Source: Trustless Labs

Background

With the launch of GPT4 LLM by OpenAI, the potential of various AI Text-to-Image models has been witnessed. With the increasing number of applications based on mature AI models, the demand for computing resources such as GPUs has risen sharply.

GPU Utils In 2023, an article discussing the supply and demand of Nvidia H100 GPUs pointed out that large companies involved in AI business have a strong demand for GPUs. Technology giants such as Meta, Tesla and Google have purchased a large number of Nvidia GPUs to build AI-oriented data centers. Meta has about 21,000 A100 GPUs, Tesla has about 7,000 A100s, and Google has also invested heavily in GPUs in its data centers, although specific numbers have not been provided. Driven by the need to train large language models (LLMs) and other AI applications, demand for GPUs, especially H100s, continues to grow.

At the same time, according to data from Statista, the AI market size has grown from 134.8 billion in 2022 to 241.8 billion in 2023, and is expected to reach 738.7 billion in 2030, while the market value of cloud services has also increased by about 14% from 633 billion, part of which is attributed to the rapid growth in demand for GPU computing power in the AI market.

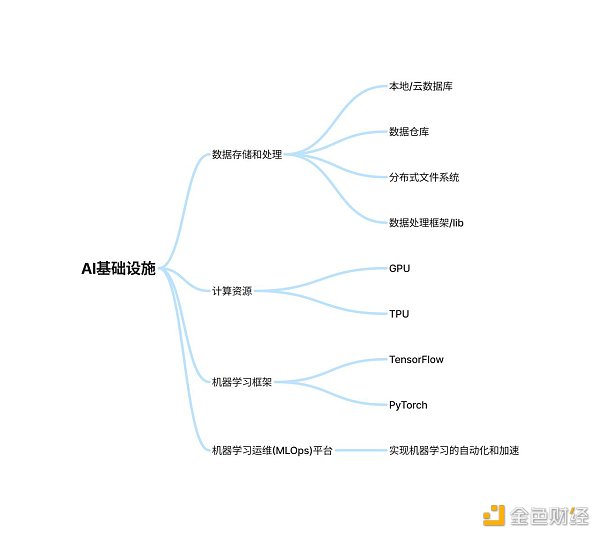

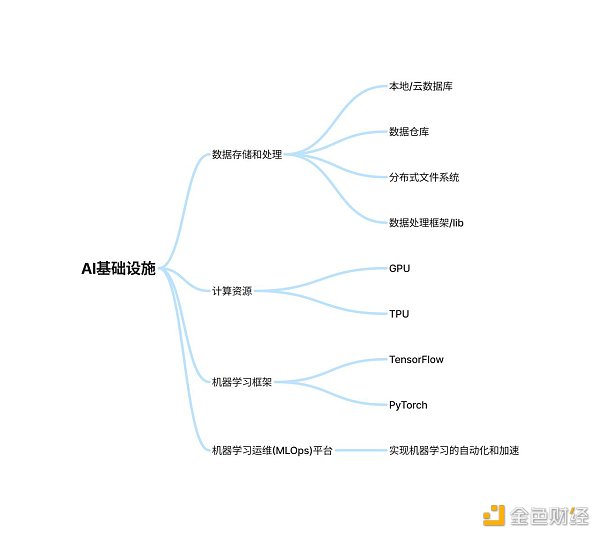

For the rapidly growing AI market with huge potential, from what perspective can we deconstruct and explore related investment entry points? Based on a report from IBM, we summarize the infrastructure required to create and deploy artificial intelligence applications and solutions mentioned therein. It can be said that AI infrastructure exists mainly to process and optimize the large amount of data sets and computing resources that training models rely on, solving the problems of data set processing efficiency, model reliability and application scalability from both hardware and software aspects.

The large amount of computing resources needed in AI training models and applications prefer low-latency cloud environments and GPU computing power, and the software stack also includes distributed computing platforms (Apache Spark/Hadoop). Spark distributes the workflows that need to be processed to various large computing clusters, and has built-in parallel mechanisms and fault-tolerant designs. The natural decentralized design of blockchain makes distributed nodes the norm, and the POW consensus mechanism created by BTC establishes that miners need to compete for computing power (workload) to win block results, which has a similar workflow to AI, which also requires computing power to generate models/inference problems. Therefore, traditional cloud server vendors began to expand new business models, renting out graphics cards and selling computing power like renting out servers. Imitating the idea of blockchain, AI computing power adopts a distributed system design, which can utilize idle GPU resources and reduce the computing power costs of startups.

IO.NET Project Introduction

Io.net is a distributed computing power provider combined with the Solana blockchain, aiming to use distributed computing power resources (GPU & CPU) to solve the computing demand challenges in the field of AI and machine learning. IO integrates idle graphics cards from independent data centers and cryptocurrency miners, and combines crypto projects such as Filecoin/Render to gather more than 1 million GPU resources to solve the problem of AI computing resource shortage.

Technically, io.net is built on ray.io, a machine learning framework for distributed computing, and provides AI applications with distributed computing resources that require computing power, from reinforcement learning, deep learning to model tuning, model operation, etc. Anyone can join io's computing network as a worker or developer without additional permission. At the same time, the network will adjust the computing power price according to the complexity, urgency and computing power resource supply of the computing work, and price according to market dynamics. Based on the characteristics of distributed computing power, io's backend will also match GPU providers with developers based on the type of GPU demand, current availability, location and reputation of the requester.

$IO is the native token of the io.net system, acting as a transaction medium between computing power providers and computing power service buyers. Using $IO can reduce %2 of the order handling fee compared to $USDC. At the same time, $IO also plays an important incentive role in ensuring the normal operation of the network: $IO token holders can pledge a certain amount of $IO to nodes, and node operation also requires $IO tokens to be pledged to obtain the corresponding income during the machine's idle period.

$IO tokens currently have a market cap of approximately $360 million and a FDV of approximately $3 billion.

$IO Token Economics

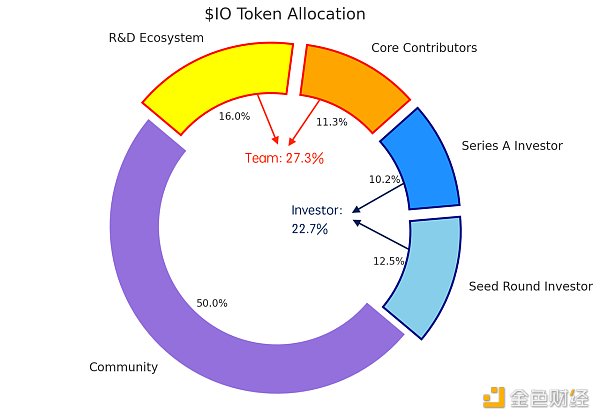

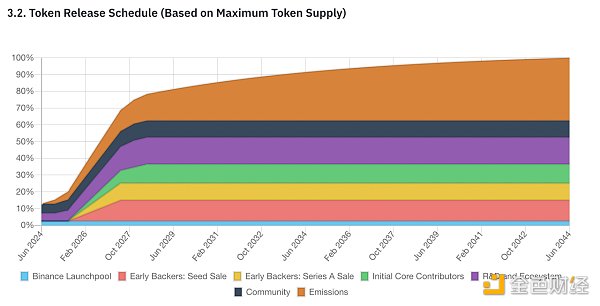

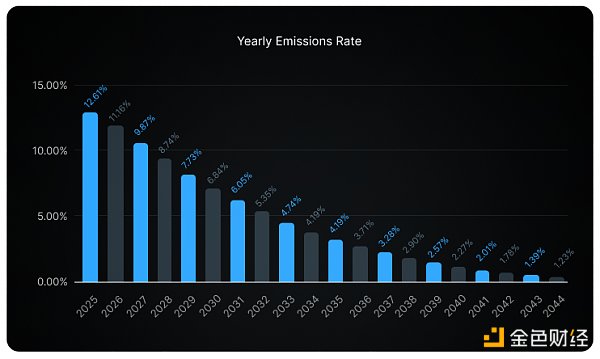

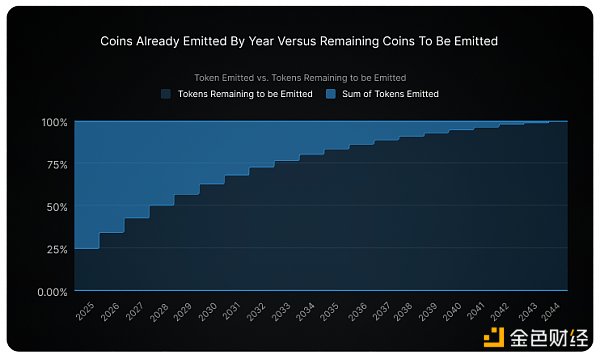

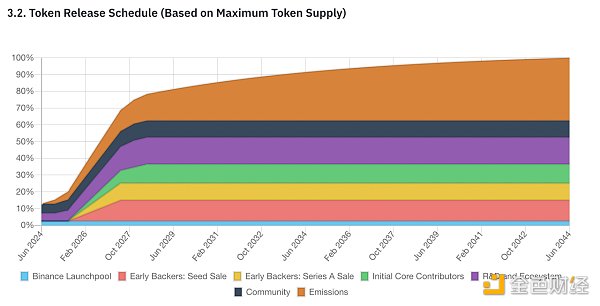

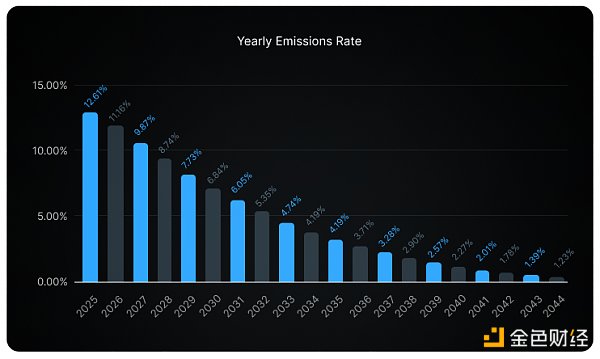

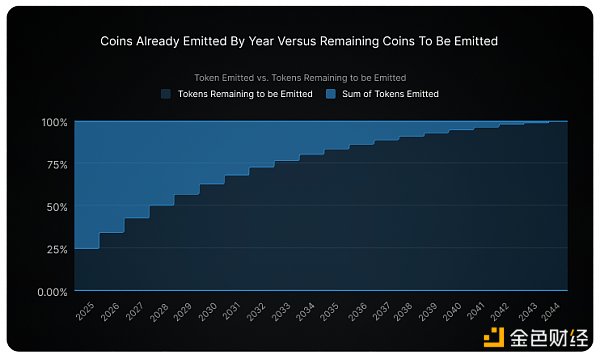

$IO's maximum total supply is 800 million, of which 500 million were allocated to all parties at the token TGE, and the remaining 300 million tokens will be released gradually over 20 years (the release amount decreases by 1.02% per month, or approximately 12% per year). The current IO circulation is 95 million, of which 75 million were unlocked for ecosystem development and community building at the TGE and 20 million were mined from Binance Launchpool.

The rewards for computing power providers during the IO testnet are distributed as follows:

Season 1 (as of April 25) - 17,500,000 IO

Season 2 (May 1 - May 31) - 7,500,000 IO

Season 3 (June 1 - June 30) - 5,000,000 IO

In addition to the testnet computing power rewards, IO also gave some airdrops to creators who participated in building the community:

Season 2 (May 1 - May 31) - 7,500,000 IO

Season 3 (June 1 - June 30) - 5,000,000 IO

(First round) Community / Content Creators / Galxe / Discord - 7,500,000 IO

Season 3 (June 1st - June 30th) Discord and Galxe Participants - 2,500,000 IO

Among them, the first season testnet computing power rewards and the first round of community creation/Galxe rewards have been airdropped at the time of TGE.

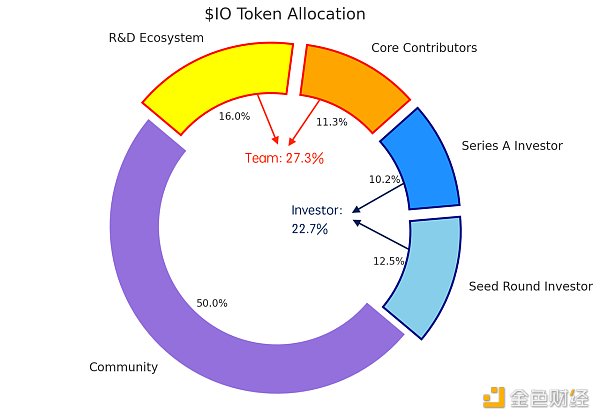

According to the official document, the overall distribution of $IO is as follows:

$IO token destruction mechanism

Competitive Product Analysis

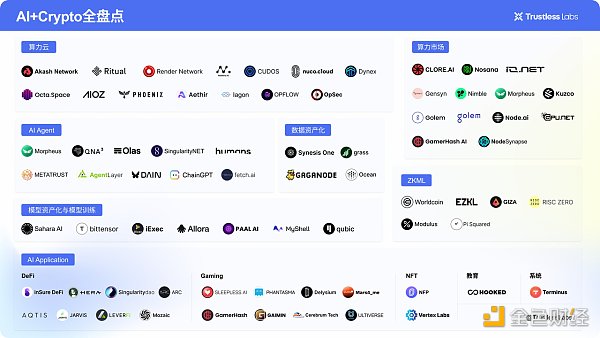

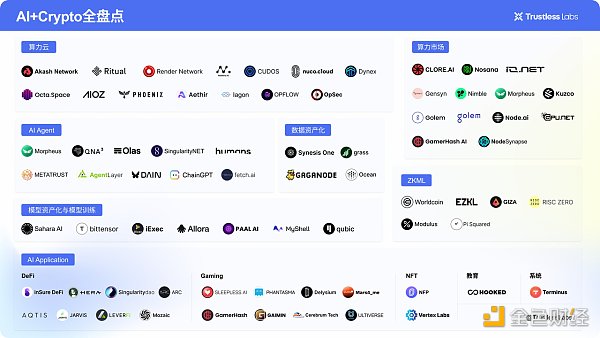

Projects similar to io.net include Akash, Nosana, OctaSpace, Clore.AI, etc., which focus on solving the decentralized computing power market for AI model computing needs.

Akash Network uses a decentralized market model to utilize idle distributed computing resources, aggregate and rent out excess computing power, and respond to supply and demand imbalances through dynamic discounts and incentive mechanisms, and achieve efficient, trustless resource allocation based on smart contracts, thereby providing secure, cost-effective and decentralized cloud computing services. It allows Ethereum miners and other users with underutilized GPU resources to rent these resources, thereby creating a cloud service market. In this market, the pricing of services is carried out through a reverse auction mechanism, and buyers can bid to rent these resources, driving down price competitiveness.

Nosana is a decentralized computing power market project in the Solana ecosystem. Its main intention is to use idle computing power resources to form a GPU grid to meet the computing needs of AI reasoning. The project defines the operation of its computing power market through programs on Solana and ensures that GPU nodes participating in the network complete tasks reasonably. Currently, in addition to the testnet operation in the second phase, computing power services are provided for the LLama 2 and Stable Diffusion model reasoning process.

OctaSpace is an open source and scalable distributed computing cloud node infrastructure that allows access to distributed computing, data storage, services, VPN, etc. OctaSpace includes CPU and GPU computing power, and services are used for disk space for ML tasks, AI tools, image processing, and rendering scenes using Blender. OctaSpace was launched in 2022 and runs on its own Layer 1 EVM-compatible blockchain. The blockchain uses a dual-chain system that combines proof of work (PoW) and proof of authority (PoA) consensus mechanisms.

Clore.AI is a distributed GPU supercomputing platform that allows users to obtain high-end GPU computing resources from nodes that provide computing power around the world. It supports a variety of uses such as AI training, cryptocurrency mining, and movie rendering. The platform provides low-cost, high-performance GPU services, and users can get Clore token rewards by leasing GPUs. Clore.ai focuses on security, complies with European laws, and provides a powerful API for seamless integration. In terms of project quality, Clore.AI's webpage is relatively rough, and there is no detailed technical documentation to verify the authenticity of the project's self-introduction and the authenticity of the data. We remain skeptical about the graphics card resources and the real level of participation in the project.

Compared with other products in the decentralized computing market, io.net is currently the only project where anyone can join without access to provide computing resources. Users can use a minimum of 30 series consumer-grade GPUs to participate in the network's computing power contribution, and there are also Apple chip resources such as Macbook M2 and Mac Mini. More sufficient GPU and CPU resources and rich API construction enable IO to support various AI computing needs, such as batch inference, parallel training, hyperparameter tuning, and reinforcement learning. Its backend infrastructure is composed of a series of modular layers, which can achieve effective resource management and automated pricing. Other distributed computing power market projects are mostly for enterprise-oriented graphics card resources cooperation, and there is a certain threshold for user participation. Therefore, IO may have the ability to use the encrypted flywheel of token economics to leverage more graphics card resources.

The following is a comparison of the current market value/FDV of io.net and competing products:

Review and Conclusion

$IO's listing on Binance can be said to have put a worthy end to this heavyweight project that has attracted much attention since its opening, the popularity of the test network, and the gradual attack by everyone during the actual test extension, questioning the opaque scoring rules. The token was launched during the market correction, opened low and went high, and finally returned to a relatively rational valuation range. However, for the testnet participants who came here because of io.net's strong investment lineup, some were happy and some were sad. Most users who rented GPUs but did not insist on participating in each season of the testnet did not get the desired excess returns as expected, but faced the reality of "reverse profit". During the testnet, io.net divided the prize pool of each period into two pools, GPU and high-performance CPU, for calculation. The announcement of points in season 1 was delayed due to a hacker incident, but the point exchange ratio of the GPU pool was determined to be nearly 90:1 at the final TGE. The cost of users who rented GPUs from major cloud platform vendors far exceeded the airdrop income. During season 2, the official fully implemented the PoW verification mechanism, and nearly 30,000 GPU devices successfully participated and passed the PoW verification, and the final point exchange ratio was 100:1.

After the much-anticipated start, whether io.net can achieve its claimed goal of providing various computing needs for AI applications, and how much real demand will remain after the testnet, perhaps only time can give the best proof.

JinseFinance

JinseFinance