When it comes to the hottest track in the past two weeks, DeSci is the best.

Since Binance labs announced its investment in BIO Protocol on November 8, this once dormant concept has risen again under the joint endorsement of CZ and Vitalik, with hot money pouring in. RIF and URO have generated a thousand times of wealth, and a new potential MEME track has also emerged.

DeSci, also known as decentralized science, refers to the concept of Messari, which refers to the act of establishing a public infrastructure through Web3 technology to achieve open and fair funding, storage and dissemination of scientific knowledge. DeSci encourages scientists to share their research results publicly and receive honors, while allowing anyone to easily access and contribute to research results. In short, DeSci is committed to solving scientific research problems based on blockchain technology, covering fund raising, knowledge sharing, review, intellectual property rights, and more.

In terms of track performance, DeSci focuses on fundraising. Most project models rely on tokenization to finance projects and support scientific research and development. At the same time, scientific research results are often advocated to be put on the chain to enhance transparency and protect intellectual property rights. At present, the core role of DeSci is to open up new fundraising channels for scientific research that requires long-term investment. Since it links the two unrelated fields of encryption and scientific research, it gives tokenization more practical significance, and is therefore strongly advocated by the market as one of the practical cases of MEME.

When it comes to the root cause of this round of DeSci's explosion, the celebrity effect is the key. On November 8, according to official disclosures, Binance completed strategic financing for BIO Protocol, allowing this "on-chain scientific version of Y Combinator" to surface. Subsequently, CZ attended the DeSci Day event held by Binance in Bangkok, and Vitalik was also present. The two discussed DeSci together, which pushed DeSci to the forefront.

The crypto community, which is good at finding hot spots, quickly surged with the DeSci craze. Pump.Science became an instant hit, and the RIF and URO projects made a thousand times the profit, making this track completely out of the circle. Andrew Kang, partner of Mechanism Capital, even wrote that "the DeSci field now feels like the DeFi era in early 2019. Everything is still primitive and experimental, but one basic conclusion can be drawn from it, that is, it has huge potential." Affected by this, even in the current market correction, according to SoSoValue data, the DeSci sector still rose 3.35% against the trend.

Although the Desci vision is positive and the opening of channels and funds for scientific research is undoubtedly valuable, from the current perspective, the hype component is obviously greater than the actual utility. In essence, the long-term nature of scientific research and the short-term profit-seeking nature of the MEME field show a significant deviation. It is a fantasy to hope to neutralize the zero-speculation scientific research field with the purely speculative MEME track.

On the one hand, there is great uncertainty in scientific research. Drug development can take more than ten years. If the direction is wrong, it will be a disaster. It has the characteristics of high investment and high risk, and requires sustainable long-term investment. This is why scientific research funds usually adopt a model led by the state and led by leading enterprises. State capital and social capital are combined to hedge risks and maintain competitiveness. However, in the crypto market, attention is the core, and hot spots are difficult to sustain. At present, the hot money around DeSci is mainly concentrated on Pump.Science, a meme coin issuance platform for scientific research projects, showing the market's attention to the money-making effect.

In fact, from a conceptual point of view, DeSci is a bit like old wine in a new bottle. If we look back at history, VitaDAO, initiated by Vita God in July 2021, is the earliest and most representative DeSci project, but the development of this project is not as magnificent as its concept.

VitaDAO is a community-owned project dedicated to funding early longevity research. Its goal is to promote scientific innovation through the collective power of the community, and to research and support projects aimed at extending human life and preventing age-related diseases. In other words, VitaDAO is a DAO community that studies longevity.

Previously, due to the strategic participation of traditional pharmaceutical company Pfizer in the project, VitaDAO briefly caused heated discussions, but then quickly fell silent as the topic of conversation declined. At present, VitaDAO is also making extensive arrangements, not only deploying US$4.2 million in funds, funding 24 projects, but also conducting research cooperation with well-known universities such as Newcastle University. But compared with its actions, the actual results are quite limited. Starting from 2021, it was not until Devcon not long ago this year that VitaDAO finally demonstrated its first product, VD001.

On the other hand, although the chaining of scientific research results will enhance transparency and intellectual property protection, and is also conducive to the diffusion of science, in the relatively closed field of scientific research, this point is almost a structural subversion. In today's scientific research system, most research teams maintain a high degree of confidentiality of research results and experimental data during the scientific research process to prevent the research results from being stolen, used or leaked by unauthorized persons, especially when it comes to deep interests, confidentiality is of paramount importance. With the strong entry of decentralization, the security of data is naturally difficult to guarantee.

With the support of the above two, it can be expected that in addition to the surface applications such as scientific research content, review fairness and data tokenization, only topics that are extremely difficult to implement, extremely time-consuming, and highly collaborative will cater to the encryption model. Judging from this round of enthusiasm, most DeSci projects are targeting a core issue of common concern to all mankind - longevity, which has led the market to jokingly call DeSci the elixir of life on the chain.

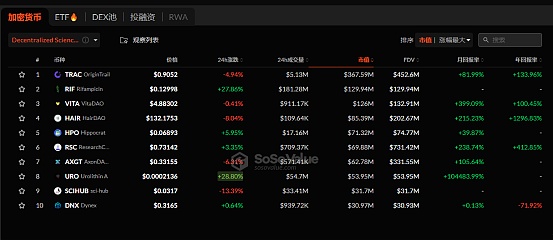

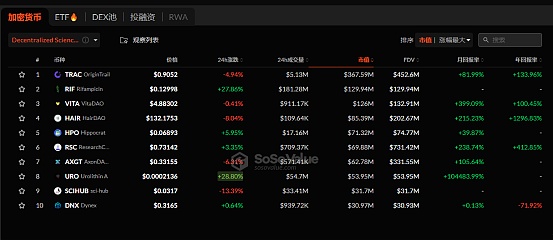

Immortality is ultimately just a beautiful vision, and the market's attention to DeSci is only for the liquidity it brings. Although the BIO Genesis community fundraising campaign initiated by BIOProtocol raised $33 million, and the DeSci sector has soared in the past two weeks. However, the primary market has limited action, and large institutions have not yet participated. From the perspective of leading projects, the secondary market attention is even more mediocre. The market value of VITA and RIF is between $120 million and $200 million, which is far from the market value of $1 billion for other sector leaders.

Development of DeSci sector, source: sosovalue

But if we ignore the long-term, DeSci is a relatively good sector in the MEME world. Compared with other MEMEs, DeSci has a stronger narrative. Although the celebrity effect is difficult to last, it has a fundamental effect because it is supported by actual scientific research projects. Any scientific research innovation and product development will strengthen the narrative. The biomedical sector is open to all fundraising, and the emerging nature of this field makes it more likely to be connected with the encryption field. In addition, DeSci has a potential breaking circle effect. The celebrity effect of the current sector is temporarily concentrated in the encryption field, led by Vitalik and CZ. Celebrities in the traditional medical and scientific research fields have not yet entered, and large institutions have not yet emerged, which also provides a direction for subsequent narratives.

Returning to the macro market, whether it is a zoo or an artist, AI-driven or scientific research verification, we can see that MEME has become the main carrier of market funds. But the successor of this round of overwhelming wealth is still the altcoin. From the perspective of the altcoin market alone, Bitcoin has risen from $10,000 to the edge of $100,000, the follow-up effect of Ethereum has been significantly reduced, and the performance of altcoins has mostly fallen. Among the top ten crypto assets, only SOL and XRP have risen. The altcoin season that has grown by dozens of times seems difficult to reproduce.

From the core point of view, the change in capital flow is the key. In the traditional bull market transmission, the general path is to gradually sink from high-stability assets to low-stability assets, and activate high-yield preferences from low-yield sources, that is, mainstream currencies-altcoins-MEME currencies-other sectors, but this year this path is not as good as before. However, with the entry of institutions and the saturation of the number of projects, large amounts of new external liquidity will only flow into the Bitcoin ecosystem, and there are no strong applications emerging in the public chain ecosystem. The altcoins are even more deeply trapped in the crisis of supply and demand institutions. Bitcoin has become a siphon of ecological funds, and funds from other sectors have also been siphoned in. Only MEME, which has a fast entry and exit and concentrated wealth effect, stands out, and the altcoin season has therefore become the MEME season.

A typical proof is that Pump.fun has become the biggest winner in the bull market. According to Dune data, as of November 24, pump.fun's cumulative revenue was close to US$230 million (US$228,908,720), and the total number of deployed tokens was about 3.74 million.

Of course, the two are not substitution effects, and the rise of MEME does not mean the collapse of the altcoin. Under the relaxation of supervision and sector rotation, the altcoin may still turn the tide. However, the improvement of MEME's market position undoubtedly reflects the structural transformation of the market. In fact, whether it is Pumpfun live broadcast, TikTok shouting or AI self-driving, etc., with the entry of Generation Z and the rapid evolution of new technologies, the crypto market is experiencing deep changes in narrative logic, communication mode, and operation mode.

The traditional cottage project is difficult to sustain by releasing tokens to maintain the narrative of long-term leeks. The market no longer pays for VC tokens, but moves towards a fairer, more autonomous, and closer to the core of tokens. Attention is increasingly scarce. In this sense, the combination of MEME and the project seems to be more competitive than a single project. The cottage is the banker, while MEME is relatively fair. MEME lacks long-term nature, and the project gives it fundamentals. The two are highly compatible, which may also be one of the reasons for the rise of concepts such as AIMEME and Desci.

But in any case, the formation of consensus is highly random, and there are very few MEME gold mines. According to Panews data, as of November 21, Pump.fun has issued a total of 3.59 million tokens, which is far more than the total number of tokens issued in the crypto world in the past 10 years. Among them, the number of graduated tokens (full curve listing Raydium) is 50,389, accounting for about 1.4%. The number of tokens with a market value of over 100 million US dollars is only 32, and only less than one in 100,000 MEMEs have a market value of more than 10 million US dollars.

In the long run, finding a consensus balance between attention and long-term will become an important issue in the development of MEME, but for individuals, survival and not returning to zero are the prerequisites for everything.

Joy

Joy