What is DeSci / Pump Science? What do the popular tokens mean?

You who hype memes are like civets in a melon field, wandering back and forth between the zoo/AI/DeSci.

JinseFinance

JinseFinance

Part.1 Insight

How to price fair valuation (FDV) of projects in irrational markets

The recent popularity of "Flowers" has demonstrated capital to the audience The secrets of the market, especially the last scene when different characters buy and sell stocks and change market liquidity to affect stock prices and their own profits and losses. These plots not only reveal the complexity of the stock market, but also reflect the different risks that investors face in the market.

Misestimation of market capitalization is very common in the traditional financial world, especially during the dot-com bubble, when liquid stocks were relatively limited and many companies' stock prices were inflated. Valuation, while actual assets and profitability do not support such a market value, leading to market instability and eventual collapse.

A similar situation also exists in the current cryptocurrency field. Due to the emerging nature and immaturity of the crypto market, coupled with imperfect regulation, the market is more susceptible to price manipulation and speculation. In this environment, it is important to understand the true value of assets.

Introduction

For newcomers, Cryptocurrency II Words such as Circulating Supply, Total Supply, Maximum Supply and Market Capitalization in the secondary market are usually the first things they come into contact with. These concepts are crucial in understanding the dynamics of cryptoassets. Circulating supply is the amount of currency currently in public hands and available for transactions. The total supply further develops to include all coins minted, minus coins no longer available. Maximum supply represents the absolute limit of money that will ever exist and is a key indicator of a currency's potential scarcity. Market capitalization is typically calculated by multiplying a currency's current price by its circulating supply, providing information about its market value.

These metrics are very informative numbers; they are an essential tool for assessing the health and potential of a cryptocurrency. When exploring a protocol’s tokenomics, we often come across detailed currency allocations, but translating this information into actionable insights into different types of currencies can be challenging. Here, the concept of Fully Diluted Value becomes relevant. It estimates a project’s market capitalization by assuming its token supply is fully circulating, thus providing a broader perspective on the long-term market potential. However, using today's prices to calculate future fully diluted value is problematic and often provides limited information because it ignores how market dynamics may change over time. How do we efficiently calculate different categories of currency and decide whether to include them in our calculations?

To illustrate this issue, Optimism and Arbitrum might be a good case study. When conducting a market cap calculation on Optimism, we found that its description of the uses of different tokens is quite complex. This article aims to tease out these categories and provide suggested treatments for each. We need an objective way to measure the current market valuation assigned to a specific project, regardless of whether this token has inflationary or deflationary dynamics in the future. We wanted to answer some simple questions, like how should we decide the market capitalization of a project, and based on the valuation method, which project is currently more popular on the market, Arbitrum or Optimism?

The discussion will unfold in the following manner, starting with an analysis of the various types of currencies that should be considered in our valuation calculations. This will include an examination of their respective functions, processing methods, and the rationale behind these choices. We will then map these currency types against the specific categories outlined in [Optimism] and [Aribitrum]’s Token Economics.

Token Type

Be clear on how to handle each Before categories, let’s get some consensus on what the circulating supply, total supply, and maximum supply of Optimism are.

Based on the definition of [Optimism] and [Table Record of Optimism], the long-term maximum supply of OP tokens is expected to be approximately 4.3 billion. Optimism defines the circulating supply as the number of OP tokens that circulate freely without any transfer restrictions. The total supply includes not only these circulating tokens, but also tokens governed by specific distribution plans. Currently, the circulating supply is 911 million, while the total supply, including distribution-controlled tokens, is around 2.2 billion. The illustration is as follows:

When calculating market cap, people usually only consider the circulating supply. But it's not a comprehensive measure. Let's break this diagram into three parts and discuss what should be done with them.

Type 1:

In block Currencies circulating in the chain

Definition: These are the currencies in the blockchain ecosystem Currencies actively traded within the system.

Whether to be included in the market capitalization calculation: Yes

Reason: These currencies have active market value and are an important part of the blockchain economy.

Uncirculated currency:

Distinguish between different types of illiquid currencies: Although these currencies are not currently in circulation, they are reserved for specific roles and have the potential to impact the future value of the blockchain. Therefore, when considering including them in our circulating supply calculations, it is key to examine the conditions under which these currencies will be distributed and evaluate their potential impact on the ecosystem. More specifically, the key question to consider is whether the circulation of these currencies is used to reward community contributions that benefit the ecosystem, or whether they are distributed because they fund projects. For example, regarding investors' locked-in shares, this situation can be compared to the real world: when the company goes public, the founders will have a lock-up period, but when calculating the uncirculated shares, we still consider this part, although this may not be consistent with the market. Liquidity does not match.

Type 2:

Assignment but" Locked” currency

Definition: Normally, not included in circulation The total supply portion of the supply is primarily held by core contributors and investors, what Optimism calls “sugar xaddies.” Tokens allocated to contributors and investors are currently locked, but according to the planned timeline, they will be unlocked and tradable in the future.

Whether to be included in the market capitalization calculation: Yes

Reason: These tokens have been allocated and sooner or later they will be tradable whether the project gets better or worse in the future.

Type 3:

Unallocated currency

Definition: Normally , the portion of the total supply not included in the circulating supply is primarily held by the Optimism Foundation. They reserve this portion of the tokens for future distribution to developers, contributors, and other important stakeholders to reward them for their contributions to the project.

Include in market capitalization calculations: No, until they are assigned

Reason: These tokens are primarily held by the Optimism Foundation for future investment and will not be distributed if no value is generated in the future.

More specific examples:

The previous discussion may have been a bit obscure, so in the following sections we would like to discuss different scenarios. These cases may not happen in the OP's situation.

1. Paying employees: This type of use should be accounted for after it occurs. Compared to tokens locked for contributors, this situation is more autonomous and we don't know what will happen in the future.

2. Exchanging tokens for USDC and selling them to the market: This type of transaction should also be recorded after it occurs. But we have to remember that this will also inflate the asset side of the balance sheet (just like selling treasury stock on the stock market). This is an act of value exchange rather than value creation.

3. Allocate tokens to ecosystem projects: This is an investment in the future of the ecosystem, usually autonomous and well thought out . Therefore, once a certain distribution is granted, it should be included in the market capitalization calculation.

4. Airdrop tokens to users: This is an investment in its users, either to gain their loyalty or is to market its agreement, and once that happens, that should be factored into it.

5. Burn tokens: these should be deducted from the calculation as they will no longer be active in the future

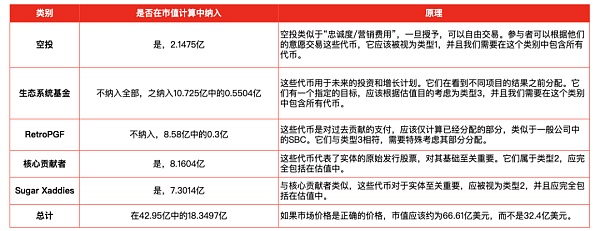

Map to the specific category of Optimism

Click This page (https://cryptorank.io/price/optimism/vesting) to see how Optimism allocates its tokens and how.

Airdrop-Type 1

Whether to be included in the market capitalization calculation: Yes

Reason: Airdrops are similar to "loyalty" Degrees/Marketing Fees” and are freely tradable once granted. Participants can freely trade these tokens; they should be considered Type 1 and we need to include all tokens in this category. Prior to distribution, these tokens are held by the Optimism Foundation (Type 3). There has been a lot of discussion around the allocation conditions on the forum (https://gov.optimism.io/t/treasury-appropriation-proposal-foundation-year-2-budget/5979/6). An important metric is return on investment (ROI).

Ecosystem Fund-Type 3

Whether to be included in market capitalization calculations: Not included until distribution

Why: Within this category there are four distinct subcategories: governance funds, partner funds, seed funds, and unallocated funds. Based on the information provided by [cryptorank](https://cryptorank.io/price/optimism/vesting) we can conclude that partners, seeds and unallocated funds are not tracked and therefore are not counted as tokens in circulation currency. A portion of the governance fund is considered a token in circulation. This is the right decision. These tokens are used for future investment and growth plans. They should be accounted for after any distribution is announced.

RetroPGF-Type 3

Whether to be included in market capitalization calculations: Not included until allocation

Reason: RetroPGF tokens represent payment for past contributions and should be included in valuation calculations after any distribution is announced. But such inclusion should be limited to the amount already allocated. Because allocations through this channel are voted on regularly, based on people's contributions, just like a company outsourcing projects to other external entities. This approach ensures that contributions are appropriately recognized and rewarded, aligning incentives with the growth and success of the community. Moreover, this type of fund is sure to have the highest return on investment (ROI) for this ecosystem, because rather than buying a promise of the future, it feels more like compensation for outstanding achievements.

Nature and distribution of RetroPGF: RetroPGF, conceived by Vitalik Buterin, operates on the principle of rewarding past rather than expected contributions. Governed by a DAO (Decentralized Autonomous Organization), it will retroactively fund projects of value to the community. The allocation of these funds is handled by the DAO, known as the "outcome oracle", which allocates rewards based on past performance and impact.

Core Contributor-Type 2

Whether to be included in the market capitalization calculation: Yes

Why: These tokens represent the entity's original issued shares and are critical to its foundation. They are type 2 and should be fully included in the valuation. Although they have a "lock-up" period, think of them as IPO lock-ups that restrict core members from selling shares within a certain period. This will not affect their holdings regardless of future events. These stock grants are rewards for their past actions and contributions to ecosystem building. Even if they cease active participation, their holdings will continue to increase as planned.

Sugar Xaddies-Type 2

Whether to be included in the market value calculation: Yes

Reason: Similar to core contributors, these tokens are critical to the entity and should be considered Type 2 and therefore fully included in the valuation.

Mapped to specific categories of Arbitrum

Click this page (https://arbitrum.foundation/) to see how Optimism distributes its tokens and how.

DAO Treasury-Type 3

Include in market capitalization calculations: Not included until allocation

Reason: Arbitrum It is described as "used to fund the ongoing development and maintenance of the organization and its technology." Therefore, the distribution of these tokens should be considered a one-time cost or investment. Prior to any deployment, these tokens are not in circulation and generate no value.

Teams and Consultants - Type 2

Whether to be included in the market capitalization calculation: Yes

Reason: Same as Optimism

Investor-Type 2

Whether to be included in the market capitalization calculation: Yes

Reason: Same as Optimism

Airdrop-Type 1< /p>

Whether to be included in the market value calculation: Yes

Reason: Same as Optimism

In the Arbitrum ecosystem DAO-type 1

Whether to be included in the market capitalization calculation: Yes< /p>

Principle: These tokens have been allocated to different DAOs, and they will have independent choices on how to allocate these tokens. Therefore, we can think of these tokens as a two-step airdrop (from Aribitrum to the DAO, then from the DAO to the users). Therefore, Arbitrum has no control over these tokens.

The following is a summary of the above:

Table 1: Token types classified according to functions

Table 2: Matching Optimism token economics to different types

Table 3: Matching Aribitrum token economics to different types

Table 4: Single-day fundamental comparison between Optimism and Arbitrum 2024.1.14 (data provided by GrowThePie)

Summary

New Crypto projects often face the challenge of low circulating supply. Market cap calculations focus primarily on circulating supply and often overlook tokens earmarked for future use. This can lead to inaccurate market capitalization data and raise issues such as potential supply manipulation, complicating accurate assessment of project valuations. The situation is further complicated when secondary market traders focus on circulating market cap and may overlook the large allocation of tokens reserved for the future.

To address these challenges, the goal is to establish a method to assess a project's current market valuation, regardless of its future dynamics. This aims to provide clear answers, such as comparing the market capitalization of projects like Arbitrum and Optimism.

In addressing this issue, it is critical to define the principles that guide market capitalization calculations. These principles should be consistent with the value that each token can generate. For example, tokens allocated for employees, VCs, and airdrops should be included in market cap calculations regardless of their locked status, as they have specific uses. Conversely, tokens reserved for future undefined use shall not be considered future supply until their intended use becomes apparent.

Applying these principles will yield general rules for token classification. Tokens with a clear purpose and allocation, intended for VCs, the community, employees or developers, should be included in the market capitalization. But discounts can be applied to account for long-term release plans. Conversely, tokens lacking a specific allocation should be dismissed from consideration until their intended use becomes apparent. Ecosystem funds and reserves are examples of these.

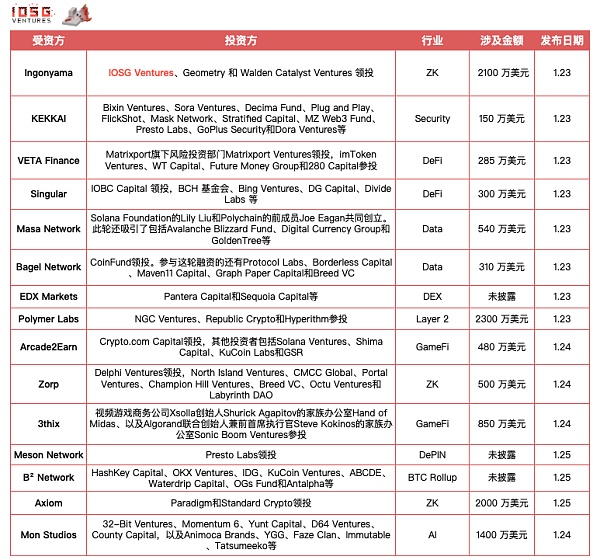

Part.2 Investment and FinancingEvents

Ingonyama, a zero-knowledge proof technology company, completed a $21 million seed round of financing, led by IOSG Ventures and others

* ZK

Ingonyama, an innovative company focused on accelerating and popularizing zero-knowledge proof technology, has completed a $21 million seed round of financing. This round of financing was led by IOSG Ventures, Geometry and Walden Catalyst Ventures led the investment. IOSG Ventures is committed to supporting projects that make breakthrough progress in ZK technology innovation and application development, and will reach a long-term partnership with Ingonyama to focus on broader ZK technology development.

Ingonyama is currently focusing on improving the capabilities of zero-knowledge proofs (ZKP) through the product ICICLE. ICICLE accelerates ZKP computation on GPUs and aims to make ZKP faster, more accessible, and cost-effective. In the future, Ingonyama plans to continue to develop and optimize ZKP technology and expand its application scope, not only in the blockchain field, but also in more industries that require a high degree of privacy and security. At the same time, establish a wider range of developers to promote the popularization and application innovation of ZKP technology.

Web3 security company KEKKAI completes US$1.5 million in seed round financing

* Security

Web3 security company KEKKAI announced the completion of a $1.5 million seed round of financing from Bixin Ventures, Sora Ventures, Decima Fund, Plug and Play, FlickShot, Mask Network, Stratified Capital, and MZ Web3 Fund , Presto Labs, GoPlus Security and Dora Ventures participated in the investment. The funds raised will be used to deepen and improve its product line, including the existing KEKKAI Plugin and the newly launched KEKKAI Mobile application.

On-chain financial platform VETA Finance completed strategic financing of US$2.85 million

* DeFi

VETA Finance, an on-chain financial platform, is The official blog announced the completion of US$2.85 million in strategic financing, led by Matrixport Ventures, the venture capital arm of Matrixport, with participation from imToken Ventures, WT Capital, Future Money Group and 280 Capital.

NFT cross-chain lending protocol Singular completes US$3 million in seed round financing

* DeFi

Singular, the first NFT cross-chain lending protocol that supports the BTC ecosystem, is announced Completed US$3 million in seed round financing, led by IOBC Capital, followed by BCH Foundation, Bing Ventures, DG Capital, Divide Labs, etc. In addition, in order to further enhance the rights and interests of users, Singular will also soon issue the first full-chain PFP project with certificate attributes - Golden Chipmunk, which can realize real-time cross-transfer on BTC, ETH, and Layer2 multi-chains, allowing NFT to get rid of the opposition. dependence on the chain itself to obtain better liquidity. At the same time, as Singular’s token, in addition to bringing exclusive identity to users, it will also enjoy many benefits such as agreement rate discounts and future airdrops.

Masa Network completed US$5.4 million in seed round financing

* Data

Masa Network successfully raised US$5.4 million in seed funding round of funding to build a decentralized network on Avalanche focused on users’ personal data. The investment round was led by Anagram, the venture capital firm co-founded by Lily Liu of the Solana Foundation and Joe Eagan, a former member of Polychain. The round also attracted participation from high-profile investors including Avalanche Blizzard Fund, Digital Currency Group and GoldenTree. The funds will be used to launch Masa's subnet on Avalanche this year. This custom blockchain is designed to handle large amounts of zero-knowledge encrypted data. This seed round follows Masa’s $3.5 million pre-seed round in 2022, bringing its total funding to approximately $9 million.

Bagel Network completes US$3.1 million in pre-seed financing

* Data

Bagel Network has raised a pre-seed funding round It raised US$3.1 million, led by CoinFund. Also participating in the round were Protocol Labs, Borderless Capital, Maven11 Capital, Graph Paper Capital and Breed VC. Bagel Network plans to solve the data monopoly problem by creating a marketplace that allows data scientists and AI engineers to exchange and authorize verifiable data sets in a cost-effective and privacy-preserving manner.

EDX Markets completed its second round of financing co-led by Pantera Capital and Sequoia Capital

* DEX

By Citadel Securities and Fidelity Digital Assets-backed crypto trading platform EDX Markets is building an exchange in Singapore and plans to expand its reach to offer spot and perpetual futures trading after securing additional funding from investors including Pantera Capital and Sequoia Capital. EDX Markets has completed an undisclosed second round of financing co-led by new investor Pantera Capital and existing backer Sequoia Capital. CEO Jamil Nazarali said the funds will be used to build new technologies and expand EDX’s presence in overseas markets.

Ethereum Layer 2 developer Polymer Labs completed $23 million in Series A financing

* Layer 2

Ethereum Layer 2 Development company Polymer Labs has raised $23 million in its Series A funding round. The round was co-led by Blockchain Capital, Maven 11 and Distributed Global, with participation from Coinbase Ventures, Placeholder, Digital Currency Group, North Island Ventures and Figment Capital.

Wanzhuan gaming platform Arcade2Earn completed US$4.8 million in financing

* GameFi

Arcade2Earn, a gaming platform that earns money, completes US$4.8 million The private token financing round was led by Crypto.com Capital, with other investors including Solana Ventures, Shima Capital, KuCoin Labs and GSR. Josh Poole, co-founder and CEO of Arcade2Earn, said that the gaming platform will also conduct a public token sale on February 27, and will sell 15 million ARC tokens, accounting for 20% of the total supply (800 million tokens) 1.875%. In addition, Arcade2Earn has no plans to conduct more public token sales in the near future, and tokens will be distributed through other methods such as community incentive programs.

ZK development company Zorp completed a US$5 million seed round of financing

* ZK

ZK-L1 Network Nockchain Development Company Zorp Announced the completion of a US$5 million seed round of financing on the It is reported that Zorp is building Nockchain as a high-throughput chain that provides proof of computing, storage and new namespaces. Zorp leverages Nock to build a combiner-based virtual machine that can be used efficiently with zero-knowledge proofs. Nockchain is a proof-of-work based blockchain that sits on top of its ZKVM.

Web3 game monetization platform 3thix completed US$8.5 million in financing

* GameFi

Web3 game monetization platform 3thix completes 850 In financing of US$10,000, Hand of Midas, the family office of Shurick Agapitov, founder of video game commerce company Xsolla, and Sonic Boom Ventures, the family office of Steve Kokinos, co-founder and former CEO of Algorand, participated in the investment.

The decentralized physical network Meson Network completed strategic financing led by Presto Labs

* DePIN

Decentralized The physical network Meson Network announced on the X platform that it has completed a new round of strategic financing led by Presto Labs, with a valuation of US$1 billion. The specific amount of financing was not disclosed. Meson Network says it focuses on DePIN+AI and has more than 100,000 active nodes in more than 150 countries.

B² Network completes seed round financing

* BTC Roll up

B² Network announced that it has successfully completed the seed round of financing and obtained It has received support from well-known investors including HashKey Capital, OKX Ventures, IDG, KuCoin Ventures, ABCDE, Waterdrip Capital, OGs Fund and Antalpha.

Axiom completed US$20 million in Series A financing

< strong>* ZK

Ethereum historical data protocol Axiom announced the completion of the project by Paradigm and a $20 million Series A round led by Standard Crypto. Robot Ventures, Ethereal Ventures, Hasu from Flashbots, Sandy, Ye and Haichen from Scroll, Alex from OpenSea, Sreeram and Calvin from EigenLabs, Liam from Optimism/ETH Global, Collin from Obol, Lakshman from Personae, Stephen and Jazzy from Zellic, Brendan and Daniel from Polygon, Zac and Joe from Aztec provided support. The funding will be used to expand the team and accelerate the development of its core zero-knowledge (ZK) platform, which is designed to empower smart contract developers to build data-rich on-chain applications. Axiom’s latest announcement comes on the heels of its latest V2 upgrade, which is focused on making the protocol more useful for smart contract developers.

Chain game developer Mon Studios completed US$1.35 million in financing

* GameFi

Developer of the MMORPG game "Spellborne" Mon Studios announced the completion of $1.35 million in strategic financing. Participants in this round of financing include 32-Bit Ventures, Momentum 6, Yunt Capital, D64 Ventures, County Capital, as well as founders and executives from Animoca Brands, YGG, Faze Clan, Immutable, Tatsumeeko and other companies. The funds will be used to continue the development of the multiplayer online role-playing game "Spellborne".

Part.3 IOSG post-investment Project Progress

MetaMask launches Ethereum validator node powered by Consensys Staking function

* Staking

MetaMask has introduced a new feature that allows users to run Ethereum validator nodes through Consensys Staking. This service is open to users willing to stake at least 32 ETH. This new staking service from MetaMask promises to require no pooling of funds and no hardware or software requirements. The user's 32 ETH stake will be used to run a validator node through the Consensys Staking service, which currently operates validators representing approximately 4% of all staked ETH.

MetaMask currently promises an annualized return of approximately 4%, after deducting a 10% fee from the rewards earned. MetaMask also offers pooled staking through popular providers Lido and RocketPool, although currently advertised rewards are lower at 3.53% and 3.14% respectively.

It was reported last week that MetaMask launched a pledged Ethereum agent running validator service through MetaMask Portfolio.

EigenLayer plans to provide a "shared security" model for DApps

* Staking

Ethereum re-pledge protocol EigenLayer plans to adopt " Shared Security” system, a mechanism that allows protocols to join the network by leveraging a public ETH staking pool. In the future, the team intends to promote the project to a major decentralized application platform and leverage so-called shared security to enable other projects to launch. This version will enable the ETH re-staking amount on EigenLayer (currently over $1.7 billion) to be made available to all services developed on the network simultaneously to enable a common security mechanism. This would make it financially impossible for attackers to destroy any given protocol.

Although the mechanisms vary widely, projects such as Polkadot have introduced this type of shared security model before. Polkadot is a blockchain ecosystem secured by a relay chain and a native token called DOT, and EigenLayer will enable ETH stakeholders and holders of ETH Liquid Staked Tokens (LST) to re-stake these assets, To economically secure blockchains or services that don’t necessarily run on Ethereum.

The Cosmos Hub community has rejected the on-chain vote for the proposal "Set the minimum inflation rate to 0%"

* Layer 1

The Cosmos Hub community has rejected the on-chain vote for the proposal "Set the minimum inflation rate to 0%". It is reported that due to the recent ATOM halving event, the current inflation rate is between 7% and 10%. The proposal aims to remove the 7% floor, which would make ATOM a scarcer asset.

Avalanche Foundation announces "eligibility framework" for Meme coin purchases

* Layer 1

Avalanche Foundation announced New rules for purchasing Meme tokens. According to the published “eligibility framework,” only Meme tokens native to the Avalanche blockchain are eligible for consideration. This means that tokens allocated for a team reserve, or tokens cloned on other blockchains, will not be accepted, while requiring the founding team to relinquish ownership of the minting contract.

In addition, Foundation will not favor tokens that are hoarded by large whales, launched without review by security companies, or without a whitelist. Although there is some flexibility in the rules, it does not mean that meeting these conditions guarantees a purchase. The minimum criteria that must be met as of January 2024 include:

At least 2,000 holdings holders, among which the top 100 holders shall not exceed 60% of the total supply

Liquidity exceeding US$200,000, consisting of At least 50 providers offer

At least $1 million in market capitalization

Average daily trading volume of at least $100,000 within two weeks

Finally, Meme tokens need to exist for at least a month to give the community time to learn about and understand the token.

AltLayer: Three categories of EigenLayer users are eligible for airdrops

* Restaking

, Rollup as a service protocol AltLayer on the X platform Announce the specific information of airdropping ALT to EigenLayer re-stakers. The following three types of users are eligible to receive airdrops: 1. Users who directly pledge ETH through EigenPod; 2. Lido, Swell, Rocket Pool, Stader Labs, Coinbase, and Binance through EigenLayer , StakeWise, Origin Protocol, and Ankr who re-stake LST; 3. Users who pledge LRT through Renzo, ether.fi, and Kelp DAO on EigenLayer.

Noble partners with Hashnote to launch tokenized U.S. bond income fund USYC on Cosmos

* Layer 1

Block Chain project Noble has partnered with asset management company Hashnote to launch tokenized physical asset products in the Cosmos ecosystem. The first product is USYC, a short-term income fund that includes U.S. Treasury notes. The Cosmos ecosystem currently includes more than 80 blockchains with a total market capitalization of more than $45 billion. As the first cross-chain physical asset on Cosmos, USYC is expected to be used as collateral in DeFi applications. Noble emphasized that USYC will provide a “T+1 redemption” guarantee to enhance investors’ flexibility.

Report: Polygon to "acquire" almost as many users as Ethereum in 2023

* Layer 1

According to blockchain analytics firm Flipside, the Polygon network will “acquire” almost as many crypto users as Ethereum in 2023. Polygon, the Ethereum expansion solution, has 15.24 million users in 2023, which is about 160,000 less than Ethereum’s 15.4 million.

Flipside defines "acquired" users as those who have made at least two transactions on a specific blockchain, at least one of which occurred in 2023. Interestingly, Polygon led the first half of 2023 but was eventually overtaken by Ethereum, which maintained its lead throughout the second half. Flipside explained: "Polygon kicked off the new year with 2.8 million new users in January, accounting for more than 40% of the network's total new users in 2023."

In addition, Bitcoin ranked third with 10.65 million new users, while Solana and Arbitrum rounded out the top five. The eight blockchains tracked recorded a total of 62 million new users, which also included Optimism, Avalanche, and Base. Flipside noted that overall, user acquisition peaked in May and then gradually declined.

Polygon zkEVM plans new upgrade that will introduce a paradigm shift for developers

* Layer 1

Polygon zkEVM previewed New Etrog upgrade, ready to introduce a paradigm shift for smart contract-based developers. This upgrade will make Polygon zkEVM a Type 2 ZK-EM, which will enable developers to deploy their code on Polygon zk-EVM just like on Ethereum. With this update, developers can simply copy and paste the code without making additional modifications. According to an update shared, the 10-day timelock for the Etrog upgrade has been triggered and Polygon developers can join the testing phase of Cardona, Polygon-zkEVM’s new Sepolia-anchored testnet.

Part.4 Industry Pulse

Horizen: ZEN 5.0.0 will perform a network upgrade on the mainnet via a hard fork on February 7

* Privacy

Web3.0 privacy platform Horizen said on the After the hard fork, users will no longer be able to conduct any transactions involving blocked addresses. Officials recommend moving funds out of the shielded pool before then and not depositing funds directly from the shielded address into the trading platform wallet.

The Rari Foundation has launched the Rari Chain mainnet on Arbitrum

* EVM

The Rari Foundation representing Rari DAO has Rari Chain mainnet launched on Arbitrum. Rari Chain is an Arbitrum-based EVM equivalent chain designed to protect NFT royalties by embedding royalties at the node level. It is a Layer 3 chain, meaning it enhances Layer 2 Arbitrum’s scalability and other features to enhance the NFT ecosystem. Rari Chain’s testnet was launched on November 30, 2023. About 46,000 wallet addresses participated in the testnet and approximately 251,000 transactions were conducted.

De.Fi has been connected to OKX Web3 wallet

* DeFi

De.Fi is now connected to OKX Web3 wallet , users can use the OKX Web3 wallet to transfer and exchange encrypted assets in De.Fi, view and scan the risk levels and governance types of smart contracts and ordinary tokens or NFTs, explore Yields investment opportunities, experience the DeFi project audit database for free, and pass Launchpad explores investment opportunities, etc. De.Fi is a Web3 social and antivirus application that provides users with in-depth analysis focused on decentralized financial security as well as powerful investment tools to help users analyze the vast cryptocurrency market and more.

Solana-based DeFi protocol Drift announces points reward plan before token launch

* DeFi

Based on the Solana block Drift Protocol, the largest perpetual futures trading platform on the blockchain, has announced a user rewards program as preparation for its token issuance. The rewards program, called Drift Points, starts today and will run through March. According to Drift Protocol co-founder Cindy Leow, approximately 100 million Drift points will be issued every month, and these points will be distributed based on users’ proportional trading volume and other activities on Drift (such as market making and providing liquidity). Drift has taken multiple checkpoints and snapshots of previous participants to reward them for their activity.

Drift is about to launch a governance token as the first step in the transition to community ownership. Token holders will elect a risk committee to manage the protocol’s upgrade rights. The committee will determine features such as fees and protocol technical parameters. Leow said that Drift tokens are expected to be released shortly after the end of the points program in March, but she did not disclose how to airdrop Drift tokens to users based on Drift points, only that there will be a connection between the two.

The sales of NBA star Howard’s NFT series are dismal, and Ava Labs officially distances itself from the project

* NFT

NBA stars Dwight Howard announced last week that he will launch a limited collection of 3,000 NFTs "Ballers by Dwight Howard" on the Avalanche Network. The casting cost of each NFT is 2 AVAX. It attracted only a handful of buyers after its debut. One day later, only 10% of the collection had been sold.

Less than 24 hours after the collection was minted, Howard announced that Ballers would be significantly redesigned. In order to attract more collectors, he promised to mint 100 pieces per ball. For additional Baller NFTs, he will personally send 1 AVAX to 10 different Ballers holders. Additionally, Howard promised that for every 100 Ballers NFTs minted, he would purchase one NFT from the popular Dokyoworld project. Afterwards, Howard reduced the total supply of "Ballers" NFT from 3,000 to 1,500.

Fusionist launches new MOBA chain game ACE Arena

* GameFi

Chain game Fusionist announced on the X platform that its launch ACE Arena, a new pixel style MOBA-like chain game, is powered by Unity. ACE Arena will only use ACE tokens. Players can earn ACEs and accumulate points for more rewards.

The market shows that the price of ACE touched US$9.284 in a short period of time and has now fallen back to US$8.8352, with a 24-hour increase of 8.95%.

Web3 game social platform GamerBoom reached a cooperation with Linea and was invited to participate in Linea Park

* GameFi

Web3 game social platform GamerBoom announced an official partnership with Linea, the zkEVM L2 network launched by Consensys, and was invited to participate in the Linea Park: Social & Gaming Voyage event. In the future, the two parties will also carry out a series of in-depth cooperation around Linea's ecological construction.

GamerBoom aims to create a Web3 game social platform based on many Web2 mainstream games, allowing players to obtain high-quality social experience and Rich Web3 rewards. It is reported that it will launch the industry's first play-to-earn product based on mainstream Web2 games in Q1 of 2024. The first batch of supported games include League of Legends (including Teamfight Tactics), Valorant (Fearless Pioneer) and Dota2. .

The Hong Kong Securities and Futures Commission released the "Strategic Focus from 2024 to 2026": It will provide regulatory guidance on new virtual asset activities

* legal

The Hong Kong Securities and Futures Commission released the "Strategic Focus from 2024 to 2026", which mainly includes: 1. Maintaining market resilience and mitigating serious damage to the market; 2. Improving the global competitiveness and attractiveness of market capital; 3. Lead the transformation of the financial market with technology and ESG (ie environment, society and governance); 4. Improve institutional resilience and operating efficiency.

In terms of virtual assets, the Hong Kong Securities and Futures Commission will provide regulatory guidance on new virtual asset activities and promote the development of the regulatory system for virtual asset trading platforms. While supporting the tokenization of traditional products, we will protect the interests of investors by using blockchain and Web3 basic technologies to promote the establishment of a responsible and secure financial technology ecosystem and establish closer ties with local and international law enforcement agencies to combat crime. .

You who hype memes are like civets in a melon field, wandering back and forth between the zoo/AI/DeSci.

JinseFinance

JinseFinanceFractal Bitcoin is an innovative blockchain expansion solution based on recursive virtualization technology that enhances Bitcoin's scalability by creating a multi-layer network structure while maintaining a secure connection to the main network.

JinseFinance

JinseFinanceThe difference between Based Rollup and traditional Rollup.

JinseFinance

JinseFinanceBy using Ethereum for sorting, Taiko aims to be more decentralized than Rollups that use centralized sorters, which describes the situation for most L2s today.

JinseFinance

JinseFinanceAvalanche’s mission is to “tokenize all the world’s assets.”

JinseFinance

JinseFinanceETC, the full name of which is “Ethereum Classic”, can be translated into Chinese as “Ethereum Classic”. It is an open source blockchain platform that can be used to write decentralized applications (DApp) run and driven by smart contracts.

JinseFinance

JinseFinanceAOVM is an AI layer protocol built on top of @aoTheComputer, combining AO's hyper-parallelism with AI large models.

JinseFinance

JinseFinanceDencun includes 9 EIPs that enhance everything from security to the staking experience.

JinseFinance

JinseFinanceAs a product of its times, Dogecoin has its own set of problems. DogeLayer is here to fix just that.

Max Ng

Max Ng Cointelegraph

Cointelegraph