Written by: 0xjs@黄金财经

The crypto market once again witnessed the "bull overnight" market.

After the US SEC postponed the Ethereum ETF decision several times, May 23-30, 2024 is expected to be the final deadline for multiple spot Ethereum ETFs to wait for US SEC approval.

If the US SEC does not approve the spot Ethereum ETF this time, the next time will be June 23, one month later.

And VanEck, ARK, and Hashdex will need to resubmit their applications for spot Ethereum ETFs.

But a big reversal occurred on May 20, 2024.

According to CoinDesk, people familiar with the matter revealed that the U.S. SEC asked stock exchanges to update their 19b-4 filings for Ethereum spot ETFs on Monday. The 19b-4 filing is a form used to inform the SEC of rule changes that allow funds to be traded on exchanges.

This suggests that they may approve the applications before the critical deadline of Thursday (May 23). But this does not mean that the ETF will be approved. Potential issuers also need to obtain S-1 application approval before the product begins trading. A person familiar with the matter said that the SEC may take indefinite time to approve the S-1 document because it has no deadline.

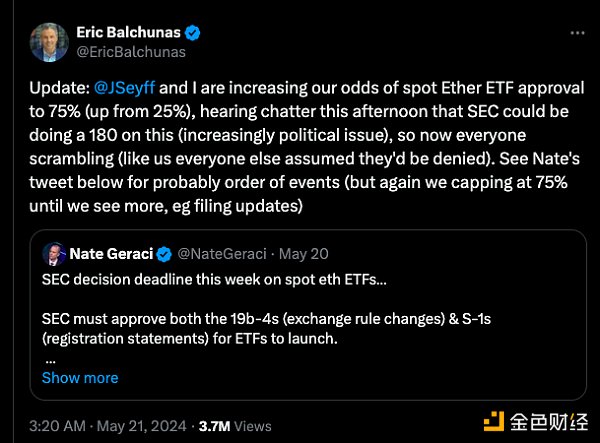

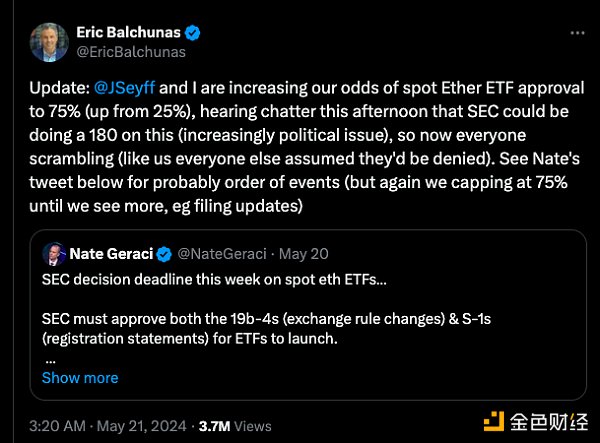

Meanwhile, Bloomberg Intelligence ETF analyst Eric Balchunas said that the probability of approval of the spot Ethereum ETF has increased to 75% (up from 25%), and this afternoon heard some people talking about the SEC might make a 180-degree turn on this (increasingly political issues).

According to a person familiar with the matter, a company that is negotiating with the U.S. Securities and Exchange Commission said that the U.S. Securities and Exchange Commission thought it was delaying a few weeks ago, but now feels that it may be on the right track to approval.

Affected by this news, the price of Ethereum woke up overnight after a long-term slump, and once soared to above $3,700, with a 24-hour increase of more than 20%.

The same is true for the ETH/BTC exchange rate. A few days ago, ETH/BTC once fell below 0.045, which made the community question the performance of ETH in this round of bull market.

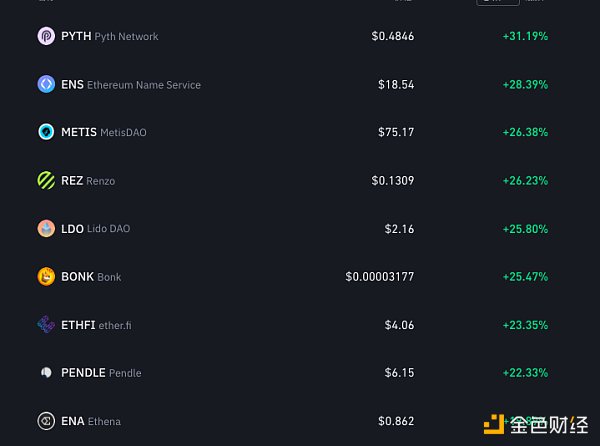

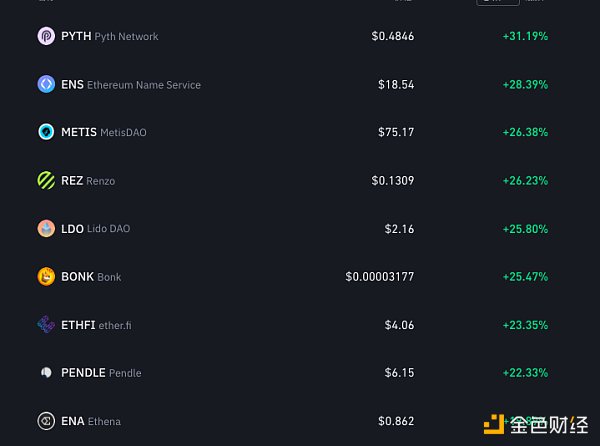

Stimulated by the surge in Ethereum, Ethereum ecosystem-related tokens also generally surged.

Before rumors that the US SEC had changed its attitude towards the spot Ethereum ETF by 180 degrees, some analysts said that the possibility of the spot Ethereum ETF being approved by the US SEC was underestimated. Coinbase institutional research analyst David Han said in a report on May 15 that the possibility of the SEC approving the spot Ethereum ETF by the end of May is between 30% and 40%. Although the market generally believes that the US authorities will not release it in the short term, the possibility of the Ethereum spot ETF being approved is still underestimated.

Crypto institutions have also expressed their views on whether the spot Ethereum ETF will be approved or not. Alex Thorn, head of research at Galaxy Digital, said that if speculation about the SEC's 180-degree turn on the Ethereum ETF is true, they may find a balance between ETH itself not being a security and staking ETH being a security.

Jake Chervinsky, chief legal officer of Variant Fund, wrote that if the spot Ethereum ETF is approved, everyone I know in Washington who is close to this process will be shocked. This means that after the SAB 121 vote, approval may mark a major shift in U.S. cryptocurrency policy, perhaps more important than the ETF itself.

JinseFinance

JinseFinance