Author: William Suberg, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Bitcoin started the new week in recovery mode after an unusually volatile weekend that triggered heavy losses.

After days of sustained selling pressure, Bitcoin price action is struggling to regain all-time highs – can bulls reverse the trend?

A critical macroeconomic week will ensure unpredictable trading conditions continue as both cryptocurrencies and risk assets Waiting for hints from the Fed. The fight against inflation continues, and the latest data shows that the forces of inflation will not go down without a fight.

Everything remains to be seen this week as BTC/USD is in a critical area that must be regained to continue price discovery.

Bitcoin is only a month away from the next block halving and may repeat history with a classic pre-halving pullback.

Cointelegraph takes a closer look at these and other existing questions in this weekly overview of what could influence BTC price action in the coming days and beyond.

BTC price "defensive" below key resistance level

Brutal for bulls hoping for a breakout The weekend quickly sent Bitcoin to its lowest level since March 6.

BTC/USD rallied to near $64,500 before recovering strongly to almost hit the $69,000 mark only to end the week with fresh losses.

As of this writing, the pair has surpassed $68,000, but is still unable to break above the area that has been dubbed an all-time high for 2021, according to data from Cointelegraph Markets Pro and TradingView.

BTC/USD 1-day chart. Source: TradingView

Analyzing the current setup, [Popular trader Skew flags the 21-period exponential moving average (EMA) on the 4-hour chart as the next line for recovery. Bitcoin’s Relative Strength Index (RSI) reading on the 4-hour time frame currently stands at 48.2 and should also move back above 50.

“Still need a strong close above the 4 hour 21EMA, RSI above 50, and recoup $69k-$70k,” he wrote as part of his latest post on X (formerly Twitter) .

“These are key confirmations for a move higher, but a bit defensive until then.”

Nonetheless, selling pressure on Bitcoin was unusually strong over the weekend due to a lack of institutional trading.

One theory circulating online attributes the trend to the unwinding of positions by a single hedge fund. Here, the entity might be long BTC while short shares of technology company MicroStrategy (MSTR). When the trade was liquidated, the fund had no choice but to sell approximately $1 billion in BTC to recoup its losses.

Investor Fred Krueger added in part of the Additional selling by owners.

Source: Fred Krueger/X

Despite setbacks, Bitcoin hits first-ever Second highest weekly closing price. The largest cryptocurrency ended the week just under $68,400, down just $600 from its previous close.

“Bitcoin starts the new week above top resistance on the charts,” popular trader Jelle wrote in an optimistic post.

“Don’t be shaken.”

Liquidity discount and capital reset

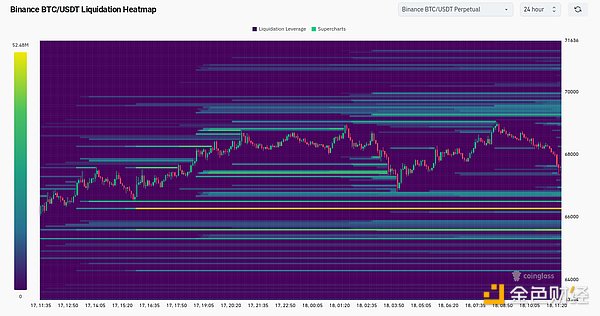

Some of the latest market data reflects the extent of the “push-in” on exchanges near two-week lows.

Data from monitoring resource CoinGlass shows the number of days in long-term liquidations totaling more than $300 million.

On Binance, the world’s largest exchange, the perpetual contract currently has little price liquidity, with a buying support wall at just $66,266. Seller is waiting on $69,000+.

BTC/USDT perpetual liquidity heat map (screenshot). Source: CoinGlass

One side effect of the weekend's action was a reset in open interest and funding rates, with the latter still too aggressive but only a fraction of recent peaks.

“There is so much pessimism on my timeline. Bitcoin is trading $5,000 below ATH,” responded James Van Straten, research and data analyst at cryptocurrency insights firm CryptoSlate.

"Every price increase is necessary for us to move higher in the next stage."

Exchange Bitcoin futures are not flat Warranty contract (screenshot). Source: CoinGlass

Van Straten noted that funding rates have not gone negative since last September and he is “highly skeptical” that this will return.

"We have been in a bullish structure since October, so the positive financing continues as we Occasionally reset when it gets too frothy,” he commented.

The classic trend of "retracement before halving"

Bitcoin miners are expected to be ready before the halving in April Enjoy the final monthly block reward of 6.25 BTC.

The debate continues about how this event will affect Bitcoin price behavior - after all,new all-time highs never occur before halvings, but after them Appeared within a few months.

Some therefore believe that the current trip to all-time highs may be more volatile than other price cycles. Finished early. However, before and after the halving, Bitcoin may still follow the classic strategy of first going lower and then going higher.

In recent content on the subject, popular trader and analyst Rekt Capital laid out the risks for holders going forward.

"In two days, Bitcoin will officially enter the 'danger zone' (orange) with the historic halving The previous retracement has begun,” he warned on March 17 with an illustrative chart.

“Historically, Bitcoin has had a pre-halving retracement 14-28 days before the halving. ."(For details, please read the Golden Finance article "Will Bitcoin enter the "dangerous period of halving"? What do people in the industry say?")

Bitcoin halving price trend comparison. Source: Rekt Capital / The biggest drop was around $73,700.

Rekt Capital added: “Bitcoin is slowly transitioning from the ‘pre-halving rally’ phase to Pre-halving retracement' phase."

He further pointed out that despite continued buying by U.S. spot Bitcoin exchange-traded funds (ETFs), standard cycle phenomena are still unfolding. .

Focus on Fed Powell after FOMC

A key week for risk assets will revolve aroundthe next Fed rate hike Decision and comments from Chairman Jerome PowellExpand.

The next meeting of the Federal Open Market Committee (FOMC) will end on March 20, which will form the Classic risk asset volatility catalyst.

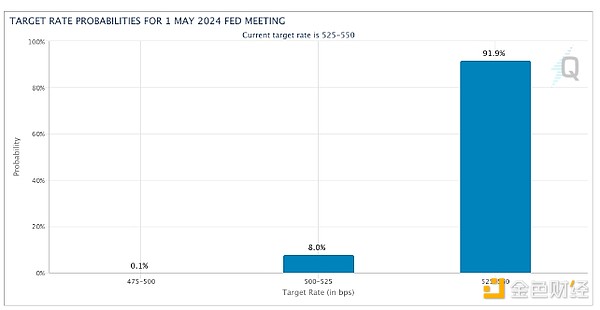

Nonetheless, the market does not expect any surprises this time - persistent inflation has eliminated the possibility of a rate cut, and even if the subsequent Federal Open Market Committee (FOMC) ) meeting is also not expected to reverse this trend.

For example, the latest estimate from CME Group's FedWatch Tool puts the chance of a rate cut at the FOMC meeting at just 8%.

Probability of the Fed’s target interest rate. Source: CME Group

In an analysis of broader FedWatch data, "Kobeissi Letter" wrote: "It's official: For the first time this year, markets are seeing just three interest rate cuts in 2024. "

"This also happens to be the first time the market has aligned with the Fed's latest guidance."

Powell will speak twice this week, the second time on March 22. Market watchers will be paying close attention to the language as clues to future policy moves.

"All eyes are on Fed guidance at this week's Fed meeting. With CPI inflation rising for 2 consecutive months, the Fed must be worried." Kobeissi continued.

"A rate cut in 2024 is almost certain as the fight against inflation continues."

" span>

Bitcoin Diamond Hand Leverage Hits All-Time High

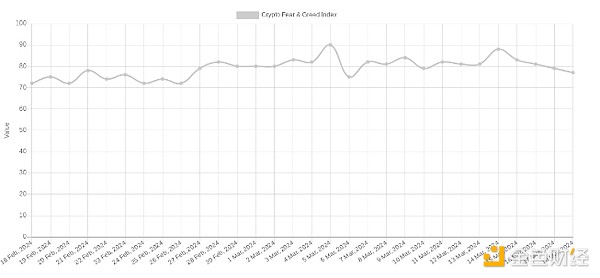

Although market sentiment remains "Extreme Greed" territory, but some holders are voting with their wallets, according to the market sentiment indicator theCryptocurrency Fear & Greed Index.

Cryptocurrency Fear and Greed Index (screenshot). Source: Alternative.me

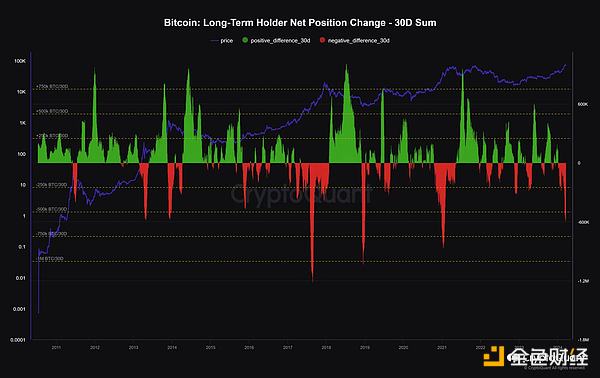

Latest data from on-chain analytics platform CryptoQuant confirms a significant surge in profits from long-term token holdings.

Long-term holders (LTH) — entities that hold coins for at least 155 days — have distributed nearly 600,000 BTC, or about $40 billion, in the past month.

Discussing the phenomenon on Coin Trust Fund (GBTC).

Changes in Bitcoin LTH net position. Source: Maartunn/X

Bitcoin miners have also reportedly stepped up their selling this year.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance cryptopotato

cryptopotato Others

Others Coindesk

Coindesk Beincrypto

Beincrypto Cointelegraph

Cointelegraph Ftftx

Ftftx