Bitcoin's economic model of halving rewards after reaching a certain number of blocks is an absolute deflationary model, but Ethereum is not.

As for the issue of Ethereum's centralization, the only thing mentioned in the application materials for Ethereum futures ETF is the price fluctuations caused by Ethereum's hard fork and the fluctuations of various financial products. In fact, I think this is a manifestation of incomplete and incomplete research on Ethereum. The degree of decentralization has a great weight on whether the product can be manipulated by the market.

Reference: Valkyrie ETF Trust II

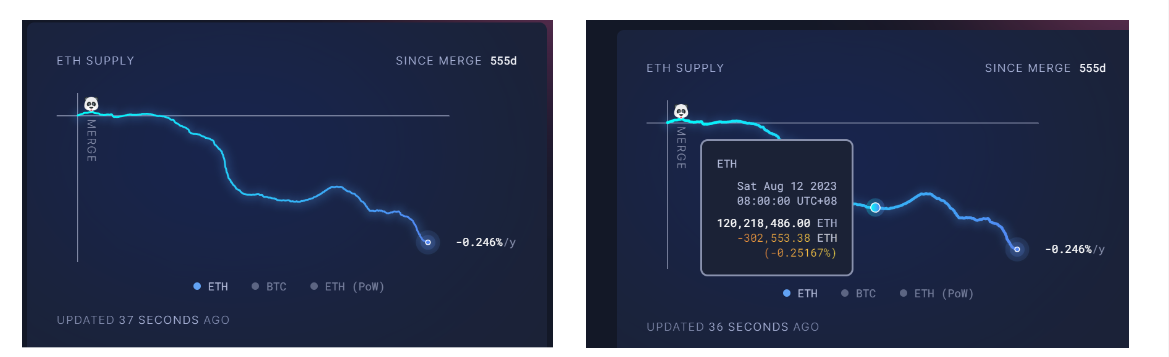

The deflation in Ethereum's economic model is that a portion of the transaction fee will be destroyed every time a transaction occurs, resulting in a decrease in supply. If the transaction volume on the Ethereum network continues to increase, and the growth rate of transaction fees exceeds the destruction rate, then the total supply of Ethereum may begin to increase, that is, deflation will no longer occur. This may happen when network activity increases, transaction fees rise, or other factors cause the destruction rate to be insufficient to offset the new supply.

For example, the period from August 2023 to November 2023 in the figure.

Image source: https://ultrasound.money/

If you dig deeper, the change from Ethereum PoW to PoS is not controllable by the SEC, but decided by the Ethereum Foundation headed by Vitalik Buterin. One of the extreme things about Bitcoin is the complete delegation of power by the founding team. Until now, no one knows who Satoshi Nakamoto is.

This means that Ethereum can actually manipulate the progress of inflation/deflation through some methods, such as:

EIP-1559 changes: EIP-1559 is a proposal on the Ethereum network that introduces the concept of a base fee and uses it to destroy ETH. If the implementation of EIP-1559 is adjusted in the future, such as reducing the destruction ratio or completely canceling the destruction mechanism, the supply of Ethereum will no longer decrease.

Changes in the issuance mechanism: The issuance of Ethereum is controlled by a variety of factors, including mining rewards, staking rewards, etc. If the issuance mechanism of Ethereum changes in the future, such as increasing mining rewards or adjusting staking rewards, the supply of new ETH will increase, which may also stop Ethereum's deflationary trend.

Technology or protocol updates: The Ethereum community may update the protocol through hard forks or soft forks, and these updates may affect the supply and destruction mechanism of ETH. For example, if new technologies emerge that can reduce transaction costs or change the way transaction fees are distributed, it may affect the supply of ETH.

Jokingly speaking, is LTC easier to pass? In a sense, it is true.

Proof of Stake (PoS) and Proof of Work (PoW) are two different consensus mechanisms, and they have their own characteristics in resisting market manipulation.

In a PoS system, validators must lock up a certain amount of tokens as collateral in order to participate in the generation and verification of blocks. If validators attempt to cheat or engage in malicious behavior, their collateralized tokens may be confiscated, which is called "slashing". This mechanism can theoretically improve the integrity of validators because they have a greater economic incentive to maintain the security and stability of the network. Therefore, compared to PoW, PoS may be more difficult to suffer from a single entity controlling the network through computing power in some cases.

However, PoS systems also face their own manipulation risks. For example, if a validator or a few validators have a large number of collateralized tokens, they may gain disproportionate control over the network, which is called "staking centralization". This centralization may lead to excessive concentration of power, thereby increasing the risk of manipulation. In addition, since validators in a PoS system are usually rewarded with transaction fees and/or newly minted tokens, this may attract wealthy individuals or entities to participate, further exacerbating the centralization problem.

In the PoW system, miners compete to generate new blocks by solving complex mathematical puzzles, a process that consumes a lot of computing resources and energy. In theory, the PoW system resists manipulation through decentralized computing power distribution, because any attempt to control most of the network computing power will be very expensive and difficult to achieve. However, if a miner group (mining pool) controls more than 50% of the network computing power, they have the ability to conduct a double-spending attack, that is, confirming two different transaction branches at the same time, thereby undermining the security and integrity of the network.

In general, both PoS and PoW have their own advantages and disadvantages, and both have potential risks of market manipulation. The choice of which consensus mechanism depends more on the preferences of the community, the specific needs of the project, and the trade-off between security and decentralization.

Of course, except for Ethereum, any project except Bitcoin basically has insufficient degree of decentralization. Many people think that SOL will be the next after the Ethereum spot ETF is passed, but no one has mentioned that Solana nodes are all enterprise-level nodes, and the possibility of doing evil is far greater than Ethereum. This does not take into account that the possibility of doing evil in Ethereum is already far greater than that of Bitcoin.

4. Grayscale

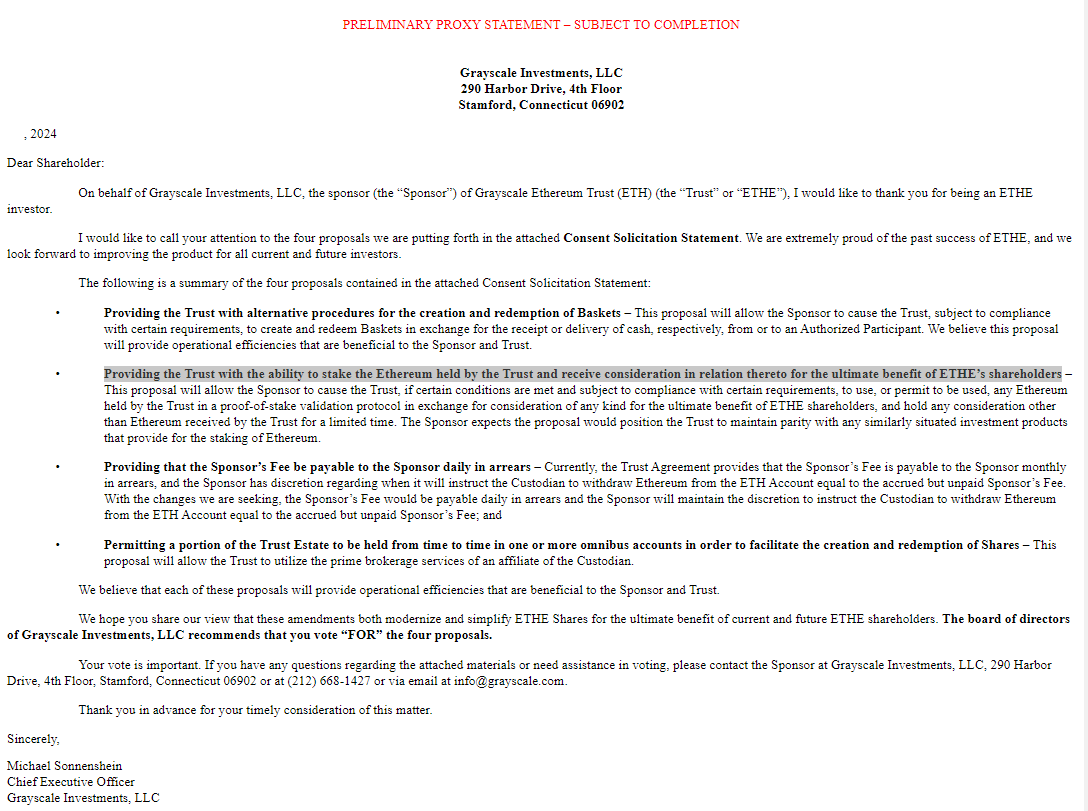

4.1 About the latest application of ETHE

Grayscale's requirements:

Allow ETHE redemption (in other words, spot ETF)

Allow Ethereum in the trust to be pledged (this is more radical)

14A refers to Form 14A of the U.S. Securities and Exchange Commission (SEC), which is a specific form of document, commonly known as a proxy statement. When a company is preparing to hold a shareholders' meeting or is involved in any matter that requires a shareholder vote, it must submit this document to the SEC and send it to its shareholders. The proxy statement provides detailed information about upcoming meetings and voting matters, including but not limited to:

Upcoming board of directors

Compensation information for executive officers

Major decision proposals, such as mergers, acquisitions, and changes to the company's articles of incorporation

Voting guidelines recommended by the board of directors

Corporate governance related information

Potential conflicts of interest or other important information about the company's management The purpose of the proxy statement is to ensure that shareholders have sufficient information when making voting decisions. It is a mechanism under the U.S. securities law framework to protect the rights of investors and ensure transparency in corporate governance. This transparency required by the SEC helps shareholders make informed decisions about the company

Grayscale's latest 14A, GRAYSCALE ETHEREUM ETF enables the trust to pledge the Ethereum held by the trust and receive consideration associated therewith to achieve the ultimate benefit of ETHE shareholders.

Link: https://www.sec.gov/Archives/edgar/data/1725210/000095017024033515/ethe_pre_14a.htm

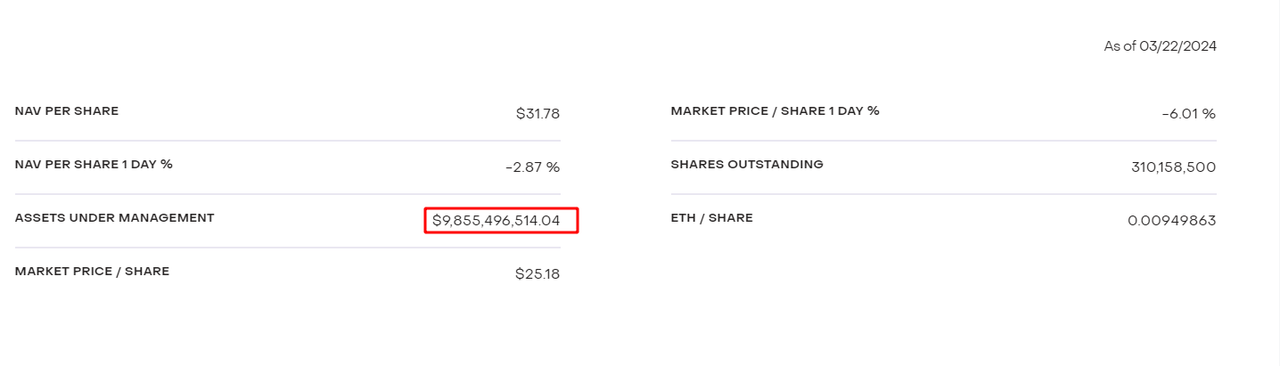

ETHE is worth less than $10 billion (compared with Grayscale's peak market value of Bitcoin: 600,000*70,000=420 billion U.S. dollars, current market value: 350,000*70,000=245 billion U.S. dollars). It can be seen that the approval of the ETF spot may not have such a severe impact on the market.

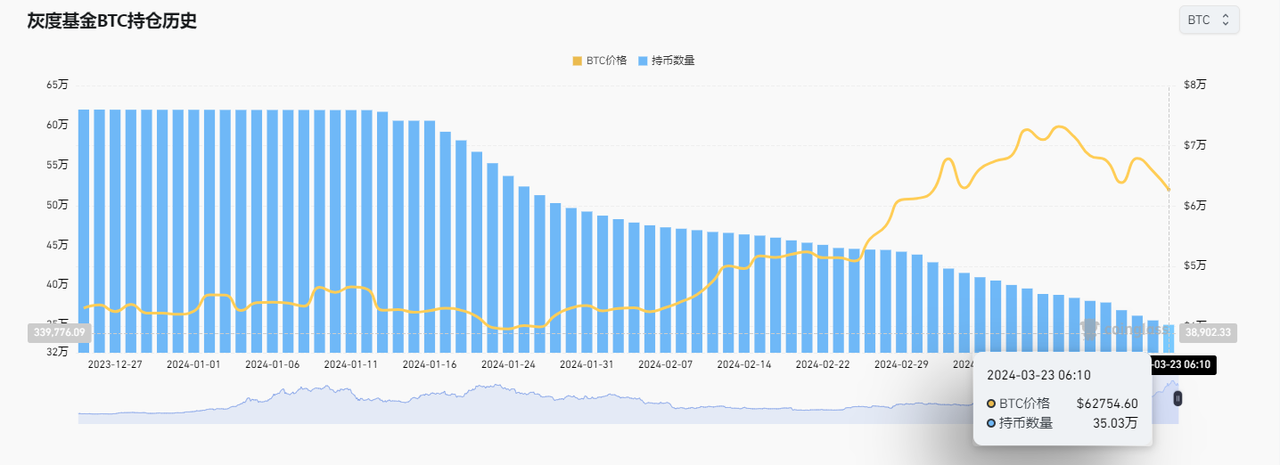

4.2 Bitcoin holdings

Grayscale's Bitcoin holdings have dropped from 600,000 at the beginning to 350,000.

Data source: https://www.coinglass.com/zh/Grayscale

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph