Author: Chen Hanxue; Source: Wall Street News

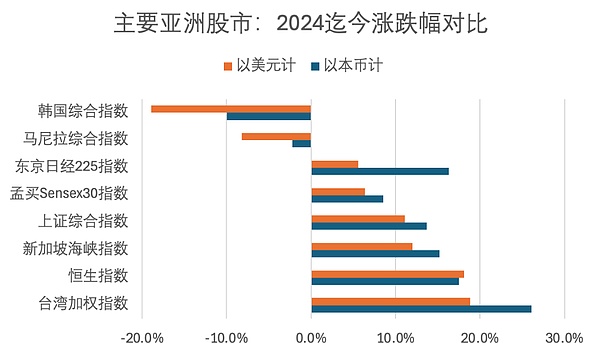

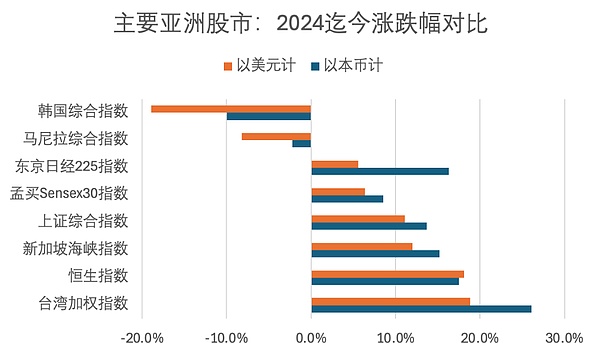

Since the beginning of this year, Asian stock markets have experienced mixed gains and losses against the backdrop of a strong dollar.

Among them, some have achieved a bull market in stocks denominated in their own currencies at the expense of exchange rate depreciation, while others have sacrificed some of their stock market gains at the expense of relatively stable exchange rates.

Only South Korea is a special case:

In terms of won, the South Korean Composite Index KSOPI has fallen by 10.0% this year. After considering the fall in the won, the KSOPI denominated in US dollars has fallen by 18.9%, both of which are the weakest in Asia.

The major declines occurred in the second half of the year. 24H1KSOPI once rose by nearly 20%, but all the gains were wiped out in the second half of the year.

What happened in South Korea in the second half of the year?

Foreign capital fled, and residents gathered to speculate in cryptocurrencies

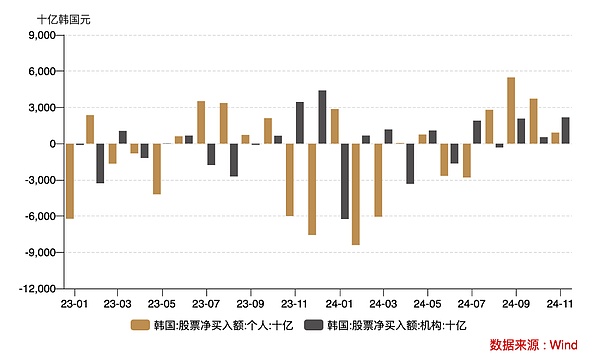

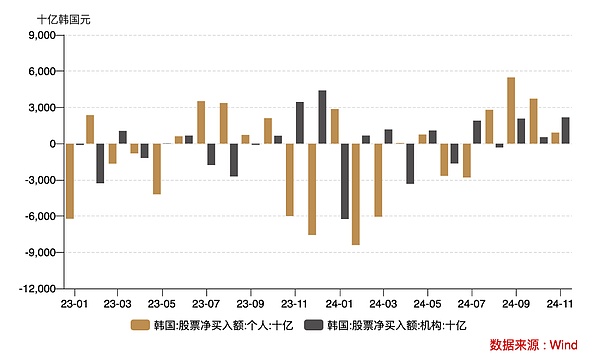

From the perspective of capital flows, since the second half of this year, only institutions in South Korea have maintained a net purchase scale in the stock market, and residents have been continuously reducing their purchases.

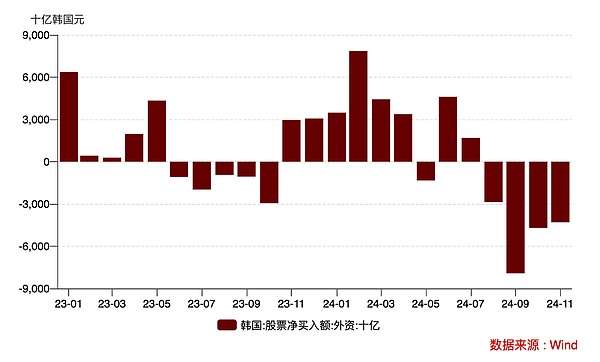

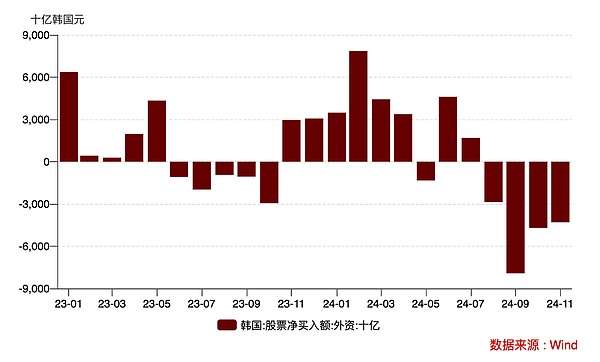

Foreign capital is more pessimistic. In November this year, foreign capital net sold 4.15 trillion won of South Korean stocks, which has been net selling for four consecutive months. In the two weeks since early December, another net sale of 2.4 trillion won.

The money that South Korean residents took out of the stock market was largely used for "cryptocurrency speculation".

Data from the Bank of Korea (BOK) show that as of November, the number of cryptocurrency investors in South Korea has reached 15.59 million, an increase of 610,000 from the previous month. Currently, 30% of the 51 million South Korean citizens are speculating in cryptocurrencies.

The average daily trading volume of the five major cryptocurrency exchanges in South Korea - UPbit, Bithumb, Coinone, Korbit, and GOPAX - jumped from 3.4 trillion won in October to 14.9 trillion won in November, an increase of more than four times.

Koreans have always been keen on investing in cryptocurrencies.

During the first bull market of cryptocurrencies in 2017, about 5% of the population participated; in the second bull market in 2021, 10% of the population participated; now this proportion has expanded to 30%.

But historically, the South Korean stock index and the price of Bitcoin were positively correlated as a whole, until October this year, when this positive correlation was completely broken.

So is Bitcoin to blame for the decline in the South Korean stock market?

Is export really strong?

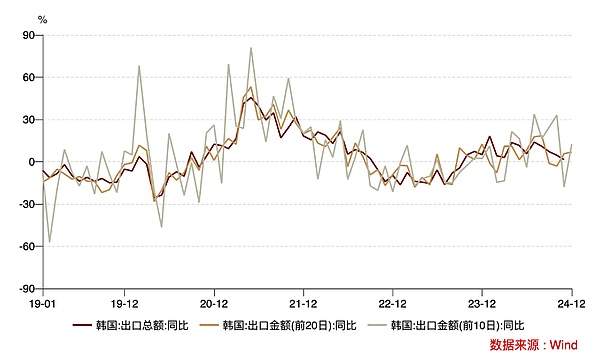

In 2023, South Korea's exports accounted for as much as 40% of its GDP. As an export-oriented economy, exports are the barometer of South Korea's economy.

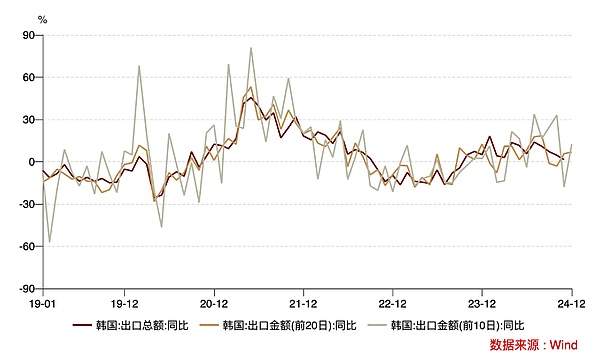

South Korea's exports seem to be picking up.

The export data for November released by the Korea International Trade Association showed that the export value in November increased by 1.4% year-on-year, maintaining growth for 14 consecutive months, but the trend has slowed down;

The export value data for the first 10 days and the first 20 days of December released by the South Korean Customs showed a year-on-year increase of 12.4% and 6.8% respectively, indicating that South Korea's exports in December should not be weak.

But behind this phenomenon, it is more likely that Trump's concerns about tariffs have led to a head start.

From the fundamentals of exports, South Korea's major export industries such as semiconductors, automobiles, and chemicals are facing unfavorable prospects.

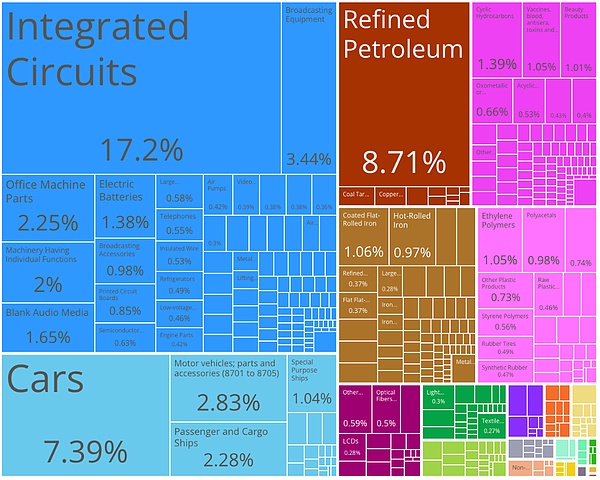

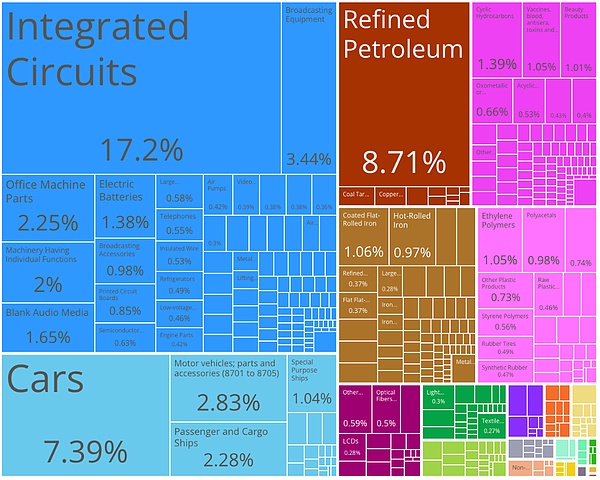

Figure: South Korea's export structure in 2022

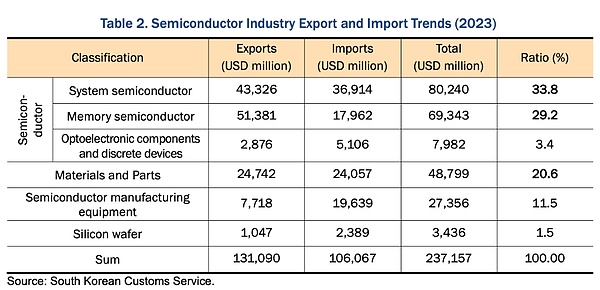

First, it is the weakness of semiconductors.

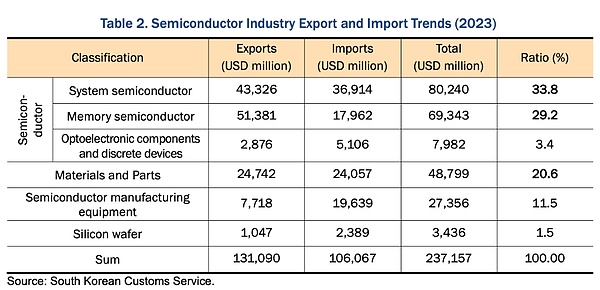

South Korea's local semiconductor giants Samsung Electronics and SK Hynix mainly focus on memory chips, which account for only about 30% of the entire semiconductor market. Compared with Taiwan, which has a complete supply chain including chip manufacturing, packaging and testing, South Korea's presence is weak.

Trend Force data shows that in the global foundry market in the second quarter of this year, TSMC's share was 62%, while Samsung Electronics was only 11%. The gap between the two companies has widened from 36.5% in 2020Q3 to 51% today.

The lack of policy support is the main reason. South Korea lacks government subsidies similar to those in the United States, mainland China, and Taiwan, making it difficult to promote the localization of chips.

South Korea's key semiconductor materials, components and equipment are also highly dependent on overseas. According to data from the Korea Customs Service, more than half of the 13 sub-sectors of semiconductor equipment have been in a trade deficit for a long time.

In particular, the Yoon Seok-yeol government chose to hard-decouple from the Chinese market, causing a cliff-like decline in the Korean semiconductor industry, which is extremely dependent on the Chinese market. In 2023, the proportion of chips shipped by Korean companies in China's chip imports has fallen to 6.3%, which had previously remained above 10%.

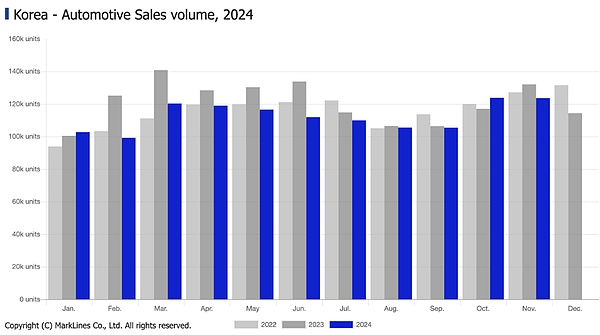

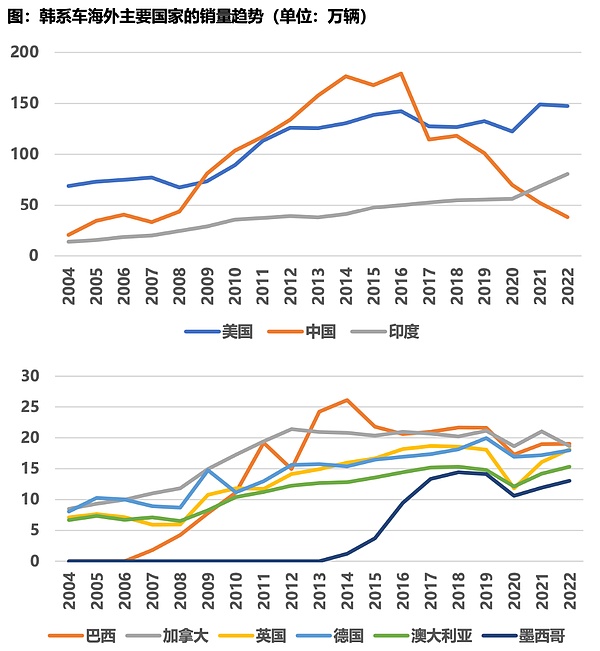

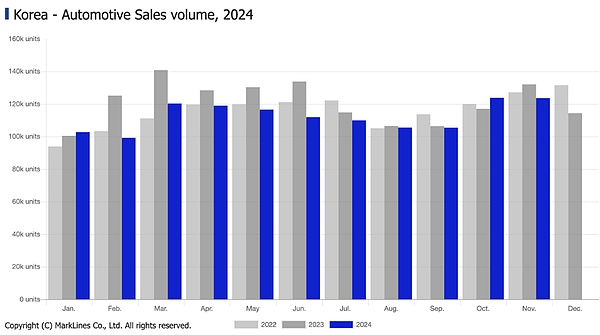

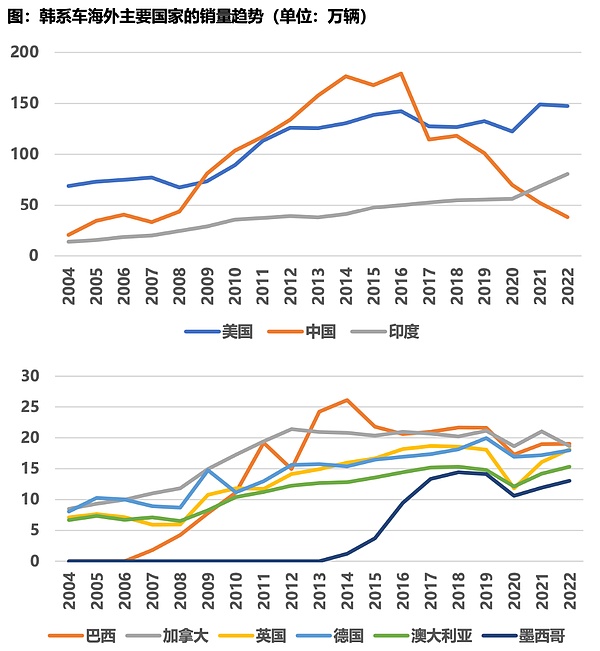

Secondly, the automobile manufacturing industry has also fallen significantly in the competition.

In 2023, the global total sales of Korean cars will exceed 8 million, an increase of more than 7% year-on-year, but the share of new energy vehicles will only be 9.3%.

China is currently the world's largest and fastest-growing new energy vehicle market. In 2023, China's total automobile sales will be 30.09 million, and the share of new energy vehicles will be as high as 31.6%. The scale of China's automobile industry is nearly four times that of South Korea, and the share of new energy vehicles is more than four times that of South Korea.

Compared with German, American and Japanese automakers who have actively launched long-wheelbase and customized models based on the characteristics of Chinese consumers, Korean automakers are slow to act and lack research and development efforts. Coupled with the difficulties in the transformation of new energy, Korean cars are in a difficult situation in the Chinese market.

Finally, the export of petroleum products (refining industry) is also facing certain downward pressure.

In November this year, SK Energy, South Korea's largest refiner, announced its third-quarter results:

the operating loss of the refining business in the July-September quarter was 616.6 billion won (US$450.2 million), the largest loss since the fourth quarter of 2022.

The company said,

"We are in an unfavorable macroeconomic environment, with falling crude oil prices and the overall refined product market being squeezed...We will continue to maintain the minimum operating rate of crude distillation units (CDUs) to prevent negative profit margins..."

LSE data showed that Asian refining margins fell to a new low since the third quarter of 2022 in June-August this year.

Today, with a large number of production growth prospects and potential and gradually disappearing demand, the market is bearish on oil prices in the long term, which restricts the production and export prospects of refiners.

The latest 2025 business outlook survey results released by the Korea Business Federation show that:

Due to widespread concerns about export conditions, 65.7% of the surveyed companies said they have formulated business plans for next year, of which 49.7% of the companies have a business policy of "tight management", which is the highest level since the 2019 survey.

The Bank of Korea said,

"In 2025, it will further cut interest rates to ease the downward pressure on the economy."

Facing the headwind of exchange rates, the Bank of Korea's resolute determination further highlights its economic weakness.

Political turmoil is not over

The recent fermentation of the South Korean president's emergency martial law has made South Korea, whose fundamentals are already weak, even worse.

On November 29, the Budget and Settlement Committee of the National Assembly of South Korea forcibly passed the budget cut bill in the absence of members of the ruling National Power Party. The special activity expenses of the Presidential Office, the Procuratorate, the Supervisory Commission and the police were fully cut, and the government's emergency reserve was significantly reduced, with a total reduction of 4.1 trillion won, which means that the Yoon Seok-yeol government will be shut down next year due to lack of money.

On December 3, South Korean President Yoon Seok-yeol launched martial law, pushing the dispute between the government and the parliament to a climax.

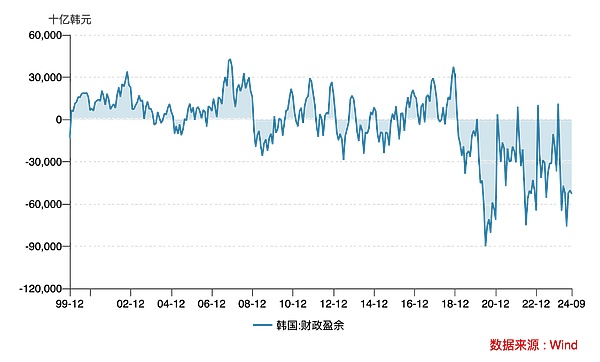

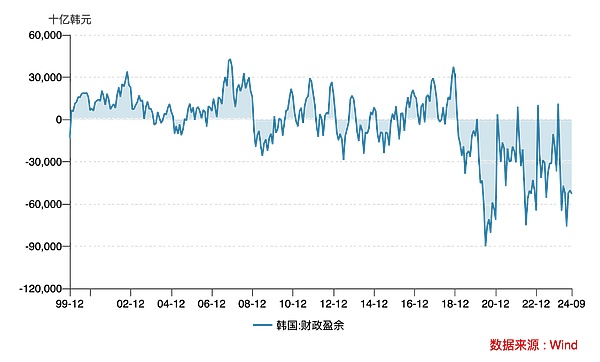

The dispute between the government and the parliament is actually a dispute over the budget. South Korea has been under extremely severe financial pressure in the past two years.

The Yoon Seok-yeol government issued a tax cut policy for the rich in 2023, which led to the largest sharp drop in fiscal tax revenue in South Korea's history. The settlement report of the Ministry of Planning and Finance of South Korea shows that South Korea's total tax revenue in 2023 is 497 trillion won, a decrease of 77 trillion won from the previous year's settlement.

Yun Seok-yeol's move is actually "robbing the country to help the rich".

Today, South Korea's fiscal deficit is still significant. In September this year, the deficit reached 52.89 trillion won, accounting for 2% of nominal GDP in 2023.

In response to the fiscal crisis, the Yoon government even cut South Korea's scientific research budget by 15% this year. This is the first time the South Korean government has made such a decision since 1991.

On December 15, the South Korean National Assembly formally passed the impeachment case against South Korean President Yoon Seok-yeol. On the 16th, Han Dongxun, the leader of South Korea's ruling party, announced his resignation as party leader.

……

Even if the impeachment case makes Yoon Seok-yeol doomed, the future of South Korea's political situation is even more confusing, which may further aggravate the bearish sentiment of foreign investors.

With both domestic and foreign investors pessimistic, where will the South Korean stock market go next year?

Kikyo

Kikyo