DeFi data

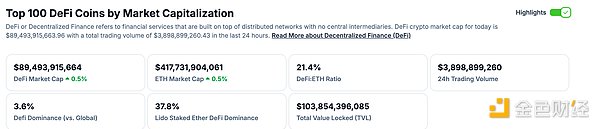

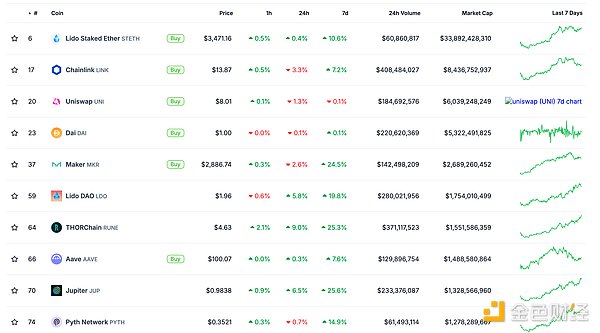

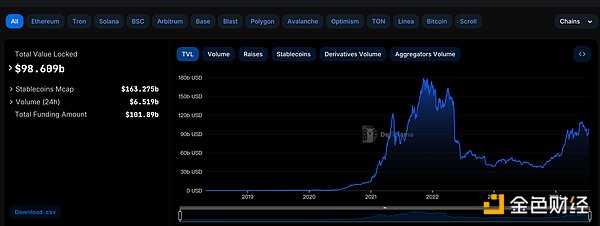

1. Total market value of DeFi tokens: US$89.493 billion

DeFi total market value data source: coingecko

< 2. The transaction volume of decentralized exchanges in the past 24 hours was 3.899 billion US dollars. img.jinse.cn/7262273_watermarknone.png" title="7262273" alt="YyJU3DLg6om58qEoen74qqezXylwl9sikOwbuWrB.png">

Trading volume of decentralized exchanges in the past 24 hours Source: coingecko< /p>

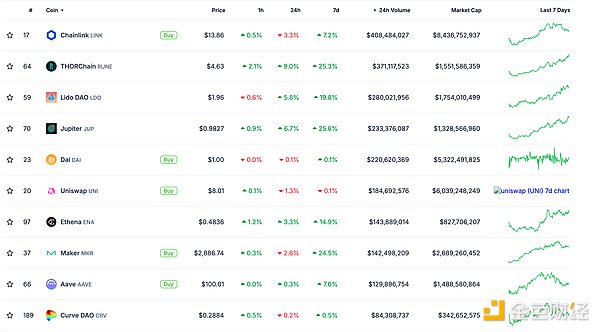

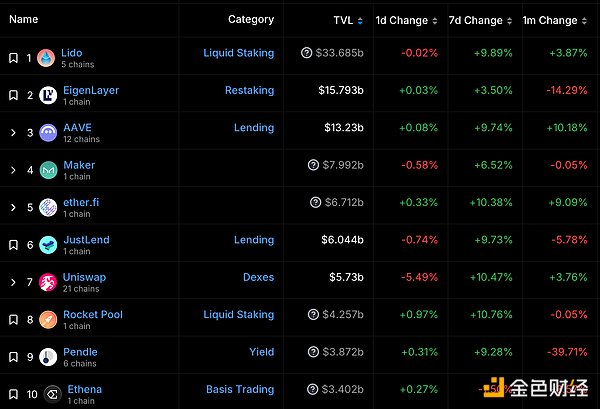

3. Assets locked in DeFi: 98.609 billion US dollars

< strong>

The top ten rankings of DeFi projects’ locked assets and locked-in amount data source: defillama

NFT data

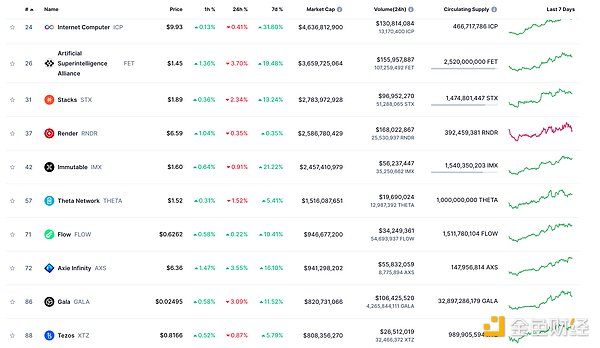

1. NFT total market value: 36.554 billion US dollars

NFT total market value, top ten projects by market value data source: Coinmarketcap

2.24-hour NFT trading volume: 2.638 billionUSD

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

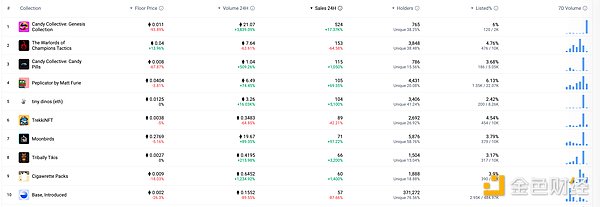

3. Top NFTs in 24 hours

< /p>

< /p>

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Currently, the fees of 9 US spot Ethereum ETFs have been announced

As U.S. issuers have successively submitted S-1/A and other documents of spot Ethereum ETFs to the U.S. SEC, the fees of 9 spot Ethereum ETFs have been announced. The specific data are as follows: BlackRock's spot Ethereum ETF has a fee of 0.25% (0.12% for the first $250 million), and its ticker is ETHA;

Fidelity's spot Ethereum ETF has a fee of 0.25% (no management fee in 2024), and its ticker is FETH;

Bitwise's spot Ethereum ETF has a fee of 0.25% (no management fee in 2024), and its ticker is FETH The fee for 21Shares spot Ethereum ETF is 0.21% (0% for the first $500 million or the first 6 months), and the code is GETH; The VanEck spot Ethereum ETF has a fee of 0.20% (0% for the first $150 million or the first 12 months), and the code is ETHV;

The Invesco Galaxy spot Ethereum ETF has a fee of 0.25%, and the code is QETH;

The Franklin spot Ethereum ETF has a fee of 0.19% (0% before January 21, 2025 or before $1 billion), code EZET; Grayscale's spot Ethereum ETF has a fee of 2.50% and its ticker is ETHE; Grayscale's spot Ethereum mini ETF has a fee of 0.25% (0.12% for the first $2 billion or the first 12 months) and its ticker is ETH.

Note: The method used for this data Focusing on speed rather than accuracy, the data is based on multiple sources, including ETF provider websites and third-party financial information providers. The data contains estimates and the data may contain errors.

NFT Hotspots

1. Animoca Brands Japan and BONSAI NFT CLUB signed a cooperation agreement Agreement

Golden Finance reported that according to official news, Animoca Brands Japan announced that it has signed a cooperation agreement with BONSAI NFT CLUB. Animoca Brands Japan will use Animoca Brands’ The network supports BONSAI NFT CLUB in the areas of marketing and token strategy, and Animoca Brands Japan signs a partnership agreement with BONSAI NFT CLUB to support the traditional Japanese bonsai art in Web3.

DeFi Hotspots

1. Web3 Foundation Research Scientist Jonas: It is recommended to reduce the annual inflation rate of Polkadot to 8%

Golden Finance reported that Jonas, a research scientist at the Web3 Foundation, suggested reducing the annual inflation rate of Polkadot to 8%, of which 15% would flow into the national treasury.

Specific parameters are: minimum inflation rate = 6.8%; maximum inflation rate = 8%; maximum Staking reward = 85%.

It is reported that the result of the above participation is that the annual yield can rise to about 11.62% (the staking rate is 58.5%), and about 1.155 million DOTs flow into the treasury every 24 days.

2. Chainlink launches digital asset sandbox

Golden Finance reported that Chainlink today announced the launch of the Chainlink Digital Asset Sandbox (DAS), which aims to accelerate digital asset innovation within financial institutions. With DAS, institutions can seamlessly Access ready-made digital asset business workflows.

Sandbox users also have access to support and consulting services from Chainlink Labs, a major contributing developer of Chainlink that helps enterprises and technology organizations.

3. DeFi Technologies treasury increased by 12,775 SOL and 1,484,148 CORE

Golden Finance reported that DeFi Technologies Inc. increased its BTC holdings by purchasing an additional 94.34 BTC, bringing the total holdings to 204.34 Added Solana (SOL) to the Treasury: The company has diversified its treasury by acquiring 12,775 SOL tokens; Added CORE (CORE) to Treasury and CORE DAO Staking: The company has purchased 1,484,148 CORE tokens , and plans to participate in CORE’s staking facility.

4.Starknet is about to release Cairo 2.7.0, Mainnet upgrade to be carried out on August 26

Golden Finance reported that according to the Starknet community, Cairo 2.7.0 will be released soon. 2.7.0-rc.3 is available and can be tested by the community. This version involves upgrading Sierra to v1.6.0, which means that contracts written in v2.7.0 can only be deployed in Starknet 0.13.2 (inclusive) and above.

Testnet The upgrade is scheduled for August 5, and the mainnet upgrade is scheduled for August 26.

5. Solana on-chain DEX transaction volume exceeded 1.8 billion US dollars yesterday, surpassing Ethereum to rank first

Golden Finance reported that DeFiLlama data showed that the transaction volume of Solana on-chain DEX on July 17 was US$1.813 billion, ranking first.

In addition, the transaction volume of Ethereum on-chain DEX yesterday was 1.747 billion US dollars, ranking second; Arbitrum on-chain DEX yesterday's trading volume was 847.65 million US dollars, ranking third.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to increase risk awareness.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Davin

Davin JinseFinance

JinseFinance Davin

Davin Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph