Author: Ben Lilly, JJ the Janitor Translation: Shan Oppa, Golden Finance

The market whisper has turned into a roar

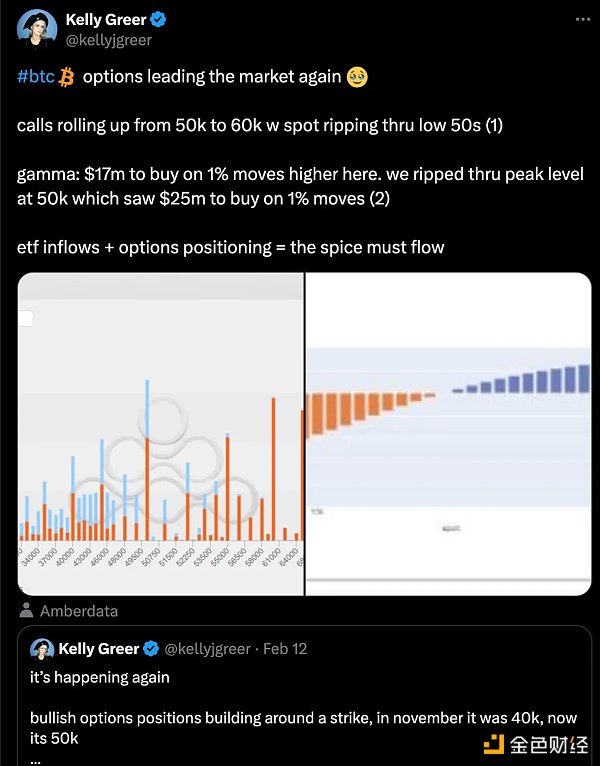

Last week we mentioned that the market is gearing up to reach 50,000 to 50,000 yuan. The $53,000 range broke out. As last week's net position chart shows, a large amount of open interest in put options is concentrated below $50,000, while call options are concentrated above $55,000, reflecting the huge underlying volatility.

The following is an excerpt from last week's update for those who missed it:

< img src="https://img.jinse.cn/7186257_watermarknone.png" title="7186257" alt="EfvqWJQTF8i55PMobPSx4x8UvWzPFIsYvviorsLN.png">

Monday is coming At that time, as billions of funds flowed into spot Bitcoin ETFs, the market was like a powder keg that encountered a fuse and was instantly ignited.

If you tuned into this Tuesday's episode of Trading Trenches, you'll hear Ben Lilly and I break down what happened.

In short, there was fierce competition among options traders after the price broke through the critical $52,000 mark. These market makers are the same institutions that previously sold out-of-the-money call options. Rising prices force them to hedge their short call positions, just like a man on fire who has to jump into the water to put out the fire... all because prices are skyrocketing.

As Galaxy HQ's Kelly Greer points out, this means that for every 1% rise in Bitcoin, traders have to buy an additional $17 million worth of Bitcoin to remain delta neutral.

This is like using a lever finger to lift a bulldozer.

Coupled with continued spot buying into ETFs and the unwinding of short positions, these factors have created the perfect storm, ultimately leading to Bitcoin’s 2021 Breaking through the $60,000 mark for the first time.

This is very similar to the situation that broke through the $30,000 mark in October this year, once again proving the procyclical nature of the options market.

However, the options market is still an area ignored by many cryptocurrency traders, as they tend to only focus on perpetual contracts and spot markets. Trader put errors are often the main driver of Bitcoin's largest single-day moves.

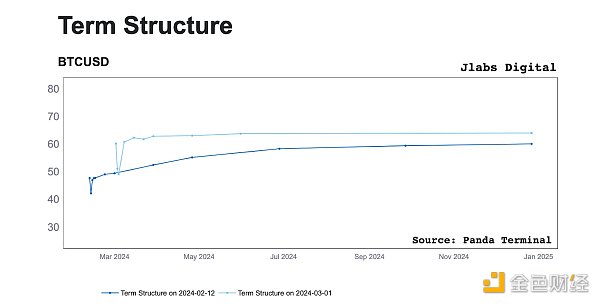

Let's compare a term structure chart (a chart that shows option pricing versus implied volatility) now and in early February.

What we can see is a clear change that traders may have learned from selling volatility low. Compared to early February, current options pricing reflects expectations for greater volatility ahead, which would otherwise see traders sell options more to lower prices.

For those who want to learn more about this topic, we have created a series of tutorials to teach you how to effectively trade Bitcoin options in 2024, because of this Movements in the term structure typically occur during the current phase of the Bitcoin cycle.

Looking to the future

Although the options market provides opportunities to capture volatility, it must always be Be cautious. Considering that the recent surge in option prices is unlikely to last until the end of March, it is recommended to hold call option positions with caution and avoid fear of missing out (FOMO) and blindly chase the rise.

Don't worry if you miss this opportunity, because there will always be better opportunities after you miss it once. Like last week, low-risk, high-reward volatility trading strategies are frequently seen in the options market. Don’t blindly take orders out of fear of missing out, or you may be paying a large premium for a contract that quickly depreciates in value.

When similar opportunities arise again, we will promptly notify you. But until then, it’s important to trade with caution and remember that volatility can take away gains just as quickly as it can bring them.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Beincrypto

Beincrypto Beincrypto

Beincrypto Beincrypto

Beincrypto Beincrypto

Beincrypto Finbold

Finbold Nulltx

Nulltx Nulltx

Nulltx Nulltx

Nulltx Nulltx

Nulltx