With the passage of BTCETF at the beginning of this year and the approaching US election, the impact of cryptocurrency and US political volatility is gradually increasing. With a series of recent operations by Trump, although cryptocurrency is an emerging and controversial field, it is now becoming an important bargaining chip for votes and financial support in US political elections.

Today, LBank will take stock of the attitude of US politicians towards cryptocurrency and further predict the future trend of the crypto market.

Crazy candidates, encryption and votes

2024 is the next "Ken" moment for the US election.

He doesn't want to miss the new power brought by cryptocurrency, but at the same time he lets the SEC act as a double-faced tiger, using various economic sanctions to maintain a serious distance relationship. Compared with Singapore's early move, the US political circles and cryptocurrency are more like the upper part of the ambiguous period, neither officially announced nor hidden, and more immersed in this seemingly confusing and nameless tug-of-war.

First, Trump, who is super crazy and at the peak of public opinion, quickly opened the floodgates of the crypto market through his speech and meme effect.

On May 22, the cryptocurrency donation website was opened to officially accept cryptocurrency donations;

On May 26, he made a public statement that "will ensure that the future of cryptocurrency and Bitcoin is created in the United States (Made in the USA)...will support the self-custody rights of 50 million cryptocurrency holders across the United States." He also promised to pardon the founder of Silk Road if elected, strongly support cryptocurrency and protest Biden's actions to suppress the industry.

On May 30, the Wall Street Journal reported that Donald Trump is considering appointing Elon Musk as a policy adviser to promote an agenda supporting cryptocurrency

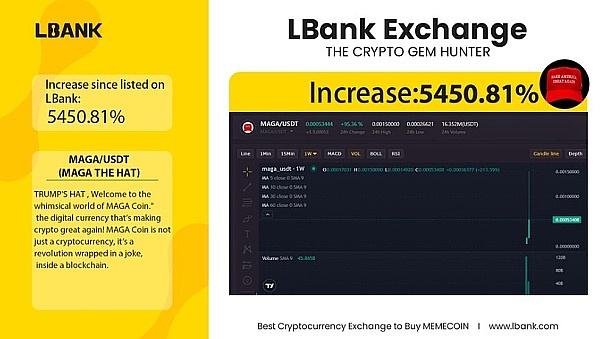

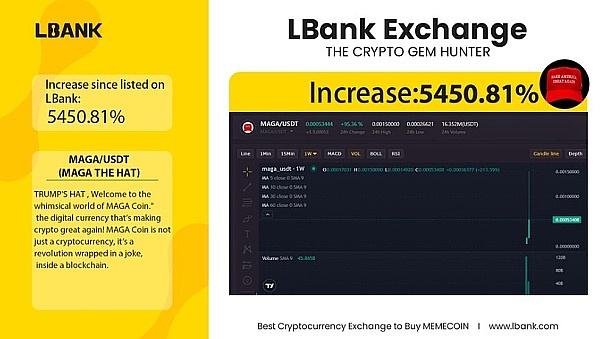

Affected by his remarks, the tokens $MAGA and $TRUMP have skyrocketed, surpassing 99% of the tokens on the crypto market, and have become the hot star MEME on the LBank platform in the past two weeks, with the popularity remaining high.

According to the on-chain data monitoring platform Arkham, the value of Trump's crypto assets has increased significantly, and has now exceeded US$12 million, including 579,290 TRUMPs worth US$8.08 million; 464,706 ETHs worth US$1.76 million; 374,889 WETHs worth US$1.42 million, and other MEME coins including MVP, CONANA, BABYTRUMP, etc.

From "not liking Bitcoin and other cryptocurrencies" five years ago, and even calling them "scams", to "supporting, affirming, and ensuring that cryptocurrencies happen in the United States" today, it is undeniable that the change is indeed keeping up with current events. As expected, in the polls on May 28, Trump's support rate rose on prediction platforms such as Polymarket due to his support for the crypto industry.

The second is the current President Biden. Influenced by Trump's remarks, Biden has also made some pandering moves to win more Generation Z voters.

On May 22, the Biden team is recruiting an "emoji manager" to manage Internet content and emojis (including MEME);

On May 23, the Biden administration issued a statement calling on Congress to cooperate on a "comprehensive and balanced regulatory framework for digital assets";

On May 29, Biden sent a presidential delegation to attend the inauguration of the President of El Salvador

At the same time, people familiar with the matter revealed that Biden's re-election campaign has begun to contact key figures in the cryptocurrency industry, seeking guidance on "the development of the crypto community and crypto policy moving forward." This marks a major "shift" from the government's previous cold attitude towards the industry.

Cryptocurrency game theory, Consensus2024 reveals market signals

At the Consensus2024 consensus conference, ARK Invest CEO and Chief Investment Officer Cathie Wood (female stock god) said: Because cryptocurrency is an election issue, the Ethereum spot ETF application was approved.

She said in an interview: "The interpretation at the time was that it would not be approved, absolutely not approved. If it was approved in the usual way, we would be questioned by the US SEC. But before that, no one had received such inquiries." Wood Sister also said that the mood in the House of Representatives surrounding the Financial Innovation and Technology Act of the 21st Century (FIT21), which was passed last week with bipartisan support, is constantly changing, indicating that this may be an election year issue.

During the event, Brian Nelson, deputy secretary of the Treasury Department and director of the Treasury Department's Office of Terrorism and Financial Intelligence, also said that FinCEN's proposal in 2023 to require cryptocurrency companies to report transactions involving mixing is intended to increase transparency, not to ban mixers.

Nelson said he sympathized with cryptocurrency users' desire for financial privacy, but suggested that the industry and the Treasury Department should work together to find ways to enhance privacy while avoiding terrorist financing.

Meanwhile, Lynn Martin, president of the New York Stock Exchange, and Tom Farley, CEO of Bullish, discussed cryptocurrency regulation, changing American politics, and the limitations and opportunities of blockchain technology to improve traditional markets. Among them, Farley highlighted the sudden shift in attitudes toward cryptocurrencies in U.S. politics, including the removal of the anti-cryptocurrency chairman of the Federal Deposit Insurance Corporation (FDIC), the passage of the 21st Century Financial Innovation and Technology Act (FIT21) in the House of Representatives, and Republican presidential candidate Donald Trump doubling down on support for cryptocurrencies in a series of rapidly occurring events.

"Whether it's Trump, Biden or Michelle Obama (who will become president), you will see progress in 2024 and 2025," he added.

Earlier on May 28, former CFTC Chairman Christopher Giancarlo also said in an exclusive interview with Forbes: The dam of the United States resisting cryptocurrency innovation is about to collapse, and cryptocurrency will eventually return as a king in the United States.

Fund flows and politics: BTCETF data and voters

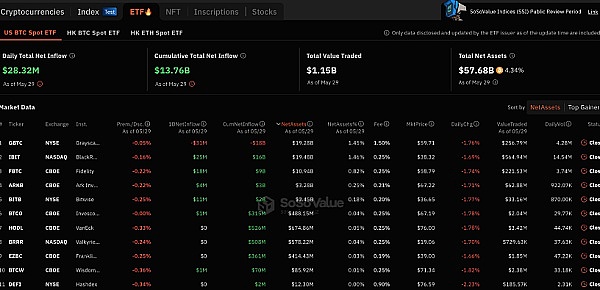

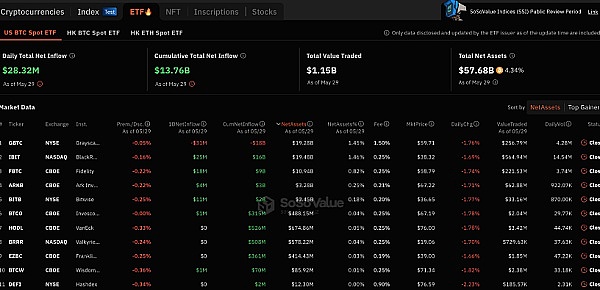

According to sosovalue data, as of May 29, the total net asset value of the Bitcoin spot ETF was US$57.683 billion, and the ETF net asset ratio (market value to the total market value of Bitcoin) reached 4.34%. The historical cumulative net inflow has reached US$13.76 billion, and it has continued to have net inflows for 12 days.

On May 28, Grayscale Investments®, the world’s largest crypto asset manager, today announced the second phase of its national survey “2024 Election: The Role of Cryptocurrency,” which found that in the face of geopolitical tensions, inflation and a weak dollar, two in five likely voters (41%) are looking at Bitcoin and other crypto assets—a statistic that is up from 34% in the first phase of the Harris Poll survey, which was conducted from November 2023. Similarly, voters increasingly say they expect to have some portion of their portfolios include cryptocurrencies (47% in 2020, compared to 40% in 2023). "In line with recent House and Senate votes, this data further demonstrates that cryptocurrencies have become a bipartisan issue that cannot be ignored by either party," said Grayscale head of research Pandl. The rise in interest is largely attributed to the successful launch of a spot Bitcoin ETF in the U.S. in January, which has now attracted $13.7 billion in net flows since its launch. Grayscale said nearly a third of voters became more interested in cryptocurrencies as an asset class after the ETF received regulatory approval.

Outlook and Risk Reminder

The United States is currently at a very critical moment and needs to make many important decisions, involving macroeconomic policy issues such as government interest rate hikes, inflation, and the United States' positioning on the international stage. With the increasing interest in cryptocurrencies, the future government's attitude towards this emerging digital asset has attracted much attention.

As the US election approaches, Trump and Biden have launched a fierce debate on the most controversial issue of cryptocurrency in order to win voter and financial support. This move not only shows that the US political parties have an ambiguous attitude towards cryptocurrencies, but also indicates the future direction of regulation and more rational risk management.

At the same time, with the election approaching, frequent law enforcement activities have also given the market a sense of conspiracy theory, and the SEC seems to have expressed its stance. LBank reminds users to understand the inherent volatility of the cryptocurrency market and invest with a cautious and informed perspective, and not to blindly follow hype or social media trends.

JinseFinance

JinseFinance