Source: C Labs Crypto Observation

This research report is also from Chainalysis, which is invested by the FBI:

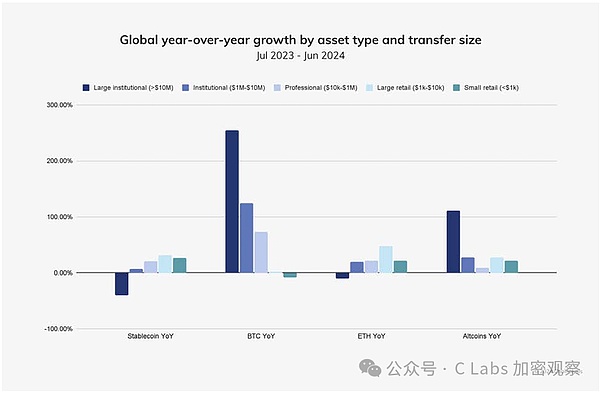

1. Global trend: Large investors abandon Ethereum

This trend is actually very interesting. For the main funds with a transfer amount of more than 10 million US dollars, it is normal for stablecoins to decrease, because these main investors have increased their positions in BTC and altcoins. However, the main investors did not increase their positions in ETH, but their positions were less than last year!

On the other hand, retail investors prefer to buy ETH and altcoins, and they increase their positions by selling their precious BTC.

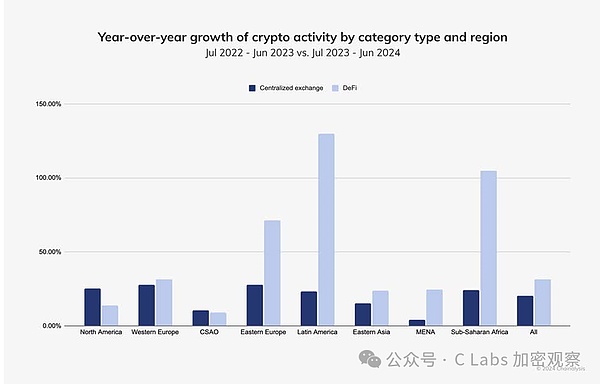

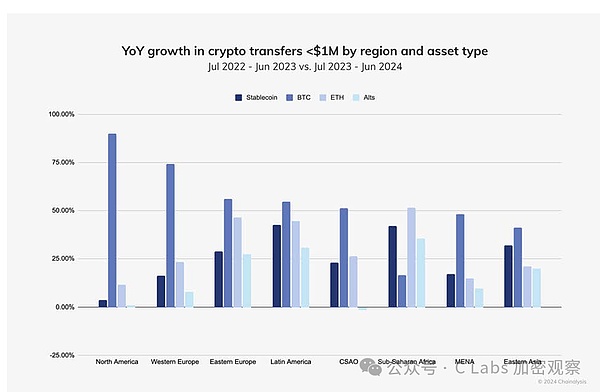

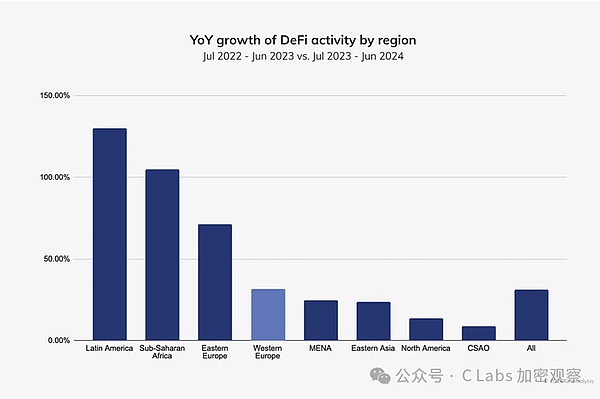

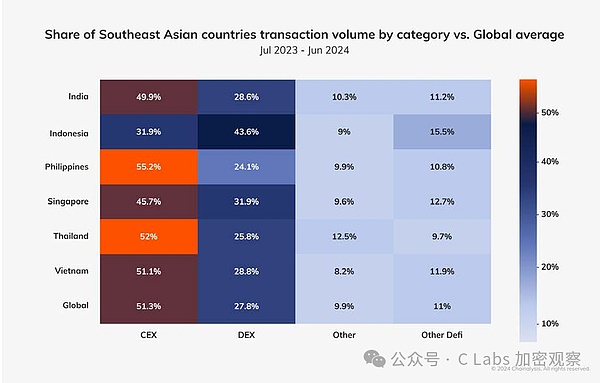

This year can be said to be the year when Dex (decentralized trading) shines. In most parts of the world, the growth of Dex is higher than that of Cex (centralized exchange).

Only in North America and Central and South Asia (CSAO, including India, Southeast Asia, and Australia), the growth of CEX can suppress DEX, which may be related to the compliance progress of CEX in 24 years~

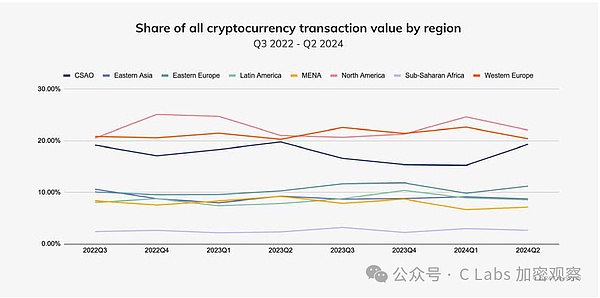

The global crypto market can be divided into three gears according to geographical division:

The first gear is North America, Western Europe, and Central and South Asia, each market accounts for about 20% of the world.

The second gear is East Asia, Eastern Europe, Latin America, and the Middle East (including North Africa), each market accounts for about 10% of the world.

The last one is Africa south of the Sahara, which accounts for less than 3% of the world and is a place that is not contested by military strategists.

But in fact, according to the data obtained by Lao Wang from the exchange, a large part of the global liquidity is still in the Chinese, but these Chinese either use VPNs or are scattered all over the world, and cannot be counted geographically.

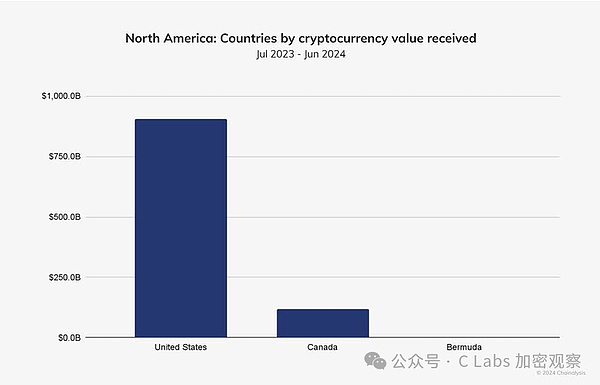

Then we scan the characteristics of each region in the world, and look at North America first:

2. North America: Global Metronome

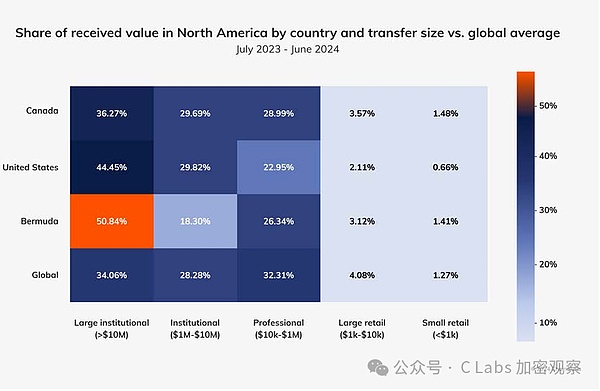

But in fact, Canada's encryption is also very powerful, mainly because it is very sad compared with the United States in North America.

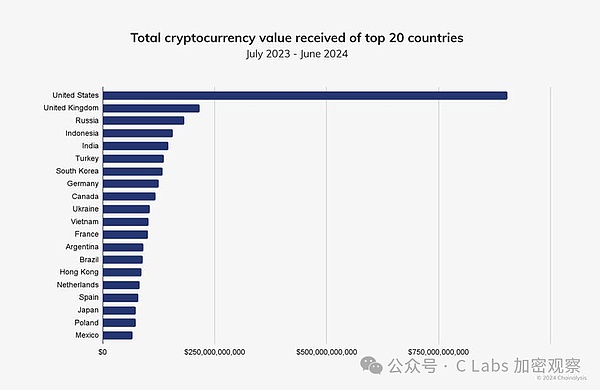

If we take out the global top 20, it looks like this:

Therefore, the most critical global encryption is the United States, which is uniquely high! Canada can actually rank 8th in the world, which is a good market.

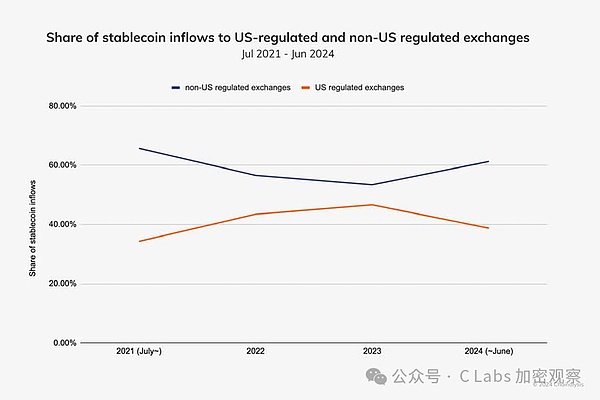

And there is a very interesting phenomenon in the North American market: people don’t believe in compliance anymore

In 2024, the share of the North American market where North American compliance is located began to decline.

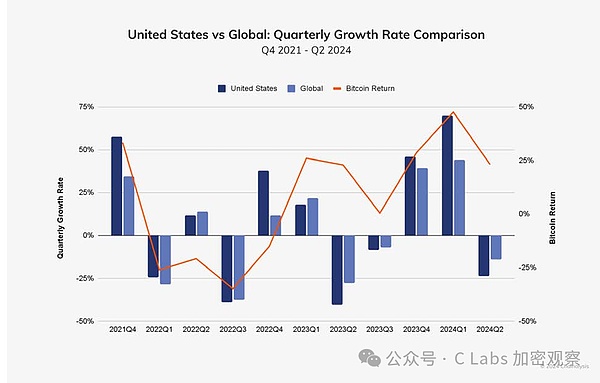

North America has also become the global metronome because of the United States:

When the United States rises, the world rises; when the United States falls, the world calls it daddy.

3. Latin America: Crypto saves inflation

Then let's look at Latin America. This place is actually very interesting because many people will pay attention to the progress of Argentina.

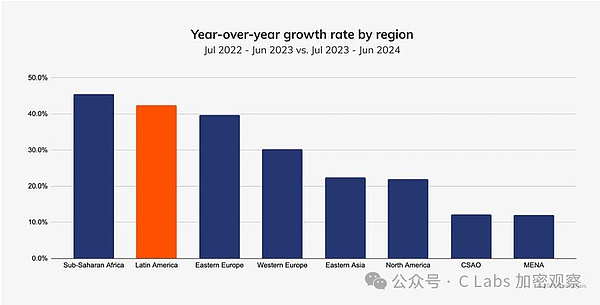

The Latin American market growth rate ranks second in the world. Considering that the growth base of Africa south of the Sahara is too small, this achievement of South America is actually very impressive.

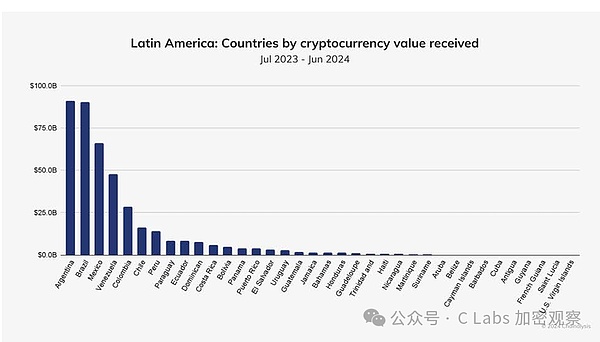

The Latin American market mainly relies on the two giants in South America: Argentina and Brazil

Let's take a look at what is the situation of Argentina's opening of cryptocurrencies and dollar controls in the context of inflation.

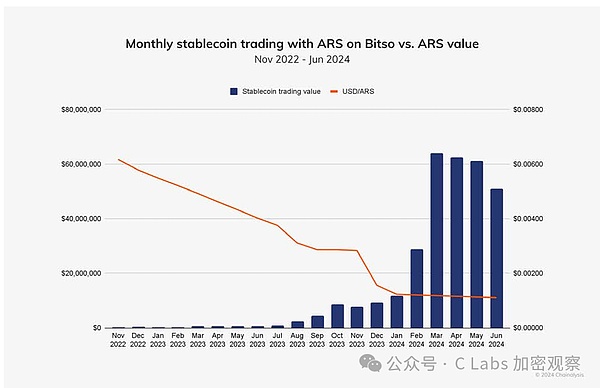

Although a large number of Argentine citizens have exchanged their Argentine pesos for stablecoins:

But judging from the exchange rate of the Argentine peso, it has been stable in the past year:

It may be that due to years of inflation, local people mainly exchange stablecoins for value preservation rather than investment:

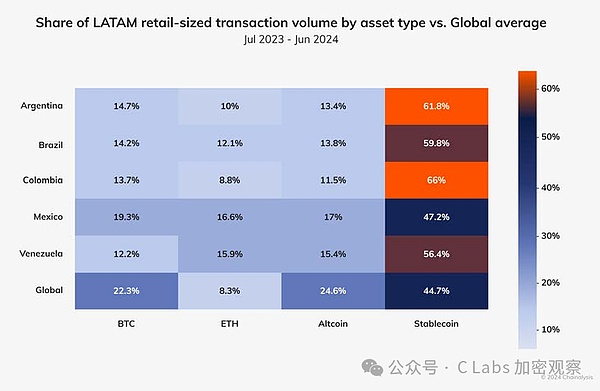

We can compare it with the wealthy North America:

Especially in Bermuda, a tax-free haven for the rich, the richer the people, the more they like Bitcoin.

And the Latin American countries, where their currencies have depreciated sharply, trust the US dollar more.

4. Central and Western Europe: North America's younger brother

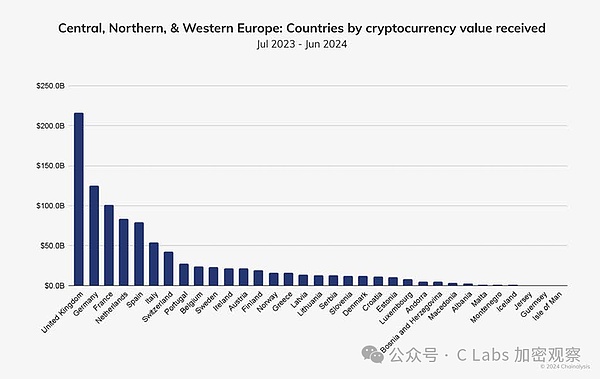

Let's turn our attention to Europe, where the UK is the boss:

Overall, the investment preferences here are still similar to those in North America:

The whole world shows this trend: rich places like Bitcoin, poor places like altcoins.

The mass adoption of this chain is also mainly contributed by users in developing countries. Central and Western Europe are the most active developed regions in embracing the chain, and the growth rate is barely on par with the global average.

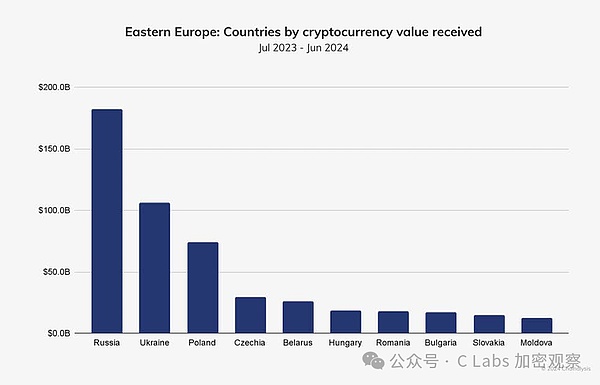

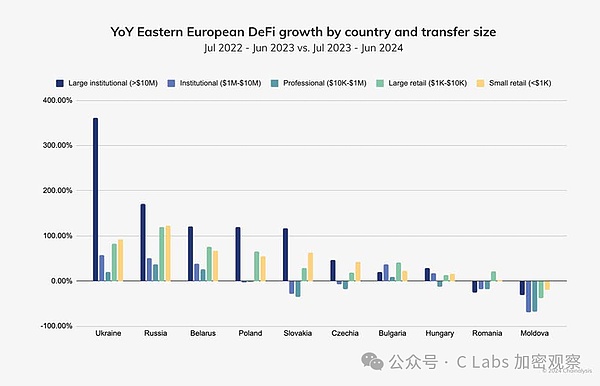

5. Eastern Europe: Growth under the Russian-Ukrainian War

The Eastern European region is also the focus of global attention. Everyone is very concerned about the market development under the shadow of war.

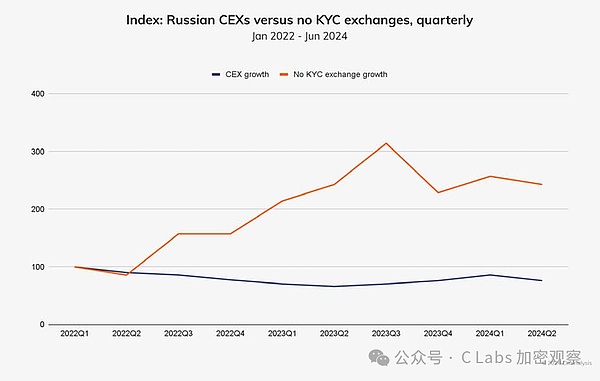

Although Russia was proposed to Swift by the United States, it still maintains contact with the world with cryptocurrency.

Especially in Russia, many exchanges do not even require KYC, so that local people can rest assured to avoid sanctions.

These exchanges that do not require KYC are mainly on-chain exchanges. Ukraine, as the country that suffered the most from the war, has decisively transferred a large amount of assets to the chain in 2024. I don’t know how much of this is aid from the United States~

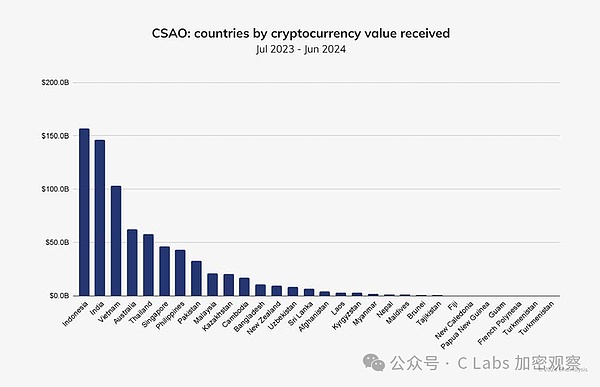

6. Central and South Asia and Oceania: The most dynamic crypto market

This region is densely populated, but the leader should be unexpected by many people. It is not India, but Indonesia!

With a population of 600 million, Indonesia has surpassed India, which has a population of 1.4 billion, in the scale of the crypto market!

Ranked third is Vietnam, which has a population of only more than 100 million.

Followed by Australia, Thailand, consumables, and the Philippines.

Malaysia, which the Chinese team likes, is actually ranked behind Pakistan, which is really surprising.

Why is this region the most dynamic? Because the development of each country is very distinctive.

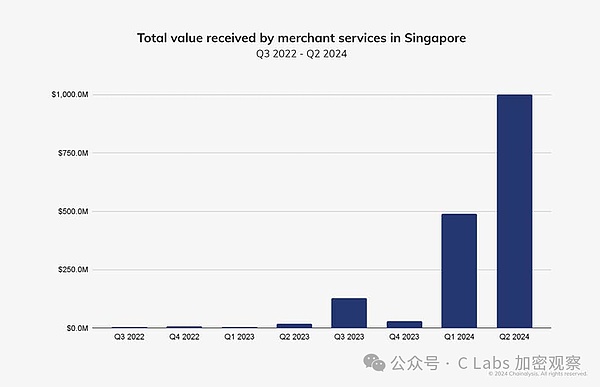

For example, Singapore focuses on institutional services:

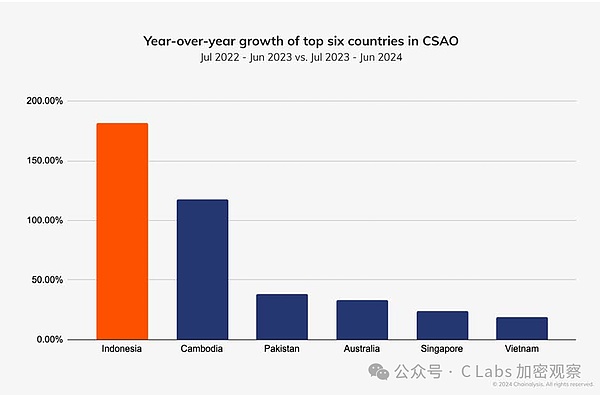

And Indonesia relies on a mysterious force that comes from nowhere, achieving a growth of more than 180% over the previous year, surpassing India to win the regional championship:

Why is Indonesia said to come from a mysterious force?

Because most of their funds are online, rather than centralized exchanges that usually require real names.

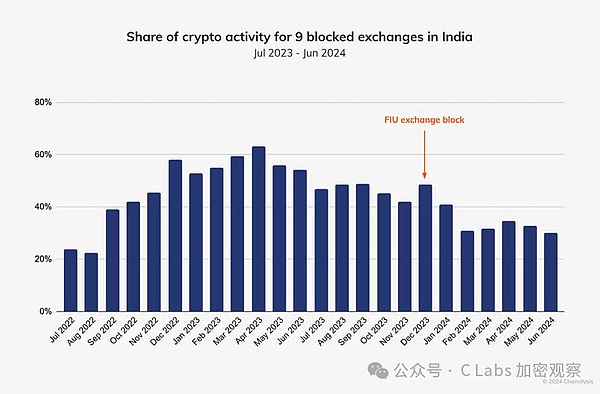

The reason why India lost the regional championship is that in December 2023, India blocked 9 exchanges in the name of local compliance:

The restricted exchanges include: Binance, HTX (formerly Huobi), Kraken, Gate.io, KuCoin, Bitstamp, MEXC, Bittrex, and Bitfinex.

7. East Asia: Hong Kong is growing rapidly

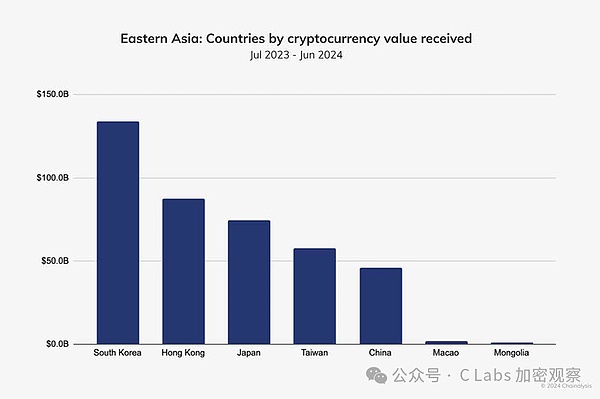

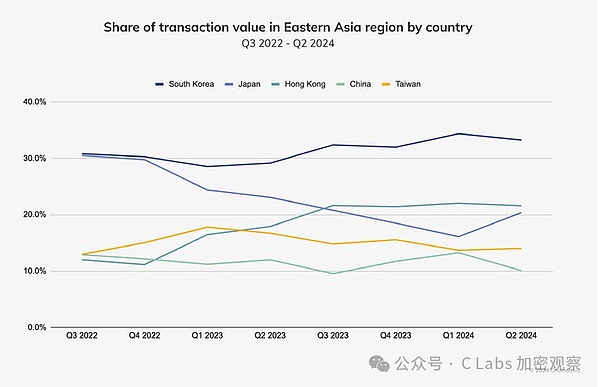

After the hidden champion China spread to the world, South Korea became the regional champion.

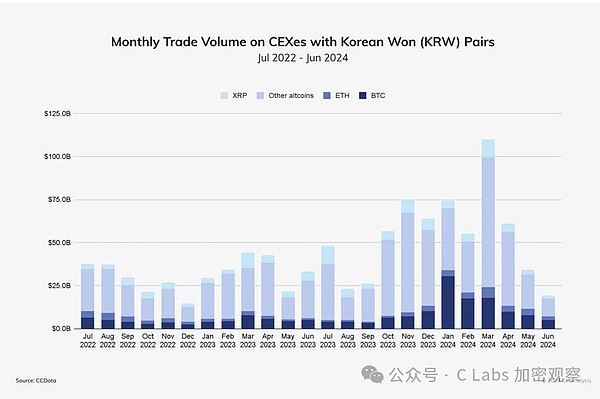

And Korean CX is really powerful. They are the only major country in the world where XRP trading volume is larger than ETH, and even in some months it can exceed BTC.

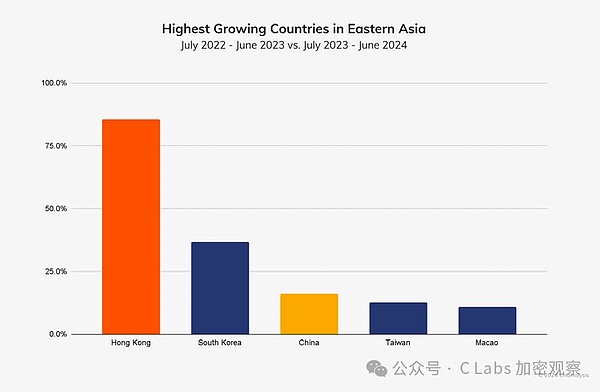

Hong Kong, on the other hand, has surpassed Japan and Taiwan with its new encryption policy, and has jumped from fifth place in 22 years to second place.

The annual growth rate is close to 100%

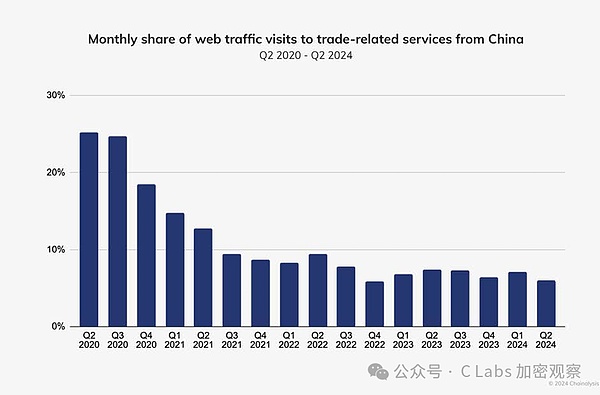

Although Hong Kong implements an open encryption policy, on the other hand, Hong Kong's defense against the mainland is stricter:

The transaction-related visits from the mainland have decreased significantly in 2024 compared with the past.

And the mainstream exchanges have indeed withdrawn from Hong Kong:

8. Middle East and North Africa: Crypto saves inflation again

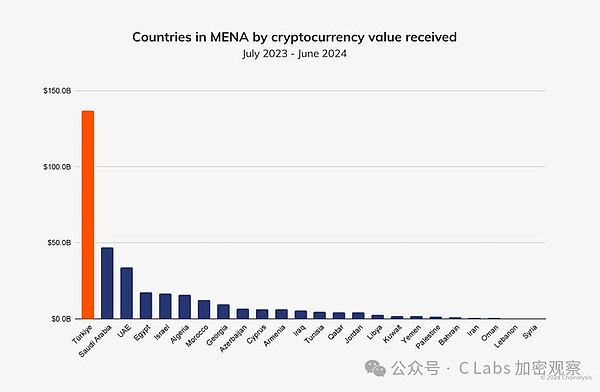

Many people think that this region is dominated by the Middle Eastern tycoons, but in fact it is not. The champion is Turkey, which suffers from inflation, and is far ahead:

So inflation is the best advertisement for cryptocurrency.

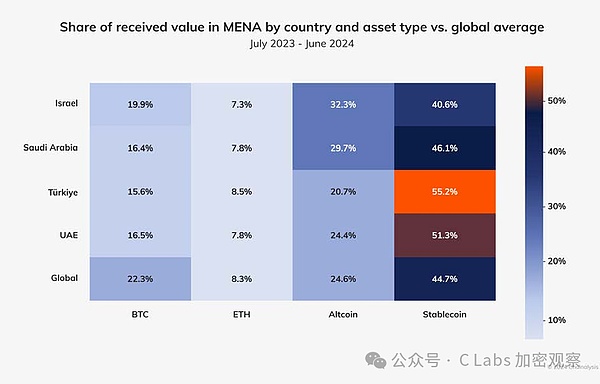

And like South America, the Turks are particularly fond of stablecoins:

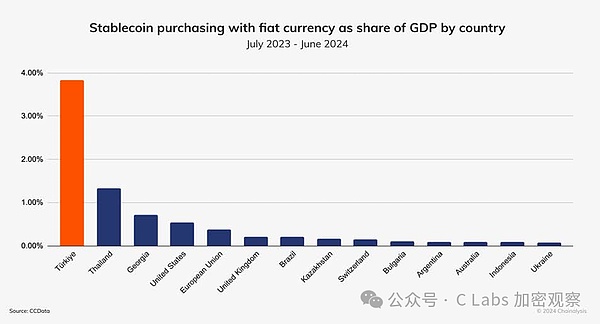

The Turkish people even exchanged the lira, which accounts for 4% of the country's GDP, for US dollar stablecoins:

But what's interesting is that the exchange rate of the Turkish lira remained stable in 2024:

So we have to admire that the regulation of the free market is really magical.

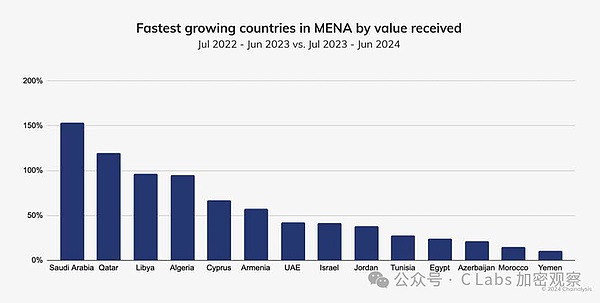

In addition, the tycoons in the Middle East are not without strength, but they are slow to react and only started to enter the market in 24 years:

The growth rates of the Saudi and Qatar markets this year exceeded 100%.

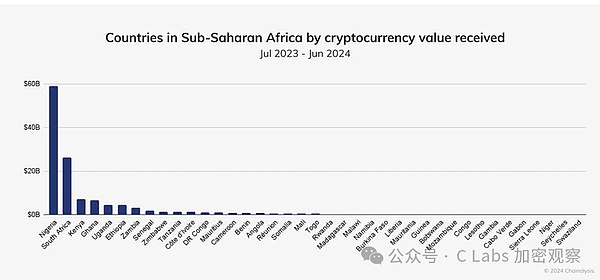

9. Africa south of the Sahara: the fastest growth in the world

The champion of this region is Nigeria, followed by South Africa, and the market size of other countries can be temporarily ignored.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian decrypt

decrypt Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Ftftx

Ftftx