Author: 099.eth, Crypto KOL; Translation: Jinse Finance xiaozou

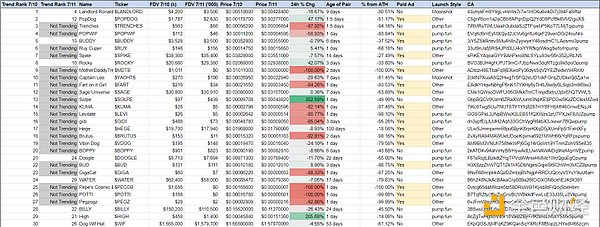

The following is the performance of the top 30 popular tokens in DexScreener from July 10 to July 11. The snapshot time is about 00:30 GMT.

Below I will explain it in more understandable language and charts. Here is the raw data I sorted out:

The simple average unweighted return of all 30 popular coins is -18%. If you divide $1,000 equally among all tokens, you will end up with $821.34.

The short version is this: if you believe that returns are randomly distributed, or that you are no better than random in picking winners, then you might conclude that you will suffer a loss after buying and holding for 24 hours.

Market value <$100k (+8% d/d, positive outlier)

Your expected return is 8%. You have a 33% chance of suffering a loss of more than 80%, and only a 17% chance of picking a positive return token.

Market value <$100k-$1m (-30% d/d)

Your expected return is -30%. You have a 41% chance of losing more than 80%. You have only a 17% chance of picking a coin with a positive 24-hour return.

Market cap of $1-10 million (-30% d/d)

Your expected return is also -30%. You have a 33% chance of losing more than 80%, and only a 17% chance of picking a coin with a positive return.

Market cap of $>10 million (-2% d/d)

Your expected return is -2%. Coins of this size don't usually crash, but only 29% of them have a positive return in the past 24 hours.

24 hours after the snapshot, only 30% of the coins are still in the top coin rankings. There is a good chance that a hot coin will fade from the spotlight and lose attention (trading volume). Devaluation can happen quickly, especially when the coin market cap is less than $1 million. Only one coin with a market cap of less than $1 million has remained on the list, and that is thanks to its status as a moonshot token.

Only three coins have managed to stay hot for less than a week.

Tip: Think of new coins as options with fast time value decay (time is not your friend, bet fast). Treat long-term Lindy hot coins differently, and every day spent on the hot list inspires more confidence.

If you randomly pick a coin from the hot list, you have a 30% chance of suffering an 80%+ loss in 24 hours.

Instead, you are selling out dreams of 2x, 3x, or greater gains. You should have a 7% chance of doubling your gains, or earning more by randomly betting on a coin and holding it for 24 hours.

60% of the coins in the hot list have paid ads. Does this have anything to do with the positive performance of these coins? Almost nothing.

The average return in 24 hours for coins with paid media on DexScreener is -50%.

Implication: If someone is paying cash to make sure I see the coin, then they can attack me if I'm stupid enough to notice.

Of the coins that paid for ads at the time of the snapshot, only 11% of them were still on the hot list a day later. So staying hot has nothing to do with ads.

Conclusion:

- Randomly picking a coin is a negative expected value strategy.

- Trying to randomly select coins on a smaller timeframe is also an -EV strategy, you are just adding more random experiments to your betting sample… given the high probability of a crash (80% drop), if you don’t know the specific special case of the coin before making a random bet, you may get more than a black eye… because stop losses are basically impractical for small market cap coins.

- By only selecting coins with a market cap of $10 million or more, you can greatly reduce the chance of a coin crashing. But it is important to note that the coin must have been issued for more than 48 hours. I have seen high-cap honeypot coins crash before, although there are no such coins in this snapshot. Also, if you don’t know a coin, at least make sure the liquidity is locked at least 5% LP/FDV.

- If you see a coin advertised… run… unless you know there is something special about it. They tend to perform poorly.

- While plenty of volatility tempts you to enter the market… 24 hours after a random snapshot, the prices of small-cap tokens are on average 70% below their all-time highs. You are unlikely to catch the upside.

- Tokens quickly drop off the hotlist. Only 10% of popular coins launched less than a week ago will stay on the hotlist for 24 hours, and they will fall off the list quickly

- In short, looking for tokens from the DexScreener hotlist is a bad strategy and can be easily fooled by fake trading volume or advertising. So, even if you are bored or tempted, stay away.

- You are better off digging deep into social media and networks you trust, or simply avoiding this game unless you are investing for fun. The above is some data to supplement what you think you know. Please invest with caution.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist