Author: Christine Kim Source: Galaxy Translation: Shan Ouba, Golden Finance

Summary

This report provides a comprehensive overview of staking, how staking works on Ethereum, and important considerations for stakeholders when engaging in this activity. This is the first in a three-part report series that will dive into the risks and rewards of various staking activities, including re-staking and liquidity re-staking. The second report in the series will provide an overview of re-staking, how staking works on Ethereum and Cosmos, and important risks associated with re-staking.

Introduction

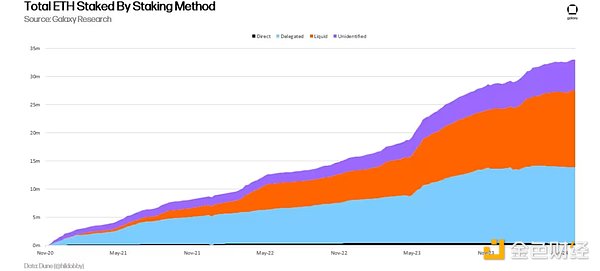

Ethereum is the largest Proof-of-Stake (PoS) blockchain by total staked value. As of July 15, 2024, ETH holders have staked over $111 billion worth of Ether (ETH), or 28% of the total ETH supply. The amount of ETH staked is also referred to as Ethereum’s “security budget” because these assets can be penalized by the network in the event of double-spending attacks and other violations of protocol rules. As a contribution to Ethereum’s security, users who stake ETH are rewarded through protocol issuance, priority tips, and maximum extractable value (MEV). Users can easily stake ETH through liquid staking pools without sacrificing the liquidity of the asset, which has led to a higher demand for staking than Ethereum protocol developers expected. Based on current staking dynamics, developers expect the total ETH supply staked (also known as the staking rate) to only grow higher in the coming years. To mitigate this trend, developers are considering significant changes to the protocol’s issuance policy.

This report will provide an overview of staking on Ethereum, including the types of users who stake on Ethereum, the risks and rewards of staking, and projections for the staking rate.

This report will provide an overview of staking on Ethereum, including the types of users who stake on Ethereum, the risks and rewards of staking, and projections for the staking rate. The report will also provide insights into developers’ proposals to change network issuance in order to curb staking demand.

Types of Stakeholders

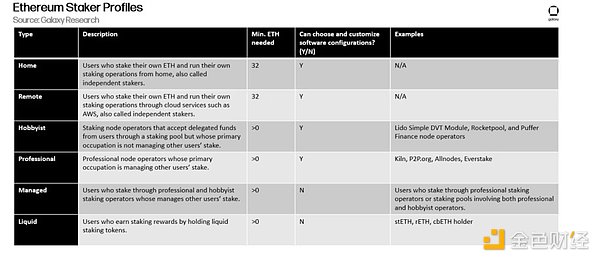

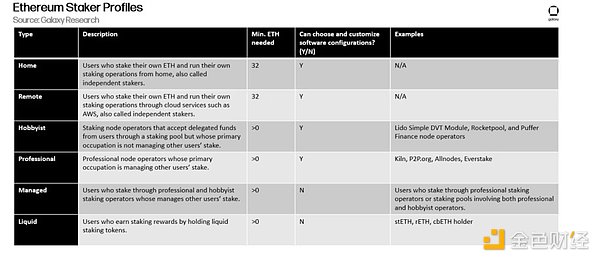

There are six main types of Ethereum users who can earn rewards through staking. The table below details their respective profiles:

Of these main types of stakers, the largest number are custodial stakers, i.e., those who delegate their ETH to professional staking node operators. While not as large as their customer base, professional staking node operators are the type of staking entity that manages the largest amount of staked ETH.

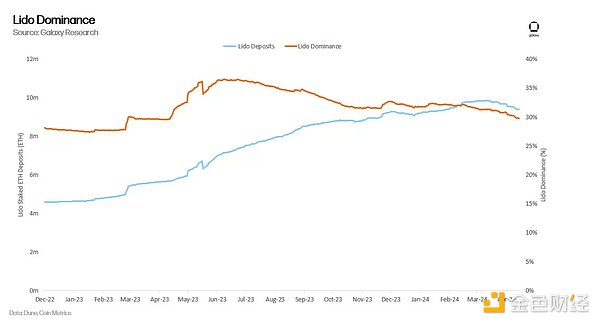

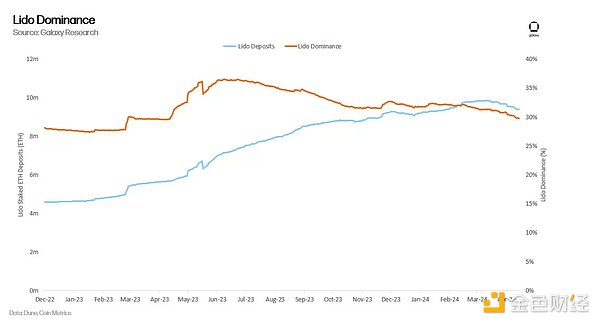

Liquidity staking, re-staking, and liquidity re-staking pool protocols are not included in this analysis, as these entities do not directly run the staking infrastructure or fund its use. However, these entities do receive a percentage of the returns from professional (or amateur) stakers who use their platform to provide services to custodial stakers; they are middleman entities that facilitate the relationship between custodial stakers and professional (or amateur) stakers, and are therefore important players in the Ethereum staking industry. Lido is a liquidity staking protocol and is by far the largest staking pool operator on Ethereum, through which ~29% of total staked ETH is delegated to professional and amateur stakers. Given the adoption and critical role of liquidity staking pools on Ethereum, it is important to understand the risks of liquidity staking.

The next section of this report will delve deeper into the risks of staking based on the technology and entity used to obtain staking rewards.

Staking Risks

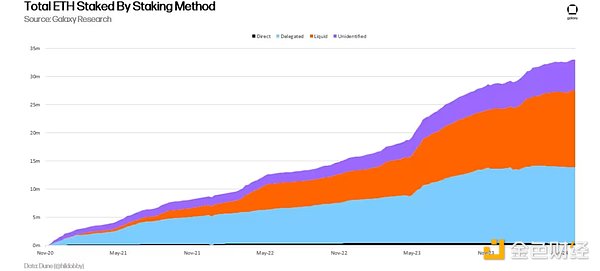

The risks associated with staking depend largely on the method and technology used to stake. Here are the three major categories that define staking methods and their associated risks:

Direct Staking: Staking is when a user or entity operates their proprietary staking hardware and software. The risks of directly staking ETH include staking penalties and slashing risk. Staking penalties due to reasons such as prolonged machine downtime may cause users to lose part of their staking rewards. Slashing events due to reasons such as misconfigured validator software may cause users to lose part of their staked ETH balance, up to 1 ETH.

Delegated Staking: Staking is when a user or entity delegates their ETH to a professional or amateur staker for staking. The risks of delegating ETH to another entity to stake on your behalf include all the risks of direct staking, in addition to counterparty risk, as the entity you delegate staking to may not fulfill its responsibilities or obligations as a staking service. ETH holders can delegate their staking to a trust-minimized staking-as-a-service entity, such as one that is primarily controlled through smart contract code, but this carries additional technical risks as the code can be hacked or contain bugs.

Liquidity Staking: Staking is when a user or entity delegates a professional or amateur staker to stake in exchange for a liquidity token that represents their staked ETH. The risks of liquidity staking include all the risks of direct staking and delegated staking, but in addition, due to market volatility and long delays in validator entry or exit, liquidity risk may lead to decoupling events, where the value of the liquidity staked token deviates significantly from the value of the underlying staked asset.

For these three types of staking activities, another risk that needs to be emphasized is regulatory risk. The further away ETH holders are from their staked assets, the greater the regulatory risk of staking activities. Delegated staking and liquid staking require ETH holders to rely on different types of intermediary entities. In the eyes of legislators and regulators, these entities may need to comply with certain rules and regulatory frameworks in order to operate, depending on their structure and business model, such as AML/KYC measures and securities laws.

In addition to regulatory risks, it is worth detailing the exact protocol risks associated with these three types of staking activities. Protocol risks arise from the fact that the network can automatically impose penalties on user stakes that intentionally or unintentionally fail to meet the standards and rules detailed in the Ethereum consensus protocol. There are three main types of penalties. In order of severity, they are:

Offline penalties: Penalties incurred when a node is offline and fails to perform its duties (such as proposing blocks or signing block attestations). Generally speaking, validators are only penalized a few dollars per day.

Initial Slashing Penalty: Penalty for any validator behavior detected by other validators as a violation of the network rules. The most common examples are if a validator proposes two blocks for a slot or signs two attestations for the same block. The penalty ranges from 0.5 ETH to 1 ETH, depending on the validator's effective balance, which currently goes up to 32 ETH. Protocol developers are currently considering increasing the maximum effective balance of validators to 2048 ETH and reducing the initial slashing penalty in the next network-wide upgrade, Pectra.

Related Slashing Penalty: After the initial slashing penalty, validators may receive a second penalty based on the total amount of stake slashed in the 18 days before and after the slashing event. The motivation for the correlated slashing penalty is to measure the penalty based on the amount of stake managed by the validator that is determined to have violated the network rules. The correlated penalty is calculated based on the sum of the malicious validator's effective balance, total balance, and the proportional slashing multiplier of 3.

In addition to the three penalties described above, special penalties can be imposed on validators if the network cannot reach finality. For a detailed overview of Ethereum finality, see this Galaxy Research report. When the network cannot reach finality, it imposes increasingly larger penalties on offline validators. By gradually destroying the stake of validators who are not contributing to network consensus, the network can rebalance the validator set to achieve finality. The longer the network cannot reach finality, the greater the severity of the penalty.

Staking Rewards

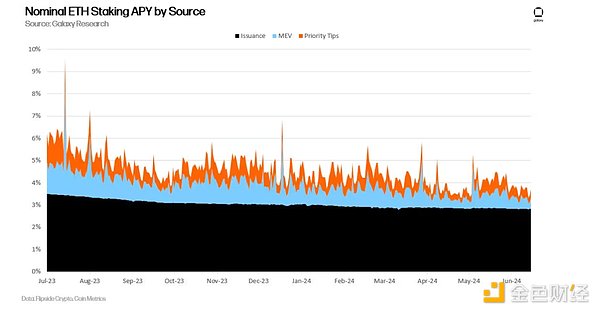

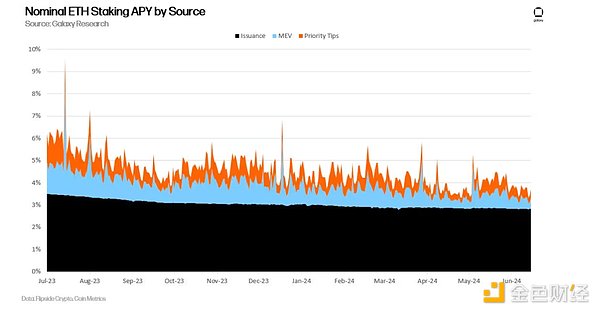

In exchange for the above risks, stakers can earn an annualized return of approximately 4% on their staked ETH deposits. Rewards come from new ETH issuance, priority tips attached by Ethereum end users to their transactions, and MEV (extra value from the reordering of user transactions within a block).

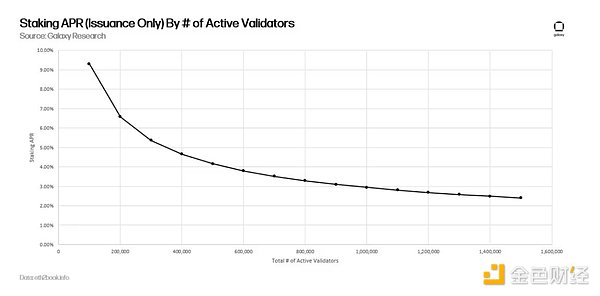

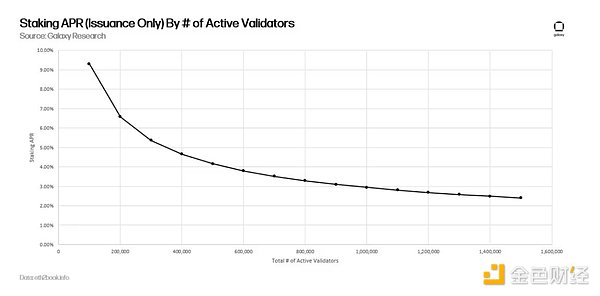

Note that staker rewards have been steadily decreasing over the past 2 years. This is mainly due to two reasons. First, the total amount of staked ETH, as well as the number of validators, has increased over the same period. As the value of stake increases, validators’ issuance rewards are diluted across more participants, as shown in the following figure:

While issuance rewards can be calculated based on the total number of active validators and the staked ETH supply on Ethereum, two other sources of income for validators are less predictable because they rely on network transaction activity.

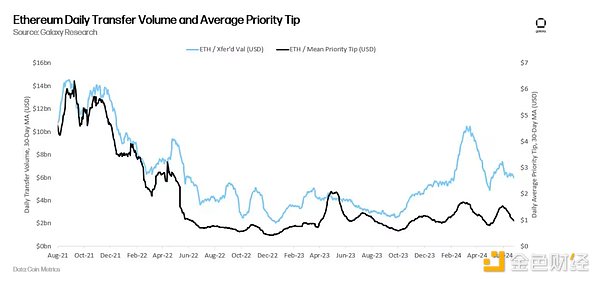

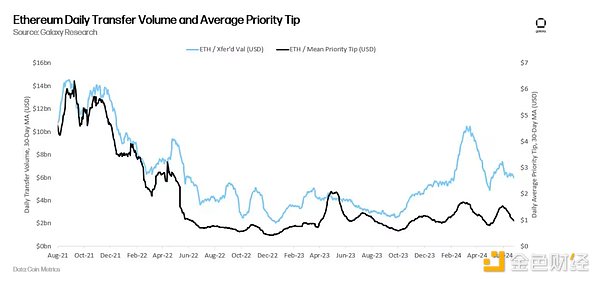

Transaction activity has decreased over the past two years, resulting in a decrease in validators’ base fees, priority tips, and MEV. In general, the higher the value of assets transferred on-chain, the higher the tip that users are willing to pay in order to prioritize these transactions in the next block, and the higher the MEV that searchers profit from reordering within blocks. As shown in the figure below, the dollar value of daily transfers is correlated with the average transaction priority fee:

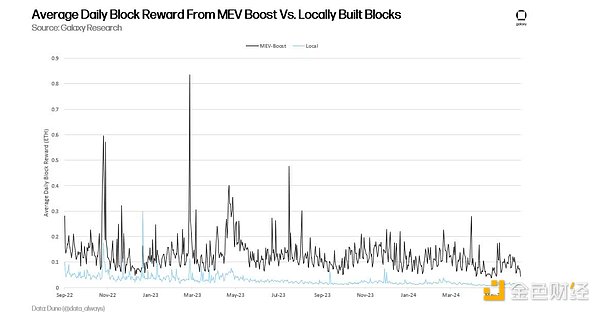

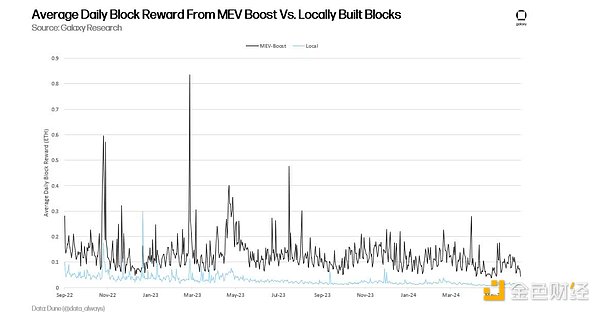

According to Galaxy's calculations, MEV can increase validator rewards by about 1.2% when rewards are calculated as an annual percentage yield. Compared to other types of validator income (including issuance and priority tips), the proportion of validator rewards from MEV is about 20%. Some attribute MEV to additional value awarded to block proposers that does not come from priority tips or issuance, which is the approach represented by the chart earlier in this report. However, others have suggested that high-priority tip transactions themselves can represent MEV profits if the high-priority tips are funded through successful front-running or reverse transactions. To account for the fact that priority tips themselves may contain MEV, other approaches compare the value of blocks built with and without MEV-Boost software.

These approaches (as shown in the chart above) suggest that the size of MEV can be much larger than 20% of validator rewards. According to an October 2023 analysis by Ethereum Foundation researcher Toni Wahrstätter, the median block reward would increase by 400% if validators received blocks via MEV-Boost instead of building them locally.

For more information on the impact of MEV on validator economics, read Galaxy Research’s report on MEV-Boost.

Staking Rate Forecast

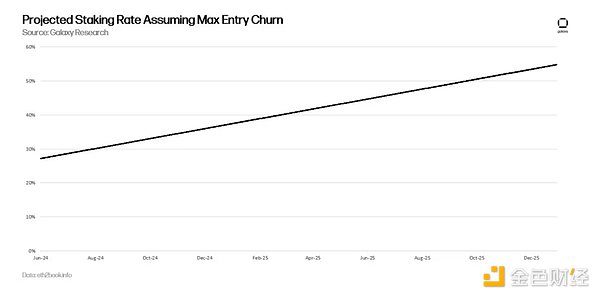

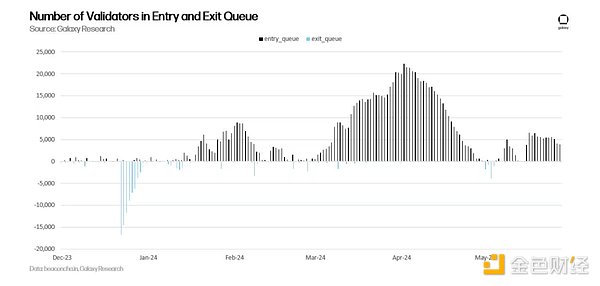

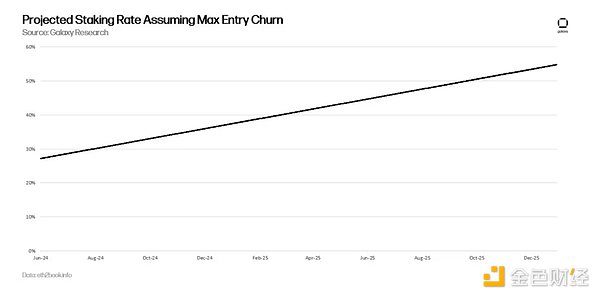

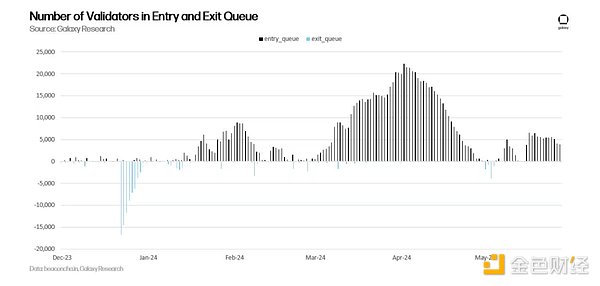

Assuming that staking demand on Ethereum grows linearly as it has over the past two years, the staking rate is expected to exceed 30% in 2024. As discussed earlier in this report, higher staking rates will reduce issuance returns. Liquid staking services on Ethereum allow users to easily stake and bypass normal restrictions on staking such as entry queues. Users can earn staking rewards simply by purchasing stETH. Large purchases of stETH will cause an imbalance between the value of stETH on the open market and the value of the underlying staked assets, which will cause a premium in the value of stETH until more ETH is staked on Ethereum. Unlike the purchase of stETH, staking activity on Ethereum is delayed. Only 8 new validators or a maximum of 256 ETH in effective balance can be added to Ethereum per epoch (i.e. 6.4 minutes). Therefore, assuming that the number of validator entries in each period from now to the end of 2025 reaches the maximum, it will take Ethereum more than a year (466 days to be exact) to reach 50% of the total ETH supply.

Historically, demand to enter the Ethereum staking queue has been higher than demand to exit. Although validator entry activity has declined in recent days, staking demand is expected to surge again for a variety of reasons, including but not limited to additional yield through re-staking, increased MEV from the resurgence of DeFi activity, and regulatory changes to support staking activities in traditional financial products such as exchange-traded funds.

Developers know that it is only a matter of time before the staking rate goes higher again and stakers' returns fall, so they are considering several options for changing the network's issuance to curb staking demand.

Issuance Change Discussion

ETH holders should expect staking yields to change dramatically in the future. Protocol developers are weighing multiple options to ensure that Ethereum's staking rate tends toward a target threshold, such as 25% or 12.5%. Caspar Schwarz Schilling, a researcher at the Ethereum Foundation, explained that the main reasons for maintaining a low staking rate include:

Liquid Staking Token (LST) dominance: If the staking rate increases, then the amount of ETH concentrated in a staking pool (such as Lido) may increase, creating the risk of centralization of one entity or smart contract application and the risk of having an excessive impact on Ethereum security.

Credibility of slashing: Related to concerns about LST dominance, high issuance consolidation into a single entity or smart contract application may reduce the credibility of large-scale slashing events on Ethereum. For example, if a slashing event occurs that affects a majority of stakers, the protocol may face social pressure from ETH holders who want to organize unscheduled state changes to restore the penalized staked ETH balance. Ethereum protocol developers have only organized an unscheduled state change once in the network’s history, which was intended to recover user funds after a smart contract bug. That was after the infamous DAO hack in 2016. (Read more about the DAO hack in this Galaxy Research report.) While unlikely, an unscheduled state change in response to a large slashing event is not impossible. In fact, some Ethereum researchers believe that this outcome is more likely in the case of high issuance.

Securing a Trustless Base Currency: Also related to concerns about LST dominance, high issuance could lead to a lack of native ETH in circulation and a surge in native ETH tokens issued by third-party entities. Ethereum researchers say they favor promoting use cases for native ETH beyond pure staking so that end users don’t have to rely on using on-chain currencies issued by relatively less centralized and trusted applications, while ETH is issued by the Ethereum protocol.

Minimum Viable Issuance (MVI):Although the cost of staking is negligible compared to the cost of mining, the cost of staking cannot be ignored. Professional staking providers require the hardware and software required to run validators, and therefore have operational costs. To stake through these providers, users must pay fees to these providers. In addition, even if users obtain liquid staking tokens by staking native ETH, they will also incur additional risks and penalties for staking through a third party if the staking operation fails. Therefore, it is in the interest of the network to keep staking costs to a minimum, as the additional cost of supporting staking activities means higher issuance, leading to an inflated ETH supply.

Ethereum protocol developers and researchers are weighing various proposals to reduce Ethereum's staking rate. These proposals include, but are not limited to:

Short-term one-time cut:In February 2024, Ethereum Foundation researchers Ansgar Dietrichs and Caspar Schwarz-Schilling once again proposed a one-time cut in the staking yield. The idea was originally proposed by Ethereum Foundation researcher Anders Elowsson. In Dietrichs and Schilling's latest article, the researchers suggest a 30% cut in the staking yield. However, this number depends on Ethereum's staking rate, which is the total supply of ETH that is staked. Given the rising staking rate since February, the researchers believe that the proposed yield cut should theoretically be higher. The proposal does not guarantee an upper limit on staking requirements, but it only requires a simple code change to implement and would curb the economic incentive to stake by reducing issuance rewards in the short term. The proposal is intended to be a temporary measure to pave the way for long-term solutions such as targeted policies.

Long term, collateral ratio target: Implement a new issuance curve where the higher the collateral ratio exceeds a target ratio (e.g. 25% of the total ETH supply staked), the more expensive it becomes for validators to stake and receive rewards. This idea is based on research by Elowsson, Dietrichs, and Schwartz-Schilling. There are several mechanisms to achieve a target ratio, each differing in terms of the issuance schedule and severity of the issuance drop. For more details on the issuance curve under the collateral ratio target model, read this Ethereum research article.

None of the above proposals will be included in the next Ethereum hard fork, Pectra. However, there is a good chance that protocol developers will push for changes to issuance in subsequent upgrades. So far, discussions within the Ethereum community about issuance changes have been highly controversial and have not resulted in broad consensus. The main objections to issuance changes include concerns that reduced staking income will hurt profitability for large staking providers operating on Ethereum, as well as individual and home-based stakers. Users have also objected to the lack of sufficient research and data-driven analysis of proposals affecting issuance to date. It is unclear what the exact target staking ratio should be to achieve MVI, and whether achieving this through issuance changes will reduce concerns about the centralization of staking distribution, or exacerbate the problem by further discouraging individual stakers from participating. To address some concerns about the long-term profitability of individual stakers on Ethereum, Ethereum co-founder Vitalik Buterin shared preliminary research in March 2024 on adding new anti-correlated rewards and penalties to favor node operators who control fewer validators.

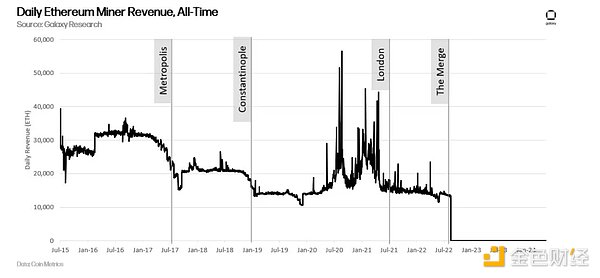

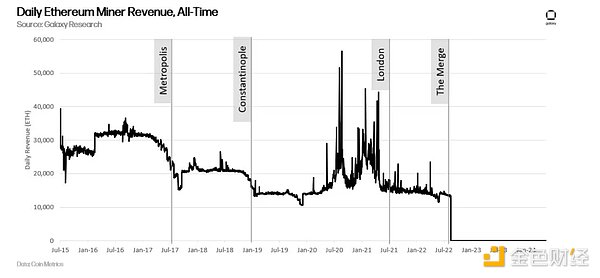

Ethereum’s proof-of-stake blockchain, the Beacon Chain, has not changed its monetary policy since its birth in December 2020. However, Ethereum’s monetary policy did undergo several revisions in its roughly seven-year history before merging with the Beacon Chain. Ethereum’s reward for mining a block was originally set at 5 ETH/block. It was reduced to 3 ETH in the Metropolis upgrade in September 2017. It was then dropped again to 2 ETH in the Constantinople upgrade in February 2019. Miners then saw their rewards from transaction fees burned in the London upgrade in August 2021, before mining rewards were abolished entirely on the network in the merge upgrade in September 2022.

Changes to Ethereum’s monetary policy under the proof-of-stake consensus protocol can be more controversial than previous changes to network issuance under proof-of-work, as the user base affected by the change is much broader. Unlike strictly miners, issuance changes affect a growing group of ETH holders, staking-as-a-service providers, liquidity staking token issuers, and re-staking token issuers. Due to the growing base of stakeholders involved in securing Ethereum, Ethereum protocol developers are unlikely to change Ethereum’s monetary policy as frequently as in the past. The contentious nature of this discussion could lead to increasingly rigid policies and rewards related to staking over time. Therefore, as the staking industry built on Ethereum grows and matures, the window of opportunity to change this aspect of the Ethereum codebase is shrinking and is unlikely to last for long.

Conclusion

The staking economy built on Ethereum is nascent and experimental. When the Beacon Chain first launched in 2020, users who staked ETH had no guarantee of being able to withdraw ETH or transfer funds back to Ethereum. When the Beacon Chain merges with Ethereum in 2022, users receive additional rewards for staking through tips and MEV. When the staked ETH withdrawal feature is enabled in 2023, users will finally be able to exit validators and profit from their staking operations. There are a host of other changes coming on the Ethereum development roadmap that will impact the business of staking and individual, at-home stakers operating on top of Ethereum. While most of these changes will not impact the economic incentives for staking, such as increasing the maximum effective balance for validators in Pectra, some will. As a result, it is important to carefully evaluate the risks and rewards of staking on Ethereum as its development roadmap continues to evolve and be implemented via hard forks. Because Ethereum’s staking economics encompass more stakeholders than Ethereum’s former mining industry, frequent changes that impact staking dynamics may be more difficult for Ethereum protocol developers to execute over time. However, Ethereum is still a relatively new proof-of-stake blockchain, and significant changes are expected in the coming months and years, which motivates the need to carefully consider changes to the staking dynamics for all stakeholders involved.

Sanya

Sanya