechanism of Bitcoin, its occurrence is predetermined, and it is anchored to Bitcoin’s endogenous time, that is, the block height. It is not at all Taking into account the feelings of the outside world, it just happens automatically after the stipulated time. Therefore, the halving is an internal cause. And the external cause can be met but not sought." (Please note: the information after the halving introduced in the original article The historical experience that the bear bottom does not break the previous high has been falsified by the price falling below 20,000 U.S. dollars at the end of 2022)

I often hear people say that the increase of BTC is not as good as one cycle. At least judging from the increase after the halving, this does not seem to be the case.

Besides, this halving is a different halving than before. “Because the halving of production that will inevitably occur in 2024 will cause the asset “hardness” (S2F) of Bitcoin to skyrocket from 57-59, which is less than gold (about 62), to close to 120, which will not only completely crush Gold will become the hardest, hardest, and almost non-perishable asset of our blue planet, the Earth, in the 4.6 billion years since its birth!"

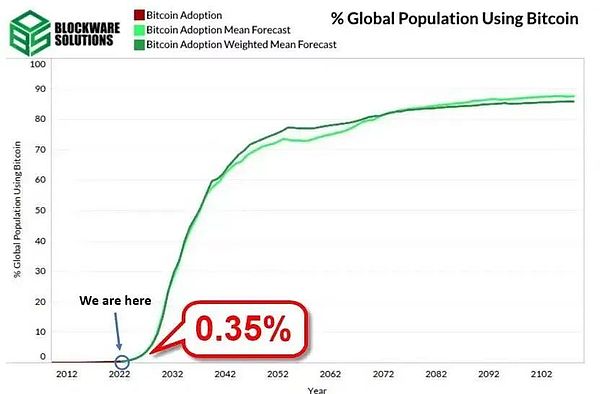

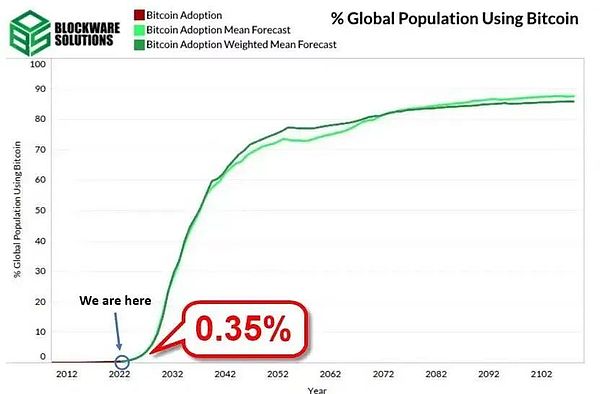

If we are currently standing at the foot of the left end of the innovation-S curve, then a huge, towering cliff stands in front of us, but it is blocked by the unpredictable future curtain and turns a blind eye.

< /p>

JinseFinance

JinseFinance