Source: Ye Kaiwen

Problems with Web3.0 in Hong Kong: People in SFC and traditional finance don’t understand Web3 and are a little afraid or contemptuous; people in Web3 are not very interested in traditional finance and institutional markets, and think that Web3 should be a decentralized innovation centered on retail investors (leeks), and look down on conservative institutional investors; but for now, the old channels, PIs, and old money are all familiar to the old guns in traditional finance. If they can move in the same direction, strengthen publicity and integration, Web3.0 in Hong Kong will go further.

Around virtual asset exchanges, in addition to the issue of the number of licenses and rules, there is also the issue of the monopoly of licensed exchanges, which take care of everything. As the Hong Kong RWA of Web2.5, the RWA exchange cannot be both a referee and an athlete, because the ecology of corporate financing and financial asset trading requires a professional market, and the professionalism, risk control, and balance require professional institutions and third-party services, not just relying on a virtual asset exchange.

This means that investment banking talents in Central have a completely new destination, the tokenization of real-world assets and the ecological market it brings. And this destination may be the talent that Europe and the United States will compete for in the future, because Hong Kong is at the forefront of the world in terms of compliance and related infrastructure such as exchanges in STO/RWA, and Hong Kong has no shortage of traditional European and American financial talents.

Although it is Web2.5, there is no construction without destruction. It is impossible to have an improvement or gradual Web3.0 revolution by relying only on traditional financial institutions. The early RWA looks very similar to traditional financial products, but its uplift around blockchain and tokenization is innovative, and the next stage of RWA products will present more innovations in native tokens and crypto financial Lego. Therefore, this requires a group of ambitious people to try and innovate RWA's crypto investment banks, and start investment research on related assets and tracks, tokenized trading, quantitative and market makers of crypto funds, etc. in the early stages of RWA, and become the mainstay of promoting the development of RWA.

RWACrypto Investment Bank

Compared with securities firms and investment banks in the traditional financial market, RWA, as a tokenization of real-world assets, is a sign of mature development, which is the emergence of professional and independent RWA crypto investment banks. These RWA crypto investment banks will have strong brand operation and management capabilities for the RWA track (including real-world assets/industries), and realize the fundraising, investment, management and withdrawal of RWA assets in an investment banking model through crypto industry capital (Crypto RWA Fund), raise Crypto Funds that specialize in investing in RWA, invest in and incubate RWA-related track companies (RWA assets), issue RWA products, continue to operate equity distribution and brand building to achieve RWA premium, continue to acquire real-world assets for RWA expansion or issue new RWA products, realize cash exit, and roll over continuous investment. In the fundraising, investment, management and withdrawal of RWA assets, you can also design your own Token model (native token) based on brand IP or asset governance, equity release and other perspectives.

In traditional financial institutions, there are three main types of investment banks: one is securities firms, such as Hong Kong securities firms. Securities firms that have applied for No. 1 license uplift this time can participate in the RWA product issuance and brokerage underwriting links; the second is investment banks such as Goldman Sachs and Morgan. In addition to simple bonds, RWA can also be a digital IPO of equity-like listing, because IPO investment banking business can also be referenced; the third is industrial capital, which is fully and deeply involved in a certain industry, such as CapitaLand in commercial real estate and Prologis in logistics and warehousing.

The most significant and typical reference for RWA is CapitaLand and Prologis in traditional industrial investment banks. CapitaLand has strong brand operation and management capabilities in commercial real estate and Prologis has strong brand operation and management capabilities in logistics and warehousing. They achieve fundraising, investment, management and exit through the industrial capital investment banking model, and are deployed in stages: private equity funds + industrial management and operation + IPO + REITs, forming a capital cycle. For example, CapitaLand has dozens of private equity funds, corresponding to asset packages at different stages and releasing part of its equity/shares to insurance funds, pension funds, etc.; there are two Singapore listed companies: CapitaLand Group and CapitaLand Investment; and six Singapore REITs are publicly listed and traded. Listed companies and REITs can issue additional shares and mergers and acquisitions as one of the asset exit channels, or list assets separately. Even when adjusting asset allocation strategies, there are very flexible operating methods. For example, in 2021, CapitaLand packaged six Raffles projects in China and released part of its equity to Ping An Insurance to realize more than 30 billion in cash recovery, and then made large-scale acquisitions of new digital economy assets such as first-tier city data centers.

CME + Four Major Grain Traders Model

The "CME + Four Major Grain Traders" industrial investment bank cooperation model is also of special reference significance to RWA.

For example, in the core bulk agricultural product soybean industry, international grain trader capital, represented by the four major transnational grain traders "A, B, C, and D", fully utilizes the pricing power of CME futures trading, as well as Wall Street financial derivatives and capital markets. With the support of the strong capital market and the ample financing of banks in various countries, they manipulate prices to suppress the soybean industry, acquire at low prices, raise prices after monopolizing the industry, promote the purchase of genetically modified soybeans, and completely control China's soybean industry.

China was originally the birthplace of soybeans and has always been the country with the highest soybean production in the world. Now China has become the largest importer of soybeans. In just a few decades, 60% of the world's total soybean production is exported to the Chinese market, but domestic soybean farmers are constantly reducing their planting. The entire soybean industry chain has been controlled by international grain trader capital.

How does international grain trader capital cooperate with exchanges to achieve industrial control?

In the mid-1990s, China basically did not need to import soybeans; in 2001, China opened its soybean market and foreign capital continued to pour in. At this time, through the Chicago Mercantile Exchange, the four major grain traders, ABCD, controlled 73% of the global grain transactions. At the same time, based on the global production supply and demand market information, they manipulated the soybean futures prices of the Chicago Board of Trade (CBOT), which was the pricing benchmark for international soybean trade.

In 2002, 2003, and 2004, multinational grain traders and Wall Street speculators made three consecutive moves in the international futures market to "force warehouses" on Chinese soybean crushing companies; in 2003, soybean prices soared, and Chinese soybean processing companies purchased and stored at high prices; in 2004, soybean prices plummeted, and after encountering crazy suppression from international investment funds, Chinese soybean crushing companies were almost wiped out. The capital of the four major grain traders entered in large numbers through low-cost expansion methods such as equity participation, controlling shares, and acquisitions, and successfully controlled 85% of China's actual soybean processing capacity.

After controlling the processing link, international grain traders began to lock in the source of soybeans and import soybeans from the production areas they controlled; foreign-funded oil-pressing companies began to only purchase genetically modified soybeans, and 90% of genetically modified soybean seeds and pesticides came from Monsanto; international grain traders used contract planting + loan provision + seed fertilizer and agrochemicals in the planting production areas (Latin America) to indirectly control the planting link.

The four major grain traders began to manipulate the pricing power of edible oils, and have controlled more than 75% of the raw materials, processing and edible oil supply in China's oil and fat market. Among the 97 large oil and fat companies in China, multinational grain traders have participated in and controlled 64 of them. With international capital, they have basically completed absolute control over the upstream, midstream and downstream.

In 2011 and later, China's imported soybeans accounted for more than 80%, and the import volume gradually reached 1/3 of the world's total imports. So far, the four major grain traders who control 90% of the world's soybean trade have controlled more than 60% of China's actual crushing capacity and also monopolized 80% of China's imported soybean sources.

These international grain traders’ industrial capital buys cheap soybeans from South America and soybeans that enjoy huge agricultural subsidies from the United States, and then resells them to crushing companies in China at high prices to earn monopoly trade profits. “South Americans grow soybeans, Chinese buy soybeans, and Americans sell soybeans and decide the price” is a true portrayal of the soybean industry.

From the soybean industry case, we are prompted to understand the power of the industrial investment banking model. The four major grain traders are based on the commodity grain dollar (international trade dollar settlement) to carry out global full industrial chain layout, control 80% of the world’s grain trading volume and market information data, and at the same time, they work in a two-pronged approach in the global agricultural product spot and futures trading and other financial fields, arbitrage between futures and spot, and jointly participate in financial transactions with the capital market that controls pricing power, and ultimately achieve the continuous upgrading of the strategy of “transaction-futures-finance-capital-full industrial chain”.

RWADigital Investment Bank's Business

From the name point of view, is it more convenient to call it Crypto Investment Bank or Digital Investment Bank?

In general, the core of the development of the RWA ecosystem is that for asset parties, funding parties, and institutional clients, RWA must be able to combine tokenization, virtual asset exchanges, and smart contracts to provide them with incremental returns, which is something that is not available or cannot be achieved in traditional financing. Only in this way can it continue to grow and promote the expansion and maturity of the RWA ecosystem, which happens to be the value of the existence of RWA digital investment banks.

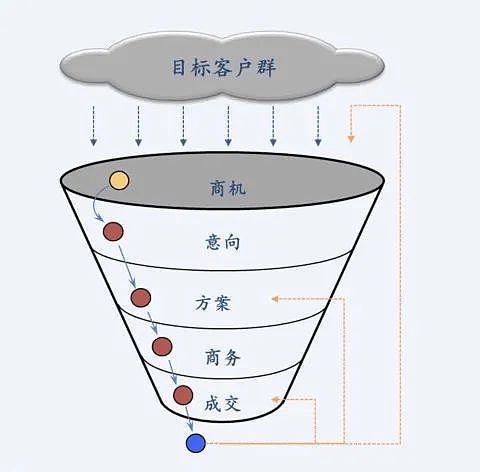

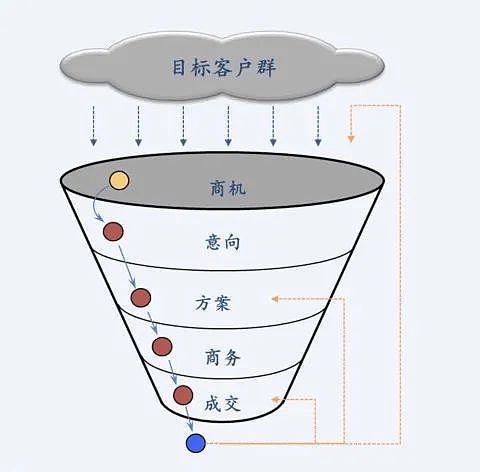

The 2B market around the corporate financing service ecosystem is a big funnel. The positioning of RWA digital investment bank is very critical. We cannot just focus on the part of issuing and listing coins. That part is the core concern of the exchange. From the market funnel of the entire crypto enterprise financing, the early target customer group's publicity and education, related meetings, investment and financing courses, etc., to professional investment research reports and in-depth analysis of the track, and then to the discussion and exchange of specific asset tokenization plans of intended enterprises, and then to the roadshow and communication with channels and sources of funds interested in RWA assets and products, and further to the specific tokenization guidance and investment consulting business. Finally, in addition to listing coins and exchanges, there are also quantitative and market making in the secondary market, etc.

RWA digital investment bank must be a cross-border model, talents and business models are cross-border, and it needs to have the experience of integrating traditional finance, crypto assets, and Web3.0. Without cross-border, it is difficult for you to coordinate and run-in the synergy between 2.0 or even 1.0 and 3.0 from the perspective of 2.5.

RWA digital investment banks also need to have traditional securities firms or investment banks’ channels and be familiar with the traditional institutional market. In this way, they can quickly start with new product promotion and trial investment based on traditional channels and institutional markets, and then continue to promote its uplift to become the pioneer of RWA asset tokenization track.

RWA digital investment banks’ coaching, incubation and investment consulting functions are currently lacking and urgently needed. They cannot rely solely on licensed exchanges. Licensed securities firms may also be restricted by traditional constraints. Without truly innovative digital investment banks, RWA will always compromise and languish.

Of course, Web3.0 will have many new ways to play, and so will RWA. For example, the design of cash flow tokenization, the design of liquidity, and the design of native tokens and crypto-financial Lego based on RWA assets are all good directions and the core magic weapon of RWA digital investment banks in the future.

At present, it is necessary to cultivate or create one or a group of influential and consensus-building RWA digital investment banks as a banner.

Just like traditional stock market investment, people generally look at CICC's investment research reports, which are produced by an investment research center with nearly a thousand people and related research personnel. If RWA products become more abundant, then the RWA encrypted "stock market" also needs a digital "CICC".

Weiliang

Weiliang