Source: TaxDAO

Ethiopia became the first African country to start Bitcoin mining. Although Ethiopia still prohibits cryptocurrency trading, it approved a law in 2022 that favors mining, allowing "high-performance computing" and "data mining". According to data from Luxor Technologies, a Bitcoin mining service company, in 2023, Ethiopia ranked fourth among the preferred destinations for Bitcoin mining equipment, second only to the United States, Hong Kong and Asia. And according to its estimates, Ethiopia has become one of the world's largest recipients of Bitcoin mining machines. This article analyzes Ethiopia's crypto tax system, especially the types of taxes and tax rates that mining companies may be involved in.

1 Related tax issues for mining

1.1 The concept of mining

Mining is an act of obtaining digital currency. It is a way to obtain rewards by solving complex mathematical problems in the network through computer calculations. Mining is widely used in the field of cryptocurrencies such as Bitcoin. Simply put, mining is a kind of computing behavior performed to obtain a certain digital currency.

1.2 Mining Income

Mining income refers to the rewards obtained by using computer equipment to participate in the consensus mechanism of the crypto asset network, verify transactions or create new units of crypto assets. The sources of mining income can be divided into two types: one is a fixed block reward, that is, every time a new block is added to the blockchain, the miner will receive a certain amount of crypto assets; the other is a variable transaction fee, that is, each transaction will pay a certain percentage or amount of fees to the miner who verifies the transaction. The calculation method of mining income depends on the consensus mechanism adopted, and there are two main types: Proof of Work (PoW) and Proof of Stake (PoS).

1.3 Tax issues of mining

The tax treatment of crypto asset mining business mainly depends on the definition of crypto assets, asset classification, and recognition and measurement of mining income and expenses in the country or region where it is located. Mining income varies from country to country or region, and the main types of taxes involved are also different. The main types of taxes involved are listed below for analysis.

First, direct taxes, that is, income tax and capital gains tax are levied on mining income. Most countries involved in mining business will treat mining income as business income of enterprises or individuals, and levy corporate income tax or personal income tax. The income tax rate is determined according to the identity of the miner (individual or enterprise), income level, place of residence and other factors.

Second, indirect taxes, value-added tax or goods and services tax are levied on mining income. At present, there is no unified opinion on the collection of value-added tax or goods and services tax on mining income in various countries or regions. In the European Union, most countries believe that mining business is not subject to value-added tax. Israel, based on the documents and other regulations on the taxation of virtual currency activities issued in 2017, regards mining business as the provision of services and imposes a 17% value-added tax. New Zealand also regards mining business as a service and imposes a 15% goods and services tax.

Some countries will impose consumption tax on mining companies for considerations such as industry resource adjustments. For example, in the United States, according to the "Budget Supplementary Explanatory Document" released by the U.S. Treasury Department in March 2023, one of the provisions proposes to impose a phased consumption tax based on the cost of electricity used in cryptocurrency mining. These companies will be required to report their electricity consumption and the type of electricity used.

2 Advantages of Mining in Ethiopia

Hit by political and economic headwinds, Bitcoin miners are often attracted to some governments with low electricity costs and friendly to the cryptocurrency industry. Although Ethiopia still prohibits cryptocurrency trading, it will allow Bitcoin mining from 2022. For all companies engaged in cryptocurrency mining, Ethiopia has become a rare opportunity, so here is a brief analysis of the advantages of mining in Ethiopia.

2.1 Resistance to cryptocurrency mining in other countries

Because of climate change and power scarcity, other countries and regions have strongly resisted cryptocurrency mining. For example, a series of developing countries such as Kazakhstan and Iran initially accepted Bitcoin mining, but when its energy use caused domestic dissatisfaction, the policy began to change to non-support and resistance. In 2021, the Chinese government also banned Bitcoin mining. Most countries ban cryptocurrency mining. Because countries may run out of available electricity, leaving miners with no room to expand. Second, miners may suddenly be seen as unwelcome by the government and forced to leave.

2.2 Cheap Electricity

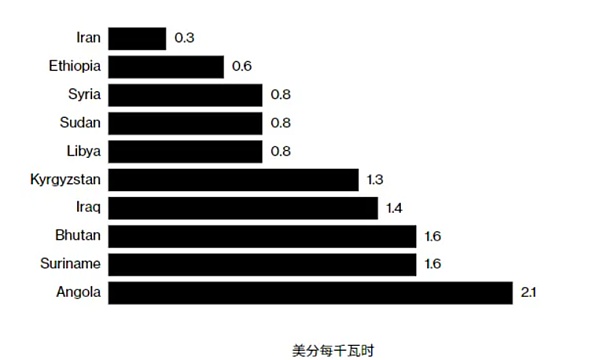

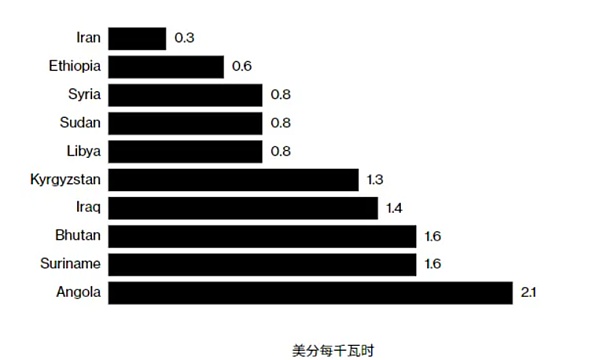

Bitcoin miners use a lot of electricity, and electricity accounts for up to 80% of miners' operating costs, so access to cheap electricity is a key competitive advantage in mining. Bitcoin mining consumed 121 trillion watt-hours of electricity in 2023. Its reliance on abundant electricity is its main weakness, as it may squeeze out factory and household electricity use, exposing mining companies to political resistance. Ethiopia has low electricity prices, as shown in the figure (Source: Statista Research Department). The Ethiopian National Electricity Corporation said it has reached power supply agreements with 21 Bitcoin miners, 19 of which are from China.

2.3 Ideal Resources and Climate Conditions

Against the backdrop of global warming, Bitcoin mining is increasingly seen as a factor in global warming, despite miners claiming they are increasingly using clean energy. A study released by the United Nations showed that 2/3 of the electricity used for Bitcoin mining in 2020 and 2021 was generated from fossil fuels.

Ethiopia can use its abundant excess green energy, renewable energy, to provide electricity to its citizens through Bitcoin mining. Ethiopia's ability to power Bitcoin mining could rival that of Texas in a few years. The completion of the GERD project will double Ethiopia's power generation capacity to 5.3 GW. Ethiopia's advantages are not just in cheap renewable energy. The climate conditions are also very suitable. The ideal temperature for mining is 5 to 25 degrees Celsius, which coincides with the average temperature in Ethiopia.

2.4 The attitude of the Ethiopian government

The Ethiopian government allows Bitcoin mining mainly because these mining companies pay for the electricity they consume in foreign currency. The power company charges Bitcoin miners a fixed rate of 3.14 cents per kilowatt-hour, which is a lucrative source of foreign exchange income. Expand foreign exchange inflows to alleviate economic challenges and see the mining industry as an attractive investment opportunity to achieve this goal. According to Project Mano, the inclusion of Bitcoin mining in the Ethiopian economy could contribute $2 billion to $4 billion to its GDP. The government's acceptance of Bitcoin mining can largely block the path of mining to break through foreign exchange controls. It can also increase employment, increase tax sources, and reduce water abandonment in hydropower stations during flood season.

3. Taxation of Mining Enterprises in Ethiopia

3.1 Taxation System in Ethiopia

3.1.1 Taxation Structure

Ethiopia implements a tax-sharing system between the federal government and the state governments. Each state pays a certain proportion of taxes to the federal government. The federal government allocates funds to each state based on the population, economic conditions and tax payments of each region.

Central taxes include tariffs and other import and export taxes on goods; personal income tax for personnel employed by the central government and international employers; profit tax, personal income tax and value-added tax on enterprises owned by the central government; taxes on national lottery income and other winning income; taxes on aircraft, trains and shipping activities; taxes on rental income from houses and properties owned by the central government; taxes on licenses and service fees issued or licensed by the central government.

Taxes shared by the central and local governments include corporate profit tax, personal income tax, value-added tax, royalties and land rent taxes for large-scale exploitation of oil, natural gas and forest resources.

3.1.2 Taxes that may be involved in mining companies in Ethiopia

(1) Enterprise Income Tax

Any enterprise that earns income in Ethiopia must pay income tax. Income tax taxpayers are divided into three categories, namely, Class A taxpayers, Class B taxpayers, and Class C taxpayers. Among them, enterprise income tax taxpayers are Class A taxpayers. According to the nature of income, the Income Tax Law divides it into five categories, namely, Class A income, Class B income, Class C income, Class D income, and Class E income. Among them, the types of income involved by enterprise income tax taxpayers are Class B income (30%), Class C income (30%), Class D income (10% or 5%), and Class E income (tax-free).

(2) Value Added Tax (VAT)

The scope of VAT in Ethiopia is the provision of goods and services, imported taxable goods and specific imported services. VAT taxpayers who are required to register and those who are voluntarily registered are divided according to the total value of taxable transactions. VAT is calculated by deduction method. When the input tax is greater than the output tax, you can choose to retain, refund or offset other taxes. The tax rate is divided into two tiers, the basic tax rate of 15% and the zero tax rate. VAT is reported monthly. Mining companies that involve the transmission or provision of heat, electricity, gas or water will be subject to VAT.

(3) Capital Gains Tax

Capital gains are income realized when operating assets are transferred. In Ethiopia, capital gains belong to Class D income stipulated in the Income Tax Law and are subject to income tax (also known as capital gains tax). The tax rate for buildings owned for business, factories, and offices is 15%; the tax rate for company shares is 30%.

(4) Royalties

In Ethiopia, royalties are payments made as a consideration for the use of, or the right to use, any literary, artistic or scientific work, including copyrights in motion picture films, films or tapes used for radio or television broadcasting, any patent, trademark, design or model, drawing, secret formula or secret process, or any industrial, commercial or scientific equipment; or payments made as a consideration for information relating to industrial, commercial or scientific experience. Royalties are taxed at a flat rate of 5%.

3.2 Tax Analysis of Mining Companies in Ethiopia

Cryptocurrency companies operating in Ethiopia need to apply for registration with the country's cybersecurity agency, the Information Security Authority (INSA). Crypto companies that fail to comply with registration requirements will be subject to legal action. At the same time, INSA has the power to regulate crypto products and related transactions. In addition, INSA will also be responsible for developing operating procedures and the construction of crypto infrastructure.

Ethiopia implements a collection principle that combines the territorial principle with the personal principle. Any enterprise that earns income in Ethiopia must pay income tax, and Ethiopian resident enterprises should declare and pay corporate income tax on their global income. The income earned by mining companies stationed in Ethiopia in Ethiopia is more likely to be identified as Class C income or Class D income, with a tax rate of 30%. The relevant provisions of Ethiopian government documents have not yet been clarified as to whether to pay income tax or profit tax based on the type of income. The supply of electricity, heat, etc. is subject to value-added tax in Ethiopia, and mining companies are extremely dependent on electricity. In fact, they are the actual taxpayers of electricity value-added tax. In the final analysis, electricity price tax will affect the tax revenue of mining companies. And it is not yet clear how Ethiopia will characterize the mining behavior of enterprises. If it is characterized as providing services or labor, it will also involve the direct payment of value-added tax.

Regarding the recognition time of mining income, many opinions believe that cryptocurrency mining represents intangible assets developed internally by mining companies. The computers, usage and various employee costs invested by miners are used for construction and mining to form internally developed intangible assets, so income or gains should be recognized when the cryptocurrency is subsequently sold. There are no clear rules and regulations indicating that Ethiopia currently has a tax incentive system for mining companies, but mining companies may be subject to some existing tax incentives, such as tax incentives for solving employment. And if mining companies are involved in the import of mining machines, they will also involve the payment of tariffs, and specific regulations and related tax rates need to be further clarified.

References

[1] State Administration of Taxation. (2023). Tax Guide for Chinese Residents Investing in Ethiopia

[2] TaxDAO. (2023). Is Crypto Mining Company More Suitable to Set Up in Hong Kong or Singapore?

[3] Techub News. (2023). Chinese Bitcoin Miners Find a New Crypto Haven in Ethiopia

[4] Zheng Mengya, Wang Keke, Wang Zhenni, Yan Huqin. (2021). Research on Tax Issues of Cryptocurrency in the Context of Digital Economy - Taking Bitcoin Mining Mechanism as an Example. World Economic Exploration. 2021, 10(1): 1-8.

Huang Bo

Huang Bo