Author: 0xSpread Source: X, @0xSpreadNews

FTX, once the world's third largest crypto exchange, announced that it will launch a customer compensation plan in early 2025. The black swan event of FTX in the past still affects the crypto industry. The funding crisis and market risks it exposed have profoundly changed the industry landscape. Today, we will review the beginning and end of the FTX collapse and analyze how it faces the challenge of revival.

1. The rise of FTX

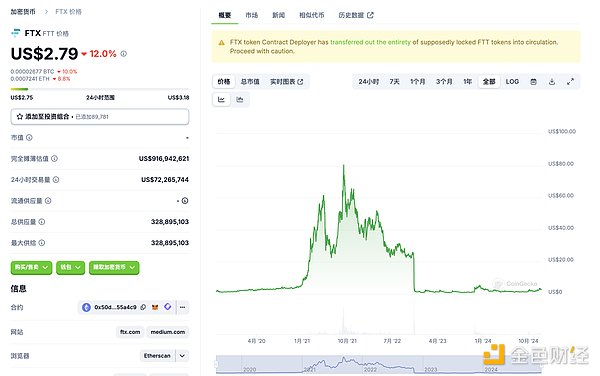

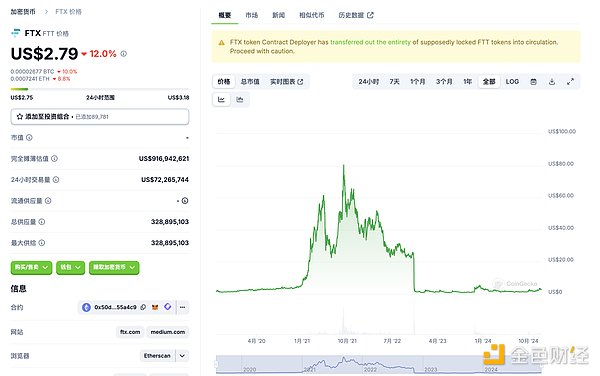

Founded in 2017 by Sam Bankman-Fried (SBF), FTX quickly became an important player in the crypto industry. With its innovative trading platform and low transaction fee strategy, FTX attracted a large number of retail and institutional investors. The platform's native token $FTT, as well as its cooperation with other crypto projects, has enabled FTX to steadily rise in the industry. In 2021, FTX successfully ranked among the top three crypto exchanges in the world with strong capital and technical support, and its market value continued to grow.

Second, the precursor of the collapse and the market reaction

Behind the glory of FTX lies a profound financial risk. Its parent company, Alameda Research, over-relies on the FTT token of the FTX platform, and FTT has poor liquidity and high volatility, making the platform's balance sheet extremely fragile.

In early November 2022, the media exposed Alameda's financial loopholes, and FTX's funding problems began to surface.

On November 5, 2022, Binance CEO Zhao Changpeng announced the liquidation of FTT tokens. This news caused panic in the market, and FTX's liquidity problems were exposed. Users withdrew their funds, and FTX's capital chain quickly broke.

On November 8, 2022, FTX declared bankruptcy and SBF resigned as CEO. The price of FTT tokens plummeted 96%, from $26 to $0.98, and major cryptocurrencies such as Bitcoin also suffered heavy losses. The crypto market instantly fell into panic.

3. Regulatory pressure and industry shock

The bankruptcy of FTX not only hit the wealth of millions of investors, but also attracted great attention from regulators around the world. Governments around the world have begun to strengthen supervision of cryptocurrency exchanges, requiring stronger compliance and transparency to avoid a recurrence of similar incidents. Many institutions that have worked with FTX have also been severely affected, such as well-known investors such as Temasek and Sequoia Capital, and the Solana ecosystem has not been spared.

Fourth, the launch of the 2025 compensation plan

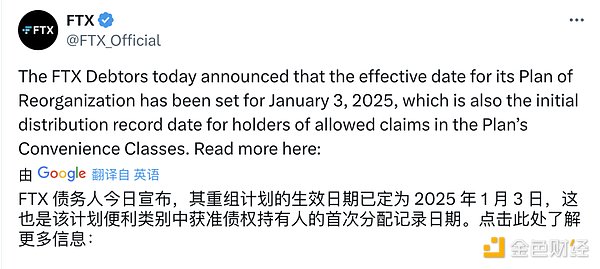

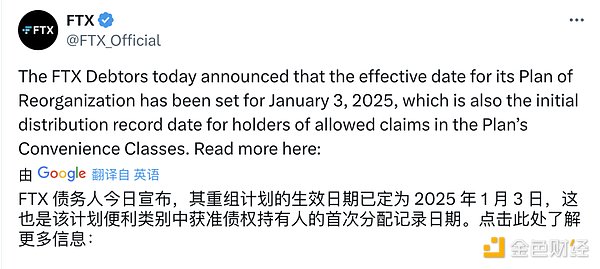

During the restructuring process, FTX announced that it will start implementing the compensation plan on January 3, 2025. The plan aims to repay customer funds that were damaged in the bankruptcy proceedings. Although FTX's total liabilities are as high as $8 billion, the process of recovering funds has made significant progress.

FTX has reached an agreement with institutions such as BitGo and Kraken to jointly assist in the distribution of compensation funds. BitGo will provide custody services for retail and institutional customers, while Kraken will support compensation for exchange customers. Users need to log in to the FTX debtor customer portal before January 3, 2025 and complete the necessary verification procedures to ensure that they can participate in the first compensation.

Learn more: FTX official information

V. FTX's revival challenge

Although FTX has launched a compensation plan and actively recovered funds, its brand reconstruction faces major challenges. Bankruptcy and a crisis of trust have greatly reduced FTX's reputation. Although the compensation plan has brought a glimmer of hope to customers, it remains unknown whether FTX can restore its former market position. Other exchanges in the industry are also closely watching FTX's revival process, especially how to restore user trust while complying with compliance requirements. The story of FTX will become a case study of rebuilding trust and risk management in the crypto industry.

VI. The Future and Lessons of the Crypto Industry

The collapse of FTX is not only the collapse of a single exchange, but also a profound reflection of the entire crypto industry. It exposes key issues such as decentralization, transparency and regulatory compliance. The crypto industry must find a balance between innovation and regulation to avoid repeating the same mistakes in the future. Although the bankruptcy of FTX has cost the market a heavy price, it has also prompted the industry to pay more attention to risk control and compliance. The future crypto market may gradually restore rationality under a stricter regulatory framework.

VII. Conclusion

The rise and collapse of FTX has become a warning for the crypto industry. With the start of the compensation plan in 2025, the story of FTX may usher in a new chapter. Although the future is full of uncertainty, this incident has profoundly affected the regulatory policies and market development of the crypto industry. In any case, the ups and downs of FTX will be an indispensable part of the history of the crypto industry, providing valuable experience for subsequent market development and risk management.

Hui Xin

Hui Xin