Abstract

Ondo Finance is the focus As for the financial agreement on the RWA track, its main business at this stage is to tokenize high-quality assets such as U.S. Treasury bonds and money market funds within a compliance framework to facilitate user investment and transactions on the blockchain.

Ondo Finance The TVL of the RWA U.S. debt track has increased 6 times in the past year, which is the main driving force of the RWA industry. Ondo Finance ranks third in the TVL of this track and has a certain first-mover advantage.

Ondo Finance Future On the one hand, the growth point lies in the expansion of the scale of existing products, and on the other hand, it also lies in the launch of other types of RWA products. Its development goal is to become an important bridge connecting the on-chain and off-chain.

Ondo Finance faces The main risk lies in fierce market competition. The RWA industry is huge and is still in its infancy, with many powerful institutions vying to enter the market to carve up the market.

$ONDO tokens unlocked in January 2024 It is in circulation, and has experienced a large increase since its listing; however, apart from being used for DAO governance, this token has no other actual use cases, and its future use scenarios are still unclear.

$ONDO generation About 80% of the currency is still in the hands of project parties, the distribution mechanism is still unclear, and there is a large risk of centralization.

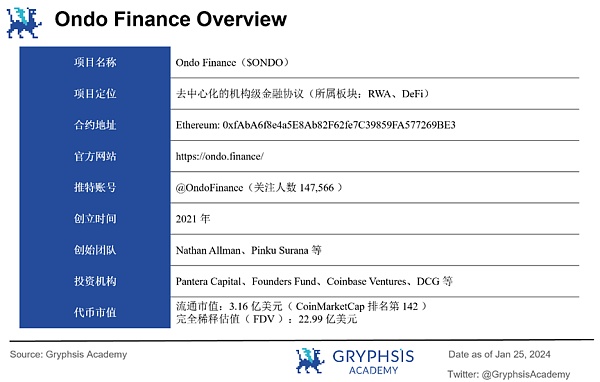

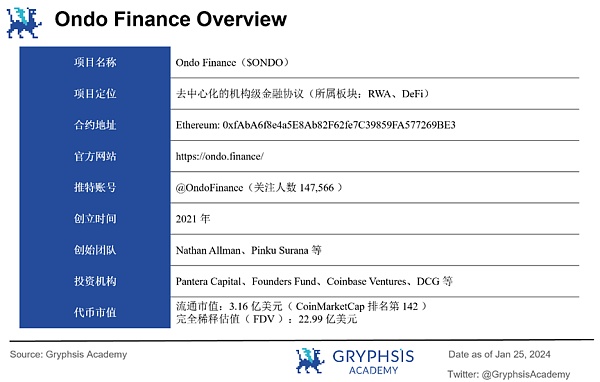

Ondo Finance is a decentralized institutional-grade financial protocol (Institutional-Grade Finance) dedicated to using blockchain technology to provide institutional-grade financial products. and services to create an open, permissionless, decentralized investment bank.

Ondo's current core business is to introduce fund products (such as U.S. Treasury bonds, money market funds, etc.) with no/low risk, stable interest-earning, and scalability into the region. On the blockchain, it provides on-chain investors with an alternative to stablecoins and enables holders rather than issuers to earn most of the income from the underlying assets.

Ondo Finance focused on the DeFi track when it was founded. From the end of 2022 to the beginning of 2023, it changed its development route and shifted to the RWA track. And achieved very good results in 2023. The important time points for project development are as follows:

(1) March 2021: The company was founded, focusing on DeFi

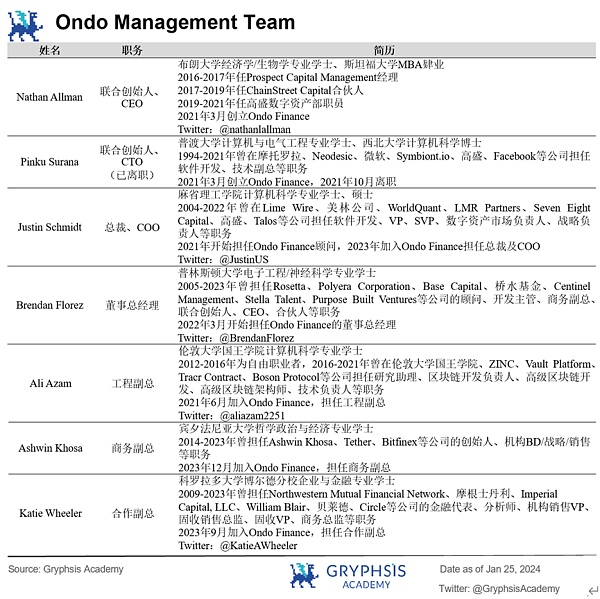

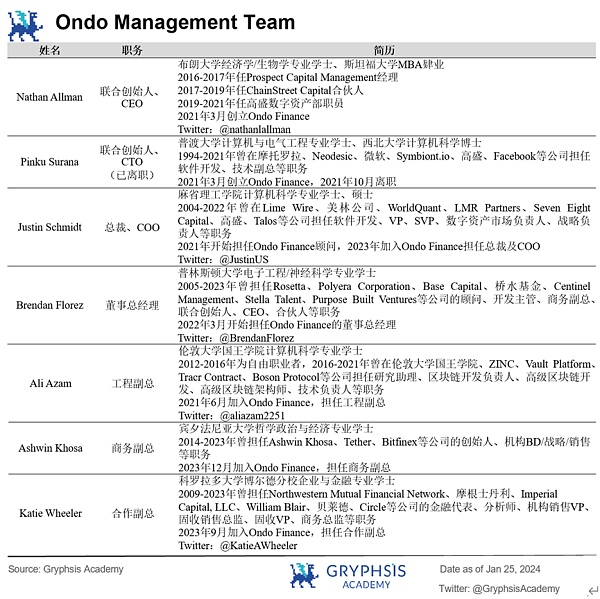

< p style="text-align: left;">Former Goldman Sachs employees Nathan Allman and Pinku Surana co-founded Ondo Finance Inc.. At the beginning of its establishment, the company was positioned to introduce structured assets with better returns to the DeFi field.

Ondo launched its first product, Ondo Vaults, in August 2021 – a structured finance protocol running on Ethereum. The product gives investors the option of “enhanced returns” or “downside protection” when providing liquidity to decentralized exchanges like Uniswap.

(2) August 2021: Seed round financing

Pantera Capital led the investment, with participation from Genesis, Digital Currency Group, CMS Holdings, CoinFund, Divergence Ventures, Stani Kulechov, Richard Ma, Christy Choi and others. The financing amount of this round is US$4 million, and the token price is 1 ONDO = 0.0057 USD.

At this stage, Ondo describes itself as "the protocol is designed to allow DeFi traders to hedge and exploit risks according to their own wishes." Ondo allows users to originate risk-isolated, fixed-income loans backed by digital assets. Both lenders and borrowers inject funds into the "Vault" executed by Ondo's smart contract, which provides two options: "fixed income" to reduce risk and "variable income" to maximize returns.

(3) Second half of 2021: Launch of LaaS service

Liquidity-as-a-Service (LAAS) can help token issuers improve the liquidity of decentralized exchanges. It pairs DAOs with underwriters (stablecoin issuers) to bootstrap highly liquid AMM trading pairs. The DAO provides governance tokens, the underwriters provide stablecoins, and Ondo assists in building liquidity pools. The ultimate goal is to help DAO build its own liquidity without having to rely on liquidity mining or market-making companies.

More than 10 DAOs including NEAR, Synapse, and UMA, as well as underwriters such as Fei, Frax, Terra, and Reflexer, participate in the program. Ondo provides over $210 million in total liquidity (TLP) between the community and LaaS Vault.

(4) April 2022: Series A financing

Pantera Capital and Founders Fund led the investment, with participation from Wintermute, Tiger Global Management, Steel Perlot, GoldenTree Asset Management, Flow Traders, Coinbase Ventures and others. The financing amount of this round is US$20 million, and the token price is 1 ONDO = 0.0285 USD.

At this stage, Ondo describes itself as "the protocol provides structured investment products built on decentralized exchanges." In addition to the "treasury" investment mentioned in the seed round of financing in August 2021, Ondo at this stage also provides LaaS to the DAO.

(5) May 2022: ICO financing

Ondo completed ICO financing on the CoinList platform. 3 million ONDO will be sold at a price of US$0.03, with a lock-up period of 1 year, and will be released linearly within 18 months after unlocking; 17 million ONDO will be sold at a price of US$0.055, with a lock-up period of 1 year, and will be released linearly within 6 months after unlocking . The financing amount of this round is US$10.25 million. For most public investors: 1 ONDO = 0.055 USD.

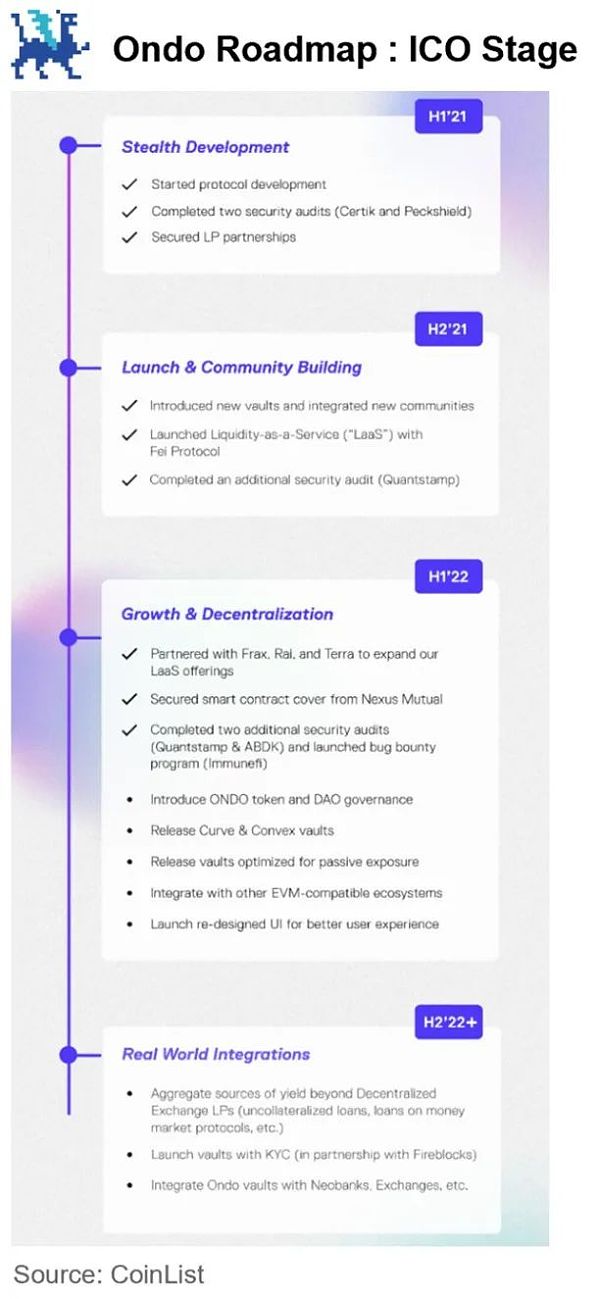

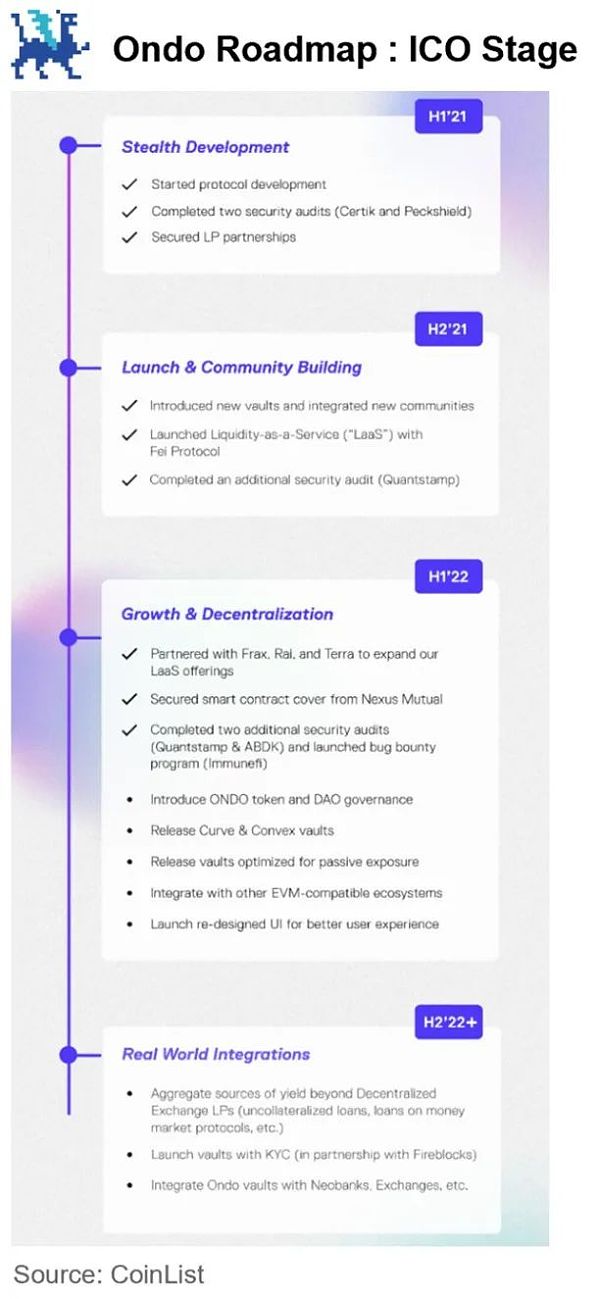

At this stage, Ondo describes itself as "providing services and connections to various stakeholders in the emerging DeFi ecosystem - including DAOs, institutions and personal". At that time, the project roadmap announced by the Ondo team was as follows:

p>

(6) January-February 2023: Abandon Vaults and LaaS, transform into RWA track

With the compression of DeFi yields in 2022, the Ondo team decided to eliminate Vaults and LaaS (collectively referred to as "Ondo V1") and focus on the development of the next generation protocol. Ondo V2 includes Ondo Funds and Flux Finance at launch.

Ondo has modified its positioning to "build the next generation of financial infrastructure to improve market efficiency, transparency and accessibility", and has successively launched USDY and OUSG. Tokenized financial products, transforming into a member of the RWA track.

(7) January 2024: ONDO tokens will be unlocked and circulated

After on-chain community voting, ONDO tokens were unlocked for circulation on January 18, 2024. After being unlocked, they experienced a large increase, and the price once exceeded 0.3U. Coinbase also announced that ONDO will be included in the currency listing roadmap.

Ondo Finance consists of two main departments: the asset management department responsible for the creation and management of tokenized financial products ( Asset Management Division) and the Second Division responsible for developing decentralized finance protocols.

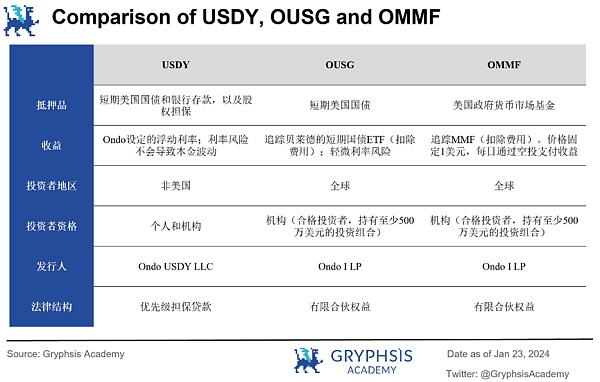

Investors can invest in products launched by Ondo by connecting a digital wallet. Ondo’s current tokenized financial products include the interest-bearing stablecoin Ondo US Dollar Yield Token ($USDY) and the tokenized U.S. bond fund Short-Term US Government Treasuries ($OUSG), and is planning to launch a tokenized money market fund. Ondo US Money Markets ($OMMF). Purchase of the above products requires KYC verification.

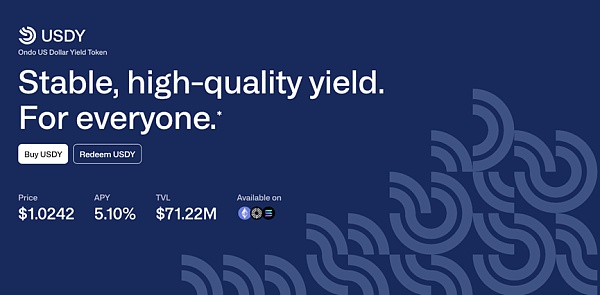

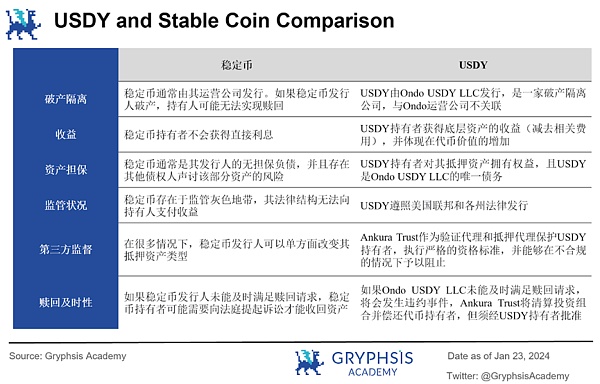

USDY is a currency consisting of short-term U.S. Treasury bonds and demand banks Deposit-backed tokenized notes available for purchase by non-U.S. individual and institutional investors. After investing, investors will receive a token certificate (Token Certificate) and receive USDY in 40-50 days. After receiving USDY, investors can transfer it on the chain for free. In terms of legal structure, USDY is issued by Ondo USDY LLC, a bankruptcy isolation company, which can insulate Ondo’s own operating risks to a certain extent.

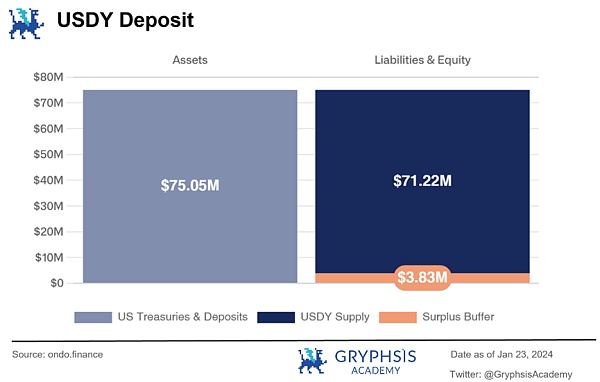

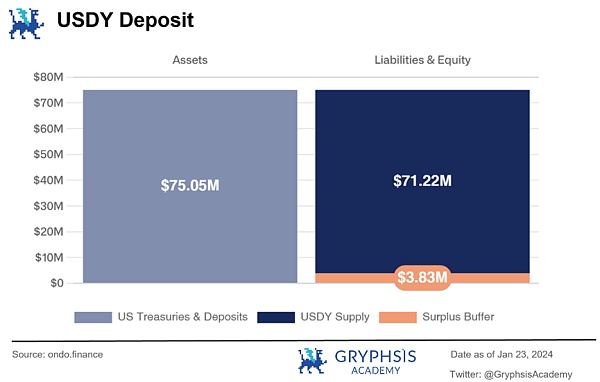

As of January 23, 2024, the total lock-in value (TVL) of USDY is approximately US$71.22 million.

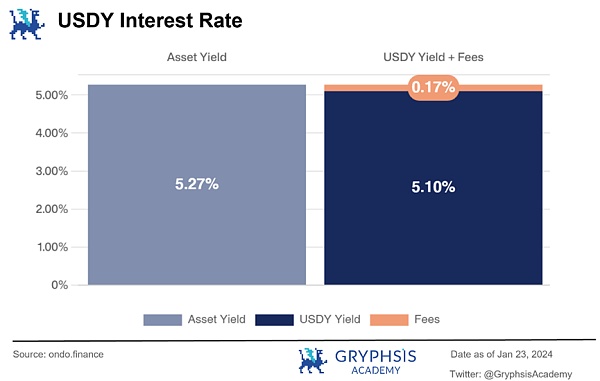

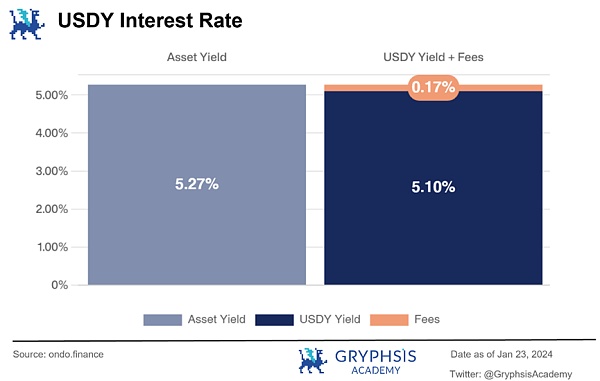

(1) Yield and fees

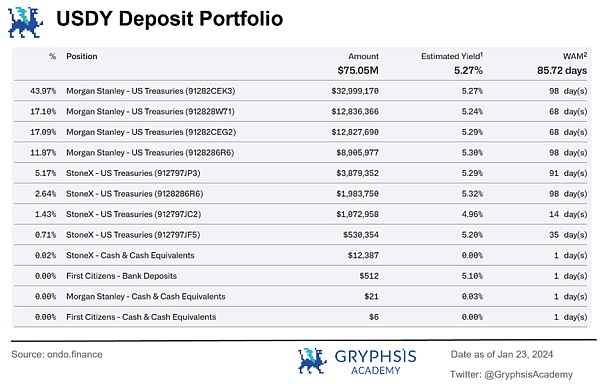

provided by USDY The annualized yield (APY) is adjusted by Ondo every month based on actual conditions. As of January 23, 2024, USDY’s APY is 5.10%. The underlying assets (i.e., a portfolio of U.S. Treasuries and bank deposits) have an APY of approximately 5.27%, and Ondo charges a fee of 0.17%.

Ondo charges a 0.2% fee on redemptions in addition to fees charged through the spreads mentioned above. In addition, investors are responsible for wire/money transfer fees for investments or redemptions under $100,000 if made by bank wire (these fees are charged by the service provider and not Ondo). But for investments or redemptions above $100,000, Ondo will pay these fees on behalf of the investor.

In addition, Ondo also specifically reminds investors that USDY is structured so that investors will not trigger U.S. federal income tax obligations.

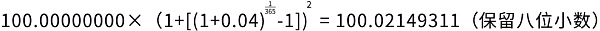

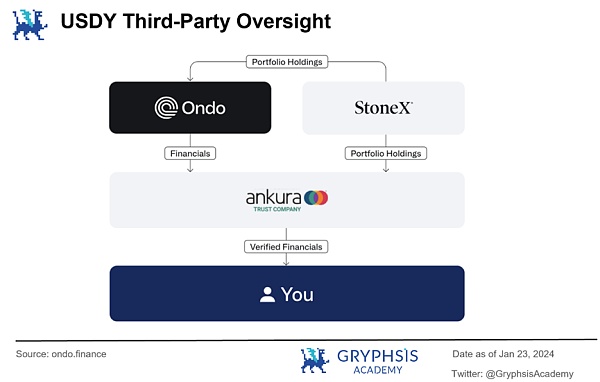

(2) Token price

USDY token The coin price is calculated based on the coin price on the first working day of the month and the coin yield for that month. For example: If the USDY price on June 1st is US$100.00000000 and the APY in June is 4.00000000%, the USDY price on June 3rd will be:

The price of USDY as of January 25, 2024 is $1.0242 .

(3) Mortgage guarantee mechanism

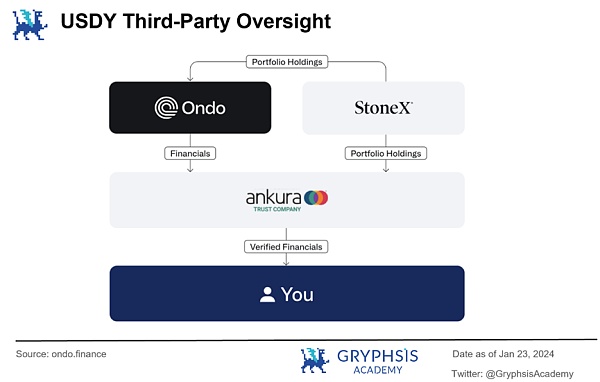

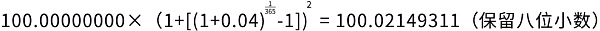

USDY is independently The legal entity Ondo USDY LLC is issued and managed by an independent board of directors, has independent books and accounts, and its assets are segregated from Ondo Finance, Inc.

USDY is a senior debt guaranteed by bank demand deposits and short-term U.S. Treasury bills, and Ondo is overcollateralized, providing a 3% initial loss position to absorb Short-term fluctuations in U.S. Treasury bond prices. That is, for every $100 worth of USDY issued, there is at least $103 worth of bank deposits and U.S. Treasuries as collateral. In addition, Ankura Trust, acting as the security agent, will provide daily transparency reports containing detailed asset holdings.

As of January 23, 2024, the total locked value (TVL) of USDY is approximately US$71.22 million, the collateral value is approximately US$75.05 million, the over-collateralization amount is US$3.83 million, and the over-collateralization rate is 5.38%.

(4) Investment and custody

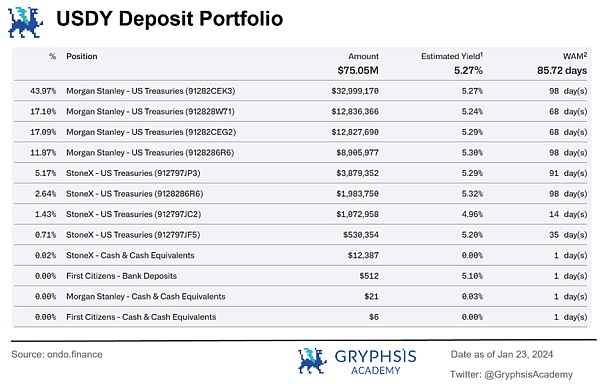

In terms of investment, Ondo stated that its goal is to maintain 65% of USDY’s collateral bank deposits and 35% allocation to short-term government bonds, and does not invest in any other assets.

In terms of custody, U.S. Treasury bonds will be deposited at Morgan Stanley and StoneX, and these U.S. Treasury bonds will not be remortgaged; bank deposits will be deposited at Morgan Stanley Leigh and First Citizens Bank. Ondo also regularly announces its collateral composition on its official website.

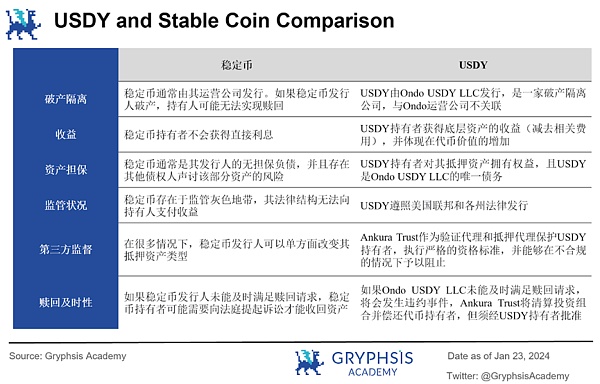

(5) Comparison between USDY and stablecoins

USDY is not essentially a traditional “stablecoin”; A tokenized secured note. The specific comparison between USDY and traditional stablecoins is as follows:

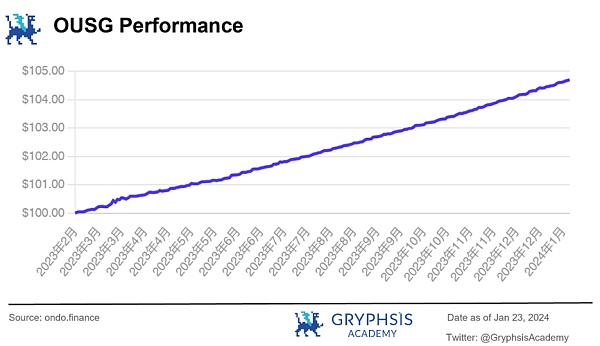

OUSG is a tokenized U.S. bond fund that aims to provide a Buy liquidity exposure in short-term U.S. Treasury ETFs. Global investors can purchase OUSG using USDC or US dollars, with a minimum investment amount of 100,000 USDC. In terms of legal structure, OUSG is issued by Ondo I LP, a partnership registered in Delaware, USA, and follows a standard fund structure.

As of January 23, 2024, the total locked value (TVL) of OUSG is approximately US$117 million.

(1) Investment and custody

The investment portfolio is absolutely The bulk will be invested in BlackRock's iShares Short-Term Treasury ETF (NASDAQ: SHV ), with a small holding of USDC and U.S. dollars maintaining liquidity.

Ondo I GP is the general partner (GP) of Ondo I LP; Ondo Capital Management acts as an investment manager to assist the GP in providing management services; Ondo Finance itself provides Technical services tokenize the fund; Clear Street acts as a securities brokerage firm and qualified custodian responsible for executing fund trading instructions (i.e. buying and selling ETFs); Coinbase acts as a cryptocurrency custodian and brokerage firm that holds on-chain assets (USDC).

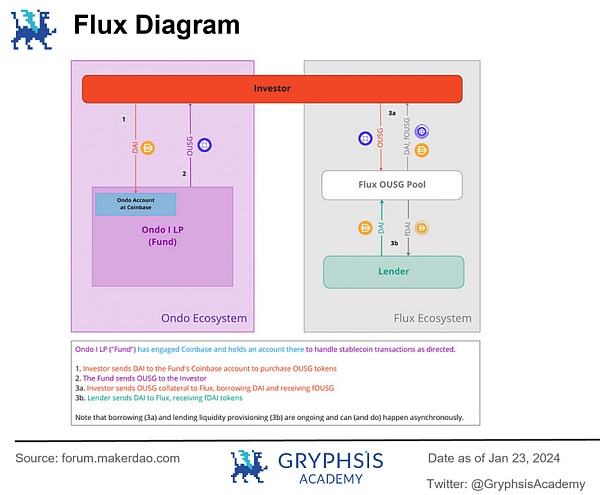

The relationship between the above subjects can be referred to the figure below:

(2) Yield and expenses

As of January 23, 2024, the annualized yield (APY) provided by OUSG is 4.73%.

For the underlying ETF assets, according to the data updated on January 19, 2024: its worst estimated return (YTW) is 5.03%, 30-day SEC The yield is 5.15%, the total assets are US$18.34 billion, and the daily turnover is US$235 million.

In terms of fees: Ondo charges a management fee of 0.15%; service providers such as Nav Consulting charge a service fee of up to 0.15% (this proportion will increase with the Decrease as TVL increases); ETF management fee is 0.15%.

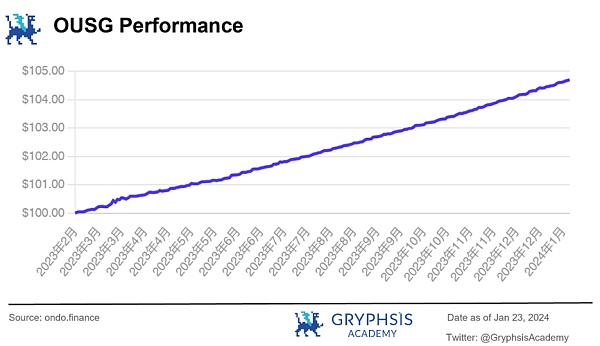

Since its issuance in February 2023, the price of OUSG has continued to move higher as gains are realized, with the current price being 1 OUSG = $104.70.

The upcoming OMMF is a tokenized money market fund that aims to provide a flow to purchase U.S. money market funds Sexual exposure. Similar to OUSG, global investors can purchase OMMF using USDC or US dollars, and the minimum investment amount is also 100,000 USDC.

(1) Investment portfolio

The investment portfolio is overwhelmingly large Part will be invested in money market funds (MMF), and a small portion will be held in USDC and USD to maintain liquidity.

(2) Yield and fees

OMMF Not yet issuance, the annualized yield (APY) shown on its official website is 4.73%.

Future earnings will be airdropped daily to token holders in the form of new tokens, and OMMF tokens will always be purchased and exchanged for $1.

Ondo has not yet announced the underlying MMF asset class.

In terms of fees: Ondo charges a management fee of 0.15%; service providers such as Nav Consulting charge a service fee of up to 0.15% (this proportion will increase with the decrease as TVL increases); MMF management fees have not yet been announced.

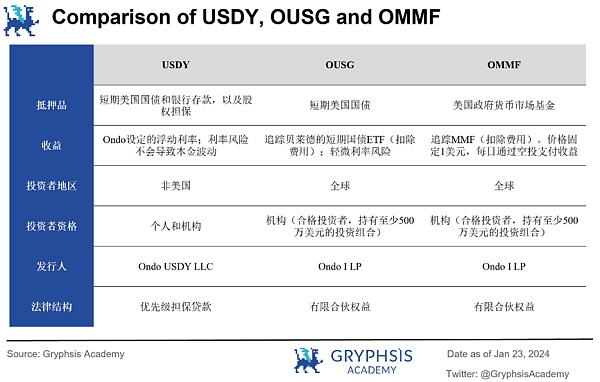

The main differences between the three tokenized financial products USDDY, OUSG and OMMF include:

OUSG and OMMF represent equity/shares held in Treasury bonds and money market funds respectively, while USDY is an interest-bearing note.

OUSG and USDY are total return instruments: any interest paid on the underlying assets is reinvested, making the value of these tokens Usually increases in value over time. Any interest paid in OMMF is periodically paid out to investors in the form of additional OMMF tokens, keeping the value of OMMF close to $1.

OUSG and OMMF are available to qualified investors around the world; USDY is only available to investors in qualified regions, but No investor certification is required.

OUSG and OMMF can be traded on the secondary market at any time; USDY has a lock-up period limit, but can be freely traded after the lock-up period trade.

The specific comparison table is as follows:

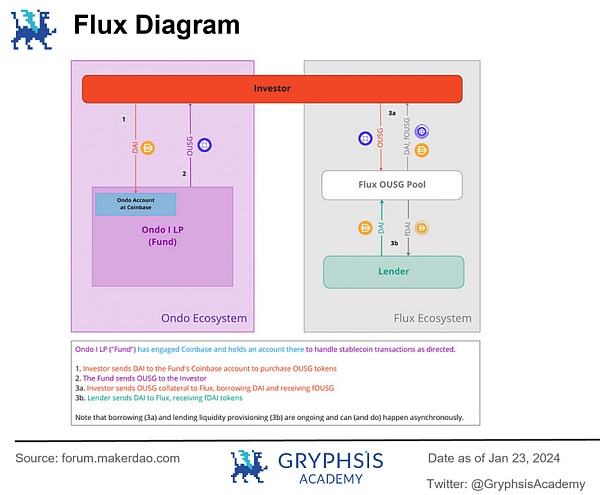

Due to regulatory compliance reasons, some of Ondo's products are only available to KYC licensed customers. Therefore, Ondo cooperates with the back-end DeFi protocol Flux Finance to provide stablecoin mortgage lending services for tokens that require permissioned investment, such as OUSG, to achieve permissionless participation in the back-end of the protocol.

Flux Finance is a decentralized lending protocol launched by the Ondo team based on CompoundV2. The protocol is basically similar to Compound. The protocol allows users to borrow and lend stablecoins backed by high-quality collateral such as OUSG. Ondo has now sold the protocol to the Ondo Foundation (formerly Neptune Foundation).

The interaction between Ondo and the Flux ecosystem can be seen in the figure below:

Ondo Finance is currently an important member of the RWA circuit.

RWA (Real World Assets) refers to the tokenization of real-world assets. By putting real-world assets on the chain, token holders It has ownership of the corresponding assets in the real world and can conduct transactions such as loans, leases, and sales on the chain.

RWA covers a wide range of assets, including sovereign currencies, bonds, stocks, real estate, commodities (such as gold) and other types of assets. As a high-quality asset with excellent credit and liquidity, U.S. Treasury bonds have become the main driver of the large-scale expansion of the RWA track in recent years.

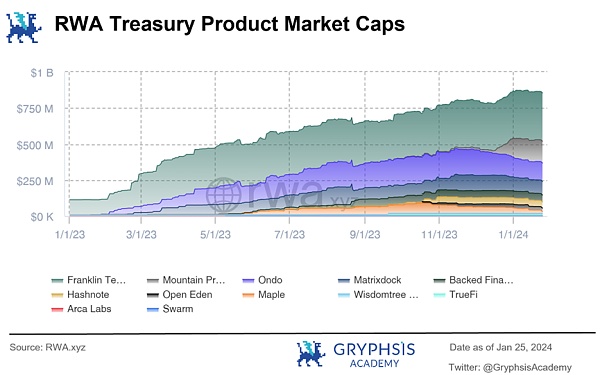

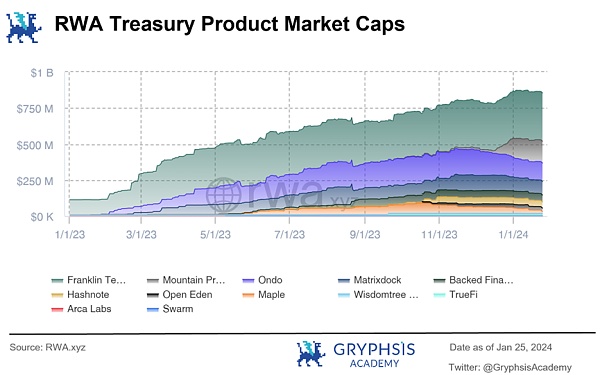

According to data from RWA.xyz, the total market value of RWA U.S. Treasury bonds was only $114 million on January 1, 2023, and on January 25, 2024 It has reached 855 million U.S. dollars on the same day, an increase of 6 times in just one year (and the above amount does not include MakerDAO's use of more than 2 billion U.S. dollars in U.S. debt as collateral for $DAI).

Ondo’s RWA U.S. debt market size reached US$128 million, ranking third in the market, second only to Franklin Templeton Benji Investments (US$336 million) and Mountain Protocol ($151 million).

U.S. bonds have high credit and good yields. Especially in the context of the poor global economic situation in 2023 and the Federal Reserve's multiple interest rate hikes, many investors choose to buy U.S. bonds to obtain better risk-free returns. But one of the pain points of investing in U.S. bonds is the high investment.

Even for U.S. citizens, the cumbersome KYC and account opening procedures are enough to shut out most people, and it is even more difficult for non-U.S. citizens. Therefore, how to introduce U.S. debt into the blockchain and lower investment thresholds in compliance with regulations is the most concerning issue for many RWA protocols.

One of Ondo's current successes is that it has initially solved the compliance issue of U.S. debt on-chain within the existing legal framework of the United States, making the RWA U.S. debt market more Participants (including investors, fund managers, custodian banks, brokers and other parties) can all agree to the operating rules of USDY and OUSG and have actually participated.

It can be said that Ondo has taken the lead in the RWA U.S. bond market. In the future, Ondo can leverage this advantage to continue to expand tokenization paths for other asset classes.

Ondo Finance's main competitors in the RWA industry include Franklin Templeton, Mountain Protocol, etc. A brief introduction of each competitor is as follows:

(1 ) Franklin Templeton

Franklin Templeton (Franklin Templeton Fund Group) is the world's leading asset management company, with a history of more than 70 years and over one trillion US dollars in assets under management. As a giant in the traditional financial field, Franklin Templeton has been very actively involved in the cryptocurrency industry, and his application for a spot Bitcoin ETF (EZBC) was approved by the U.S. SEC in January this year.

As early as April 2021, Franklin Templeton had launched the government money market fund Franklin OnChain U.S. Government Money Fund (FOBXX) on the Stellar chain. FOBXX is the first U.S.-registered mutual fund to use a public chain for transaction processing and recording share ownership. It is regulated by the U.S. Investment Company Act of 1940. From its registration, management and disclosure, this product is a market One of the most compliant RWA products on the market. FOBXX is currently the largest product on the RWA U.S. debt track.

According to FOBXX’s official website, it invests more than 99% of its total assets in securities fully mortgaged by the U.S. government, and its assets have excellent creditworthiness. The shares of the FOBXX fund are represented by the "BENJI" token. The BENJI price is stable at US$1. It is mainly for US investors, and both institutional and retail users can participate. FOBXX distributes proceeds from U.S. Treasury bonds to BENJI holders through the application it developed, the Benji Investments App.

Currently, FOBXX’s total assets exceed US$300 million, with an annualized rate of return (APY) of approximately 5.28%. From the perspective of institutional strength, product scale, start-up time, compliance, etc., Franklin Templeton is the well-deserved leader of the RWA U.S. debt track.

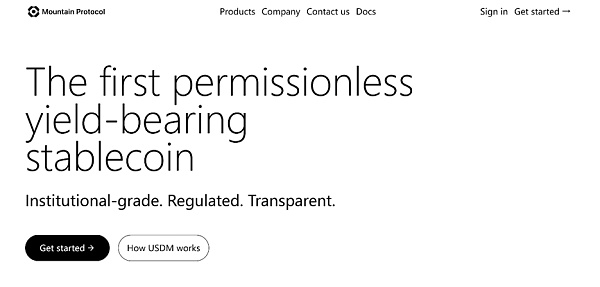

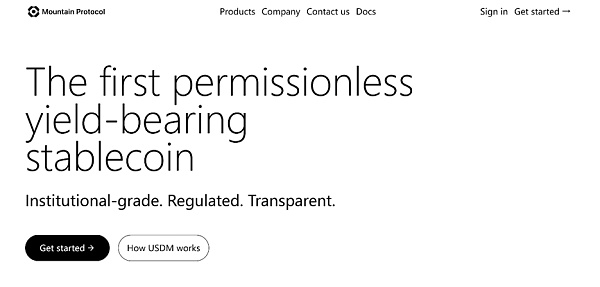

(2) Mountain Protocol

Mountain Protocol is a revenue stablecoin protocol. Its main business is to issue U.S. Treasury bonds as The collateral stablecoin USDM allows users to enjoy the benefits of U.S. Treasury bonds while using USDM.

USDM is issued by Mountain Protocol Limited, and its collateral is short-term US Treasury bonds. The company has obtained a digital asset business license from the Bermuda Monetary Authority (BMA) to ensure its compliance. Users mint/exchange USDM stablecoins with 1 USD and use them in various DeFi ecosystems. The Mountain Protocol adjusts the total supply of USDM based on the yield of U.S. Treasury bonds, so that the USDM balance held by users increases accordingly.

Using Mountain Protocol requires KYC certification, and due to compliance with relevant laws, the protocol does not provide services to domestic users in the United States, and is currently only open to institutional investors. and redemption channels, retail users can only purchase in the secondary market.

The current total asset size of USDM is approximately US$150 million, with an annualized rate of return (APY) of approximately 5%. As an interest-bearing stablecoin, Mountain Protocol's USDM currently mainly challenges the status of traditional stablecoins such as USDT and USDC, but in essence, as a RWA asset, it also has great development potential.

(3) Matrixdock

Matrixdock is a digital asset platform under Matrixport. Its development goal is to provide RWA tokenization solutions plan. The product currently launched by Matrixdock is STBT, which is a token guaranteed by U.S. Treasury bonds and a reverse repurchase agreement collateralized by U.S. Treasury bonds as the underlying asset.

Similar to USDM, the interest-earning method of STBT is that the project party distributes it to STBT holders every day based on the rate of return of the underlying assets, increasing the holdings of STBT in their accounts. quantity. Unlike USDM, USDM's on-chain transactions do not require permission, but Matrixdock restricts STBT through the contract whitelist mechanism to only be able to be transferred and traded between accounts authorized by Matrixdock. In addition, STBT is minted using USDC or USDT, which is more in line with the usage habits of users on the chain.

In addition, the issuance of STBT also adopted the method of establishing a special purpose company to achieve complete bankruptcy protection (not affected by Matrixport). Matrixdock also uses Chainlink’s Proof of Reserve (PoR) to increase STBT’s transparency.

STBT's current total assets are approximately US$95 million, with an annualized rate of return (APY) of 5.10%. Matrixdock’s official website has also reserved space for display of other types of RWA assets, but details have not been announced yet. As the RWA U.S. bond issuer currently ranked fourth in TVL, if Matrixdock wants to overtake others in a corner and introduce more novel underlying assets to the chain, it may have a chance to win.

Ondo’s roadmap for the next two years consists of three main phases:

Phase 1: Focus on integrating tokenized cash equivalents such as USDY, OUSG and OMMF. This includes establishing partnerships with different blockchains, adding white-label tokens for brand equity on other chains, and creating different token versions for different applications (author’s note : It can be simply understood as developing tokens according to specific standards, customizing them to a certain extent according to the project party's requirements and selling them as "OEM", similar to the concept of "sheathing").

Innovative technologies such as Ondo Bridge and Ondo Converter are designed to facilitate cross-chain transfer and conversion of tokens, integrating these tools to provide a seamless user experience.

The second stage: focus on expanding the tokenization of public securities. Ondo is preparing to announce initiatives to redefine the tokenization of public securities, addressing the major barriers that currently limit the widespread use of tokenized securities on public blockchains, such as liquidity and infrastructure issues (Author’s Note: Stocks, companies that can be traded on the open market Bonds, REITS and even options, futures and other financial derivatives fall under the category of "public securities").

The third phase (specific details have not yet been disclosed): Explore the application of blockchain in various traditional financial functions, leveraging both centralized and decentralized mechanisms To maintain Ondo's institutional quality standards.

During these stages, Ondo will work closely with partners, including various blockchains, OTC counters, market makers, exchanges and DeFi protocols, to ensure broad distribution, integration and liquidity of products.

Ondo's smart contracts have been audited by a number of well-known industry institutions, including:

Code4rena Audit, January 2023

NetherMind Audit, April 2023

- < p style="text-align: left;">August 2023 Zokyo Audit

September 2023 Code4rena Audit

September 2023 Code4rena Audit

p>

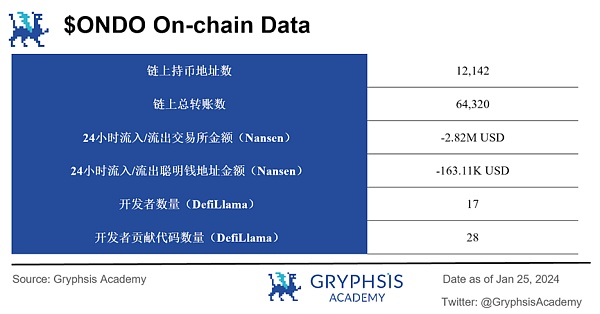

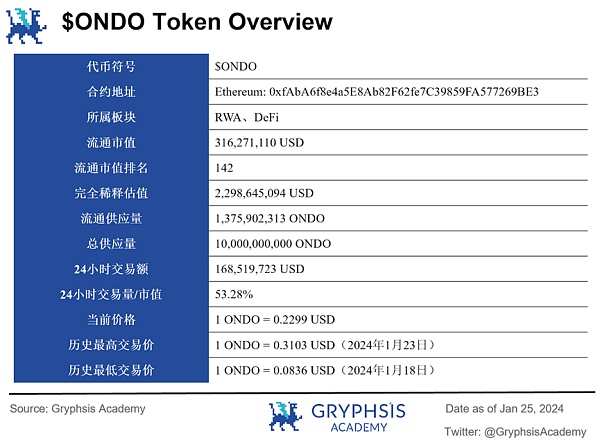

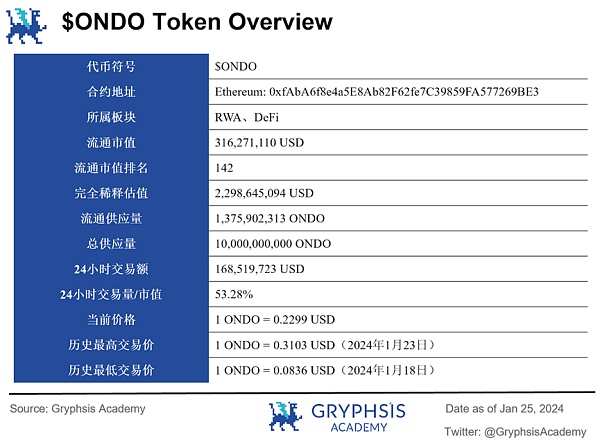

As of January 2024 On the 25th, the basic information of $ONDO tokens is as follows:

p>

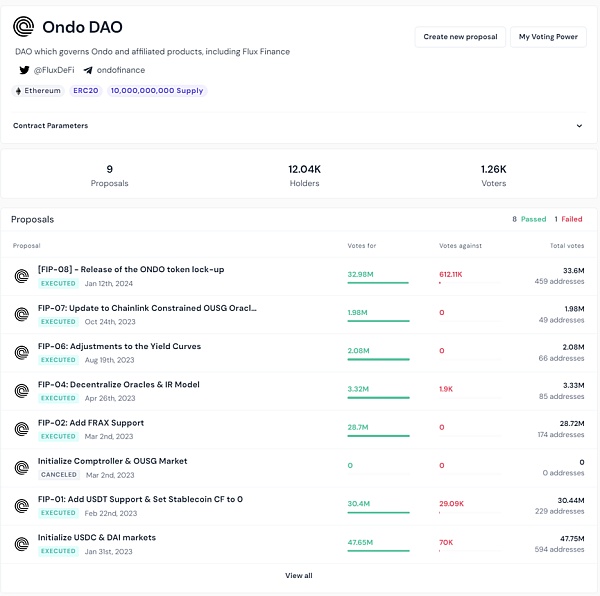

As of now, $ONDO is the governance token of Ondo DAO, and there are no other actual use cases. There are also no incentives for $ONDO tokens to use Ondo Finance related products.

According to the description of Ondo Foundation:

Ondo DAO gives $ONDO holders the following and Specific rights regarding Flux Finance, which are currently governed by the Ondo DAO:

Launch of new fToken Market (i.e. supports new assets as collateral and/or can be lent within the Flux protocol)

Pause fToken Market

p>Update interest rate models for each market

Update oracle address

Withdraw reserves from fToken market

< p style="text-align: left;">Ondo DAO has the following additional rights:

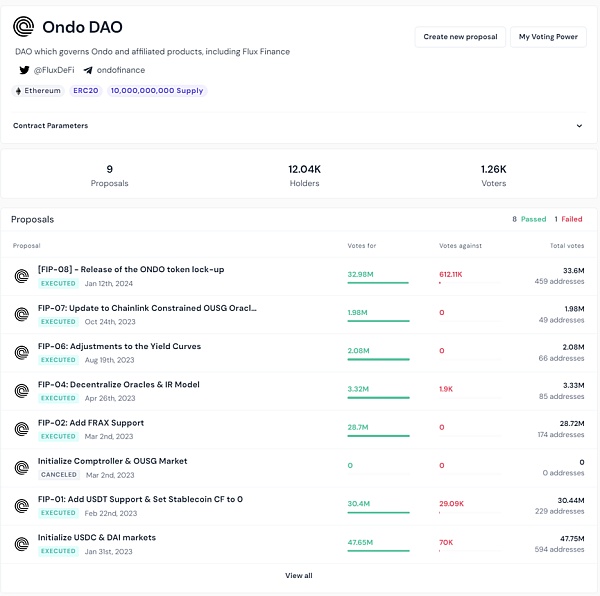

As of January 25, 2024, a total of 9 proposals were launched on Ondo DAO, of which 8 were passed and 1 was canceled.

Since it is not yet clear how the $ONDO token is related to RWA products, the market speculates that Ondo may use $ONDO as an incentive for tokenized financial products such as USDY in the future.

If $ONDO tokens can be combined with RWA products and use $ONDO tokens as an incentive to flow on the RWA product chain, it may promote RWA products to enter the market. The perspective of mass crypto investors.

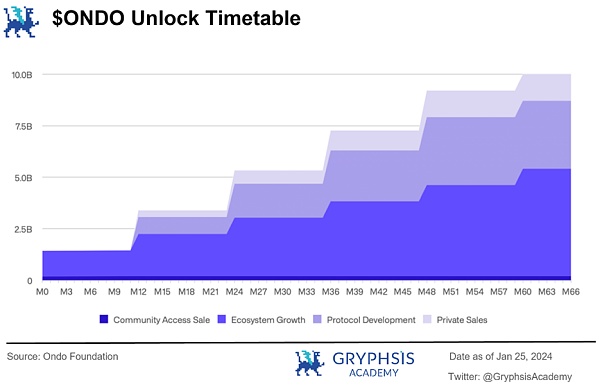

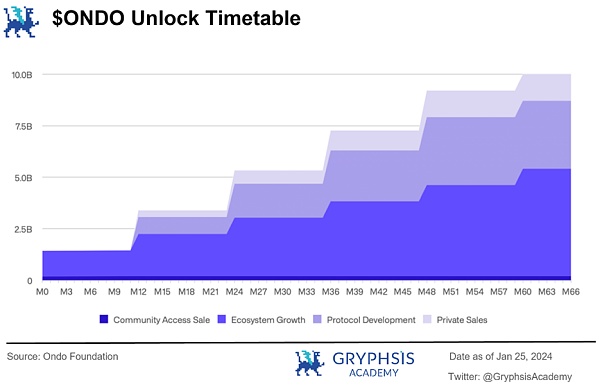

According to the Ondo Foundation's proposal on December 27, 2023, $Ondo is planned to be distributed as follows:

Community sales: 198,884,411 (~2.0%)

Ecological growth: 5,210,869,545 (~52.1%)

Protocol development: 3,300,000 (33.0%)

Private placement sales: 1,290,246,044 (~12.9%)

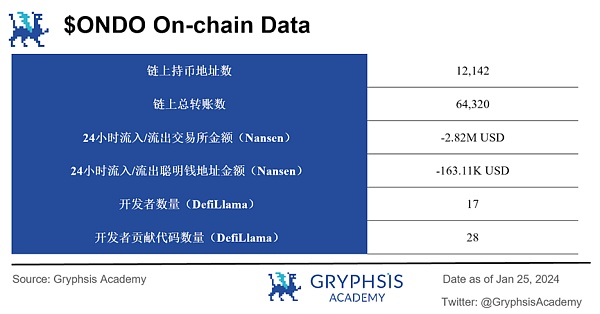

As of now, there are still nearly 80 % of $Ondo tokens are held in project wallets and have not yet been allocated.

According to the Ondo Foundation's proposal, more than 85% of $ONDO tokens will be locked, and the locked tokens will be unlocked 12, 24, 36, 48 and 60 months after the initial token unlock. Private investors and project teams will be locked in for at least 12 months and unlocked over the next 4 years. Investors who participated in the ICO through CoinList were all unlocked on January 18, 2024.

It is worth mentioning that in the past few days, the Ondo project's address has transferred $ONDO tokens to the exchange address many times (currently the project's wallet The $ONDO in it is less than 80% of the total circulation), it may be that the project party lends tokens for market making.

$ONDO from community investors in January 2024 It was unlocked on the 18th and has been traded on the secondary market for only 7 days. Its historical trend is as follows:

In addition, the primary market trading price of $ONDO before unlocking is as follows:

According to data from CoinMarketCap, the main trading venues of $ONDO are Bybit, HTX and Gate.io. The specific distribution is as follows:

< /p>

< /p>

In summary, the main highlights of Ondo Finance are as follows:

The RWA U.S. debt track where Ondo Finance is located has seen TVL increase 6 times in the past year This is the main driving force of the RWA industry, and the industry has a very bright future.

Ondo Finance ranks third in the TVL of the RWA U.S. Debt Track, where it has proven the feasibility of its business model. There is a certain first-mover advantage.

Ondo Finance is already planning RWA products for other types of assets. If it can first launch products that are easily accepted by the market in the future, then It will further expand its leading advantage and become an important bridge connecting the on-chain and off-chain.

Ondo Finance cooperates with leading companies in the industry such as Morgan Stanley and Coinbase (Coinbase is also an investor in Ondo), Strictly complying with relevant U.S. laws and regulations will make it easier to gain the trust of investors.

Ondo Finance’s founder and core team have worked for Goldman Sachs, Morgan Stanley, Tether, Bitfinex, Circle and other companies. It is conducive to further in-depth cooperation with the above-mentioned enterprises.

The main risks of Ondo Finance are as follows:

The RWA track has just started, and many leading and powerful institutions are also vying to enter this field. Ondo Finance will face very fierce market competition in the future.

In addition to being the governance token of Ondo DAO, the $ONDO token has no other actual use cases. Ondo Finance’s related products are not strongly tied to $ONDO. The future usage scenarios of $ONDO are questionable.

$ONDO tokens are still about 80% in the hands of project parties, the distribution mechanism is still unclear, and there are major problems Centralization risk.

Reference materials

[1] https://docs.ondo. finance/

[2] https://blog.ondo.foundation/unlocking-ondo-a-proposal-from-the-ondo-foundation/

[3] https://coinlist.co/ondo

[4 ] https://www.theblock.co/post/114786/former-goldman-sachs-employees-launch-defi-protocol-ondo-seed-funding

[5] https://www.theblock.co/post/143769/ondo-finance-raises-funding-peter-thiel-founders-fund

[6] https://www.reflexivityresearch.com/paid-reports/ondo-finance-overview

[7] https://cryptorisks.substack.com/p/asset-risk-assessment-ondo-and-flux?utm_source=%2Fsearch%2Fondo&utm_medium=reader2

Statement

This report is original by @longyeyouxin, a student of @GryphsisAcademy, under the guidance of @CryptoScott_ETH and @Zou_Block work. The authors are solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy, nor the views of the organization that commissioned the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be relied upon for investment decisions. It is strongly recommended that you conduct your own research and consult with an unbiased financial, tax or legal advisor before making any investment decisions. Remember, the past performance of any asset does not guarantee future returns.

JinseFinance

JinseFinance

< /p>

< /p>