IRS Accused of Overstepping in Blockchain Investigator Requests

The IRS faces criticism for its aggressive tactics in seeking help from blockchain investigator ZachXBT, raising concerns about privacy and professionalism.

Weiliang

Weiliang

On April 30, six Hong Kong virtual asset spot ETFs rang the bell and were listed on the Hong Kong Stock Exchange, officially ushering in their market debut.

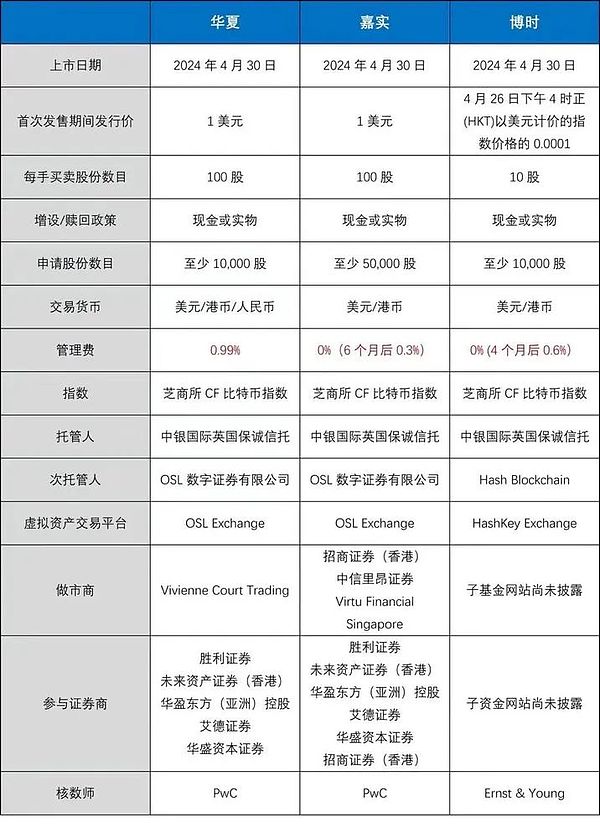

In the previous week, the official website of the Hong Kong Securities and Futures Commission (SFC) had listed the Bitcoin and Ethereum spot ETFs of three fund companies, China Asset Management (Hong Kong), Bosera International and Harvest International, and disclosed the issuance information one after another.

In terms of the issue price, the products of Harvest International and China Asset Management (Hong Kong) were issued at US$1 (HKD7.827) per share. The initial issue prices of Bosera Bitcoin ETF and Ethereum ETF were basically the same as 1/10000 and 1/1000 of the tracking index on April 26, 2024, respectively. Holding 10,000 shares is approximately equal to 1 Bitcoin, and 1,000 shares is approximately equal to 1 Ethereum.

Opening prices of 6 ETFs, source: public information

From the results of the first show, the performance of Hong Kong ETFs can only be said to be unsatisfactory. As of the close of the market, the transaction amount of the first batch of 6 Bitcoin and Ethereum spot ETF funds launched in Hong Kong totaled only 87.58 million Hong Kong dollars, and most ETFs fell below the opening price. Taking the largest Huaxia Bitcoin ETF as an example, it opened at 8.07 Hong Kong dollars and closed at only 7.95 Hong Kong dollars. In sharp contrast, the trading volume of the 11 spot Bitcoin ETFs in the United States on the first trading day reached 4.6 billion US dollars, about 383 times that of the first day in Hong Kong.

Since Hong Kong issued its virtual asset declaration, the crypto industry has placed high hopes on Hong Kong. Now, a year has passed and Hong Kong has taken a big step, but the result is still mediocre. "Loud thunder, little rain" has become the market's nickname for Hong Kong's Web3.

In fact, there have been signs of this situation for a long time. As early as April 15, when the first batch of virtual asset ETFs were publicly announced to be approved, the industry's discussion about it was mixed.

Although major mainstream media platforms have called it a historic event, the market has obviously followed the vote. The prices of Bitcoin and Ethereum have remained volatile or even slightly declined, and have been little affected by this news. In the previous hype of the US Bitcoin spot ETF, whether it was through the surge of the previous market, or through the short-term decline of Bitcoin, or even Bitcoin breaking through new highs, all showed the huge influence of the United States on the crypto market. This influence is undoubtedly difficult for Hong Kong to achieve.

The root of the difficulty comes from the scale of funds. Since the news of the approval of Hong Kong spot ETFs came out, the market has had different opinions on the capital flow of ETFs. Eric Balchunas, senior ETF analyst at Bloomberg, publicly stated on the X platform that since the market size of Hong Kong ETFs is only about US$52 billion, coupled with the limitations of approved institutional fund management and the lack of liquidity of Hong Kong's basic ecosystem, all virtual asset spot ETFs in Hong Kong can attract US$500 million, which is an excellent performance.

Some industry insiders also expressed opposition to this, believing that the institutional effect of the Hong Kong ETF market is significant, and the recognition of virtual assets is high, and there may be opportunities for a turnaround. Taking gold ETFs as a comparison, the SPDR GOLD TRUST AUM in the Hong Kong market has reached US$69.8 billion, which shows that Hong Kong is highly optimistic about highly recognized anti-inflation assets. Another example comes from Chainalysis. It is estimated that from June 2022 to June 2023, Hong Kong's active over-the-counter cryptocurrency market has driven US$64 billion in trading volume. In this regard, Wayne Huang, the project leader of OSLETF, believes that this ETF should be able to attract at least $1 billion, while Paolo of the crypto exchange VDX even believes that $10 billion can be introduced this year.

From the current trading situation, the transaction scale is still not optimistic. The trading volume on the first day did not reach 100 million yuan. Looking at the futures ETFs listed in Hong Kong, the three ETFs only attracted 529 million Hong Kong dollars in capital inflows. Of course, given the limitations of futures, this data can only be used as a lower limit valuation.

Returning to the essence, around the analysis of the scale of funds, the market is most concerned about whether the southbound capital channel can be opened. Mainland Chinese capital and Hong Kong need to invest in each other's market stocks through the Shanghai-Hong Kong Stock Connect or the Shenzhen-Hong Kong Stock Connect, which is why there are southbound funds (from mainland China to Hong Kong) and northbound funds (from Hong Kong to mainland China). In short, the influx of money from the mainland into Hong Kong is generally believed by the market to be the key to the rise of Hong Kong's cryptocurrencies.

Even the core participants of ETFs do not have a definite answer to this question. The primary compliance of ETFs comes from the underlying assets. Currently, Hong Kong spot ETFs target virtual assets such as Bitcoin and Ethereum, and virtual asset transactions are strictly prohibited in the mainland. Therefore, many issuers say that it is difficult for southbound funds to buy ETFs. Caixin also reported on this, saying that according to the joint circular issued by the Hong Kong Securities and Futures Commission and the Hong Kong Monetary Authority in December 2023, both the virtual asset futures ETFs currently available in the Hong Kong market and the virtual asset spot ETFs to be issued in the future cannot be sold to retail investors in mainland China and other places where the sale of virtual asset-related products is prohibited.

There are exceptions. Mainlanders holding Hong Kong identity cards, even if they are not permanent residents of Hong Kong, can participate in the transactions of the above ETFs under compliance. According to the information, mainland institutions or mainlanders holding identity cards in both places also have the opportunity to participate, and it is difficult to clarify whether there is a gray area during the period. But a rather ambiguous proof is that the currently approved virtual asset spot issuers can all be seen with Chinese capital, and the two ETFs under China Asset Management have not only Hong Kong dollar and US dollar counters, but also additional RMB counters.

Issuance data of 6 ETFs, source: public information

But from the actual operation of mainland users today, mainland investors will be prompted to refuse transactions when purchasing ETFs. Therefore, as far as the current situation is concerned, the influx of southbound funds is still difficult, and offshore funds and local capital will become the main areas for the sales of virtual asset spot ETFs in Hong Kong.

Pop-up window for mainland users to buy on Tiger Securities, source: X platform

Beyond the scale, the local crypto market in Hong Kong still has many problems. The high cost and small market make it difficult for Hong Kong to emerge a huge technology ecosystem, and it is even more difficult to discover large-scale application projects. As a channel for the exchange of funds, it is obviously more in line with Hong Kong's positioning, but this channel is not only subject to regulatory restrictions, but also faces challenges from other markets. For example, offshore capital can choose overseas exchanges with lower costs, which directly leads to the market's almost flat reaction.

Even if the market is not optimistic, through ETF itself, it is obviously more meaningful for Hong Kong, a financial center. Although the Hong Kong authorities have severely refuted the statement that the financial center is a relic, and the data also proves that Hong Kong has significant advantages in the bond, wealth management and other markets, as well as banking, insurance and other sub-sectors, it has to be admitted that in recent years, under multiple factors such as the tightening macroeconomic environment and the rise of overseas markets, Hong Kong is still under pressure in terms of international competitiveness.

Taking the most controversial stock market as an example, the lack of liquidity of Hong Kong stocks has become a recognized fact. Data shows that in 2023, the number of IPOs on the Hong Kong Stock Exchange will be 73, a year-on-year decrease of 19%, and the total amount of IPO funds raised will reach HK$46.295 billion, a year-on-year decrease of 56%. Not only has the fundraising scale hit a ten-year low, causing Hong Kong stocks to fall out of the top five IPO markets in the world, but 36 of the 73 listed new stocks broke the issue price on the first day, with a break rate of 51%.

Against this background, virtual assets, as the main representative of the foreseeable financial sector of digital assets, are of self-evident importance for the beachhead layout of international financial centers. The virtual asset ETFs in the United States have already provided an example of this. In just less than 4 months, the asset management scale of 11 Bitcoin spot ETFs in the United States has exceeded US$52 billion. At present, Hong Kong's efforts have not been completely in vain. At least in terms of regional competition, in addition to the United States, Dubai, Singapore and Hong Kong have already emerged as the three major powers. The proven flow of funds and people is slowly flowing into Hong Kong with the establishment of the ecosystem and the listing of ETFs.

From the perspective of the industry, Hong Kong's approval of ETFs has a significant role in promoting the compliance of virtual assets and has also added momentum to the development of Hong Kong's encrypted industry. Specifically, ETFs have greatly improved the convenience of investors' purchases. Products that previously required opening an account on a compliant exchange can be directly traded through securities accounts and banks after the listing of ETFs. Retail investors can use them directly, and institutions or funds that are difficult to invest directly in virtual assets due to regulatory citations can also participate indirectly through ETFs.

"Investors in Hong Kong can buy ETFs like stocks. Now Interactive Brokers, Tiger, Victory, etc. can support purchases." A Hong Kong worker said. In contrast, to buy US virtual asset ETFs, you must be a professional investor in Hong Kong, with an investment amount threshold.

It is worth mentioning that Hong Kong's acceptance of physical redemption makes virtual asset ETFs have a more flexible trading model in the trading process, supporting coin-in-cash-out, coin-in-coin-out, money-in-coin-out and money-in-cash-out. Compared with the US, which only allows cash redemption with money-in-cash-out, it adds more arbitrage mechanisms and is also conducive to the participation of crypto-native users.

Returning to the ETFs listed this time, the fee war that originally started in the United States has also been restarted in Hong Kong.

Since the underlying assets tracked are the same, investors will focus on expense ratios and liquidity when choosing ETFs. In theory, the ETF expense ratio in Hong Kong should be higher than that in the United States. The reason is that the compliance costs of Hong Kong crypto exchanges are higher than those overseas. For example, in addition to fixed costs such as operation and maintenance, technology, RO, and data tracking, there are also linearly increasing insurance costs for custodial assets. This invisible high cost can be seen from the listing fee. According to official data, HashKey Exchange, which has relatively weak liquidity, estimates that the listing fee ranges from 50,000 to 300,000 US dollars, while Coinbase claims that it does not charge a listing application fee, but the company reserves the right to charge the fee to pay for service fees in the evaluation and listing process.

The facts are consistent with the data. According to the product summary, the ETF products of the three institutions are all higher than the equivalent ETF levels in the United States. Among them, the ETF product expense ratio of Huaxia is the highest, reaching 1.99%, while that of Harvest and Bosera is 1% and 0.85% respectively.

From the current perspective, Hong Kong has made some trade-offs in management fees to attract funds, and major issuers all hope to gain scale advantages with lower management fees. According to statistics, the management fees of the three funds are 30 basis points for Harvest International, 60 basis points for Bosera International and 99 basis points for China Asset Management. Among them, the management fee of Harvest International's products is waived within 6 months of holding, and the management fee of Bosera International's products is waived within 4 months after issuance, while China Asset Management's internal evaluation management fee rate can be reduced to 65 basis points.

Comparison of the three issuers, image source: TechubNews

Compared with the United States, the management fee rate of Hong Kong ETFs is still slightly high and does not have core competitiveness. According to the data, except for Grayscale and Hashdex, the fees of the other nine approved Bitcoin ETFs in the United States range from 0.19% to 0.49%. The representative product BlackRock's iShares fee is 0.25% and only 0.12% in the first 12 months. But it is worth mentioning that even though Grayscale's fee rate is as high as 1.5% and funds have continued to flow out in recent months, it is still the ETF institution with the highest asset management scale, which indirectly reflects the importance of liquidity to the ETF itself.

Reflected in the actual transaction data, the head effect of Huaxia, which has a high fee rate but an advantage in asset management scale, is shown. Data shows that the initial issuance scales of Huaxia Bitcoin ETF and Huaxia Ethereum ETF were HK$950 million and HK$160 million respectively, and in the first day's trading volume, Huaxia accounted for nearly 57%. Although it seems to be in danger, Hong Kong may have anticipated this situation from the beginning. A person in charge of a Hong Kong crypto exchange said, "It can't be compared with the United States, but compared with similar products in Europe, Canada, Switzerland and other regions, Hong Kong still has an absolute advantage. Hong Kong can also be used as a fulcrum to develop towards Southeast Asia, Taiwan, China, and even the Middle East. After compliance, traditional funds will enter as appropriate. There is definitely an ETF market, but it is difficult for Hong Kong's compliant exchanges to rise in a short period of time." From the perspective of differentiation, in addition to the advantages of more active funds and physical asset subscription, Hong Kong's strict compliance also builds a safer and more controllable trading environment. Take insurance as an example. According to the regulations of the Hong Kong Securities and Futures Commission, crypto exchanges must insure all custodial assets. User assets must be separated into hot and cold assets, with 98% placed in cold wallets and only 2% placed in hot wallets. If a cold wallet is lost, more than 50% of the compensation can be obtained, while if a hot wallet is lost, the compensation is paid in full. In this context, traditional capital in the Asia-Pacific region, which is highly concerned about risks, can also enter the market with peace of mind.

Another advantage is the Ethereum spot ETF. At present, the Ethereum spot ETF in the United States is still in the game, and the news is true and false. There are arguments to support whether it is passed or not. From the perspective of passing, most people believe that it is difficult for the SEC to find a reason to reject it in the context of the Ethereum futures ETF having been passed, and the whale accounts headed by Justin Sun have gradually begun to increase their holdings of ETH. But from the perspective of rejection, the securities nature of Ethereum and the tough attitude of the SEC make the market hesitant. Recently, according to four people familiar with the matter, U.S. issuers and other companies expect that the U.S. Securities and Exchange Commission will reject the application for Ethereum spot ETF. It is said that after the issuer met with the SEC, the SEC's attitude was flickering, and the staff did not discuss the implementation details of the financial product, which was in sharp contrast to the previous intensive and detailed discussions on Bitcoin spot ETF.

This may also bring certain opportunities to Hong Kong's ETF. When the ETF was approved, Hong Kong approved two types of spot products, Bitcoin and Ethereum, at one time, which directly filled the gap in the U.S. Ethereum ETF, although from today's data, the ETH product has a trading volume of only about 20.09 million Hong Kong dollars.

Considering various reasons, the issuer is still confident. China Asset Management has purchased up to $1 billion in insurance for its assets, which indirectly reflects the expectation of the market size. Han Tongli, CEO of Jiashi International, even said in an interview that "Hong Kong ETFs should not be worse than any ETF in the United States, and may even surpass the United States."

At present, there are market rumors and people standing up for ETF capital inflows of 500 million, 1 billion, 10 billion, and even 20 billion US dollars, but judging from today's market performance, no matter which data is, it still needs the test of time.

It is quite interesting that looking at Hong Kong's encryption at different nodes will get very different results.When the 2022 declaration was released, everyone in the market had high hopes for Hong Kong, and the rise and fall of the east and the west began. After the new license regulations were promulgated in 2023, the compliance costs and strict supervision made the exchange admit that it was "dancing in shackles", and the market enthusiasm quickly subsided, and ignoring and waiting became the attitude. And then this year's listing of virtual asset ETFs, mixed views began to emerge. The only thing that remained stable was that at each node, the Hong Kong encryption sector rose accordingly, and the news seemed to have become a signal of speculation in the secondary market.

In response to this, a friend laughed and said, "Are we expecting too much from Hong Kong, and Hong Kong giving back too little?"

It is too early to say this. In previous articles, the author cited the number of listed coins to describe the current Hong Kong encryption industry. In fact, even if there is no deliberate description, it is known that Hong Kong's encryption is struggling and slowly entering a new compliance era after experiencing ecological loss in 2017 and 2018. The competition among compliant exchanges, offshore exchanges, and securities institutions has just started. Whether in terms of public education or market cultivation, Hong Kong is in its early stages.

At the next node, looking at Hong Kong again, what position will the encryption industry occupy? The question is still unknown. But from the current situation, Chinese Web3 will always have a place, and the Asia-Pacific market is one of the key markets for encryption after all, and it needs windows and fulcrums to carry this market and group, not to mention the possibility of large-scale digital asset exchanges in the future. From this point of view, the future of encryption in Hong Kong is still very big, at least, much bigger than the data we see now.

The footnote of history has been determined, and the future of Hong Kong Web3 is stumbling.

The IRS faces criticism for its aggressive tactics in seeking help from blockchain investigator ZachXBT, raising concerns about privacy and professionalism.

Weiliang

WeiliangHong Kong, virtual currency, this article explains how Hong Kong’s virtual currency OTC business is conducted in compliance with regulations? Golden Finance, virtual currency OTC will usher in an era of compliance in Hong Kong.

JinseFinance

JinseFinance JinseFinance

JinseFinanceThe U.S. government is pushing to have an independent inquiry into the crypto exchange despite concerns over cost.

Others

Others如今,Paradigm 再次迎来范式转移,不再只专注加密货币/Web3,开始将关注领域扩大到Ai。

8btc

8btc Coinlive

Coinlive FTX claimed its 2021 financial results were audited by Armanino and Prager Metis.

Others

Others Cointelegraph

CointelegraphGolden Finance launched the cryptocurrency and blockchain industry morning newspaper "Golden 8 AM" Issue 1628 to provide you with the latest and fastest digital currency and blockchain industry news.

Ftftx

Ftftx"The value of cultural relics lies not only in appreciation and collection. Digitize antique cultural relics, and use more different forms to keep these old objects carrying cultural and historical value alive, with eternal DNA."

Ftftx

Ftftx