Author: Thor Hartvigsen & Thlither & Hyphen, On Chain Times; Translated by: Jinse Finance xiaozou

1. Introduction

Polymarket is one of the most successful cases in the crypto space this year, attracting thousands of users every day and hundreds of millions of dollars in monthly trading volume. As the largest blockchain gambling market, it has a clear advantage over centralized prediction markets, proving that cryptocurrencies can unlock real innovation.

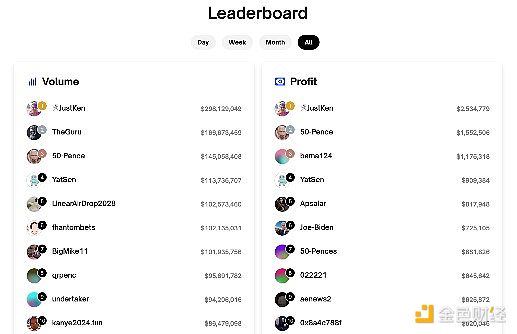

Last week, the On Chain Times team had the honor of speaking with Domer (“JustKen” on the Polymarket leaderboard). Domer has long been at the top of the Polymarket charts in terms of trading volume and profits. Domer has conducted nearly $300 million in total trading volume on more than 5,000 trading markets and has unique insights into the field of prediction markets and political betting.

During the interview, Domer talked about his professional background, the framework for predicting market trading, and trading psychology.

2. Dialogue with Domer

Q: "How did you get into political betting? What made you decide to devote yourself to it full-time?"

With poker, you can play perfectly and still lose money. You can play for countless hours and still lose money. The volatility of money is stressful, which is really stupid. Emotionally, poker is either extremely boring or extremely dangerous.

With stocks, you can be completely right about a company, but it may take years for that result to materialize. To give you a simple example: I first "bet" on stocks in the early 2000s when I discovered that almost all of the land on which McDonald's restaurants are located was owned by them and that the land was rapidly appreciating in value during the real estate bubble. They had a real estate empire that should have pushed the stock price even higher. It would have at least pushed the price up a few percentage points, if not more. But it wasn’t until years after I bought McDonald’s that the “street” really connected the dots. So you might be right about some aspects of a company, but that doesn’t mean you’ll make money in the stock market. Market volatility can be silly and absurd over short periods of time.

More than anything, I love finding an edge and betting on outcomes, and prediction markets are one of the best and most fun ways I’ve found to do that. As for the U.S. government, they’ve basically kicked me out (for now), but it looks like their reign of terror is about to end now that they’ve lost in court over prediction markets. There’s hope.”

Q:“You’re the most profitable trader ever at Polymarket. Have you noticed that people are copying your trades aggressively? Want to be your teammate or trading counterpart?”

A: “For copy trading, the answer is yes, but it’s quickly becoming no. I’ve made a lot of bets and lost a lot of them. I also have a high risk tolerance and a deep bankroll. So a lot of people will copy my trades, but stop after losing money once. At this stage in my career, I think I probably lose more often than I win, but win more money than I lose. People who copy my trades will have to guess.

As for teammates - I get a lot of useful "advice". I get a lot of private messages. I have a core group of people that I trust and can talk to. To most people, I may be just one person betting, but I talk to people almost constantly about my ideas and listen to their opinions. I'm smart, but not always smart, and I'm by no means the smartest person, so it's important to talk to smart people and face reality. The gambling industry is a profession that is very much like a wanderer. But you can't cut off contact with other wanderers, otherwise your career will not last long. ”

Q:“In your post aboutEIGENyou mentioned that you kept buying at 20 cents because you thought the odds were close to 50%, can you talk about why you thought that? Was it a purely qualitative bet or did you factor in other more specific data into your considerations?”

A:I would say that bets can be a process. Usually they start with a gut feeling. I make a lot of small bets. But when you are going to make a large bet, you need to rely on more than just your gut feeling, and sometimes you don’t have a lot of time to think about research, so in this case, I did a lot of research on what CZ would face. I talked to some experts on the subject matter. Based on my research, I thought he would be released from prison in early October. But usually your research is unprecedented. CZ is the richest prisoner in the world (my opinion). You can’t use a guy swindling $500 from the local laundromat as a precedent for a guy worth $50 billion in the criminal justice system. So it’s a very inexact science. He ended up going to jail a week earlier than I expected, and it turns out he beat EIGEN by a few days, and I lost the bet. But it was a remarkable bet, albeit a losing one.”

Q:“For large positions, liquidity is both an opportunity and a limitation. Does Polymarket’s market liquidity impact your trading decisions? If so, how? Do you encounter challenges where liquidity limits your ability to enter or exit positions?”

A: “Liquidity is very interesting, and I don’t think I would think about it much, except in certain specific circumstances.

As for exiting a position, for a small gut bet, I wouldn’t care about liquidity. For a large, well-researched bet, I wouldn't care about exit liquidity, and therefore I wouldn't care about liquidity. I'd probably make a medium-sized bet somewhere in the middle where I think I might have an edge but am not too sure, and if liquidity is low, I might be cautious about getting too involved. If new information comes in, you might get stuck in an illiquid market. The answer is "it depends."

As for entry - I think everyone would love to have unlimited liquidity for entry. It's true that limited liquidity is a challenge for almost every bet I want to make. I will say, though, that high liquidity can be a bad thing if you over-bet simply because you can. So be careful about market liquidity tempting you to over-bet. I might be guilty of over-betting simply because liquidity is high. ”

Q:"It seems like you make hundreds of bets a day. How much of your trading is automated and how much is manual? ”A: “No one will believe this, but I trade manually. I have a lot of orders on my books, so most of my trades are order matching rather than entering new trades.”Q: “You trade a wide range of forecasts, from politics to macroeconomics. Do you find certain types of markets more predictable or profitable than others? How does your strategy differ between different categories?”A: “That’s a good question. I should clarify this question. I have some knowledge of what I am good at. In general, I like to chase the world, so I like to bet on a variety of events. I also like new things in the market that I am not familiar with. The way I think about it is that if I am not familiar with it, then it is likely that others are not familiar with it either. So we all start with a little bit of knowledge and see who can give the best answer. It’s a bit like a combination of a race and a jigsaw puzzle.

By the way, speaking of things that people are “familiar with,” I’ve found that so-called super subject matter experts are sometimes very bad at predicting the areas in which they excel. This is because they place too much importance on their expertise.”

Q: “As the number one trader by volume at Polymarket, you have a unique insight into what generates betting activity. With the U.S. presidential election in less than 6 weeks, Polymarket will face a new dual pressure: 1) they must safely settle over $1 billion in bets, and 2) they need to establish a new leading market after the election market ends. How do you view these two challenges? What do you hope to get from Polymarket as the election draws closer? ”

A: “I really don’t think settlement is a pressure. Polymarket has settled tens of thousands of markets totaling billions of dollars. The US election market will be very large and likely highly contentious, but someone will eventually be sworn in as the next president, and I don’t see the settlement mechanism itself as a stressor (if no one is sworn in and there’s a civil war, then we’ll probably have bigger problems to worry about than Polymarket’s settlement scheme). By the way, if you’re worried about settlement, you can always sell your winning sahres to someone like me for 99.9 cents!

As for the next massive market, the US presidential election will always be the largest market in prediction markets. It’s one of the largest group events in the world, and even if hundreds of millions (billions) of people can’t vote, they’ll at least more or less support the winner. So you certainly can’t replicate that scale in any other single market.

But there’s no doubt that prediction markets in general are exploding. I remember my first “big” market after entering Polymarket in early 2021: the ship stuck in the Suez Canal blocking the conduit of global trade. Almost everyone in the world knew or paid attention to this story. Everyone on the site was betting like crazy, telling the story of the Polymarket market. What was the total volume? Not even $500,000. If the same situation happened today, the same market would easily trade over $50 million, maybe even more.

To put it in perspective, in 2021, Polymarket was a small sandbox with only a few kids playing. Now it’s a big beach with thousands of people. In a few years, it might be a beach island.

There are always interesting markets to come, there are always elections around the world, and once the next president is inaugurated, the 2028 election will follow. I hear Vance is the Republican favorite. ”

Q: “What advice do you have for traders who are dabbling in stocks/options/cryptocurrencies but have never traded binary event contracts? How would you explain your Polymarket strategy to someone just starting out? ”A: “First, give it a try. Deposit $10 or $100, whatever. The worst that can happen is that you have a little fun or interest but lose your entire capital. If that’s the worst that can happen, it’s not that bad.

The second point I want to make is that you don’t have to feel pressured to predict any market or bet on any one thing. Just because everyone is betting on the presidential election doesn’t mean you have to join in. There are hundreds of markets online covering all kinds of topics. Look for something you think you can find an edge on. Try to find an edge. If you succeed in finding an edge, great, bet on it! If you don’t, you don’t have to do anything, just look for something else.

Don’t see anything you like, but have a good idea for something interesting that you’d like to bet on? Then come to discord and propose a market on it.

In terms of strategy, I would say the betting guide you should use is roughly that you bet based on your edge. If you can't find an edge, don't bet unless you're doing it for fun (like betting on a game you're watching). If you find an edge but you're not sure it works, bet less. If you find what you think is a huge edge, bet more. This may sound simple and stupid, but it's an important and powerful concept. A lot of people bet too much when they don't have an edge."

Q:"I really enjoyed reading your article on the Venezuelan presidential election. It taught me a lot about what happened specifically, but what did it teach you as an event contract trader? Did it change the way you approach markets that seem to have disputes?"

A: "Almost all of the markets on Polymarket have no disputes. This is definitely more than 99.5% of the markets that don't have any problems or stupid disputes.

But some rare issues are highly controversial. Controversies are tricky, they can be fun, silly, interesting, and stressful all rolled into one. New users should avoid controversies like the plague unless they are masochists or know exactly what they are getting themselves into. I have lost and won controversies. I remember my losses a hundred times more vividly than my wins.

In the case of Venezuela, the opposition candidate may have won, but the incumbent president manipulated the results and said he won. Now I guess this happens at least from time to time around the world, where the ruling party rigs the "election" and voting becomes meaningless. If it were that easy, the ruling party would have been labeled the winner on Polymarket. But what is really interesting about this election is that the opposition anticipated the fraud and went to great lengths to prove that they were the winner, recruiting thousands of volunteers and saving ballot "receipts". They basically proved that they won. The ruling party was caught off guard by this, and they quickly produced a spreadsheet of the "real" results, which turned out to be a screw-up, showing that the numbers they gave were impossible and fabricated. So, the results were highly disputed, and UMA ruled that the evidence was sufficient to show that the opposition had won, even though it was unlikely that the tyrant in power would let them stay in power. If it weren't for the incredibly strong evidence and the obviously faked spreadsheet, the tyrant would probably have won on Polymarket.

As for my approach to disputes, it's a shame that I have to get involved because I have investments in many markets. But after being tortured so many times by UMA (my main complaint is that they don't care about what they are doing, and people who don't care don't really put in the effort), I try to strictly limit the time I spend on disputes. There is a group of users on Polymarket who specialize in trying to convince UMA in the dispute process, and there is a lot of networking and backroom dealing involved. It's all very unseemly, ridiculous, and bordering on fraud, but I'll save that for another time. Keep this in mind when I answer questions about tokens later. ”

Q:“What do you think ofnon-blockchainplatformslikeKalshiorPredictIt? Have you used them? Or do you do most of your trading on Polymarket? Do you often look for arbitrage opportunities between different markets for the same event?”

A:

“I used to use Kalshi and PredictIt, and I would recommend them! But I don’t use them as often anymore, because Polymarket has grown so big and it’s become a one-size-fits-all platform.

I do often look for arbitrage opportunities, but a lot of people do, and these days those arbitrage trades get closed very quickly.

You have to be careful with arbitrage, because there is no nuance in the market, and you could theoretically lose both sides.

”

Q:“Prediction markets like Polymarket are growing in popularity, especially when it comes to predicting major political and economic events. Looking ahead, how do you see these markets evolving? Do you think they have the potential to become influential enough to actually affect real-world outcomes, rather than just predict them?”

A: “I think it’s normal and unsurprising that these markets are becoming an important class of financial contracts that are quoted and referenced.

The reason the largest markets on Polymarket don’t get a lot of attention is because of what the Fed is doing. These markets now have tens of millions of trades because they are both unpredictable and very important. There are already similar “prediction markets” in financial markets that are widely cited – the CME (and their Fed Watch chart). You’ll see these trading numbers all over the financial web and in the news. You rarely hear about predictions from sites like Polymarket and Kalshi (this will change). Traders in these markets are more accurate than the CME. Yes, amateurs are more accurate than professionals. Accuracy will win out in predictions, so you will see media quotes shift over time.

As for influencing real-world events, I think this is more of a philosophical question. Personally, I come from a poker background, and one of the principles of poker is "don't stir the pot." If there's a bad player at the table, you don't let him know he's not playing well, otherwise he might change his behavior (like leave, or learn more). In that sense, I'm reluctant to try to solve market problems by influencing events. I think there should be a wall between the two. Putting aside philosophical questions - whether it's realistic to not influence real-world events, I don't know.

Q:"What is your favorite PM contract right now? Why? What new markets need to be listed as soon as possible?"

A: "Well, if there was such a contract, I would probably quietly buy as many shares as I could, and I wouldn't share (there is such a market now). But I’ll give you a roundabout answer: I think people take it for granted that the US election is too close, and I think a savvy trader might find opportunities they can bet on. If Trump or Kamala wins by a surprisingly large margin, they’ll make a ton of money. That’s a realistic outcome, even though media reports suggest otherwise.” Q: “There’s always a debate about whether projects really need to launch their own tokens, even though TGEs are clearly profitable. In your opinion, would a native token improve Polymarket’s user experience? What’s easier? What’s harder?” A: “This may offend some people, but I’m not a cryptocurrency advocate. Not yet. I think a lot of crypto has potential, but not many people are really taking advantage of blockchain technology.” Unfortunately, many cryptocurrencies are scams, a breeding ground for hackers, and attract a large number of people trying to make a quick buck. I have spoken to two people who are currently in prison for ridiculous crypto crimes. I follow airdrops sporadically (because airdrops are a hot market on Polymarket!), and I am very confused as to why so many projects are issuing tokens. I will not name names!

Even though I am skeptical about cryptocurrencies and airdrops, I will say that I strongly support the Polymarket token. This is not because I am biased! Let me explain in detail.

I think the potential of cryptocurrencies is realized in the form of Polymarket. You have the world's largest prediction market organized by smart contracts, and every trade is conducted on-chain. Your money is not sent to a company, your money is in your wallet and controlled by you. Settlement is decentralized. All of this cannot be underestimated, and in my opinion, Polymarket is a huge innovation in multiple aspects. I do have a preference for Polymarket, but I do think it is the first killer application based on blockchain.

If someone asks me if they should trade crypto, my response would probably be “What part of crypto?” and “…are you sure?”, but if someone asks me if they should get into Polymarket, my response would be “Yes, I’ll help you get started!”

The reason a token is a good thing is because there are thousands of markets that need to settle in this prediction market. As I said before, settlement is 99.5% easy, but sometimes annoying. The token holders who are betting on the success of Polymarket should be the ones who decide settlement in unclear markets. As it stands, UMA votes on disputes, and I think their interests are more or less aligned with Polymarket, but not completely aligned, and if the interests are not completely aligned, then voters may lose interest. It is true. They are disinterested and disappointed. UMA ownership of the token itself is also somewhat centralized, so a lot of these disputes will be decided by a very small number of people. This undermines an exchange that is supposed to be completely decentralized. A token that helps to smoothly resolve disputes would solve a lot of problems. If Polymarket is a killer app, then the killer feature it needs is a dispute resolution process.”

Q:“I see you listed a book byDaniel Kahnemannon your list of recommended books—heuristics, risk/loss aversion, and dual systems thinking all play a big role in betting. What do you thinkDaniel Kahnemannwould think of Polymarket? Does his perspective always come to your mind?”

A:

“I think about Kahneman and Tversky’s description of biases every day, and I’m not exaggerating. Their findings are uncomplicated—in some ways obvious—but that doesn’t make them any less profound. I think of price anchoring, the endowment effect, loss aversion, availability bias, and so on.”

“I think about Kahneman and Tversky’s description of biases every day, and I’m not exaggerating. Their findings are not complicated—in some ways obvious—but that doesn’t make them any less profound. I think of price anchoring, the endowment effect, loss aversion, availability bias, and so on.” If you want to be a top trader or get better at anything, you should learn more about trying to control your brain's biases.

Daniel Kahnemann would love Polymarket. He is the champion of prediction markets.

I would like to say that it is very hard to get rid of biases, and you must always keep this in mind to protect yourself from losing money. I would say (and I believe it) that it is easy to make money in prediction markets. The future is unpredictable, but not that unpredictable. You can easily find markets where you can make money. But the really hard part of prediction markets is avoiding losing too much money on stupid things. Because it is easy to make money in prediction markets, it is even easier to lose money. Read Kahneman and Tversky's books, and try to avoid some of the pitfalls, because many stupid bets only reveal their stupidity in hindsight. And that is not necessarily hindsight bias!"

YouQuan

YouQuan