Author: @Web3Mario

Abstract:

This week, the market officially entered the cool-off period before the Jackson Hole meeting. Everyone is waiting for Powell to make an official interpretation of the latest employment and inflation data and give clear guidance on future monetary policy, which will undoubtedly become a key reference for the September interest rate decision. However, there was a very interesting piece of information last Friday that did not attract much attention in the crypto world. That is, Democratic presidential candidate Harris officially announced his first clear economic policy framework, the "Opportunity Economy" framework. Because I was sorting out the analysis article on Usual Money last Friday, I did not notice it. I carefully studied the relevant details over the weekend and found some interesting insights. I hope to share them with you. In general, Harris's "Opportunity Economy" framework is an extreme left economic plan, which specifically refers to reducing the cost of living of the American people from four aspects, including housing, medical care, food and daily necessities, and childcare, through the power of government policies. If this plan is implemented, it is likely to push the cryptocurrency market back to the 2021 trend, but it will be accompanied by the resurgence of inflation in the United States.

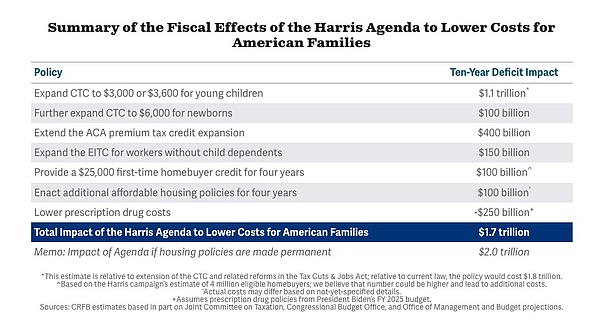

Harris' first economic policy document "Agenda for Reducing Costs for American Families" - a subsidy plan of 1.7 trillion

In recent times, with Harris's official nomination as a presidential candidate, her momentum has been significantly improved under the active publicity of major investors and major media. The poll data also surpassed Trump for a time, and it was expected to be the winner. Of course, friends who are familiar with the democratic election system may know that polls are highly subjective and unofficial activities. Organizers can cleverly obtain the results they want to see through the survey methods, questionnaire design, and selection of survey subjects. It is not surprising that the Democratic Party, which has mastered the mainstream media, can easily create such dazzling data. Therefore, it is still mainly a wait-and-see perspective to look at this matter, but this also reflects to a certain extent that after integrating internal forces, the Harris campaign team, whose propaganda machine has been fully launched, is still not to be underestimated. This is why Trump is eager to return to Twitter and actively interact with Musk. Therefore, we also need to actively observe and analyze Harris' possible policy route.

One of the core points that Harris has been questioned about is that she has not shown a clear preference for economic policies since she entered politics. This is mainly related to her work experience. Of course, considering the political issues she has dealt with in the past, including immigration and security issues, Harris has shown a left-wing populist attitude. The market has predicted to a certain extent that her economic policies may be left-leaning if she takes office. However, on August 16, Harris's election team officially released its first clear economic policy document, "Agenda for Reducing the Cost of American Families", which surprised many people and caused considerable controversy. Here is a brief explanation of why the proposal is called "opportunity economy" because Harris' team believes that by reducing the cost of American families, many middle-class people will get more employment and entrepreneurship opportunities, thereby stimulating overall economic vitality and regaining the American dream. The main reason for the controversy is that this is an extreme left economic policy, which reduces the cost of living of the American people in four aspects through government intervention, including housing, medical care, food and daily necessities, and childcare.

There are three specific directions in terms of housing:

1. Harris called for the construction of 3 million new homes to end the housing supply shortage in the next four years. The plan is stimulated in three specific directions, including tax incentives for the construction of entry-level homes and economical and practical rental housing; the establishment of a 40 billion federal innovation fund to incentivize innovative housing construction programs; reducing government review and approval processes and reducing related costs;

2. Reduce housing rents by cracking down on companies and major landlords, including preventing Wall Street investors from buying and selling houses in large quantities at a markup, canceling tax incentives for buying single-family rental houses; preventing large corporate companies from manipulating rental prices through private equity-backed pricing tools;

3. Provide a $25,000 down payment subsidy for first-time homebuyers. This policy has been significantly expanded from 400,000 subsidy quotas in the Biden administration to 4 million, and the review standards have been relaxed.

The medical sector mainly includes three directions:

1. Set the upper limit of insulin costs at $35 and the upper limit of prescription drug out-of-pocket costs at $2,000;

2. Speed up the negotiation of prescription drugs by medical insurance.

3. Enhance competition and require greater transparency in the healthcare industry, starting with cracking down on pharmaceutical companies that hinder competition and the abuse of pharmaceutical middlemen that squeeze the profits of small pharmacies and increase consumer costs.

The food and daily necessities sector mainly includes:

1. Promote the first federal ban on food and grocery price fraud;

2. Establish clear rules to make it clear that large companies cannot unfairly exploit consumers and make excessive profits from food and groceries.

3. Ensure that the Federal Trade Commission and state attorneys general have new powers to investigate companies that violate regulations and impose strict new penalties.

Childcare mainly includes:

1. Tax cuts for middle-class families with children, with a maximum credit of $3,600 per child;

2. Provide a $6,000 tax credit for the first year of a newborn child's family;

3. Tax cuts of $1,500 for dual-income families;

4. Tax cuts for health insurance purchases;

The Harris team promised to implement these proposals within the 100 proposals it took to take office to reduce the cost of living for ordinary Americans. The most controversial ones are mainly concentrated on its policies on housing and food and daily necessities, as well as the overall budget of the entire policy. First of all, most opponents believe that its radical housing subsidies and construction policies will greatly increase government fiscal pressure and cause a more serious debt crisis. Secondly, the policies on food and daily necessities also violate the market rules. The government attributes the cause of inflation to the improper profits of related enterprises, which obviously shows a lack of understanding of the market and a lack of understanding of the different characteristics of oligopoly markets and fully competitive markets. In fact, the retail industry belongs to a fully competitive market, and the profit margins of most retailers in their retail business are usually in the single digit. If the government intervenes, it will lead to an imbalance in the relationship between market supply and demand, thus triggering a new round of inflation and causing a large number of related enterprises to go bankrupt.

Finally, in terms of the total budget of the plan, the non-profit organization Committee for a Responsible Federal Budget estimates that the plan will increase the government deficit by between 1.7 trillion and 2 trillion in the next 10 years, which may cause three problems. First, the current debt crisis in the United States, which has intensified, will become more serious. Disorderly government spending will continue to consume the credit of the United States and trigger a potential dollar crisis. Secondly, the stimulus plan will further push up domestic inflation in the United States. Finally, as Harris' team pointed out that the budget will be borne by the wealthy in the tax structure, this is undoubtedly contrary to Trump's policy of reducing corporate taxes to benefit the rich, which will further intensify social contradictions in the United States. It can be seen that after the bill was made public, the US dollar index and gold, as a safe-haven asset for inflation, both showed a more dramatic reaction.

Impact on the crypto world - short-term bullish and long-term bearish

Next, let's analyze the impact of the bill on the crypto market. The American society has always been proud of its spindle-shaped social class structure. Although the proportion of the middle class is on a downward trend, it is still more than 50% overall. The impact of this bill mainly benefits this part of the population. We know that the effectiveness of government policy intervention in the economy has a diminishing effect, because it will significantly affect the expectations of all parties in the market. However, in general, the impact of government intervention in the short term is still strong. Therefore, if the above plan can be implemented, the effect in the short term is beyond doubt. By then, the cost of living of most middle-class families in the United States will be significantly reduced, which will increase the disposable income of residents in the short term. This has created soil for the rise of risky assets, especially high EPS technology assets. The reason is also very simple. Only when the leeks become rich can the big capital make money. When the big capital makes money, it will actively sell new narratives, and the market will become active.

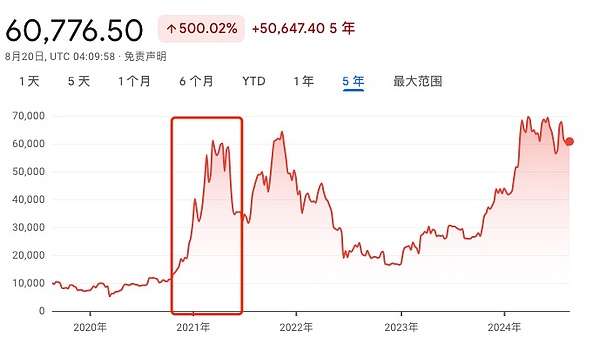

This story has already been staged once in 2021. The 1.9 trillion COVID-19 relief bill implemented by the Biden administration at the beginning of 2021 has caused a surge in the disposable income of most American families in the short term, which has completely detonated the rising frenzy of the crypto market dominated by Bitcoin. Of course, with the accumulation of wealth effects, the inflationary pressure in American society has become increasing day by day. Everyone knows the story behind it. In order to fight stubborn inflation, the Federal Reserve had to carry out a monetary tightening cycle for more than two years. This also triggered a substantial retracement of risky assets. Therefore, I believe that if an economic policy of the same scale can be implemented, it will benefit crypto assets in the short term, but in the medium and long term, we need to be vigilant about the monetary policy risks brought about by the return of inflation caused by this. Of course, this requires Harris to win the election and ensure that the policy can be effectively implemented. I will continue to pay attention to it in the future.

Coinlive

Coinlive

Coinlive

Coinlive  nftnow

nftnow decrypt

decrypt Others

Others Others

Others Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph