Author: David Canellis Source: blockworks Translation: Shan Ouba, Golden Finance

Ethereum is currently in the longest inflation period in its history, and "blobs" (data blocks) may be the culprit.

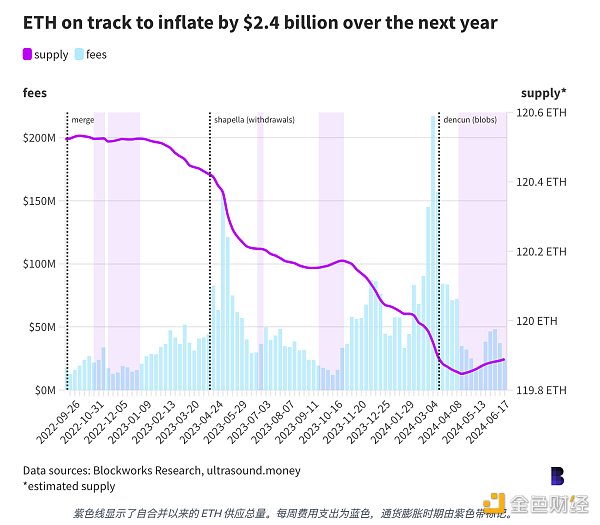

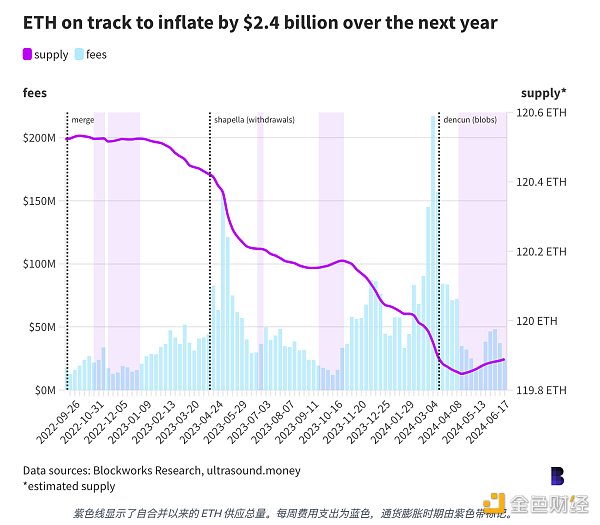

Since mid-April, Ethereum's circulating supply has been rising steadily for nearly 72 consecutive days, adding nearly 50,000 ETH (about $168.7 million). ETH holders benefit from the increased scarcity brought about by the reduction in supply. However, the opposite is currently happening - ETH is becoming less scarce - because Ethereum's base fee is at its lowest point in the past two years. At the same time, the number of transactions on the Ethereum mainnet has increased, and the activity of the second-layer network has exploded.

Since the merger in September 2022, ETH has only been in a state of inflation for a long time on a few occasions, the longest being 40 days shortly after the merger and 30 days at the end of last year. (There is no universal standard for when Ethereum is in an inflationary period. For this article, an inflationary period is defined as three consecutive days of total ETH supply increasing, or vice versa.)

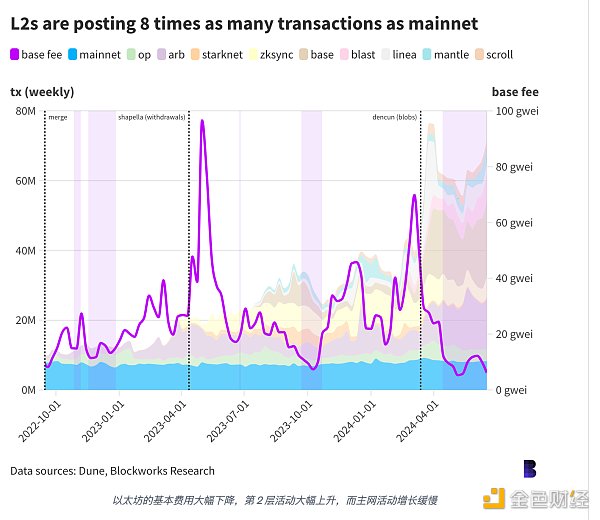

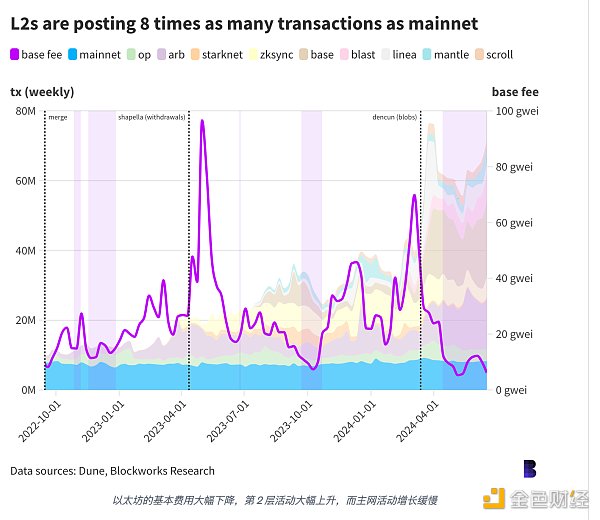

ETH is in an inflationary state because the base fee used for burning has been significantly reduced. The Dencun update in March of this year specially reserved space in each block so that the second-layer network can settle "blobs" transactions without competing with mainnet users.

This, combined with improved data availability through proto-danksharding, has led to a significant reduction in competition for block space.

Since there is enough block space for everyone, including second-layer users via blobs, Ethereum base fees have plummeted 90% since Dencun, causing more ETH to be issued per block than destroyed.

In addition to abandoning proof-of-work (PoW) in favor of proof-of-stake (PoS), the merger also allows Ethereum to become deflationary on a per-block basis. The Ethereum base fee paid by users was once part of the reward for miners who found blocks by consuming electricity.

But without any electricity costs after the merger, the total block reward will far exceed the expenses. This may distort the currency's supply distribution in the long run, and validators will end up accumulating too much ETH in almost pure profit.

To make the experience fairer for ordinary users, developers choose to burn the base fee. Validators receive priority fees, reduced block rewards, and additional MEV earnings if activated.

The current reward for each Ethereum block is only 2 ETH (about $6,800), and the fee contribution is less than 2.5%. Proof-of-work Bitcoin pays nearly 3.3 BTC ($200,000) per block, though the costs are significantly higher.

To be clear, Ethereum has burned a significant amount of supply since the merge, though most of it was before blobs appeared. Overall, 1.71M ETH ($5.8B) has been burned and 1.36M ETH ($4.46B) has been issued, resulting in a supply reduction of 346,000 ETH ($1.17B).

This makes ETH deflationary at 0.161% per year.

If Ethereum was still running proof-of-work, the supply would increase by 6.76M ETH ($22.87B) — an annual inflation rate of over 3%. So even with the recent inflationary tendencies, holders are still much better off, albeit slowly and slightly dilutingly.

Cheng Yuan

Cheng Yuan