Source: Zhibao Investment Research

Summary

At this meeting, the Fed cut interest rates by 25bp to 4.25%-4.5%, in line with expectations. The overnight reverse repo tool was technically adjusted to the lower end of the range of the federal funds rate.

The wording of the meeting statement was adjusted, reflecting that the FOMC considered that the "rhythm" and "magnitude" of the implementation of subsequent policies had changed. There were also differences in the ticket type, some members opposed the December rate cut.

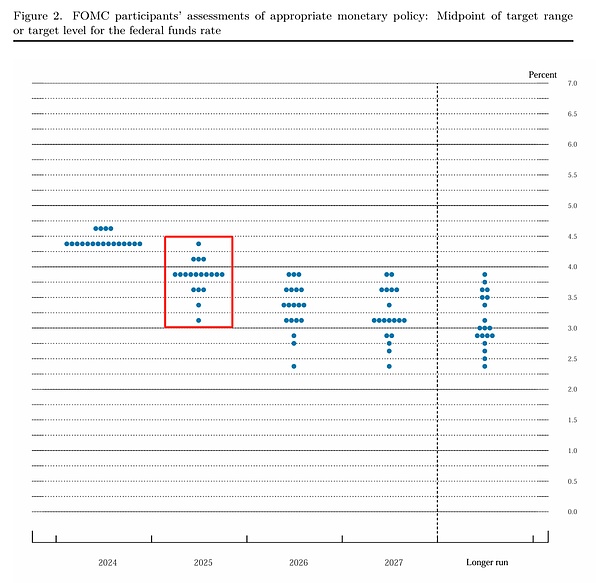

The economic forecast clearly reflected concerns about inflation risks, and the Fed's risk balance clearly tilted towards inflation again. The dot plot only hinted at two rate cuts next year, showing an definite hawkish tendency.

In his opening remarks, Powell mentioned the "more neutral setting" and "Cautious" for further rate cuts, expressing a hawkish stance.

The dollar/VIX soared, while U.S. bonds, U.S. stocks, gold, and Bitcoin fell sharply.

Statement (bold indicates changes)

Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee's 2 percent objective but remains somewhat elevated.

Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee's 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In support of its goals, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; and Christopher J. Waller. Voting against the action was Beth M. Hammack, who preferred to maintain the target range for the federal funds rate at 4-1/2 to 4-3/4 percent. Beth M. Hammack voted against the vote, preferring to maintain the target range for the federal funds rate at 4.5% to 4.75%.

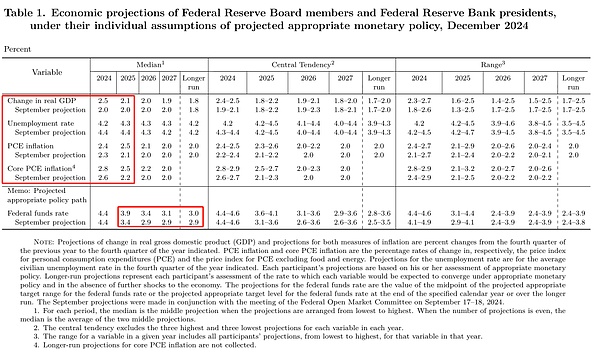

Economic Forecasts and Dot Plot

The economic forecast for 24/25 was raised, the unemployment rate forecast was lowered, and the inflation forecast was raised. The inflation forecast for 25 years was raised by a large margin.

The dot plot only indicates two interest rate cuts throughout next year, showing a strong hawkish tendency.

Question and Answer Session

Mi Kou was not able to follow the press conference throughout the meeting due to illness, and the specific questions and answers are still to be sorted out after the official document is released.

Alex

Alex

Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Weiliang

Weiliang Catherine

Catherine Kikyo

Kikyo