DeFi data

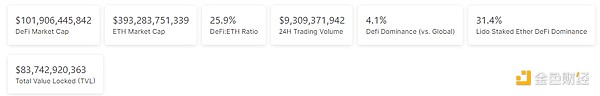

1. Total market value of DeFi tokens: US$101.906 billion

< /p>

< /p>

DeFi total market capitalization data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$9.309 billion

< img src="https://img.jinse.cn/7195539_watermarknone.png" title="7195539" alt="SGK8Bj62MJZYPwTYhwbpUzW34x4J25yTQh6EG5wC.jpeg">

< p style="text-align: center;">

Trading volume data of decentralized exchanges in the past 24 hours Source: coingecko3. Assets locked in DeFi: US$8.891 billion

Top 10 locked assets of DeFi projects and locked position data source: defillama

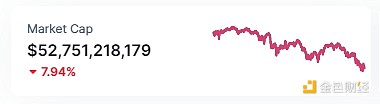

NFT data

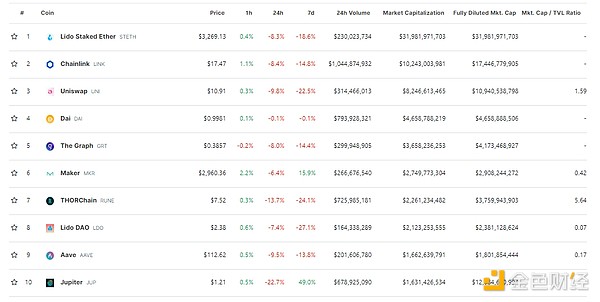

1. NFT total market value: US$52.751 billion

NFT total market value and top ten project data source: Coinmarketcap

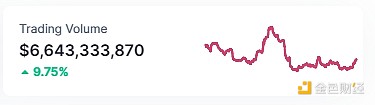

2.24-hour NFT transaction volume: 6.643 billionUSD< /strong>

NFT total market value, market value Data source for the top ten projects: Coinmarketcap

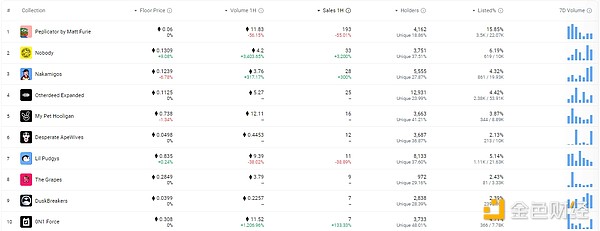

Top NFT within 3.24 hours

Top ten NFT sales within 24 hours Data source: NFTGO

Toutiao

< strong>SLERF’s 24-hour trading volume exceeded US$3 billion

CoinGecko data shows that SLERF’s 24-hour trading volume exceeded US$3 billion, surpassing DOGE’s US$2.363 billion, ranking among all Meme tokens First.

DeFi Hotspots

1.OrangeDX, a DeFi development company on the Bitcoin chain, completed US$1.5 million in financing, GBV Capital and others participated in the investment

OrangeDX, a DeFi development company on the Bitcoin chain, announced the completion of US$1.5 million in financing, GBV Capital, Odiyana Ventures, Triple Gem Capital, Nxgen, X21, Spicy Capital, Alphabit Fund , FundLand Capital and others participated in the investment. OrangeDX is positioned as a multi-faceted Bitcoin protocol platform, aiming to use the Bitcoin blockchain to expand transactions, bridging, lending and other services to further expand the BRC-20 ecosystem. It is also committed to through the Initial Liquidity Offering (ILO) mechanism Cultivate new projects.

2. Blast ecological DeFi project Juice completed US$7 million in financing, Arthur Hayes and others participated in the investment

Blast ecological DeFi project Juice completed US$7 million in financing. Arthur Hayes, DWF Ventures, Delphi Digital, etc. participated in the investment. Juice is built by the full chain and Bitcoin DeFi infrastructure OMEGA team based on Blast.

3.THORChain: Network nodes have been asked to delete all BNB Chain beacon chain liquidity pools

Decentralized cross-chain The chain trading agreement THORChain issued a document on the If the address starts with 0x (BSC), no action is required.

In addition, Ragnarok has successfully completed testing on Stagenet, but forcing the return of funds to users does not guarantee success. Users need to cash out before Ragnarok starts to ensure the successful return of funds.

4.BitMEX Research: ETH staking may bring challenges to Grayscale’s ETHE product conversion

BitMEX Research posted on social platforms that ETH staking This may create challenges for Grayscale's ETHE product transition.

If the SEC does not allow staking, then there is even more reason to redeem ETHE as soon as possible. If Grayscale reduces the fee from 2.5% to 1.5% and the staking yield is 4%, then Investors who do not redeem and hold stETH may lose 5.5%. Fund outflows may be faster than GBTC.

If the SEC allows staking, the policy may not be difficult for Fidelity and BlackRock. For example, they could adopt a policy of staking 70% of incoming Ethereum and holding 30% in spot Ethereum for liquidity. For ETHE, it won’t be so easy as they anticipate large, unknown outflows. This means that ETHE's yield will likely be lower, encouraging more outflows.

5.DEX Hercules has been launched on the Ethereum L2 network Metis

Golden Financial Report, Decentralized Exchange (DEX) Hercules has been launched on the Ethereum layer 2 network Metis. According to the team, “Hercules DEX provides customizable liquidity infrastructure and tools to help builders launch, guide third-party projects to have liquidity and cultivate cooperation partnership. They will introduce a range of features such as custom automated liquidity management, centralized liquidity pools, and dynamic fees."

Metaverse Hotspots

1.The Sandbox launches metaverse "Cobbleland: Austin" in Austin, Texas

According to official news, The Sandbox announced the launch of the metaverse "Cobbleland: Austin" in Austin, Texas, USA The metaverse "Cobbleland: Austin" includes well-known locations such as the State Capitol, Austin Central Library, Stevie Ray Vaughan Statue, South Congress Avenue, Paramount Theater and Sixth Street, as well as local small and medium-sized businesses, users It is possible to interact through avatars known as C-tizen.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Ftftx

Ftftx Ftftx

Ftftx Ftftx

Ftftx