Author: Yashu Gola, Cointelegraph; Compiler: Songxue, Golden Finance

The U.S. Securities and Exchange Commission (SEC) is getting closer to the January 10 decision deadline for the Bitcoin ETF, and the market is interested in obtaining There is hope for approval. This pivotal event could have widespread consequences for the cryptocurrency market, including the second-largest cryptocurrency Ethereum.

Ethereum ETF Hopes

Approval of a Bitcoin ETF could set a regulatory precedent for other crypto-based Currency ETFs pave the way. The reason is that approval of a Bitcoin ETF would likely involve establishing a framework that would apply to other cryptocurrencies, including Ethereum.

In December 2023, the SEC delayed decisions on several pending U.S. Ethereum ETF applications until May 2024. These include the Hashdex Nasdaq Ethereum ETF, Grayscale Ethereum Futures ETF, VanEck Spot Ethereum ETF, as well as the spot Ethereum ETF submitted by Cathie, Sister Mu’s ARK Invest and 21Shares.

These delays are part of an SEC process that involves gathering public input before deciding whether these ETFs should go public. Nonetheless, they also emerged amid the commission’s attempts to classify some proof-of-stake (PoS) cryptocurrencies as securities.

Interestingly,Ethereum has not been classified as a security in any of the SEC’s recent lawsuits against cryptocurrency exchanges. The commission also did not challenge Ethereum’s classification through the Commodity Futures Trading Commission’s (CFTC) ETF registration process.

This increases the likelihood of a spot Ethereum ETF being approved in the United States in May 2024, which could boost ETH prices.

Ethereum-Bitcoin Correlation

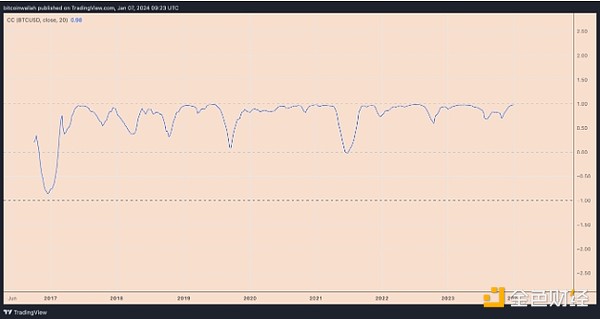

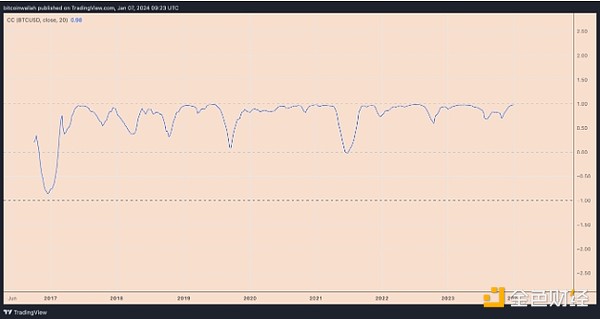

If Bitcoin ETF Approval Won’t Become a Sell News Event , then the price of Ethereum is well-positioned to rebound due to its consistent correlation with BTC prices in recent years.

Daily correlation coefficient chart for ETH/USD and BTC/USD. Source: TradingView

Essentially, this means that the approval of a Bitcoin ETF could trigger a significant increase in cryptocurrency exposure among traditional investors. In turn, this could cause ETH prices to surge as the market anticipates increased demand.

Conversely, delays or denials could lead to short-term bearish pressure as the market adjusts to the setback. A recent Bitwise survey found that only 39% of U.S. financial advisors believe a Bitcoin ETF will be approved this year.

Ethereum price technical hints at correction

From a technical perspective, the Bitcoin ETF made Ahead of the decision, ETH’s price was approaching the resistance trendline of its prevailing rising wedge pattern. A delay or rejection could result in a price pullback towards the wedge’s lower trendline near $1,865 in February.

ETH/USD weekly price chart. Source: TradingView

The $1,865 level coincides with ETH’s 0.236 Fibonacci line and its 50-week exponential moving average (50-week EMA; red wave).

On the other hand, ETF approval could invalidate Ethereum’s rising wedge setup entirely in favor of an ascending triangle reversal pattern, as shown below.

ETH/USD weekly price chart. Source: TradingView

By March, the triangle’s upside target is near $3,870, a 75% upside from current price levels, coinciding with the 0.786 Fibonacci line.

Xu Lin

Xu Lin