Foreword

Since its launch in 2017, Cardano (ADA) has grown into a PoS network that aims to push the limits of blockchain technology. As a platform committed to security, scalability, and functionality, Cardano is more than just a cryptocurrency, but provides a powerful environment for developers and users to build decentralized applications and systems. Through close collaboration with organizations such as Input Output Global (IOG), the Cardano Foundation, and EMURGO, Cardano has taken an important step on its roadmap and entered the competition in areas such as smart contracts, defi, and NFT.

This article will take you deep into the latest developments, key data and network features of Cardano, explore the use cases of ADA and its role in the entire crypto economy. Whether you are a developer, investor or enthusiast of blockchain technology, this article will provide you with a comprehensive insight into the Cardano ecosystem, from governance innovation to financial health to the dynamic growth of DeFi, looking forward to the future of Cardano towards its ultimate goal, the Voltaire era.

About Cardano

Cardano is a PoS layer 1 network launched in 2017. Its goal is to provide security, scalability and functionality for decentralized applications and systems built on its network. In addition to the community support of developers, node operators and projects, Cardano is also supported by Input Output Global (IOG), Cardano Foundation, EMURGO and other institutions. Together, these institutions promote the development, adoption and fundraising of the network, leading Cardano to the final stage of its roadmap, the Voltaire era.

Compared to other smart contract networks, Cardano takes a unique approach to development. The Ouroboros consensus mechanism allows for stake delegation, while the extended eUTXO accounting model facilitates native token transfers, scalability, and decentralization.

With a loyal group of users and developers, Cardano has proven its staying power. After Cardano began supporting smart contracts through the 2021 Alonzo hard fork, it began to compete in more traditional crypto markets such as DeFi and NFTs.

Key data

Profit data

ADA is the native asset of Cardano and serves as the main medium of exchange for network transactions. It has four main network-level use cases:

(i) Settling network transaction fees: ADA is used to pay for transactions on the Cardano network.

(ii) Registering a stake pool: Users can use ADA to register a stake pool, participate in network consensus, and become a stake pool operator (SPO).

(iii) Staking: Whether as a stake pool operator or a delegator, staking ADA can help secure the network and earn token rewards.

(iv) Rewarding voters and funding projects: In Project Catalyst, ADA is used to reward voters and fund projects.

The maximum supply of ADA is 45 billion, and its circulating supply will experience inflation before reaching this maximum. After every five-day epoch, 0.3% of the ADA reserve (uncirculated ADA) is allocated to SPOs as rewards. This "inflation" tends to zero as the reserve is depleted and the circulating supply approaches 45 billion.

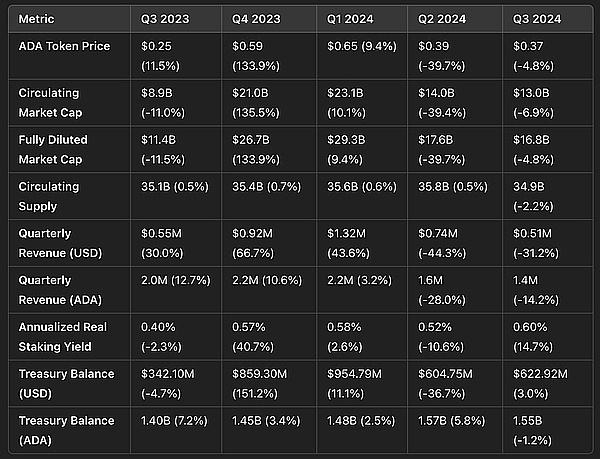

The annualized effective staking yield takes into account the dilution of value due to inflation. In Q3, the annualized effective staking yield was 0.6%, but this can vary between different stake pools.

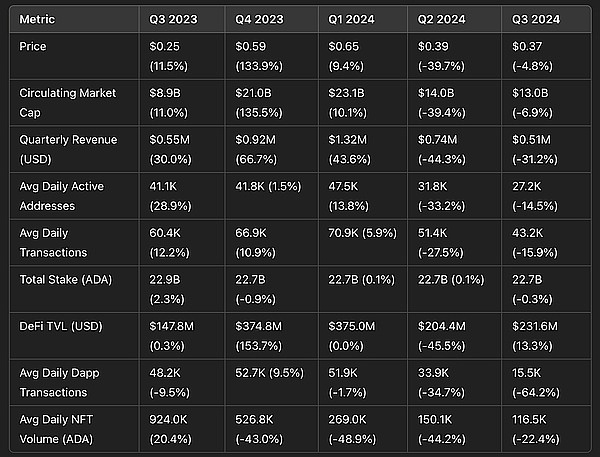

In Q3, the price of ADA fell by 4.8% to $0.37. Correspondingly, ADA's total market capitalization fell by 6.9% month-on-month to $13 billion, with the small difference in market capitalization due to a 2.2% decrease in circulating supply. Due to the price drop, ADA's total circulating market capitalization ranking fell from 10th to 11th in Q3.

On Cardano, each transaction is subject to a network transaction fee, which is used to process the transaction and pay for storage costs. The fee calculation includes a minimum fee plus a variable fee based on the size of the transaction. Revenue (in USD) fell 31.2% quarter-over-quarter to $510,000, while revenue (in ADA) fell 14.2% quarter-over-quarter to 1.4 million ADA. This difference is due to the price drop of ADA throughout the quarter.

Currently, 20% of Cardano's transaction fees go to the treasury. Cardano's treasury balance (in ADA) fell 1.2% quarter-over-quarter to 1.55 billion ADA, but the USD value of the treasury increased by 3% to $622.92 million.

Daily Activity

In Q3, Cardano's average daily transactions fell 15.9% quarter-over-quarter to 43,200, while the average number of daily active addresses (DAAs) also fell 14.5% to 27,200. Cardano's average transaction fee remained unchanged at $0.13. However, the average transaction fee (in ADA) decreased by 17.9% month-on-month to 0.54.

The ratio of transactions to active addresses (txs/DAAs) decreased by 1.7% month-on-month to 1.59. An increase in this ratio generally means that activity is more evenly distributed among users; conversely, a decrease in the ratio indicates an increase in "heavy users."

The total stake (ADA) and the ADA staking ratio decreased by 0.3% and 4.1% month-on-month, respectively. Due to the decline in ADA prices, the total stake (in USD) decreased by 5.1% month-on-month to $8.5 billion. The total stake (in USD) represents the economic security of the network.

Governance, Forks

In April 2024, Cardano announced the Chang hard fork, a two-phase network upgrade designed to enable on-chain governance and complete the core objectives of the final roadmap phase of Cardano. Voltaire takes the final step towards the self-persistence of Cardano through on-chain voting and off-chain mechanisms and institutions such as the member base organization Intersect.

Phase 1: Begins after the launch of the Chang hard fork on September 1, 2024. This phase kicks off a technical bootstrapping period, setting the stage for decentralized voting and governance actions.

Interim Cardano Constitution: To fill the gap until a real constitution is iterated through the Cardano Constitution Workshop and approved at the Cardano Constitution Conference in Buenos Aires, Argentina in December 2024.

Interim Constitutional Committee (ICC): Composed of seven members, three of whom are elected by vote. In the first phase, the ICC has veto power over certain on-chain governance actions.

Phase 2: Will see Cardano’s on-chain governance fully online as the Cardano Constitution is completed and approved. This phase will give ADA token holders the power to direct technical changes and treasury withdrawals, in part by introducing a new user role, the Delegated Representative. ADA token holders will be able to delegate governance power to DReps and SPOs, who can vote on governance proposals on their behalf.

Once Phase 2 is complete, DReps, SPOs, and the Constitutional Council will govern all areas of the network through an on-chain voting and treasury system based on CIP-1694. This will transfer responsibility from the IOG, the Cardano Foundation, and EMURGO, which historically held all seven governance (genesis) keys together. Actions that can be governed include matters related to the Constitutional Council, parameter changes, constitution updates, hard fork initiations, protocol parameter changes, and treasury withdrawals.

Intersect & SanchoNet

Testing related to CIP-1694 continues on SanchoNet, a testnet launched in Q3 2023 that is intended to serve as a sandbox to test and build processes and tools for Cardano on-chain governance. Developers use this testnet to launch new infrastructure (such as wallets and voting explorers), SPOs can test voting and proposals, and details about DReps can be discussed here.

SanchoNet and the broader Voltaire outreach are led by Intersect, a member-based organization serving the cardano ecosystem that combines the strengths of community members, SPOs, and project teams. Intersect was founded to bring ADA token holders together under a common vision for a more transparent, collaborative, and innovative cardano ecosystem.

Intersect maintains over 60 code bases, including the complete Cardano Haskell code, and promotes Cardano's open source approach through various standing committees and working groups. In addition, Intersect is working on creating an open product roadmap, an annual budget process, and has been operating a grant program where projects are awarded for developing governance-related areas such as education and the DRep platform.

DeFi

In the third quarter, Cardano's DeFi total locked value (TVL, in US dollars) increased by 13.3% month-on-month to US$231.6 million, while the DeFi diversity score increased by 12.5% to 9. There were also many changes in the TVL of various protocols in the third quarter.

Minswap's TVL increased slightly by 4.4% month-on-month to US$58.6 million.

Liqwid’s TVL increased dramatically by 77.2% to $47.1 million, surpassing Indigo, whose TVL fell 19.7% month-on-month to $38.4 million.

Smaller protocols such as Splash Protocol and SundaeSwap grew by 76% and 26% to $16.9 million and $16 million, respectively.

Indigo is a synthetic asset issuer that offers iUSD, iBTC, and iETH. A week after the end of the third quarter, Indigo completed its upgrade to V2.1. The upgrade introduced an algorithmic interest rate that splits interest between the treasury and INDY stakers, among other improvements.

Splash is a decentralized exchange (DEX) that launched in July after raising 17.2 million ADA in the SPLASH token sale in May. Splash is also working on snek.fun, a protocol similar to pump.fun on Solana that allows users to easily launch and trade tokens. The app launched in September and saw over 2,230 tokens created and 4.5 million (ADA) in trading volume on its first day.

SundaeSwap continued its momentum from Q2 with the launch of its V3 upgrade, which introduced a dynamic fee model and increased transaction load capacity. A 90-day trading fee waiver was included at launch, which expired in August, and a proposal to increase fees was passed in September. SundaeSwap's revenue is distributed among SUNDAE token holders, SundaeSwap's treasury, Sundae Labs, and others.

Ada Token Unlock

Recently, Cardano (ADA) will unlock tokens this week. It is expected to unlock approximately 16.84 million ADA tokens, which account for 0.05% of the current circulation.

Future Outlook

Cardano was launched as a PoS layer 1 network in 2017, aiming to provide a secure, scalable and feature-rich platform to support decentralized applications and systems. Through its unique Ouroboros consensus mechanism and extended eUTXO model, Cardano has demonstrated competitiveness in the fields of smart contracts, DeFi, and NFTs.

With the implementation of the Alonzo hard fork in 2021, Cardano's development has entered a new stage after supporting smart contracts. In the future, Cardano will achieve full on-chain governance and self-persistence through the Chang hard fork, ushering in the Voltaire era. By introducing new governance mechanisms, increasing the diversity of the DeFi ecosystem and TVL growth, Cardano is expected to continue to consolidate its position in the blockchain industry and promote the further development of its ecosystem through continuous technological innovation and community governance.

Miyuki

Miyuki

Miyuki

Miyuki Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Brian

Brian Alex

Alex Davin

Davin Weiliang

Weiliang Joy

Joy