Author: Wall Street Journal; Compiled by: BitpushNews Mary Liu

Earlier In 2017, BlackRock CEO Larry Fink called Bitcoin a "money laundering index." He has also repeatedly criticized cryptocurrencies, calling them "something customers and people don't want to invest in." .

Now, he says he is a true believer in Bitcoin. His firm, BlackRock, manages the fastest-growing Bitcoin fund and has partnerships with top players in the digital asset industry.

Larry Fink's U-turn at BlackRock lends legitimacy to Bitcoin and signals Wall Street's growing eagerness to capitalize on a technology long considered wild Market in the west.

Through low-cost and popular spot ETFs, BlackRock opens the door for mainstream investors to buy and sell Bitcoin as easily as investing in stocks.

Rob Goldstein, chief operating officer of BlackRock, said in an interview: "We believe that a core part of our mission is to provide choice and opportunity, which is beneficial to our clients. is an important topic."

Bitcoin's elasticity is also part of this decision played a role. The token has experienced ups and downs since its launch, however, after each crash, another boom cycle begins, attracting more investors.

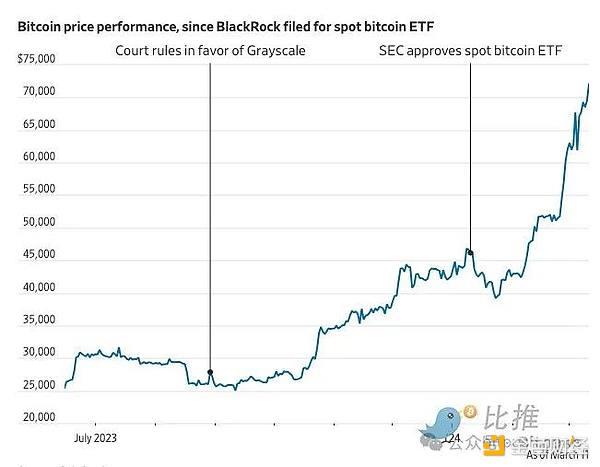

Today, Bitcoin prices are back to all-time highs, approaching $73,000 at one point, something that seemed impossible 16 months ago when cryptocurrency trading As a result, FTX suddenly collapsed and Bitcoin hovered near $16,000.

Industry critics say they are surprised by BlackRock's embrace of cryptocurrencies as the firm offers clients exposure to the volatile asset Exposed to reputational risks.

John Reed Stark, the former head of the Internet Enforcement Office of the U.S. Securities and Exchange Commission (SEC), said that companies such as BlackRock are obviously attracted by the "fee game."

He said: "The irony is that it is supposed to be decentralized, but what is more decentralized than Wall Street giants is that it is from every possible Charge fees and sell things that no one understands."

BlackRock is currently on The average fee charged on its Bitcoin ETF assets is about 0.19%. The fund has already hit the fee-waiving threshold, which would see investors pay 0.12% in fees on the first $5 billion in assets or the fund's first year, after which fees will rise to 0.25%.

BlackRock insists it has conducted years of research into the crypto industry to develop a digital asset strategy and give clients what they want.

Bitcoin’s rebound after the cryptocurrency crash in 2022 has strengthened BlackRock’s belief in sticking with the strategy, according to people familiar with the matter.

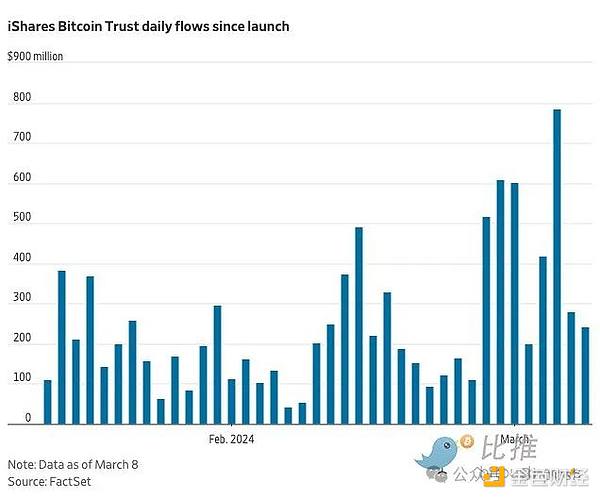

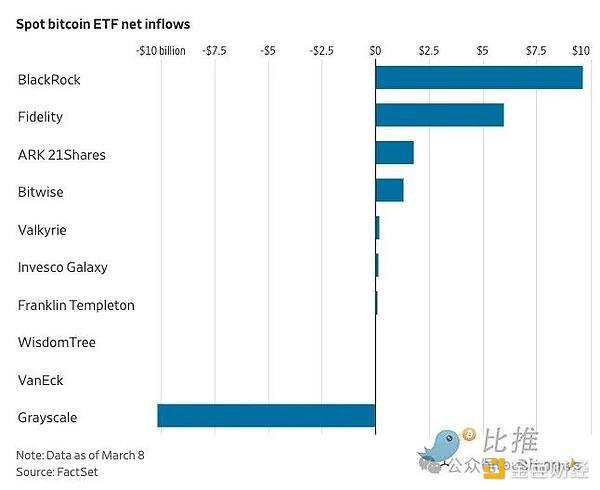

BlackRock is one of the important drivers of Bitcoin's latest round of rise. Among the nine spot Bitcoin ETFs launched in January, its iShares Bitcoin Trust leads the way in net inflows. In fact, the ETF was the fastest ever to attract more than $10 billion in assets.

Many mainstream investors began buying Bitcoin in June, when BlackRock joined the race for a spot Bitcoin ETF as the asset manager ETF applications have a near-perfect approval record, and court rulings forcing the SEC to reconsider rival applications have strengthened confidence in approvals.

Dennis Kelleher, president and CEO of Better Markets, an organization that advocates for regulation of the financial sector, said it is not surprising that BlackRock has quickly become the Bitcoin market leader.

"BlackRock has unparalleled market penetration, unparalleled distribution network and powerful marketing power, all of which create falsehoods for ordinary investors. of comfort."

BlackRock has a very different view on cryptocurrencies than its biggest rival, Vanguard. Vanguard, founded by legendary investor Jack Bogle, said it has no plans to launch a spot Bitcoin ETF and will not offer crypto-related products on its brokerage platform. The asset management firm, which oversees $8.7 trillion in assets, called Bitcoin "more of a speculation than an investment" in a recent blog post.

In addition to Bitcoin ETFs, BlackRock has also partnered with some of the largest cryptocurrency players A partnership was established. It holds a minority stake in stablecoin company Circle Internet Financial and manages more than $25 billion in reserves in government money market funds that back Circle’s USD Coin.

BlackRock has also partnered with cryptocurrency exchange Coinbase Global to provide users of asset management firm Aladdin's software platform direct access to crypto through an integration with Coinbase's institutional arm. currency opportunities, BlackRock also manages private Bitcoin trusts for professional clients. The trust has more than $250 million in assets, and most clients have since moved money into new ETFs, according to people familiar with the matter.

BlackRock's acceptance of Bitcoin has been gradual. During the epidemic, Rick Rieder, the company’s chief investment officer for global fixed income, began allocating Bitcoin futures in his funds. Robbie Mitchnick, BlackRock’s head of digital assets, also helped convert Fink into a Bitcoin believer, according to people familiar with the matter.

2022 is the year when Fink’s stance on digital assets begins to change significantly.

In a conference call in April of that year, he said his company was studying the cryptocurrency space extensively and was seeing growing customer interest.

In the same month, BlackRock participated in Circle’s $400 million financing, and by the summer, BlackRock quietly launched private trusts—its first for U.S. institutions Spot Bitcoin products for customers. The company seeded the fund with its own capital and worked with outside investors to scale it.

In the same year, BlackRock also formed a partnership with Coinbase to allow institutional clients who own Bitcoin on cryptocurrency exchanges to use its software tool suite Aladdin to Manage its investment portfolio and perform risk analysis. Coinbase is also the custodian of its spot Bitcoin ETF.

Now, BlackRock’s cryptocurrency ambitions are no longer limited to Bitcoin, as the asset manager is filing a pending application with the SEC to launch ETFs holding Ethereum, the second-largest cryptocurrency by market capitalization and the native token on the Ethereum blockchain, face a May deadline for regulators to decide on a number of such applications.

Cheng Yuan

Cheng Yuan

Cheng Yuan

Cheng Yuan Bitcoinist

Bitcoinist CryptoSlate

CryptoSlate cryptopotato

cryptopotato decrypt

decrypt Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph