Author: Zoltan Vardai Source: cointelegrap Translation: Shan Ouba, Golden Finance

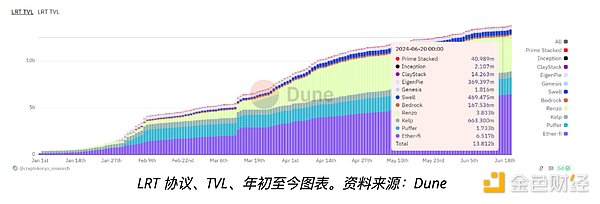

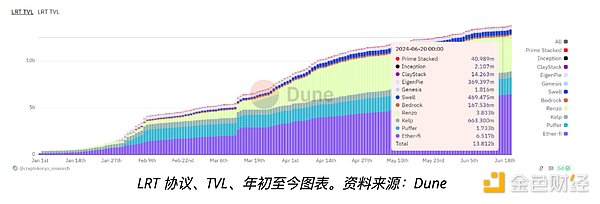

Liquid re-pledge tokens (LRT) is becoming an important part of the re-hypothecation industry and may reshape the entire decentralized finance (DeFi) field. LRT simplifies the complexity of traditional Ethereum staking and improves the capital efficiency of DeFi by providing stakers with the equivalent of their pledged tokens that can be deployed in other protocols. Demonstrating its growing importance, LRT’s total value locked (TVL) has grown by more than 8,300% year-to-date to $13.8 billion, up from just $164 million at the start of 2024.

p>

According to a report shared by Node Capital with Cointelegraph, the simplicity brought by these protocols is part of their significant growth:

“The shift to Liquid staking tokens is driven by the need for more efficient and user-friendly financial instruments... LRT has the potential to not only dominate the staking space, but also reshape the entire DeFi Ecosystem. ”

Liquid re-staking protocol makes staking easier for retail users, who require a minimum of 32 Ethereum (worth over $106,000) to pass traditional Staking to run a validator node.

EigenLayer is a key part of the rise of liquidity re-staking protocols

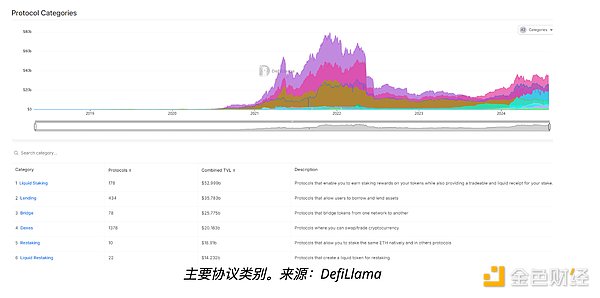

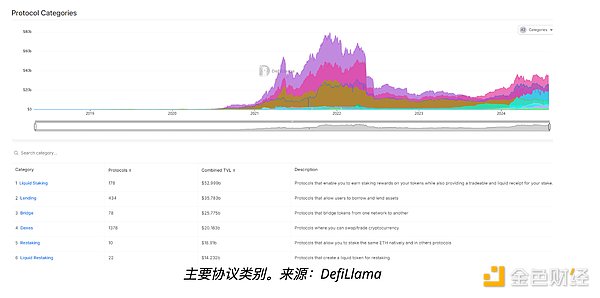

According to data from DefiLlama, Liquidity staking protocols have grown to become the largest protocol category, with a total TVL of $52.9 billion, while liquidity re-hypothecation protocols rank sixth, with a cumulative TVL of over $14.2 billion.

p>

Node Capital Token Engineering Analyst Harel said that EigenLayer is TVL’s largest re-pledge protocol and an important reason for the success of the liquidity re-pledge industry:

< blockchain One of the many complexities being abstracted away is EigenPods management and related processes into tokens,” Harel explained of the continued evolution of the LRP infrastructure. Helping the protocol category attract billions of dollars in capital:

"In a short period of time, these LRPs have amassed billions of dollars in equity capital and built Complex operator infrastructure, positioning themselves as key enablers on the supply side and gaining strategic advantage in influencing the demand side of active verification services."

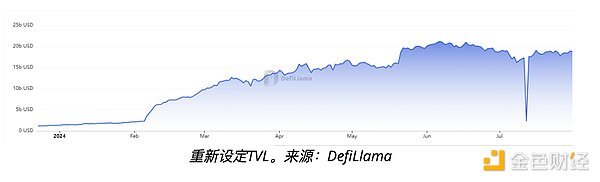

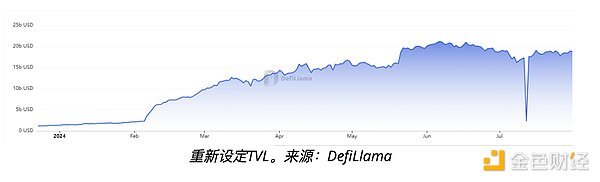

EigenLayer's TVL exceeds US$16 billion, accounting for more than 85% of the entire rehypothecation industry's TVL, with a value of US$18.9 billion.

p>

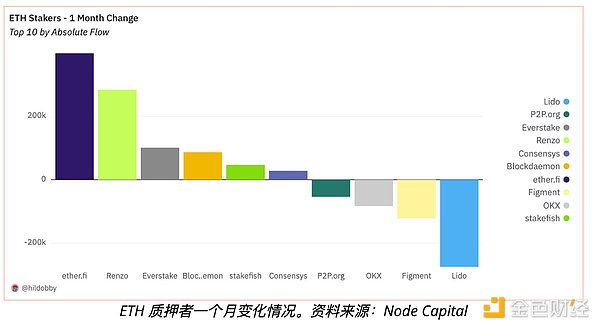

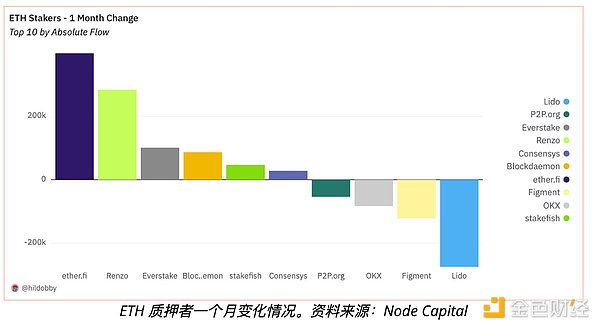

Ether.fi controls more than 50% of the LRT market

According to data from Node Capital, Ether .fi controls over 50% of the LRT market.

The report states that the protocol's success is largely due to its user-friendly re-staking model, which simplifies traditional staking:

"The distribution of market share further highlights ether.fi's dominance, with over 50% of the total market. This dominance demonstrates the platform's success in bringing the complexity back to Staking operations are simplified into a user-friendly token model, thereby promoting autonomous accumulation of value. ”

Ether.fi experienced massive outflows in April. According to Node Capital, the protocol’s absolute flow was close to 400,000 ETH on April 2, while Lido’s outflows exceeded 250,000 ETH.

JinseFinance

JinseFinance