Author: Sangmi Cha, Sidhartha Shukla, Bloomberg; Compiled by: Deng Tong, Golden Finance

Do Kwon from South Korea presided over one of the biggest busts in the history of the volatile cryptocurrency industry. His Terraform Labs Pte created the TerraUSD stablecoin, which is designed to maintain a constant $1 value through a complex combination of algorithms and trader incentives involving sister token Luna. Their combined value soared to more than $60 billion until confidence in the system evaporated in May 2022, prompting investors to flee and strip the tokens of their value. With Kwon's whereabouts unknown, South Korea issued an arrest warrant on charges including violating capital markets laws. He denies any wrongdoing or being "on the run." But he became the subject of an Interpol red notice and was arrested in Montenegro in March 2023, triggering extradition requests from South Korea and the United States. A year later, a Montenegrin court ruled that the rights should be sent to South Korea, but the country's top court suspended the decision on March 22. His extradition to either country will now only be possible after further consideration by the courts.

1. Who is Kwon?

According to his LinkedIn profile, 32 years old Kwon left Stanford in 2015 with a degree in computer science. As he puts it, he "fell down the crypto rabbit hole" having previously worked at Apple and Microsoft. Kwon, who co-founded Terraform Labs in 2018, is one of many young programmers who see digital ledgers as a gateway to the financial revolution One of the members. His project to create a stable digital currency outside of mainstream finance and regulatory institutions has attracted a large following but has critics who say it is a Ponzi scheme doomed to fail. Arrogant and combative at times, Kwon has attacked his opponents online, telling one critic that the Luna community was not "poor as you bastards." When his project failed, he said he was "heartbroken over the pain my invention has caused all of you."

2. What happened to the TerraUSD stable currency?

TerraUSD is an algorithmic stablecoin and its sister token Luna has ballooned in value amid the pandemic-era cryptocurrency boom. TerraUSD is not backed by U.S. dollars or traditional assets, but should be worth $1 because it is redeemable for $1 worth of Luna, and as the Terraform Labs network becomes more valuable, the value of Luna will increase. TerraUSD became increasingly popular when Kwon launched the Anchor Protocol, which offered an eye-popping 20% off TerraUSD deposits interest rate. But when investor confidence evaporated due to the virtual currency sell-off, the entire edifice came crashing down. When the price of TerraUSD dropped to 99 cents on May 7, 2022, its peg began to collapse. Terraform Labs significantly increased Luna's supply in pursuit of recovery, causing the latter's price to drop. (It was once worth over $100.) Bitcoin reserves worth billions of dollars failed Stopping the spiral: Within days, TerraUSD and Luna were nearly worthless. South Korean authorities are trying to determine the whereabouts of assets worth millions of dollars.

3. Why did Kwon become a fugitive?

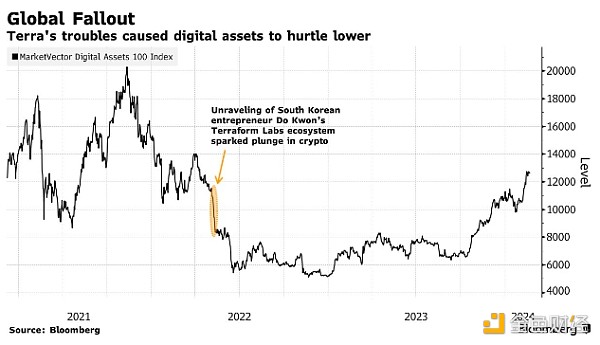

TerraUSD’s collapse rocked the global cryptocurrency industry, causing cryptocurrency market capitalization to shrink from its peak in November 2021 $2 trillion. That has drawn scrutiny from regulators from the United States to Asia, as well as law enforcement in South Korea, where some 280,000 people have purchased Luna. Lawyers for Luna investors filed a complaint with South Korean prosecutors accusing Kwon of engaging in fraud and illegal fund-raising. On September 14, 2022, prosecutors said arrest warrants had been issued for Kwon and five others on charges including violating capital markets laws. Kwon was believed to be in Singapore, but Singapore said on September 17 that he was no longer in Singapore. Prosecutors said on September 26 that Interpol had issued a red notice, requiring police around the world to find and arrest him, and that he had been stripped of his South Korean passport. In February 2023, the U.S. Securities and Exchange Commission charged Kwon and Terraform Labs with fraud. In March, Kwon and Han Chang-joon, Terraform's former chief financial officer, were arrested at the airport in Montenegro's capital, Podgorica, as they tried to board a private jet to fly to Dubai. On the same day, the United States accused Kwon of masterminding a years-long cryptocurrency fraud. Han Changjun was extradited to South Korea in February 2024.

4. Kwon’s defense

Kwon’s Terraform Labs rejected South Korea’s accusations, saying that the case against him had become “highly politicized.” A spokesman for the company said prosecutors acted unfairly and had no reasonable basis to accuse Kwon of violating the country's Capital Markets Act because Luna did not Qualify as securities under this standard. Whether Luna is subject to securities laws is a key issue in the case and echoes broader questions raised by officials around the world about the status of digital tokens. Representatives for Kwon have previously said the SEC's lawsuit accusing him and Terraform Labs of securities fraud is without merit.

5. What are the broader impacts on cryptocurrency?

Billionaire Mike Novogratz, whose Galaxy Digital business backs Terraform Labs, called TerraUSD a "great idea that failed" and a teaching moment about cryptocurrency risk management. The impact of the Terra incident includes encouraging officials to develop rules for stablecoins to better protect buyers. Jurisdictions such as the European Union, Japan, Singapore, Hong Kong and Dubai have increased regulation of the industry as they compete to become digital asset hubs. The U.S. Congress has been considering a number of cryptocurrency bills, including legislation that would create guardrails for stablecoins. Investors are also more wary of decentralized finance (DeFi) – especially trading and lending tokens on distributed ledgers.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Joy

Joy Hui Xin

Hui Xin Joy

Joy Joy

Joy Davin

Davin Hui Xin

Hui Xin Joy

Joy Alex

Alex Alex

Alex