BlackRock Also Caught Up in Bitcoin Rune Madness? ETF Wallet Receives Over $20,000 Worth of Rune Airdrop

BlackRock finds itself in Rune token frenzy amid Bitcoin's halving. Airdrop mystery unfolds with $20,000 Rune tokens.

Edmund

Edmund

With the release of "not so hard" economic data, the market continued to digest the dovish Powell (many other committee members are hawkish), and the expectation of interest rate cuts rebounded. The Dow Jones Industrial Average rose for five consecutive weeks, and the S&P and Nasdaq rose for four consecutive weeks. In particular, the Nasdaq Technology Index rose by more than 3% this week. After the CPI data this week, U.S. stocks have recovered all of the losses in April and hit a record high.

The bull market that began in October 2022 was not smooth sailing, and the main setback came from market concerns that the Federal Reserve would maintain high interest rates for a long time. Nevertheless, since then, the S&P 500 index has returned nearly 52%, including a year-to-date increase of more than 10% in 2024.

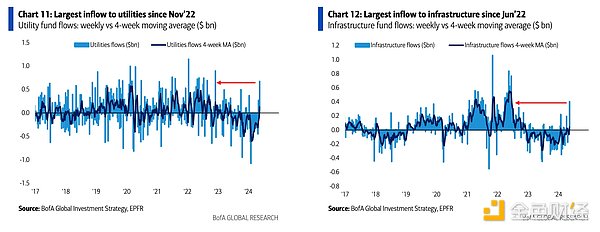

While much of the market's ascent since 2022 has been driven by significant growth in the tech sector (along with the so-called "Big Seven" and particular enthusiasm for AI), we need to see the breadth of the market start to broaden recently, a positive sign for the durability of the bull market. Cyclical sectors such as industrials and financials, as well as more defensive and rate-sensitive sectors such as utilities, have gained ground in recent weeks, as can be noted.

Europe's latest inflation data and speeches by central bank officials all support a June rate cut, which seems to be a done deal. However, European stock investors have begun to pay attention to the prospect of a rate cut after June. This prospect has been hit by the cautious speeches of officials, and European stocks closed slightly lower last week (but still near historical highs).

Chinese stocks continued to strengthen, supported by unprecedented real estate market stimulus policies. The CSI 300 rose to a 7-month high, the China Concept Index (HXC Index) rose to an 8-month high, and the strongest Hong Kong stock HSI rose 4.74% to a 9-month high, of which the domestic real estate index rose 9.9%, and has risen 40% in the past four weeks. Analysts generally believe that the government wants to support this industry, but does not want to over-stimulate it, so it is still looking forward to more policy support.

Gold (historical high), silver (+11%), cryptocurrencies, copper, and crude oil all rose. The main background for the rise in copper prices is the expectation that the wave of electrification will drive the growth of copper demand, including electric vehicles, artificial intelligence data centers, or the expansion of power grid facilities to meet the surge in electricity demand. At the same time, as the production capacity of new copper mines decreases, the West sanctions Russia's supply.

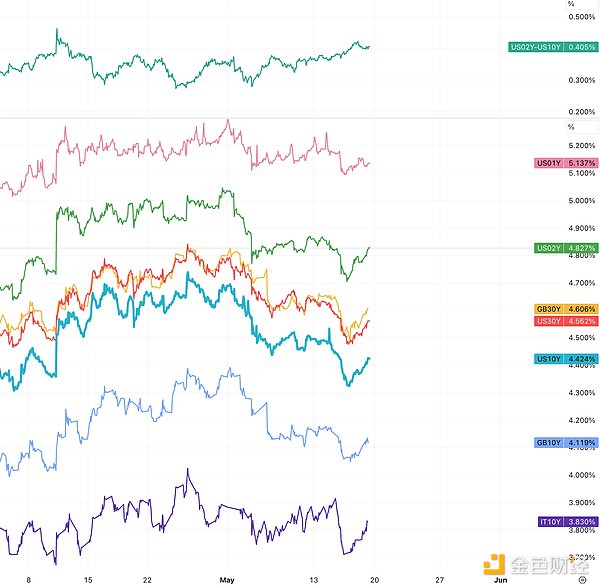

The V-shaped trend of U.S. Treasury yields only fell slightly throughout the week. Judging from the timing of the unusual trend, this is related to the release of several leading indicators of the U.S. economy, which hinted that growth is facing serious resistance. Although it is considered to be good for the stock market:

In the stock and commodity markets, it seems that goldiloc's status has returned (the economic momentum is good, the Fed can control inflation, although it may not return to 2%), but there are some concerns in the bond market.

sofar 93% of S&P 500 companies have reported results, and 78% of EPS have exceeded expectations. The earnings growth rate of 5.7% is the highest year-on-year earnings growth rate since the second quarter of 2022 (5.8%). For the second quarter of 2024, 54 S&P 500 companies issued negative EPS guidance and 37 S&P 500 companies issued positive EPS guidance. Analysts expect EPS growth to reach 9.2% in the second quarter. In addition, analysts also expect earnings growth rates of 8.2% and 17.4% in the third and fourth quarters of 2024, respectively.

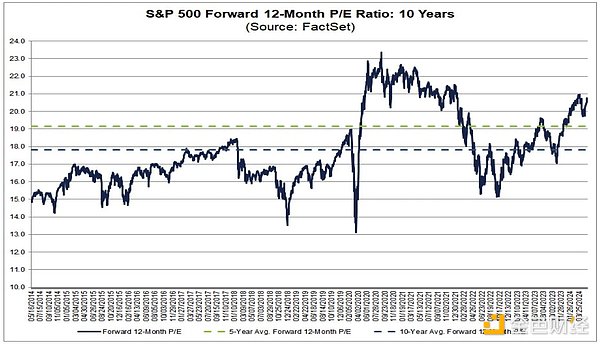

Optimistic expectations support high valuations: The S&P 500's forward 12-month price-to-earnings ratio is 20.7. This P/E ratio is higher than the 5-year average of 19.2 and the 10-year average of 17.8:

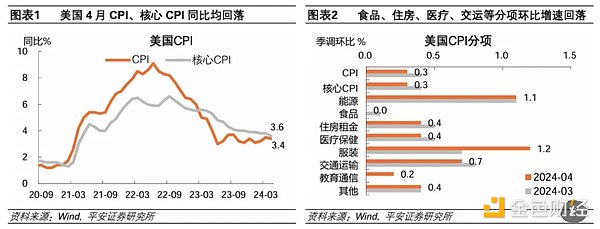

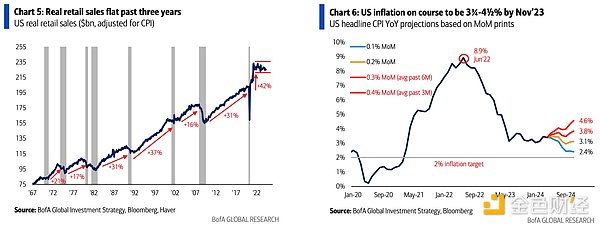

Last week, the much-anticipated April CPI (Consumer Price Index) report was released. The results were in line with what the market was expecting, with inflation seemingly returning to a milder trend after months of above-expectation reports that caused market anxiety.

The fundamental trends in the CPI report were encouraging. The overall core CPI fell year-on-year to 3.6%, the lowest level in three years. It rose 0.3% month-on-month, lower than the expected 0.4% and lower than last month's 0.4%. Although there is nothing particularly optimistic if we only look at these numbers, this is the first CPI report this year that is not higher than expected, so it is enough to make the long-suppressed sentiment of bulls completely explode after the FOMC.

Among them, commodity prices continued to fall, and the decline in the cost of automobiles and household goods played a boosting role. In the past 6 months, the core commodity side has been falling except for February, echoing Powell’s recent statement that commodity inflation has basically returned to the pre-epidemic period, and continued deflation is suppressing inflation. Core services rose by 0.4% month-on-month and 5.3% year-on-year, which is still the most problematic part of CPI. The biggest of these is housing, which rose 0.4% month-on-month and 5.5% year-on-year. Rental inflation and owner's equivalent rent (OER) both rose 0.4%. Housing and gasoline contributed more than 70% of the nominal CPI increase this time. Other services including transportation, auto insurance, and medical services declined slightly, while education unexpectedly rose by 0.2% (extra disturbance caused by the student movement?)

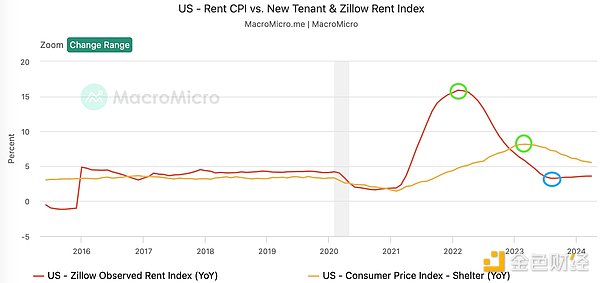

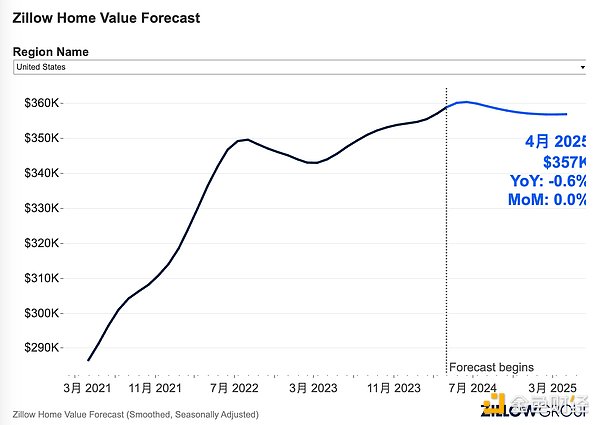

Zillow expects house prices to peak this summer and turn downward. It now expects a 0.6% increase in 2024, down from last month's forecast of 1.9% growth in 2024 and well below the pre-pandemic average annual appreciation rate of around 5%. Zillow predicts a 0.9% drop in home prices over the next 12 months. The main reason is that the number of listings has surged and the market has turned to the buyer's side:

"New Federal Reserve Mouthpiece" Nick Pointing out that after the April report, two more CPI reports are needed to boost the Fed's confidence. The Fed may still not cut interest rates before September. The significance of the April CPI data is that it retains the possibility of a rate cut later this year and calms some concerns that the Fed may need to open the door to further rate hikes.

The PPI data released on Tuesday is more interesting. Driven by energy prices and service costs, the nominal PPI rose by 0.5% month-on-month in April, significantly higher than the expected 0.3% and 0.2% in the previous month. The annual increase was 2.2%, in line with expectations, but a new high so far this year. The core PPI excluding food and energy also rose by 0.5%, significantly higher than the expected 0.2%, and the annual increase was 2.4%, also in line with expectations.

These inflation figures are obviously not good news, but the market did not fall much before the opening. The reason is that the government revised last month, and the nominal and core month-on-month growth rates in March changed from the original increase of 0.2% to a decrease of 0.1%. This completely changed the interpretation, from inflation to deflation. The market was confused all of a sudden. Should it be nervous about the significantly higher expectations of PPI, or happy because of the timely deflation last month? Judging from the final trend, the market chose the latter, and all three major stock indexes rose at the opening.

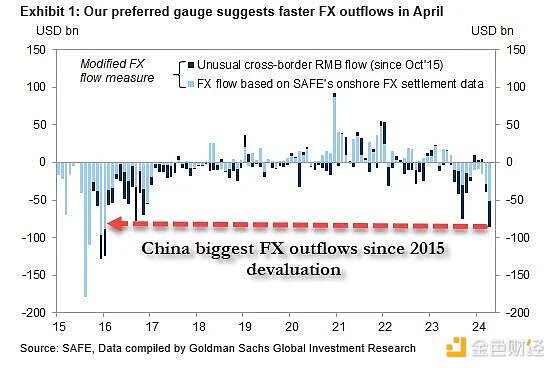

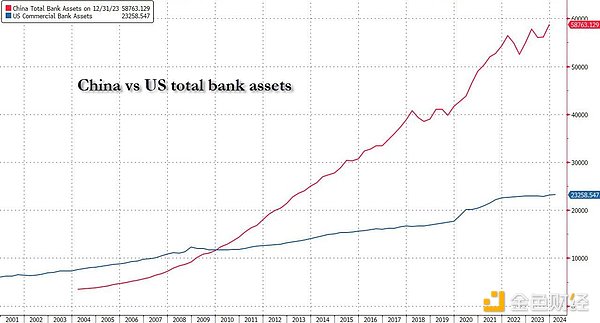

As of March, China sold US bonds for the fifth consecutive month, and sold a total of US$53.3 billion in the first quarter, setting a record. Even during the 2008 financial crisis, there was no such continuous reduction in government bonds and agency bonds.

Bloomberg analysis pointed out that although it is close to the Fed's interest rate cut cycle, China is still selling the US dollar and the US dollar, so there should be a clear intention... With the resumption of the Sino-US trade war, China's selling of US securities may accelerate, especially if Trump is re-elected as president.

While selling US dollar assets, official gold holdings are rising again. According to PBOC data, the proportion of gold in reserves climbed to 4.9% in April. This is the highest level since 2015. The IMF mentioned that since 2015, China and countries with close ties have increased their gold holdings in their foreign exchange reserves, while countries in the US camp have remained basically stable, which seems to mean that their central banks may buy gold out of concerns about the risk of sanctions.

On the other hand, Japan is buying. According to the Ministry of Finance, foreign holdings of US Treasuries reached $8.09 trillion in March, up from $7.97 trillion in the previous month, setting a new record high. US Treasuries have performed strongly this month, with the most foreign buying in three months. The volume of US Treasuries in Japan has also risen sharply, and is now at a record high of $1.19 trillion.

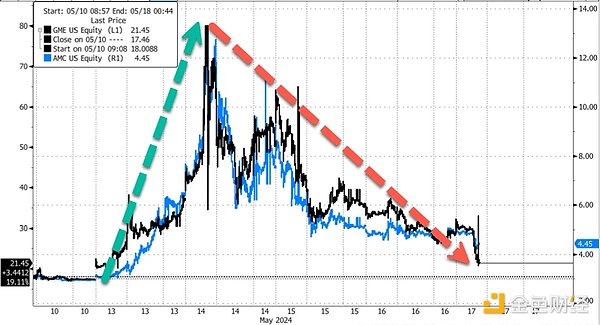

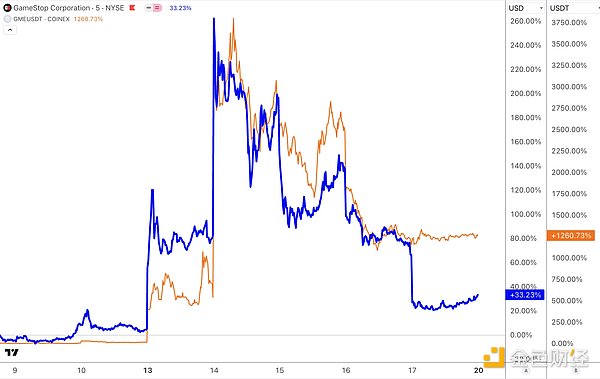

From Monday to Wednesday, Roaring Kitty returned after three years and posted on X, triggering a massive short squeeze on heavily shorted Gamestop and AMC Entertainment Holdings, and the company's market value once rose to $19.8 billion. The rally lasted only 2 days before entering a correction. Then on Friday, GME announced that it would use the MEME hype to issue 45 million shares, which severely suppressed the hype enthusiasm (retail is fuel, not people), but the stock has still nearly doubled so far in May (AMC also announced an additional $250 million in shares this week). In addition, GameStop also predicted that first-quarter net sales will drop from $1.24 billion in the same period last year to between $872 million and $892 million.

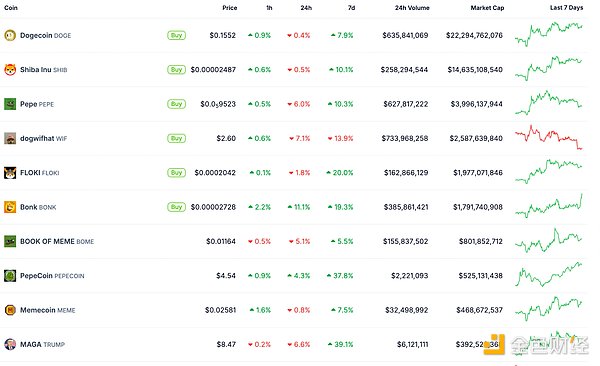

The GME meme coin on Solana rose 40 times last week, and its synchronization rate with the GME stock trend is very high:

Microsoft's stock price and AI concept cryptocurrency did not react much. Apple, on the other hand, is said to have finalized the details of integrating some GPT technologies into the iPhone. If Siri can use these technologies, its interaction quality and user experience will achieve a huge leap, so it was Apple that reacted the most last week.

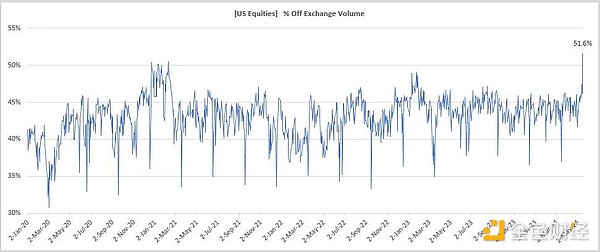

Rising over-the-counter trading volume is often seen as an indicator of rising retail trading activity. On Friday, over-the-counter trading accounted for 51.6% of all U.S. stock trading yesterday, the highest level on record. Goldman Sachs analyst Scott Rubner said he heard more discussion about "FOMU" (fear of missing out on a big performance) this week. In addition, the hashtag "#DOW 40 K" is trending on social media, indicating that retail traders are excited about the recent performance of the Dow Jones Index.

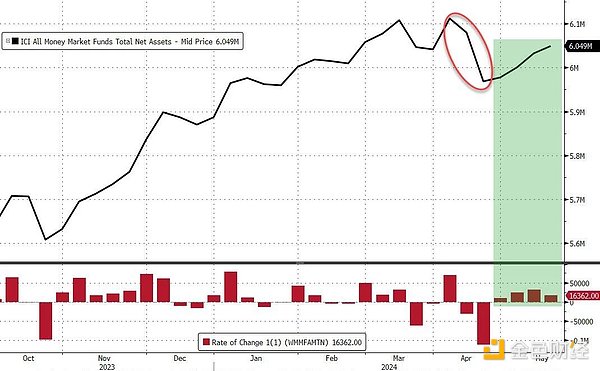

Money market funds saw inflows for the fourth consecutive week (+ $16.4 billion), returning to an all-time high of more than $6 trillion after a seasonal tax-related decline, to the highest level in a month:

The abundance of cash is also reflected in the global scope. The use of the Federal Reserve's reverse repurchase agreement (depositing cash to earn interest) by foreign central banks has risen to the highest level in a year:

The funds flowing into the Ut and Infra sectors hit the largest level in more than a year:

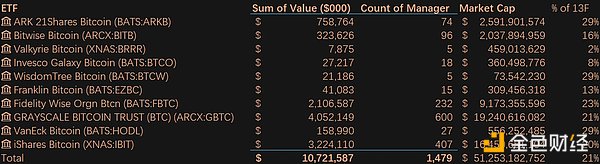

Nearly 1,500 holding records worth $10.7 billion were reported, accounting for 20% of the total value of ETFs, of which 929 institutions owned at least 1 Bitcoin ETF. Among them, 44% of the companies held IBIT, and 65% of the companies held Grayscale GBTC (which should be the shares converted after the listing, not the increase in holdings). 99% of the institutions were located in the United States, and Hong Kong companies ranked second.

MILLENNIUM, the largest owner, is worth $1.9 billion. Bracebridge Capital holds more than $400 million, a hedge fund that manages the endowments of Yale and Princeton universities. The Wisconsin Investment Board (dominated by public pensions) reports that it has more than $160 million in Bitcoin funds. JPMorgan Chase, which has been critical of Bitcoin, also reports owning a small amount of spot Bitcoin ETF shares.

Bloomberg analysts commented, "Typically, these big fish institutions don't show up in 13F for a year or so (when ETFs get more liquidity) but as we've seen, these are not ordinary good signs because institutions tend to act collectively. "

IBIT also stood out for breaking the previous record of 10 billion set by a traditional ETF. IBIT broke this threshold in 49 days. The JPMorgan Nasdaq Equity Premium Yield ETF (JEPQ) previously held this record, which took about three years.

A shift in AI investing: While Nvidia has been a dominant player in the AI space, many investors looked to other companies in the first quarter. For example, Druckenmiller cut his stake in Nvidia, believing it to be overvalued in the short term. Meanwhile, some investors are starting to look at other stocks that are expected to benefit from the AI revolution, such as Apple, Meta Platforms, and Microsoft.

Focus on Chinese companies: The Chinese stock market has had a tough time due to concerns about a slowing Chinese economy. However, some prominent investors saw investment opportunities and increased their holdings of Chinese retail and technology companies. For example, David Tepper significantly increased his holdings in companies such as Alibaba, Baidu, and Pinduoduo. Big short Michael Burry significantly increased his holdings in JD.com and Alibaba.

Buffett's secret stock revealed: Berkshire Hathaway has always kept a stock in its portfolio secret. In the latest 13-F filing, the mystery was finally revealed. The stock is Chubb, a Swiss-registered insurance company.

On Thursday local time, according to media reports, the Chicago Mercantile Exchange plans to launch spot Bitcoin trading to meet the needs of Wall Street. CME declined to comment. After the news came out, the US crypto asset trading platform Coinbase plummeted by 9.4% in the overnight market. However, CME mainly serves institutions, while Coinbase mainly serves retail investors - Coinbase's retail trading revenue in Q1 was $935 million, far higher than the $85 million of institutional revenue.

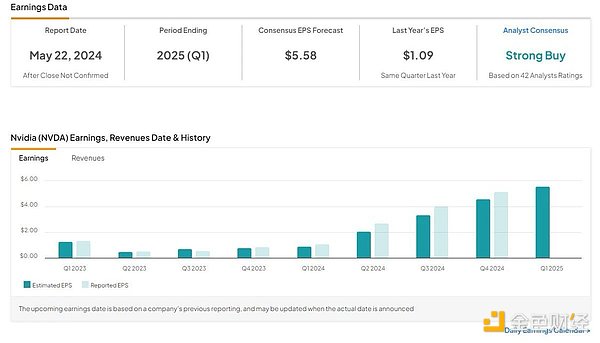

If there were still inconsistent views on inflation signals last week, the next major catalyst is the release of Nvidia's report this week. The consensus expectation is that Nvidia's revenue in the first quarter of fiscal year 2025 is expected to reach US$24.65 billion, more than double the previous year. The company's previous revenue guidance was US$24 billion, with a fluctuation of 2%. Net profit in the same period is expected to be US$12.87 billion, a year-on-year increase of more than 530%.

Since the third quarter of 2022, Nvidia has exceeded expectations for five consecutive quarters. You know, ChatGPT had not appeared at that time. The real outbreak was in the spring of 2023. Then NV's profits began to soar due to the hot sales of artificial intelligence GPU chips. One problem is that the percentage of exceeding expectations in the last three quarters has gradually narrowed, from 2% to single digits, but there is no need to worry too much. After all, this is much stronger than before. Many institutions have raised Nvidia's new target price range, ranging from $1,100 to $1,350.

The factors that drive NV's performance guidance upward are the following: First, Microsoft, Google, Amazon's AWS, Meta's announcements show that this year's capital investment in cloud computing is as high as $177 billion, far higher than last year's $119 billion, and will continue to increase to $195 billion in 2025. These investments will provide momentum for Nvidia's continued growth in data center revenue and profits, especially in the next generation.

Blackwell AI chips will be released later this year. NV's data center revenue has soared from 50% to 80%, and AI remains Nvidia's main growth driver.

Analysts' high confidence in Nvidia's future performance growth potential is mainly based on: First, product supply and market demand. Better supply of H100 GPUs (shortened delivery time) and strong demand for H200 GPUs in China provide strong support for Nvidia's current quarterly performance. The upcoming Blackwell series of GPUs (B100 and B200) are expected to be sold from the third quarter and occupy most of the market share in the fourth quarter. The average selling price of these two GPUs is about 40% higher than that of existing products, indicating higher revenue potential.

AMD and Intel are catching up with Nvidia. However, in the GPU market, NV firmly controls about 92% of the market share. As we have analyzed before, NV's barriers are not only the chip itself, but also the software and community ecology, which comprehensively reduce customers' costs and make it impossible for competitors to cross in the short term.

In terms of valuation, NV has entered the 2 trillion club. Apple's revenue at the same level is more than 7 times that of NV, so NV needs to maintain high growth to maintain its stock price. However, in order to invalidate the growth story, it will take several consecutive quarters of poor financial performance to change the market's view and cause the stock price to fall sharply. Therefore, even if this financial report disappoints everyone, the market position will not be shaken by an unsatisfactory financial report, and a rebound is expected in the current short term when there are no alternatives.

In recent weeks, we have seen technology companies that have exploded, including ASML, Inter, AMD, SMCI and ARM. After the earnings reports that were lower than expected, the stock prices fell by 10% to 30%, but so far they have basically recovered more than half of the decline.

In addition, this week, several senior Fed officials will make speeches, including Board members Barr and Waller, as well as regional Fed presidents Williams and Bostic. Focus on the statement of Waller, the next successor to the Fed. In his speech last week, he did not make any comments on the economic and monetary policy outlook. The minutes of the last FOMC meeting will also be released on Thursday.

BlackRock finds itself in Rune token frenzy amid Bitcoin's halving. Airdrop mystery unfolds with $20,000 Rune tokens.

Edmund

EdmundCZ’s sentencing date is set for 30 April, following a settlement reached between him and Binance with the US Department of Justice in November 2023.

Catherine

CatherineDOJ recommends 3-year prison for CZ amidst Binance legal woes. CZ's team argues against prison, suggests probation. CZ expresses remorse in letter to judge, receives support from sister and Binance co-founder. Legal saga highlights complexities in crypto regulation.

Edmund

EdmundSafeMoon files for bankruptcy amid fraud charges, leading to a significant drop in its cryptocurrency value.

Huang Bo

Huang Bo Coinlive

Coinlive Despite a drop in value of 76% since it's ATH, Bitcoin followers are still bullish on its ability to replace fiat currency.

Beincrypto

BeincryptoOne of the circulating news was that DCG owed over US$1.1 billion to its subsidiary Genesis.

Tristan

TristanAn easy-to-understand informative piece about wETH (Wrapped Ether).

Nell

Nell Nulltx

Nulltx Nulltx

Nulltx