CertiK releases "Hack3d: 2023 Annual Web3.0 Security Report"

Through statistics and analysis of security incidents in the Web3.0 field over the past year, the latest trends in Web3.0 security are fully revealed.

JinseFinance

JinseFinance

Author: Volcano X Capital

This report aims to deeply analyze the mining machine market, from the definition and classification of mining machines to the development history of mining machines, as well as the introduction and comparison of mainstream mining machines on the current market, to provide reference for individuals or companies interested in entering the mining field.

With the surge in cryptocurrencies such as BTC, blockchain mining has gradually come into the public eye, attracting the attention of a large number of investors and technology enthusiasts. Mining, as an important way to obtain digital currency, its core equipment - mining machines - has become a hot topic. However, although the concept of mining machines has been widely discussed, many people still lack a deep understanding of how mining machines work and whether they are profitable. This report aims to deeply analyze the mining machine market, from the definition and classification of mining machines to the development history of mining machines, as well as the introduction and comparison of mainstream mining machines on the current market, to provide reference for individuals or enterprises interested in entering the mining field.

In simple terms, mining machines are dedicated computer hardware used to earn cryptocurrency. They use computing power to verify transaction information and create new blocks by running corresponding mining software, and in the process produce new cryptocurrency as a reward. From a macro perspective, any device that can run a mining program can be called a mining machine, including but not limited to professional mining machines, home computers, smart phones, etc. From a micro perspective, mining machines specifically refer to high-performance devices designed specifically for mining, such as ASIC mining machines, GPU mining machines, etc.

ASICmining machine: designed for specific algorithms, such as Bitcoin's SHA-256, Litecoin's Scrypt, Dash's X11, etc., with very high efficiency and computing power, but lack flexibility.

GPUmining machine: suitable for a variety of algorithms and currencies, such as Ethereum's Ethash, Zcash's Equihash, etc., providing good adaptability and versatility, but may not be as efficient as ASIC on a single algorithm.

CPUMining: Although most mainstream currencies have difficulty in obtaining significant returns through CPU mining, there are still some projects such as Monero that emphasize CPU mining friendliness.

Hard Disk Mining: It represents an energy-saving and environmentally friendly mining method, mainly used in projects such as Filecoin and Chia, and participates in network maintenance by providing storage space.

LoRaWANGateway: The Helium network "mines" by deploying IoT devices. This method is almost negligible in terms of resource consumption, but it relies more on network layout and coverage.

Cryptocurrency mining machine classification and performance comparison

Cryptocurrency | Mining machine type | Features | Computing power reference | Energy consumption efficiency reference | Major manufacturers |

BTC | ASIC | Specialized and efficient, optimized for SHA-256 algorithm | ~110TH/s | ~3250W | Bitmain, Canaan Technology |

ETH | ETH | Strong versatility, support for multiple currencies | ~100MH/s | ~320W | NVIDIA, AMD |

ZEC (Zcash) | GPU/ASIC | Privacy protection cryptocurrency, Equihash algorithm | Nvidia, Bitmain ASICs: ~700 Sol/s (GTX 1080 Ti) ~250W (GPU benchmark) Nvidia, Bitmain ASICs: ~19.5GH/s ~1350W valign="top"> Innosilicoin | ||

LTC (Litecoin) | ASIC | Using the Scrypt algorithm, it aims to lower the threshold for Bitcoin mining | ~580MH/s | ~1500W | Bitmain |

DOGE (Dogecoin) | ASIC | Originally created as a joke, now widely followed, also uses Scrypt algorithm | ~10GH/s | Depending on the specific model | Multiple manufacturers |

FIL | Hard disk (storage space mining) | style="text-align: left;">Low energy consumption, depends on available storage space | Depends on hard disk capacity | Low | Western Digital, Seagate |

XCH | Hard disk (Proof of Space and Time) | Environmentally friendly, uses unused hard disk space | Depends on hard disk capacity | Low | Western Digital, Seagate |

HNT | LoRaWAN gateway | Build a wireless network with extremely low power consumption | N/A | Extremely low | Helium official, third party |

Monero (XMR) | CPU/GPU | Emphasis on privacy protection, using the RandomX algorithm, more friendly to CPU mining | ~1KH/s (Ryzen 7 CPU) | ~65W (CPU benchmark) | Multiple manufacturers |

CPUMining (2009)

Features: Using the central processing unit (CPU) of an ordinary personal computer for mining.

Limitations: Low efficiency and high energy consumption.

GPUMining (2010-2012)

Features: Graphics processing units (GPUs) have significant advantages over CPUs in parallel processing, greatly improving mining efficiency.

Data: For example, the early AMD Radeon HD 5870 can reach a hash rate of about 400 MH/s.

FPGAMining (2011-2012)

Features: Field Programmable Gate Array (FPGA) provides a better power consumption ratio, but requires users to configure and program it themselves.

Transformation: Although the efficiency has been improved, the complex configuration requirements limit its popularity.

ASICMining (2013Present)

Features: Application-specific integrated circuit (ASIC) mining machines are designed specifically for mining, providing unprecedented efficiency and speed.

Data: The computing power of early ASIC mining machines ranged from a few GH/s to TH/s, while the current leading ASIC mining machines such as Bitmain's Antminer S19 series can reach more than 95TH/s, and the energy efficiency ratio has been greatly improved.

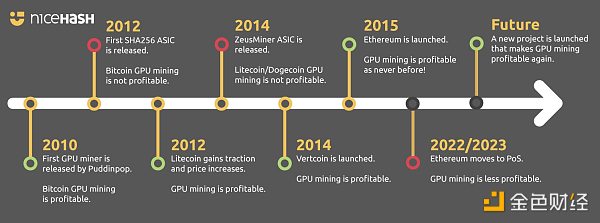

In the development history of cryptocurrency mining, several key events have had a significant impact on the mining machine market. At the same time, the mining machine wave has also affected the price fluctuations of digital currencies to varying degrees.

Key Events

Introduction of Bitcoin ASIC Miners (2013):

Impact: The emergence of ASIC miners greatly increased the total computing power of the Bitcoin network, making CPU and GPU mining uneconomical. During this period, the difficulty level of Bitcoin rose rapidly.

Data: In early 2013, the price of Bitcoin rose from about $13 to over $1,000 by the end of the year. Although prices are affected by many factors, the introduction of ASIC miners is believed to have increased market participation and contributed to the price increase.

Ethereum network congestion and graphics card shortage (2017, 2021):

Impact: Due to the explosive growth of DeFi and NFT projects, the transaction volume of the Ethereum network has surged, resulting in an increase in Gas fees. At the same time, mining demand has led to a global shortage of graphics cards and soaring prices.

Data: In 2021, the retail price of some high-end graphics cards is 2 to 3 times higher than the recommended retail price. The price of Ethereum was about $730 at the beginning of 2021 and reached a high of more than $4,000 by the middle of the year.

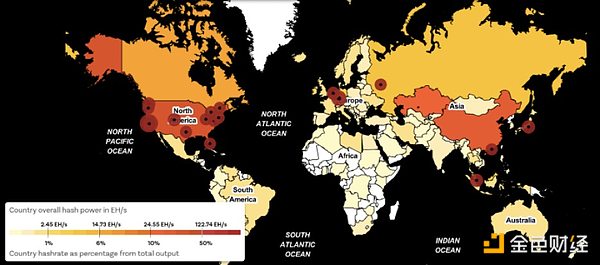

China Cracks Down on Cryptocurrency Mining (2021):

Impact: The Chinese government has imposed strict restrictions on cryptocurrency mining and trading, resulting in a major adjustment in the distribution of global computing power, with many mining farms moving overseas, such as the United States and Kazakhstan.

Data: This incident directly caused the total network computing power of Bitcoin to drop by about 40% in a short period of time, and the price of Bitcoin also experienced a short-term sharp fluctuation, falling from a high of about $64,000 in May to about $30,000 in July.

The impact of the mining machine wave on digital currency prices

The increase in mining profitability is positively correlated with the price of cryptocurrency: When the price of cryptocurrency rises, more people invest in mining, which drives up the demand for mining machines, further exacerbating the rush to buy hardware equipment (especially graphics cards and dedicated ASIC mining machines). For example, in the big bull markets of Bitcoin and Ethereum in 2017 and 2021, the prices of mining machines and graphics cards soared, and even ran out of stock.

New technologies and algorithm changes may affect prices: Whenever a new generation of more efficient mining machines is launched, the competitiveness of old mining machines decreases, and some miners will withdraw from the market, while the high efficiency of new mining machines attracts more investors to participate in mining. This change in supply and demand may have an indirect impact on the price of cryptocurrency.

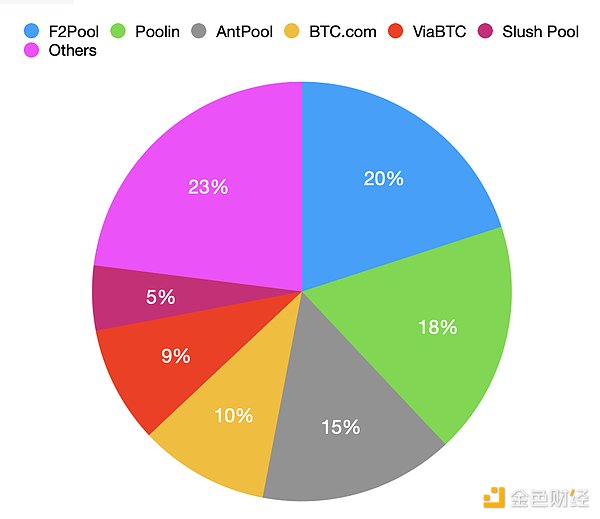

Pools are an important part of cryptocurrency mining, allowing miners to combine their computing resources to increase the chances of finding blocks and distribute rewards based on the proportion of contributed hashrate. Over time, the distribution of mining pool hashrate has changed, reflecting the market competition and technological progress. Below is the hashrate distribution of some of the major mining pools, as well as other notable mining pools:

Pool Name | Hashrate Percentage (%) | Region | ||||

F2Pool | China | |||||

Poolin | 18 | China | ||||

AntPool | 15 | BTC.com | 10 | ViaBTC | 9 | China |

Slush Pool | 5 | Czech Republic | ||||

Others | 23 | Multiple regions |

Mainstream mining pool computing power distribution (taking Bitcoin as an example)

F2Pool: Founded in 2013, it is one of the earliest Bitcoin mining pools in the world. It is currently the largest single Bitcoin mining pool.

Poolin: Founded in 2017 by several former key members of BTC.com, it competes fiercely with F2Pool.

AntPool: Operated by Bitmain, it is a veteran mining pool that serves miners worldwide.

Other Mining Pools Worth Noting

BTC.com: This mining pool has historically been one of the leaders in hashrate, but its market share has declined in recent years.

ViaBTC: Founded in 2016, it provides mining services for multiple cryptocurrencies such as Bitcoin, Bitcoin Cash, and Litecoin.

Slush Pool: Founded in 2010, it is the world's first Bitcoin mining pool. Although it is not as powerful as the aforementioned large mining pools, it is widely respected for its long history and contributions to the community.

Interpretation:

Pool concentration: Through the data table and pie chart, we can clearly see that the top mining pools (such as F2Pool, Poolin, AntPool) occupy most of the market share. This shows that the computing power in the field of Bitcoin mining is highly concentrated in the top mining pools.

Geographical distribution: The table also provides information on the regions where the mining pools are located, reflecting the dominant position of certain countries or regions in the Bitcoin mining industry, and can also observe the impact of policies, electricity prices and other factors on the distribution of mining pools from the side.

Diversity and decentralization: Although the top mining pools account for a large proportion, the 23% share of the "other" category also shows that there is a certain degree of diversity in the market. This is beneficial to maintaining the decentralization and security of the network.

Leasing and sales of physical mining machines

Sales: Manufacturers sell directly to consumers or through distribution channels. With the rise of the mining boom, the demand for high-performance mining machines is growing.

Leasing: Individuals or companies can rent mining machines for a period of time, lowering the entry threshold. Leasing services provide flexibility, allowing users who do not have enough capital to purchase mining machines to participate in mining.

Cloud Mining Service

Purchase of computing power: Users can purchase computing power provided by cloud mining platforms without having to directly purchase and manage physical mining machines. This reduces the complexity and direct investment of mining.

Computing power leasing: Similar to purchasing computing power, but usually exists in a shorter-term contract, providing users with greater flexibility and a lower threshold for participation.

Mining machine hosting service

Hosting operation: Mining machine owners host their own mining machines in professional mining farms, where the mining machines are maintained and monitored by professional teams. This reduces the burden of equipment management and optimization for individual miners.

Facility rental: For users who want to control their own mining machines but do not want to deal with hardware setup and maintenance issues themselves, they can rent the location and facilities of professional mining farms.

Other mining services

Maintenance and optimization: With the popularity of mining machines, companies specializing in mining machine maintenance, upgrades and optimization services have emerged in the market to help miners keep their equipment in the best condition.

Consulting services: Provide industry knowledge, investment advice and risk assessment services to new entrants. These services are designed to help customers make wise investment decisions.

Software Solutions: Develop specialized mining software to improve mining machine efficiency, optimize computing power configuration, and provide data analysis, monitoring, and management capabilities.

Importance of the Ecosystem

Building a healthy mining machine industry chain ecosystem is critical to the entire cryptocurrency mining industry. It not only enables participants to obtain resources and services more efficiently, but also promotes technological innovation and improves the competitiveness of the overall industry. At the same time, as the cryptocurrency market fluctuates, these services provide the necessary flexibility and adaptability to help miners and investors maximize profits and reduce risks.

Company | Founded | Country | Advantage | Products | left;">Market Positioning | Track Layout | ||||||

Bitmain | 2013 | Beijing, China | High-performance ASIC mining machine manufacturing | Antminer series | Leader in cryptocurrency mining hardware | Canaan Creative (Canaan Creative) | 2013 | Hangzhou, China | Innovative ASIC technology | AvalonMiner series | Blockchain hardware and computing solutions | Exploration of mining machines + blockchain technology applications |

NVDIA | 1993 | California, USA | Leading GPU technology | GeForce series | Graphics processing and high performance computing | GPU mining + multi-field technology applications | ||||||

AMD | 1969 | California, USA | CPU and GPU Advantages | Radeon GPU, Ryzen CPU | Diversified Computing Solutions | GPU Mining + Gaming/Server Market | ||||||

MicroBT | MicroBT | 2016 | Shenzhen, China | High-efficiency mining machine design | WhatsMiner series | Competitors in the field of cryptocurrency mining machines | Mining machine production + technological progress promotion | |||||

Innosilicon | 2006 | ASIC Design and Manufacturing | Multiple Cryptocurrency Miners | Cryptocurrency Mining Solutions Provider | Multi-currency Miner Manufacturing + Electronics/Storage Layout | |||||||

Ebang International | 2010 | Hangzhou, China | left;">Transformation into cryptocurrency hardware manufacturing | Ebit mining machine series | Cryptocurrency hardware and technical services | Mining machine manufacturing + trading platform development |

Core advantages and main products: The core advantages of each company are reflected in its flagship products, such as Bitmain's Antminer series and Canaan Technology's AvalonMiner series, which are both known for their high-performance ASIC mining machines. NVIDIA and AMD, with their GPU products, have occupied an important position in the gaming and professional markets in addition to cryptocurrency mining.

Market Positioning: Bitmain, Canaan, MicroBT and Ebang focus more on cryptocurrency mining hardware, while NVIDIA and AMD play a role in the broader field of high-performance computing, of which cryptocurrency mining is only one of the application scenarios.

Blockchain Track Layout: Although these companies have different main businesses, they are all seeking deeper development and application in the field of blockchain technology. Bitmain and Canaan focus on the expansion of blockchain technology in a wider range of fields, such as AI and global high-performance computing solutions, while NVIDIA and AMD support the diversified application of blockchain technology through their GPU technology.

Company | Country | Service | Advantages | Positioning | Partners / Projects | Key Data |

Cipher Mining | United States | Bitcoin Mining Data Center Operation | High Efficiency Data Center Management | Leader in Bitcoin Mining | N/A | |

Bitfury (2011) | Netherlands | Manufacturing of high-performance mining machines, operating mining data centers | Global blockchain technology leader | Innovator in blockchain technology and cryptocurrency mining | Hut 8 Mining Corp | Data centers in North America and Europe |

Hut 8 Mining Corp (2017) | Canada | Blockchain Infrastructure and Bitcoin Mining | Environmentally Friendly Mining Solutions | Sustainable Digital Asset Mining and Blockchain Technology Company | Bitfury | Operates over 100MW of green energy data centers |

Core Scientific | United States | Digital asset mining and blockchain technology service provider | Blockchain innovation combined with AI technology | North American digital asset mining operation giant | Horizon Kinetics | With over 300MW mining capacity |

Marathon Patent Group (2010) | United States | Digital asset technology company, focusing on mining business | Scale operation in the field of cryptocurrency mining | Technology company focusing on Bitcoin mining | DMG Blockchain Solutions | Increasing Bitcoin mining hash rate |

Riot Blockchain, Inc. (2000) | United States | Investment and development in mining business and blockchain technology | Owns large-scale high-performance mining facilities | Pioneer in blockchain applications and cryptocurrency mining | Whinstone US, Inc. | Planning 1.4GW mining facilities |

Genesis Mining (2013) | Hong Kong | Cloud mining services | Providing cloud mining services for a variety of cryptocurrencies | Leader in the cloud mining industry | Hive Blockchain Technologies | Over 2 million users worldwide |

Hive Blockchain Technologies (2017) | Canadian | Blockchain technology company, involved in cryptocurrency mining | Mining using green energy | Genesis Mining | Operating ETH and BTC mining farms |

Conclusion and analysis:

Market leader positioning: Most of the listed companies have become leaders in the blockchain and digital currency mining field with their specific technological advantages and market positioning. For example, Bitfury and Core Scientific represent innovation and specialization in blockchain technology and data center operations.

Importance of environmental sustainability: Companies such as Hut 8 Mining Corp and Hive Blockchain Technologies emphasize the use of green energy for mining, showing that the market is paying more and more attention to environmental sustainability, which also reflects the trend of increasing environmental pressure and social responsibility faced by the cryptocurrency mining industry.

Cooperation and merger trends: As the industry develops, many companies expand their business scope and market share through cooperation or mergers with other companies, such as Riot Blockchain, Inc.'s acquisition of Whinstone US, Inc., which marks the expansion of the industry scale and the increase in concentration.

The rise of cloud mining services: Cloud mining services provided by companies such as Genesis Mining are becoming increasingly popular, providing individuals and small investors with a low-threshold way to enter the cryptocurrency mining field, reflecting the market's demand for more flexible mining solutions that do not require self-configuration of hardware.

Technological innovation and efficiency improvement: All companies are seeking to improve mining efficiency and reduce operating costs through technological innovation, reflecting the increasingly fierce competition in the field of cryptocurrency mining and the trend of constantly pursuing high-efficiency technological solutions.

With the continuous development of cryptocurrency mining, miners and investors face a variety of challenges and risks, but there are also opportunities:

Electricity costs: For mining, electricity costs are one of the largest operating costs. Low electricity price areas will bring obvious cost advantages to mining farms.

Regulatory risks: Cryptocurrency mining is subject to strict regulation by national policies, especially issues involving power consumption and environmental impact, which may result in the need for mining farms to relocate or close.

Technological progress: Mining machine technology continues to advance, and new generations of mining machines will quickly make old equipment obsolete. Investors need to constantly update their equipment to remain competitive.

Market volatility: The volatility of cryptocurrency prices directly affects mining returns, and high volatility increases investment risks.

The shift to clean energy: With the growing concern about environmental issues, mining farms using renewable energy will become a trend.

Technological innovation: ASIC and GPU technologies will continue to advance, and more efficient and energy-saving mining equipment may appear in the future.

Changes in consensus mechanisms: With the popularization of consensus mechanisms such as POS, traditional POW mining methods may gradually decrease, which will have a profound impact on the mining machine market.

Diversification of services: In addition to hardware sales, mining machine companies may provide more one-stop services including hosting and cloud mining.

Early investment returns

Volcano X Capital has always had a strong interest in the mining industry and invested in this field in the early stage. With its keen market insight and professional industry analysis, it has achieved good investment income and returns. These successful cases prove that Volcano X has a forward-looking investment perspective and effective risk management strategy in the field of mining investment.

Mining Machine Market Analysis and Forward-looking Description

As the cryptocurrency market matures, especially as mainstream digital currencies such as Bitcoin are increasingly recognized by global investors, the mining machine market has also shown significant growth. Volcano X has conducted in-depth analysis and research on the mining machine market, focusing on the development trend from the technological advancement of ASIC mining machines to cloud mining services. From the continuous improvement of mining machine hardware performance to the optimization of mining efficiency, to the improvement of the mining ecosystem, all these factors have jointly promoted the advancement of the mining industry.

In the future, with the further application and expansion of blockchain technology and the improvement of the encrypted digital currency system, mining machines and related mining products will continue to benefit from the growth of the entire industry. In addition, as more countries and regions legalize digital currencies and establish regulatory frameworks, the market is expected to usher in a wider range of participants and larger-scale investments.

Future Development Prospects of Mining Products

During the current bull market, the significant rise in Bitcoin prices has brought a new round of enthusiasm to the mining industry. High Bitcoin prices mean that mining activities can bring higher economic returns, thereby attracting more investors and miners to enter the market, increasing the demand for mining machines and related mining services.

Volcano X Fund believes that although the mining market will face multiple challenges such as electricity costs, environmental impacts and policy supervision, the mining industry will continue to maintain a sustained growth momentum through technological innovation and adjustments to market mechanisms. In particular, technological progress in energy conservation and emission reduction and improving energy efficiency will be a key factor in supporting the development of future mining products.

In summary, Volcano X Fund is optimistic about the important role of mining products and services in the future development trend of digital currencies, and will continue to use its in-depth knowledge and resources in the industry to explore new investment opportunities to achieve long-term capital appreciation. At the same time, the fund will also pay close attention to industry dynamics and policy changes, and flexibly adjust strategies to maximize market opportunities and manage investment risks.

Through statistics and analysis of security incidents in the Web3.0 field over the past year, the latest trends in Web3.0 security are fully revealed.

JinseFinance

JinseFinanceShiba Inu and D3 collaborate to integrate .Shib addresses with DNS, enhancing crypto usability.

Brian

Brian Coinlive

Coinlive One of the circulating news was that DCG owed over US$1.1 billion to its subsidiary Genesis.

Tristan

TristanThe question of whether Genesis Trading and Digital Currency Group (DCG) will go bust currently hangs over the crypto and Bitcoin market.

Bitcoinist

BitcoinistFTX.US is no longer part of the Crypto Council for Innovation, an industry lobby group.

Others

Others Cointelegraph

Cointelegraph“We're really designing a whole world,” Two Bulls founder James Kane said about the role his business will play in the yet to launch metaverse.

Cointelegraph

Cointelegraph Bitcoinist

BitcoinistThe planned merger has been canceled, but the two companies still have a good working relationship, aiming for carbon-neutrality in their mining operations.

Cointelegraph

Cointelegraph