Original: Liu Jiaolian

Slap in the face.

At nearly 10 o'clock in the evening on March 13 (UTC+8), the Ethereum mainnet ushered in an important upgrade: the Cancun upgrade. An important protocol is activated, EIP-4844 proto-danksharding (data sharding in the prototype stage).

As always, the market regards successful upgrades as all the benefits. On March 12, ETH reached a local high of $4,090. Two days after the upgrade, the opening price on March 15 had fallen back to $3,845, a drop of nearly 6% from the highest point.

The "enemy" that should logically be blocked by Ethereum's expansion - Solana, the representative of the new public chain, has been open for trading since March 11 The price started at 143 knives and stormed upwards. By the opening on the 15th, it had reached 167 knives. It did not stop, but accelerated further. As of the writing of this article, it had even increased by 10% in one day, once exceeding the recent high of 180 knives, and it is 2021. January’s all-time high of $259 is just one step away. From 143 to 180, in just 5 days, the increase exceeded 25%.

Solana slapped Ethereum and its younger brothers L2 (second floor) with a pull plate.

The slaps were loud and endless.

So a clever KOL (opinion leader) immediately stood up and expressed his position: the market is always correct. The Cancun upgrade degenerated Ethereum into a block lessor, and the application tax was transferred to the L2 brothers. However, the brothers were helpless and no one could win. So he was beaten to a pulp by Solana and lost his armor.

Market pricing is always efficient and correct. This is the famous efficient market theory. The market often misprices, creating investment opportunities, a theory embraced by value investors.

Perhaps the key lies in which one the leeks believe.

If the leeks believe that the market is always correct, then it will create a harvesting opportunity for the dealers to increase shipments.

Ethereum upgrades, Solana soars. There can be three reasons behind it:

One: The Ethereum upgrade has declared the failure of the expansion route, proving the rise of new public chains and the decline of Ethereum. The secondary market correctly detects this and reflects it through the price.

2: Ethereum’s expansion route is successful and pragmatic. New public chains don’t have a few years to jump around. Ethereum will eventually dominate the smart chain. market. The secondary market misjudged this trend and experienced temporary mispricing.

Three: Ethereum has not failed, but its success remains unrecognized, and challengers will fail. The bookmakers have a more profound, thorough and leading understanding of this, so they must make good use of this window period before the market wakes up, pull orders and ship goods, and hand the project into the hands of the leeks at a high level. In this case, the new public chain will have a miraculous rise in the secondary market, attracting Leeks to take over the market at a high level.

So which one does the current situation belong to? Everyone has his or her own free will.

In the rough encryption market, the way to promote one's own justice is simple, crude and often effective, and that is "pulling the pot" - just like what was said during the ancient conquests. A big flag raised.

Under the banner, the people's hearts are attached to it. On the pull plate, people swarmed.

If the holders of ETH do not change their ambitions and change their minds for one day, and if they do not cut ETH to switch to a new public chain, then they will not change their positions for one day. Stop pulling up until you change your beliefs, change positions, and accept the increase.

In this situation, who cares about the "downtime chain"?

Yes, this situation has been laid out for a long time. As early as the end of 2023, "Messari, an investment research institution that represents the mainstream opinions of Western crypto investment institutions to a certain extent," "strongly expressed its bullish view of Solana and bearish view of Ethereum in its year-end report." (Same as above)

In terms of decentralization, isn’t EOS more decentralized than Solana? In terms of performance, isn’t EOS better than Solana? EOS is totally unconvinced that Solana can subvert Ethereum. But EOS just failed. Whether you are born at the wrong time or you are doing your own thing, holding Block.One, which has raised a large amount of BTC from Liek, in your hand, lying down comfortably, eating and waiting to die, how can you care about the success or failure of EOS itself?

A brief look at the current actual data:

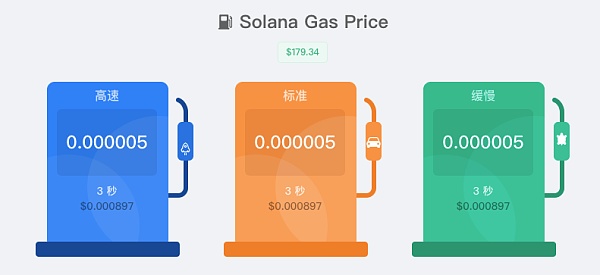

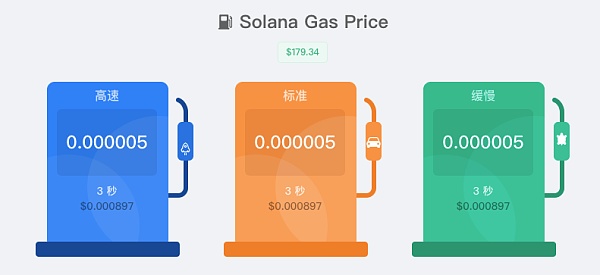

Solana network is about 3,000 TPS. The gas fee for an on-chain tx is approximately 0.000005 SOL, which is approximately equal to $0.0009 less than $0.001 based on the current price of $179.

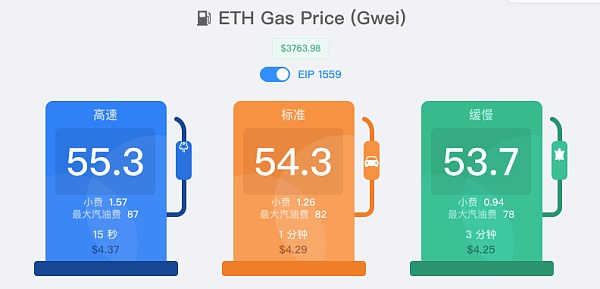

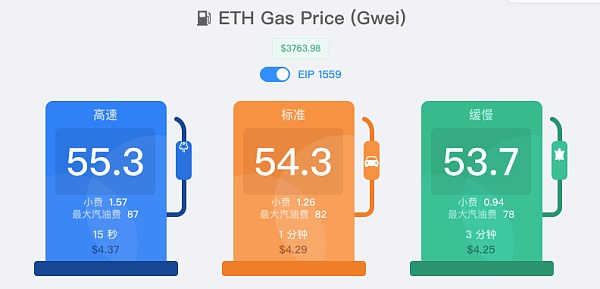

Ethereum L1 network is about 15 TPS. The gas fee is about 55 Gwei, which is approximately $4 based on the current price of $3765.

Ethereum L2 network, taking Optimism as an example, has less than 10 TPS. The gas fee is approximately 0.011 Gwei, equivalent to $0.0009, which is less than $0.001.

Above, TPS is not the maximum design capacity of the network, but the actual transaction rate. If the chain is inactive, then no matter how much transaction volume the chain can carry, its actual TPS will be relatively low.

Ethereum started from the expansion route of ETH2.0 calculation sharding + data sharding, and made a trade-off to become the new expansion route of data sharding + L2. The Cancun upgrade is just a prelude to data sharding. True first-level sharding requires subsequent upgrades to achieve the ultimate goal of exceeding 100,000 TPS in the “The Surge” roadmap.

Although the road is long, you will reach it if you go; although the task is difficult, you will succeed if you do it.

When you finally reach your destination, you may miss the old days with blue sky and white clouds, and a familiar melody rings in your ears:

"The sky was always blue at that time/the days always passed too slowly/

You always said graduation was far away / We all went our separate ways in a blink of an eye/

Who meets you who is sentimental/who comforts you who loves to cry/

Who read the letter I wrote to you/who threw it in the wind"

JinseFinance

JinseFinance