That man is back again.

Last week, according to the website of the U.S. Bureau of Prisons, CZ, who has been in prison for nearly four months, will be released on September 29. The latest news shows that CZ has left the prison after 118 days in Lompoc Prison No. 2 and has been transferred to the Reentry Management Office RRM Long Beach. He is still in custody.

After this news, the market was excited. Binance's new coins once again rushed to the list of gains to welcome the upcoming return of the spiritual leader, and the X platform continued to sing praises.

After all, the current relatively sluggish market really needs a shot in the arm.

Looking back, in November last year, Binance reached a solution with the U.S. Department of Justice (DOJ), the Commodity Futures Trading Commission (CTFC), the Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network (FinCEN) regarding the investigation of Binance's historical registration, compliance and sanctions issues.

CZ eventually admitted to violating the Bank Secrecy Act, the International Emergency Economic Powers Act and the Commodity Exchange Act for unlicensed money transfer business, conspiracy charges and prohibited transactions, and paid a sky-high fine of $4.368 billion, setting a record for the largest fine in FinCEN's history.

The initial prison term was expected to be within 18 months, but then the Ministry of Justice wanted to increase it to 3 years. However, after 161 letters of support and the discretionary consideration of the active confession, CZ was finally sentenced to four months in prison in April this year, and officially started his sentence in June. He is expected to be released from prison on September 29.

The 4-month sentence is actually not much, but since November last year, Rachael Teng has officially become the new CEO of Binance, and in this nearly one-year power handover of Binance, Binance's dangers and opportunities are also vividly reflected.

In terms of opportunities, CZ's departure officially opened the era of compliance in exchanges and even in the encryption field, announcing the official end of the wild west world. Exchange compliance has become a general trend. It was also after this that Bitcoin ETF officially brought institutions into the encryption field. Due to CZ's turnaround, Binance was able to get rid of its historical baggage first and gain a better opportunity to walk in the market in the name of compliance.

Rachael Teng's promotion is also based on this. Professional managers with complete political and business backgrounds can better lead Binance to complete the construction of global compliance. The follow-up is also the same. Although it does not plan to return to the United States for the time being, Binance already has 19 licenses around the world. This year, it has newly obtained compliance licenses in Thailand, India and Brazil. Its achievements in compliance are obvious to all.

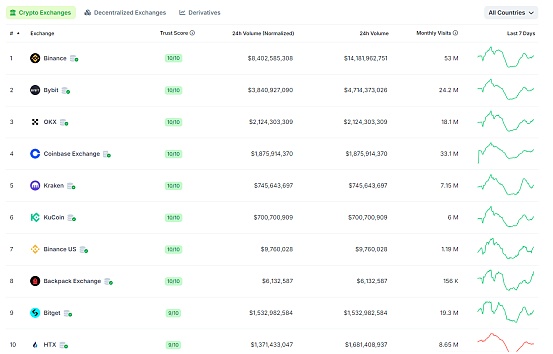

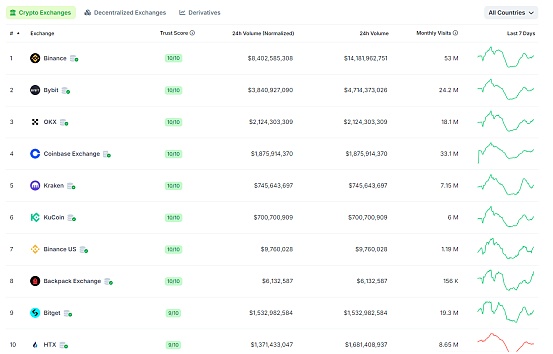

Initially, the market suspected that CZ's departure would affect Binance's operations, but judging from the data alone, Binance's performance this year is still quite impressive. Coingecko shows that Binance's daily trading volume remains relatively stable, with 24-hour trading volume ranking first among all exchanges, and monthly visiting users as high as 530 million people. According to DefiLlama data, from the end of November last year to now, Binance has a net inflow of more than US$4 billion, firmly sitting on the leading exchange. Just a few days ago, Rachael wrote that Binance's historical transaction volume exceeded 100 trillion US dollars in early September.

Overall, after leaving the strong support of the patriarch, Binance seems to have done quite well, but on the other hand, a new crisis is slowly approaching.

In terms of compliance, Nigeria dealt a heavy blow to Binance at the beginning of this year. In February, it announced that Binance was suspected of conducting illegal financial transactions on its platform. Later, it accused Binance of contributing to the collapse of its own fiat currency. There was a rumor that the authorities wanted to ask Binance for a fine of 10 billion. Although the rumor was overturned later, the Nigerian authorities still detained Binance executives Tigran Gambaryan and Nadeem Anjarwalla on the pretext. Until now, Binance’s grievances with Nigeria have not ended, and Gambaryan has not been released.

On the other hand, the whirlpool of public opinion has never left Binance.

At the end of last year, due to the unsatisfactory new projects on Launchpad, Binance encountered doubts about "girlfriend coins", saying that Hooked Protocol, whose product attributes were unclear, had low popularity, and limited experience of team members, could IEO only because of the friendly relationship between Primitive Capital Dovey Wan and He Yi. In April, after Space ID and Open Campus IEO, the rumor intensified, and some users on X even sarcastically said that Binance had a girlfriend coin section. At that time, He Yi responded that Binance definitely did not have a girlfriend coin section, and at the beginning of this year, CZ issued three key directions for Binance's 2023 plan. The first was education, followed by compliance and product services, and then gradually calmed down public opinion.

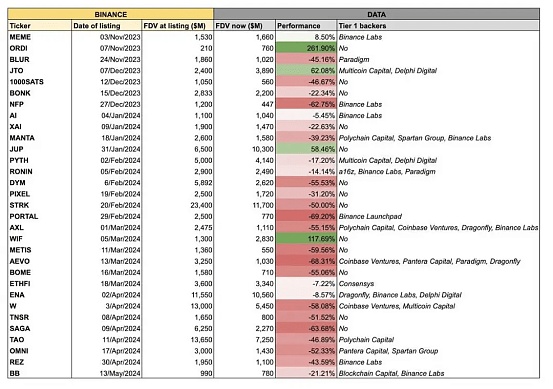

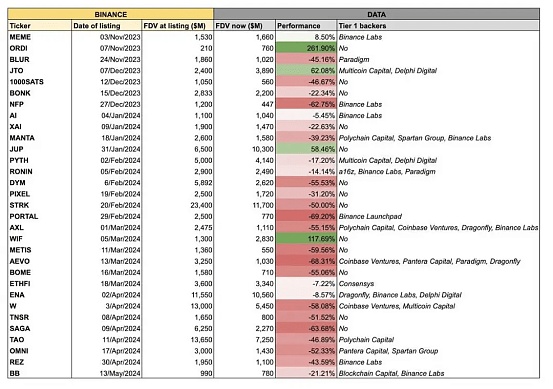

If the girlfriend coin is just a small circle of verbal disputes, it didn't take long for high FDV tokens to follow, setting off a big debate in the entire crypto market. First, Tradetheflow pulled out a table, pointing out that the currencies listed on Binance in the past six months generally performed poorly, and even more were cut in half after being launched. The common point is that these currencies all show significant high FDV characteristics, which in turn triggered a debate between Dragonfly and a16z on MEME and VC tokens. In this context, Binance was accused of frequently listing coins and draining the market's liquidity, leading to the depression of copycats. At the same time, it only served VC tokens, deviated from the community and became an accomplice in cutting leeks. The market soon heard a boycott.

On May 20, Binance's public relations was timely and announced the public recruitment plan for the coin listing project. According to the announcement, tokens launched with high valuations and low circulation models will lead to huge selling pressure when they are unlocked in the future. Such a market structure is not good for ordinary investors and loyal community members of the project. In order to cultivate a healthy industry ecosystem, Binance will take the lead in supporting small and medium-sized cryptocurrency projects.

On June 16, He Yi also responded to FDV and Girlfriend Coin in the community AMA, saying that the anti-VC wave and the popularity of memecoin reflect the lack of high-quality assets in the market. He hopes that more projects with real business models can be built on the blockchain, rather than just staying on the concept of nothingness, and admitted that the investigation was insufficient when the Hook was launched.

In fact, after this, Binance was cautious about the launch of VC tokens, and the frequency of high FDV tokens was rapidly reduced, and began to move closer to the community's MEME tokens and the popular Ton ecosystem. After NOTCoin fired the first shot, DOGS followed closely, and Hamster and Catizen were also launched on Binance. So far, Binance has launched 6 TON ecosystem-related currencies. However, this move has aroused dissatisfaction in the community, pointing out that Binance's listing logic is unclear, and that listing has shifted from application value to traffic value. Listing for the purpose of making quick money is actually lacking the original intention of the industry. The dispute over the size of Nerio has further fermented the controversy. The listing of projects with a market value of less than 20 million US dollars on Binance has become the focus of criticism for a while, market manipulation has also been mentioned again, and there are endless complaints about insider trading.

Faced with various doubts, He Yi once again maintained stability. He not only wrote a long article in response, but also explained the current listing process and the four major listing standards, and humbly stated that "I am not necessarily right."

It is quite interesting that looking at all the public opinion whirlpools, the core reason is actually Binance's innovation. In the current market environment, Binance hopes to seek change in stability to expand the sector and gain a larger share. However, it is precisely because of the seemingly aggressive innovation and the disappointing performance of the new coins that it has been accused of losing its original intention and lacking a pattern. He Yi's responses have also been attacked as being too active and not like a helmsman.

In the final analysis, the Binance in the hearts of users is still the Binance led by CZ. At that time, the rapid growth of the industry's hot spots paralyzed the bottom line of users' tolerance. Users are accustomed to the founder's silent work style and hope that Binance, as an industry vane, will lead the growth and innovation of encryption.

But it is worth mentioning that the current market environment is not as good as before. In the past two years of development, not only has the compliance sickle been hanging high, but the entry of Wall Street institutions has added uncertainty. The crypto market is no longer based on exchanges as the core of absolute discourse power, and the winter of primary market investment institutions is coming. The lack of market liquidity is prominent, and innovative applications are rare. PvP has become popular, leaving only MEME prosperity, and even the operation and publicity of projects have appeared in the event in a brand new way. Everything reflects that the industry has entered a reshuffle period, and exchanges have inevitably taken off the coat of faith and finally came to the world in a commercialized original posture.

It is based on this context that the market has high expectations for CZ's return, hoping that he will return again to lead the currency circle in the storm to find a new direction. But it should be emphasized that as part of the plea agreement, CZ will be banned from participating in the company's daily operations for three years. Of course, its equity as Binance is still real and valid, so it is still feasible to pay attention to the company's performance as a shareholder, or to replace or nominate a new board of directors or a new CEO.

However, due to CZ's position in Binance and the existence of co-founder and partner He Yi, it is obviously very likely that he will participate in the company's operations in other forms. However, given that the two external supervisors appointed through the plea agreement will also pay close attention to similar situations, for safety reasons, it can be foreseen that CZ will indirectly guide the company's operations.

As early as after reaching a plea agreement, CZ had already expressed his intention not to serve as any form of CEO and would focus on investing in blockchain, artificial intelligence and biotechnology companies. CZ's previous non-profit project Giggle Academy stagnated after his imprisonment, and the market can also look forward to the subsequent progress of this project.

Can CZ turn the tide? From the current market situation alone, there are many difficulties. After all, this is a market problem, not a single individual problem. In other words, CZ is the one who climbed all the way to the top from the old era, and the old narrative is no longer viable. But fortunately, new traffic is still pouring in, and younger and more creative groups are entering the currency circle. At the moment of changing course, how to undertake and value new groups and new logic may be the problem that the legendary CZ needs to solve next.

On the other hand, in any case, CZ's return is still a great boon to Binance, and it will also have a positive effect on boosting user sentiment. It will be a high probability event for the Binance series of currencies to usher in a rise, and some people in the market have begun to target the so-called concept of CZ's release from prison.

It can be seen from this that even if the market is no longer that market, CZ is still that CZ.

JinseFinance

JinseFinance