Author: Stacy Muur, Crypto Researcher; Translation: Jinse Finance xiaozou

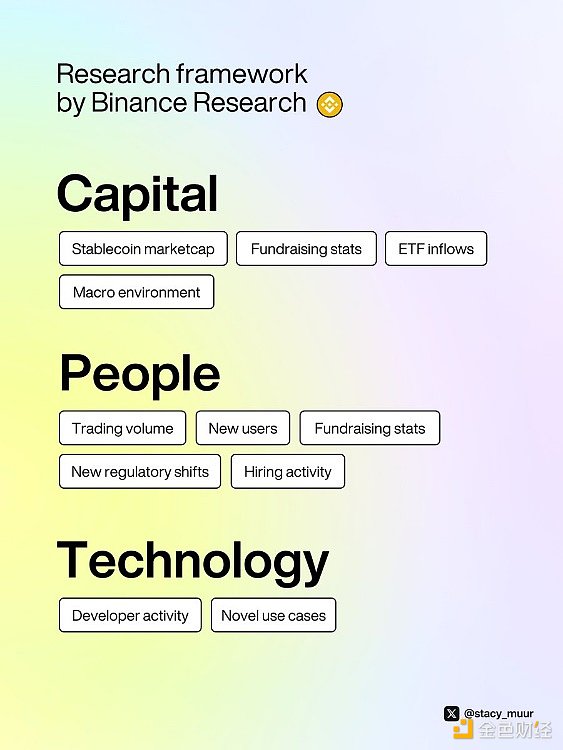

Researchers at Binance recently launched their CPT (Capital, People, Technology) framework. According to the report "What's Driving the Crypto Market?" released by Binance Research, the main structural drivers to watch are as follows.

The framework proposed by Binance Research examines the market from three key perspectives:

· Capital: Inflows from retail investors, venture capital, and traditional finance.

· People: Providing opportunities for individuals to actively participate and make money.

· Technology: innovation and development activities.

Part 1: Capital

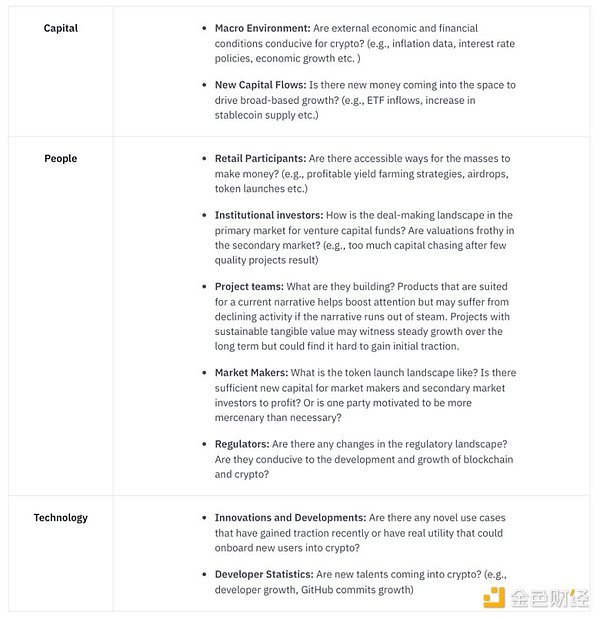

New capital is critical to the broad sustainable growth of the crypto market. Without new inflows, investors must compete for returns in a zero-sum game, resulting in some people benefiting and others losing.

Indicators to watch:

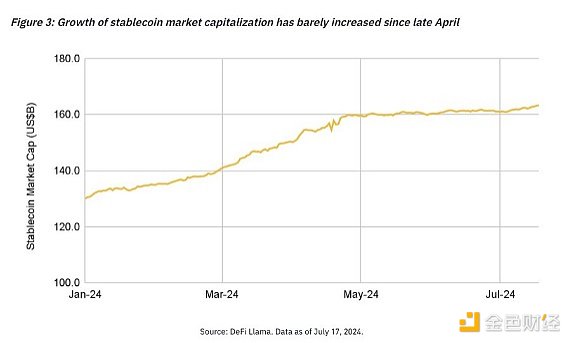

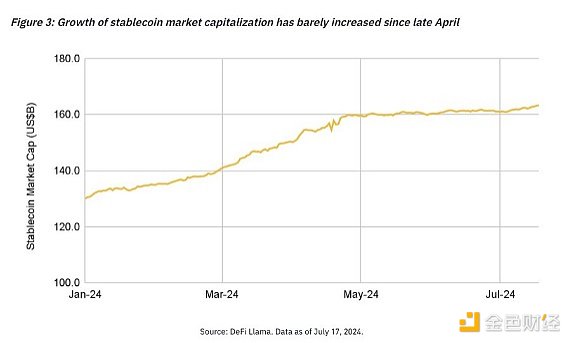

· Stablecoin market capitalization: almost flat since April. (Data source: DefiLlama)

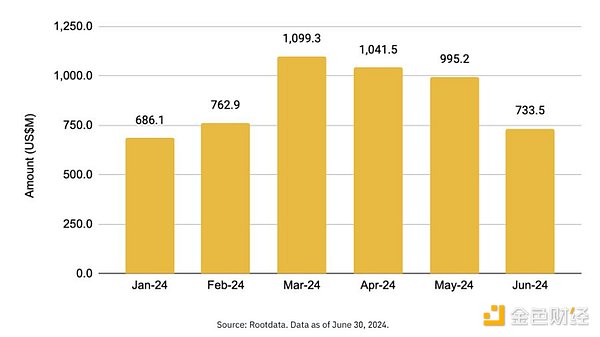

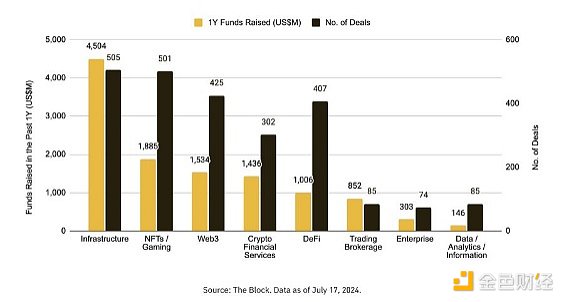

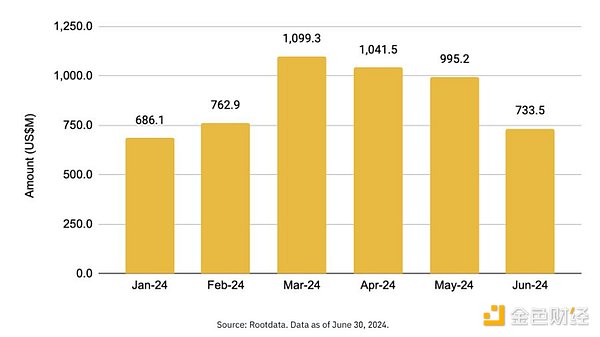

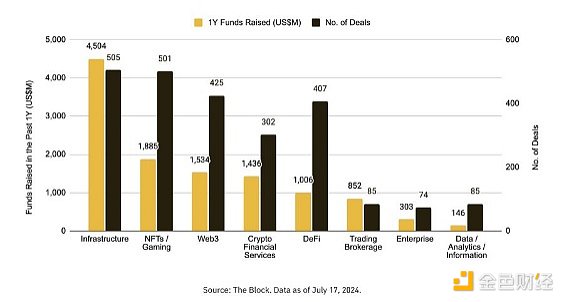

· Fund raising: In the past few months, the amount of funds raised by projects has been declining. (Data source: RootData)

· Spot ETF net inflows slowed slightly: Although ETH ETF trading is expected to start next week, this has led to a slowdown in the increase in new capital. (Data source: SoSoValue)

Part 2: People

Generating sustainable returns and profits is the primary motivation for many market participants. This part focuses on the behavior and motivation of users to actively participate in Web3.

Indicators worth paying attention to:

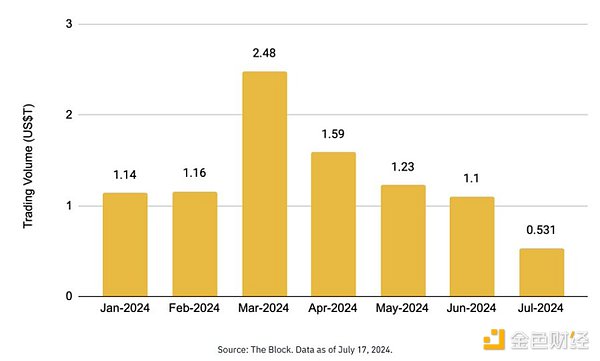

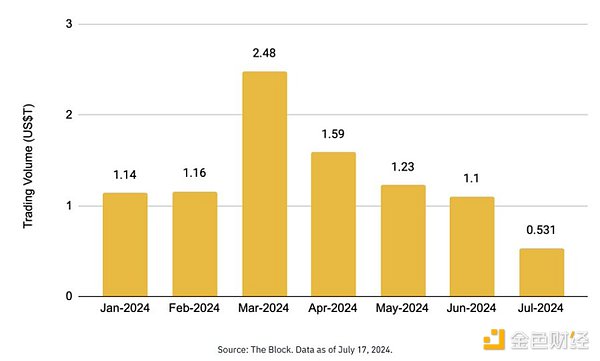

· Transaction volume: After the peak price of the year in March, the transaction volume has declined. (Data source: IntoTheBlock)

Personal advice:

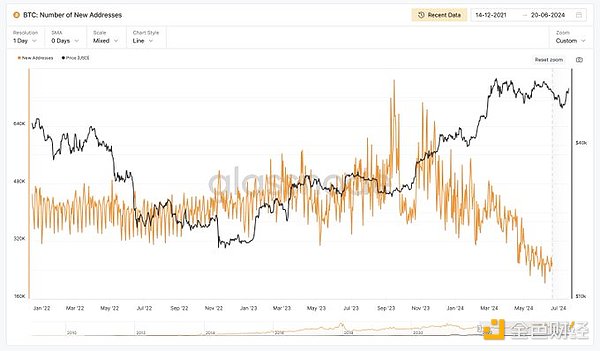

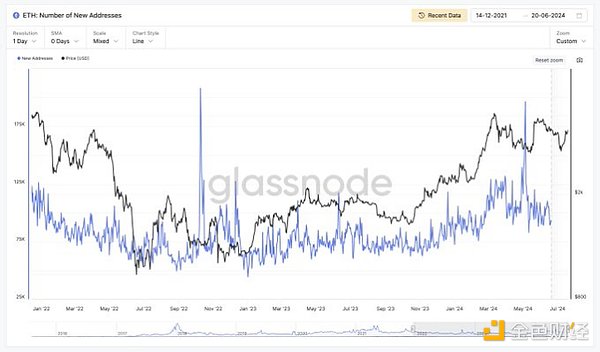

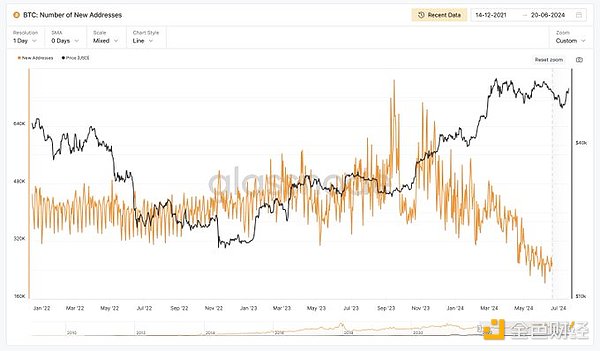

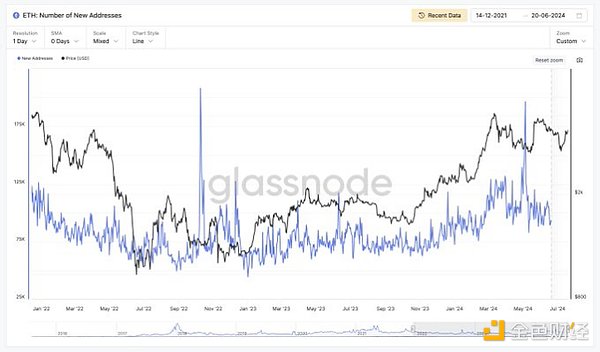

· BTC & ETH: Number of new addresses.

For BTC, the number of new addresses has been declining since February 2024. For ETH, the number of new addresses peaked in April/May 2024. (Data source: IntoTheBlock)

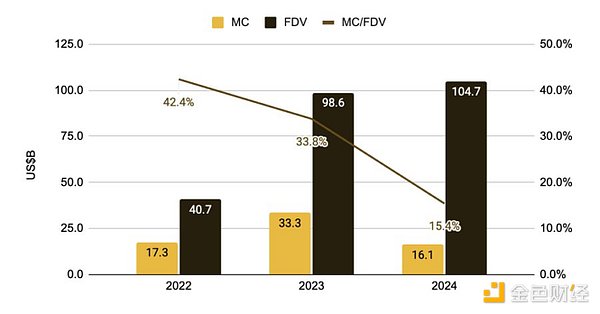

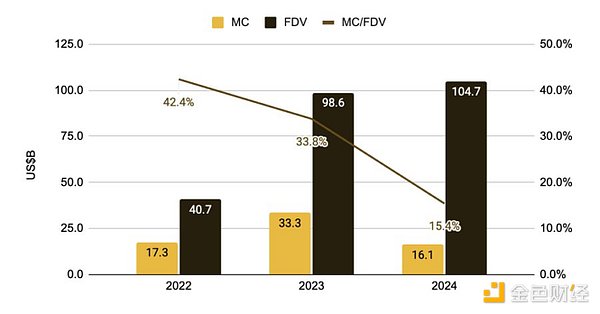

The decline in trading activity is closely related to the fact that speculative opportunities are limited, which is the result of the general prevalence of tokens with low circulating supply and high valuations. This market structure provides little meaningful sustainable upside for the broader market after the TGE.

Part 3: Technology

From a high-level perspective, the latest developments in Web3 are designed to attract the next billion users. This includes advances in scaling, chain abstraction, and mass-market social and gaming applications.

However, the majority of funds continue to flow into infrastructure, providing underlying support for a wider range of technologies.

Indicators worth paying attention to:

Personal advice:

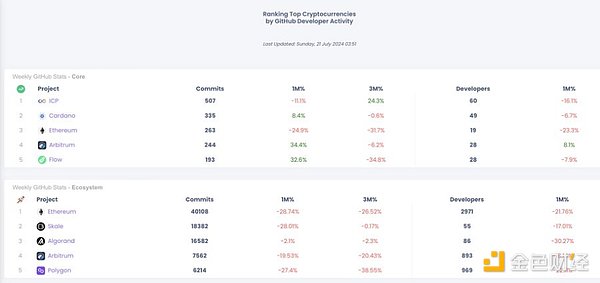

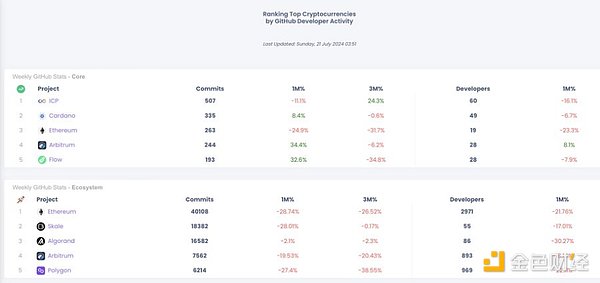

DefiLlama allows people to view the number of active developers for each project. In addition, Cryptometheus also ranks the top cryptocurrencies based on GitHub developer activity.

Upcoming Catalysts:

·Spot ETH ETF Approval

·Rate Cuts

·U.S. Presidential Election and Bitcoin Conference

·Impact of Bitcoin Halving

Jixu

Jixu