Author: Bradley Peak, CoinTelegraph; Compiler: Deng Tong, Golden Finance

1. What is Pyth?

Pyth Network is a decentralized oracle (essentially a service that connects blockchain to real-world data) that brings real-time financial indicators such as stock, cryptocurrency and commodity prices to the blockchain.

Pyth was originally launched on Solana in 2021 with the mission of providing high-quality data for blockchain applications, especially decentralized finance (DeFi), where accurate data feeds are critical for asset pricing and preventing mispriced transactions.

Unlike some oracles that extract data from multiple intermediaries, Pyth obtains data directly from top financial institutions, including exchanges and trading firms, which improves the speed and reliability of its data feeds.

2. How Pyth Network Transforms Real-Time Data

Pyth Network is updating the way blockchain systems access real-time market data by directly linking to high-quality sources such as trading firms, major financial institutions and exchanges.

Instead of relying on intermediaries, Pyth sources asset prices directly from first-party providers, including companies from traditional finance and cryptocurrency markets. This enables decentralized applications (DApps) to access accurate, low-latency pricing information, which is critical for tools such as lending platforms, trading protocols, and asset tokenization systems.

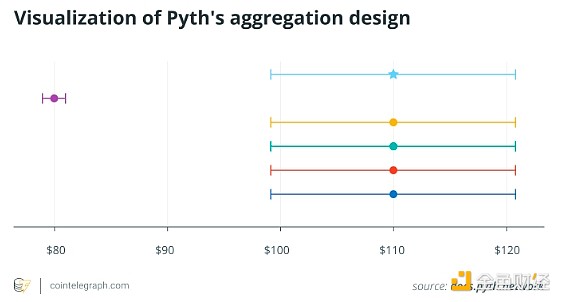

What makes Pyth stand out is its commitment to reliability and accuracy. Unlike many oracles, Pyth uses a unique data aggregation process that takes multiple data points from providers and creates a single, reliable price feed that is resistant to volatility or manipulation. This is critical in DeFi, as any delays or inaccuracies in price data can lead to problems such as liquidation errors in lending protocols or arbitrage opportunities that harm the market.

Did you know? Pyth Network publishes data sources on its own blockchain Pythnet, thereby enhancing transparency and security in the field of blockchain oracles.

Three, how does Pyth Network provide accurate encrypted data?

Pyth Network's accuracy is driven by a strong verification process and aggregation model that leverages its vast network of data publishers.

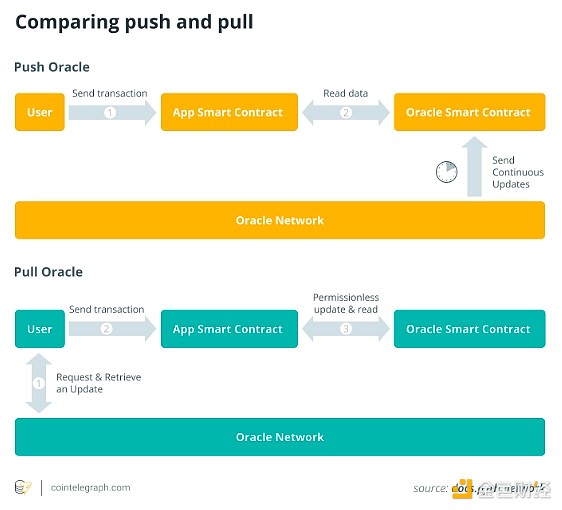

From trading platforms to financial entities, each data provider sends asset prices to Pyth along with confidence intervals - an indicator of the accuracy of the prices they provide. Pyth's protocol then aggregates these multiple data points to form a single price feed for each asset, updated every 400 milliseconds. By using its "pull oracle" design, Pyth updates data only when users request it, rather than continuously pushing data, minimizing blockchain congestion and reducing costs.

To maintain data integrity, Pyth employs a weighted aggregation approach that filters out any extreme outliers and gives more weight to more reliable sources. This approach significantly reduces the risk of tampering or data manipulation. The result is a secure and accurate system where asset prices are cross-validated across multiple independent sources, ensuring that DeFi applications can rely on them for accuracy and stability.

Did you know? The first blockchain oracle Reality Keys was developed to address the inherent limitations of smart contracts. Blockchains are self-contained and highly secure, but they cannot directly access external information such as market prices, weather conditions, or event outcomes—and this data is critical for many real-world applications.

Fourth, Pyth Network's main use cases

Pyth Network's real-time data feeds enhance DeFi applications, including DEX, lending platforms, stablecoins, derivatives, and yield optimization.

By providing accurate, decentralized pricing, Pyth enables responsive trading, efficient liquidations, stablecoin value pegs, risk-managed derivatives, and optimized yields, ensuring stability and transparency across the DeFi ecosystem. Let’s take a closer look at some of its applications:

Decentralized Exchanges (DEXs):Pyth’s real-time data powers decentralized exchanges, enabling accurate price updates for assets traded across multiple chains. With DEXs like Drift Protocol on Solana, Pyth’s low-latency data helps maintain efficient price discovery and risk management. For example, Drift leverages Pyth’s fast updates to enable features like perpetual futures and other derivatives, allowing traders to effectively respond to volatile market conditions while keeping their transactions transparent and secure.

Lending Platforms:For DeFi lending protocols, reliable asset pricing is critical for accurate loan-to-value (LTV) ratios and automated liquidations. By feeding real-time data into lending platforms, Pyth supports collateral valuation and liquidation events, protecting lenders' interests and maintaining platform stability. Protocols such as ReactorFusion on ZKsync use Pyth's pricing to efficiently process loan values, while Solend on Solana leverages Pyth to monitor collateral risk and trigger automatic liquidations, minimizing losses in volatile markets.

Stablecoins:Stablecoin platforms rely heavily on Pyth to peg their value to assets such as the US dollar, euro, or other currencies and commodities. By integrating with Pyth, stablecoins such as Tether's USDt can maintain their value through frequent, accurate price feeds, which is critical for stablecoin reserves and protecting users from decoupling risks. This stable connection to fiat or crypto collateral assets keeps DeFi transactions smooth and trustworthy, especially during market volatility.

Derivatives and Structured Products:In the derivatives market, Pyth enables platforms to create complex financial instruments such as perpetual swaps, options, and structured product vaults. For example, Kwenta and other Synthetix projects use Pyth’s feeds to provide exposure to digital assets and real-world markets, keeping positions well-hedged and reducing the risk of liquidation mismatches. Pyth’s high-frequency data also supports unique options such as leveraged positions, further advancing DeFi trading options with decentralized price integrity.

Yield Optimization and Other DeFi Applications:Yield farming and liquidity protocols use Pyth’s price feeds to optimize rewards and manage risks associated with staking or providing liquidity. High-yield investors benefit from real-time data tracking asset performance, helping them maximize returns. In addition, applications in the blockchain ecosystem such as Mantle’s Lendle integrate Pyth to support dynamic yield assets and liquidity pools, promoting innovation and user participation in DeFi.

Did you know? The largest project using Pyth Network is Synthetix on the Optimism blockchain, which relies heavily on Pyth's low-latency price feeds from Synthetix Perpetuals (Perps) v2. The integration enabled Synthetix to create 40 new perpetual markets, process nearly $15 billion in trading volume, and generate a large amount of staking fees for its users.

V. Timeline: History of Pyth Network

Over the years, Pyth Network has remained committed to its mission of decentralized financial data, continuously enhancing its infrastructure and supporting the development of DeFi with accurate, high-frequency market data feeds.

2021: Launch on Solana and first price feed

In April 2021, Pyth Network was announced, with initial development supported by Jump Crypto. Pyth launched in August on Solana’s high-performance blockchain, providing high-speed, low-latency price feeds for over 30 crypto assets.

By the end of the year, Pyth had sourced data from around 40 major financial providers, including exchanges and market makers, supporting its goal of providing reliable, real-time data to DeFi applications.

2022: Scaling with Pythnet and Cross-Chain Capabilities

Pyth Network expanded significantly in 2022 with the launch of Pythnet, its own Proof-of-Authority blockchain forked from Solana. Pythnet allows for faster data aggregation and more frequent updates.

In August of the same year, Pyth integrated with the Wormhole bridge to reach other blockchains, enabling it to support price feeds for Ethereum, BNB Smart Chain, and more. This year is the year of cross-chain expansion for Pyth, aiming to make its high-frequency data available to the broader DeFi ecosystem.

2023: Governance Launch and PYTH Token Airdrop

Pyth launched its PYTH governance token in November 2023. To encourage community participation, Pyth conducted an airdrop to distribute PYTH tokens to early users and active DeFi participants, granting holders voting rights on protocol changes and development.

The launch was an important step in the decentralization of Pyth governance, allowing the community to participate in decisions about fee structures, network updates, and ecosystem development.

2024: Multi-chain and Institutional Growth

Pyth continues its multi-chain growth, expanding partnerships and price feed integrations with various DeFi platforms such as Drift Protocol and ReactorFusion.

By mid-2024, Pyth reported a total value of more than $5 billion and occupied nearly 10% of the oracle space, highlighting its growing role as a trusted source of real-time data for DeFi across various blockchain networks.

Six, Pyth Network vs. Chainlink: What's the difference?

The choice between Pyth and Chainlink depends on project needs: Pyth is suitable for high-speed, financial-driven data centered on DeFi, while Chainlink is suitable for a wider range of use cases that require data diversity and strong ecosystem support.

Speaking of oracles, you may know Chainlink, which is the most widely used decentralized oracle today. Pyth supports more than 1,600 projects, so why do you still need Pyth?

First, there are significant differences between Pyth Network and Chainlink in data sources. Pyth obtains data directly from financial institutions, exchanges, and trading companies, ensuring high-quality first-party information from organizations such as Jane Street and Binance. Chainlink typically collects data through independent node operators, who typically source data from aggregators such as CoinMarketCap and BraveNewCoin.

This reliance on relayers means that Chainlink’s data sources are more diverse, but may not be as consistent as Pyth’s direct source data, especially for high-frequency financial data. There are a few other key differences; let’s take a closer look at each one.

Cost Efficiency and Data Update Model

Pyth is built around an efficient pull model that allows users to request data updates only when needed, significantly reducing transaction costs. As a result, Pyth’s updates are nearly instantaneous, taking only 300-400 milliseconds, tailor-made for latency-sensitive DeFi applications.

In contrast, Chainlink typically uses a push model, updating prices periodically based on specific conditions such as price volatility or time intervals, which can be costly and slow. For example, Chainlink updates data every few seconds or minutes based on preset conditions, making it a good fit for applications where speed is less important but reliability is paramount.

Target Audience and Use Cases

Pyth focuses on the DeFi sector and financial data applications, such as decentralized exchanges, lending, and derivatives platforms. Its data sources are optimized for real-time financial transactions, where accurate, high-frequency data is critical.

However, Chainlink supports a wider range of use cases, including non-financial sectors such as insurance, gaming, and supply chains, which require different external data types.

Transparency and Governance

Both oracles have governance mechanisms, but Pyth's approach is more in the spirit of Web3.

Pyth is governed by a decentralized autonomous organization (DAO), which directly incorporates community input into decision-making on protocol changes and updates, ensuring transparency.

Chainlink also integrates community participation, but concerns about centralization remain due to its multi-signature contract system, which gives a few people significant control over data sources.

Pyth's full on-chain transparency further enhances users' trust in the authenticity of their data, while Chainlink's data remains off-chain, requiring users to verify its source separately.

VII. The Future of Pyth

Pyth Network's roadmap emphasizes significant expansion of cross-chain compatibility, supporting more than 50 blockchains such as Near and Arbitrum to expand its influence in DeFi.

By enabling seamless, permissionless data feeds across chains, Pyth enhances the interoperability of DeFi applications.

Future plans include expanding coverage of assets beyond cryptocurrencies to include commodities, equities, and foreign exchange, making it a versatile oracle for digital and traditional finance.

Technical improvements are also underway to reduce latency by 20% and increase the number of data providers per feed, thereby enhancing data reliability for high-frequency trading and derivatives platforms.

Finally, Pyth’s community-driven DAO model will allow stakeholders to guide its strategic direction on issues such as fees and data integrity.

These initiatives position Pyth as a foundational oracle for secure, real-time data solutions across DeFi and Web3 as the industry matures.

Huang Bo

Huang Bo

Huang Bo

Huang Bo JinseFinance

JinseFinance Joy

Joy Brian

Brian Jasper

Jasper Coinlive

Coinlive  Tristan

Tristan Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph