Written by: Web3Mario Source: X, @web3_mario

Abstract: During the holiday, I found an interesting topic and studied World Liberty Financial, which has been very popular in the past two days. This DeFi project, in which members of the Trump family are deeply involved, made more detailed promises in the Twitter space on September 17, including the distribution of WLFI tokens and the vision of the project. Trump spent a long time talking about his optimistic attitude towards the crypto field in the meeting. So for such a project that does not seem to be so "Web3 style", how should we grasp its value? I have done some research on this point and have some experience to share with you. In general, I think the core value of World Liberty Financial lies in finding new fundraising channels to alleviate Trump's disadvantage in raising funds for the 2024 campaign. Then the essence of investing in WLFI tokens is a bet on Trump's election, which is a political donation.

The negative image of Lianchuang and the unclear roadmap make World Liberty Financial quite controversial

Many articles have introduced the background of this project. Here is a brief review. In fact, the project has been controversial since its announcement. The focus of the controversy is on three aspects:

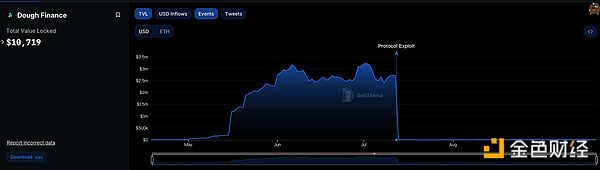

Lianchuang’s background is relatively negative: Considering that two members of the Trump family who are deeply involved in the project, Eric Trump and Donald Trump Jr., do not have much experience in the encryption industry, the industry background of Trump’s two sons is still related to real estate. Therefore, it is generally believed that the actual operators of the project are their two co-founders, Zachary Folkman and Chase Herro. Trump said in the live broadcast that Herro and Folkman were introduced to Trump's son by real estate investor Steve Witkoff. Prior to this, the two had collaborated on a DeFi lending project called Dough Finance, which was established in April 2024 and suffered a flash loan attack on July 12, losing more than 1.8 million US dollars, and then the project entered a state of stagnation. In addition, the resumes of the two are not the elite routes of most entrepreneurs in the technology or financial industries. Folkman's previous influential project was called "Data Hotter Girls", a dating teaching seminar, and Herro had a criminal record in the past.

The product roadmap is not clear: Although the Trump family has been promoting the project with vague descriptions over the past month and promised that it will do many things at the same time, in fact, the project has not been able to disclose some more detailed and accurate plans or descriptions. In this twitter space, Folkman seemed to give some descriptions that the project does not try to create new financial instruments, but aims to improve the usability of DeFi. During the fireside chat, Donald Trump Jr. talked about his family's experience of being "de-banked", which refers to the difficulties that some individuals or companies encounter when obtaining credit lines from established financial institutions. So it is not difficult to see that the focus of the project at the beginning of its launch should still be on the lending scenario, but such information does not seem to be enough to convince most people. And recognize its vision and business logic.

Centralization of WLFI Token Economics: In this interview, Folkman also gave a detailed distribution plan for WLFI tokens, with 20% of the project tokens allocated to the founding team including the Trump family, 17% of the tokens for user rewards, and the remaining 63% of the tokens for public purchase. However, this distribution ratio seems to be very different from traditional Web3 projects. The tokens are basically concentrated in the hands of the team and the whales, and there is not even a distribution for community incentives.

So why did such a project that does not seem to be very attractive receive strong support from the Trump family, especially at this sensitive time point near the election. I think the core reason is to find new fundraising channels to alleviate Trump's 2024 campaign's disadvantage in raising funds. Then the essence of investing in WLFI tokens is a bet on Trump's election and a political donation.

Trump's current campaign funds have obvious disadvantages, and he hopes to find more flexible fundraising channels

We know that the U.S. federal government consists of three parts: the legislature, the judiciary, and the executive branch. The executive branch obtains positions through appointment, recruitment or examination. The legislature, specifically Congress, is composed of the Senate and the House of Representatives. Members of both houses are elected, while the judiciary is between the two. Different state laws have different provisions. During his presidency, Trump appointed more than 200 federal judges, which greatly changed the ideological composition of the federal judicial system. This is also the reason why he can maintain countermeasures when facing the legal litigation crisis in the first half of the year.

The essence of an election is a political show. In this process, a lot of money needs to be spent on publicity to gain more voter support, and the channels of publicity cover all aspects online and offline. Moreover, considering that the entire publicity actually started a year before the election, the capital consumed in such a long period is far from the same order of magnitude as that of events such as the release of movies or concerts. Although the rhythm of publicity is affected by some unexpected events, it is highly likely that the budget will be allocated in an increasing trend. The closer to the election, the faster the funds will be consumed.

Due to the legislative power, some interest groups will be formed between the government and the business community in this process. Some large entrepreneurs will choose to fund some politicians in exchange for the politicians' promotion of some bills that are in their own interests after the election. And this donation is the so-called political donation. In order to avoid excessive rent-seeking and the worst corruption, the US law has designed some bills to standardize the entire process. Among them, "527 organization" is a tax-free organization designed for candidates to raise funds to support elections. Of course, there are many subdivisions, with different designs for the scale of capital received and the way it is used.

Usually, a politician's performance in some key events or unexpected events will significantly affect the amount of funds raised, because the funders' funding for politicians is also carried out in stages. For example, a bad debate or a sudden scandal will affect the funders' confidence in the entire future election situation, and thus stop donating. Therefore, the fund-raising situation can more accurately reflect the performance of the candidates.

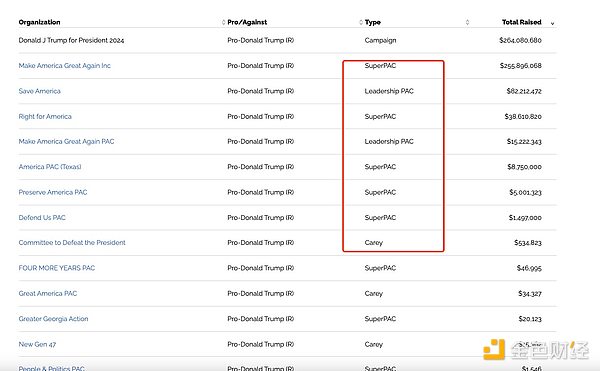

After introducing this background knowledge, let's take a look at the gap in fundraising between the Trump 2024 campaign team and the current Harris 2024 campaign team. This gap is mainly reflected in two aspects, the scale of funds and the efficiency of control.

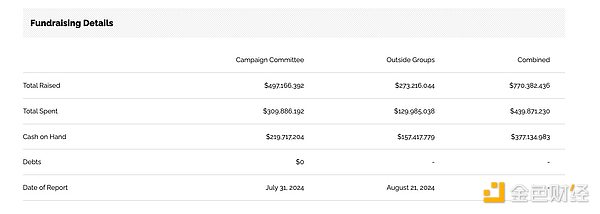

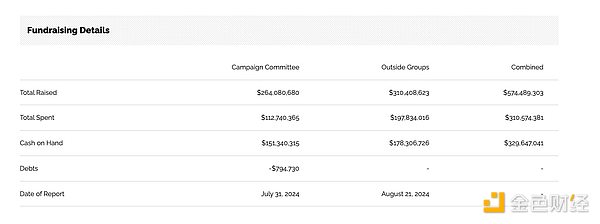

First of all, regarding the scale of funds, in fact, the Democratic Party has always been ahead of the Republican Party in terms of the scale of campaign fund raising. This situation has intensified after Harris was confirmed. It seems that the support forces within the Democratic Party have completed integration and began to support this young candidate. So far, Harris's team has raised a total of 770 million US dollars and has spent 440 million US dollars. Trump's team has raised a total of 570 million US dollars and has spent 310 million US dollars. Whether from the perspective of remaining funds or the funds invested in the past, the Trump team undoubtedly has a big disadvantage, which is why after the assassination, in addition to successfully forcing the Democratic Party to replace Biden, Trump's momentum has been fading. And after the first presidential debate last week, Harris undoubtedly performed better in terms of debating skills, which allowed her to quickly raise $50 million within 24 hours after the debate, which shows her strong ability to attract money.

Of course, it is also interesting to look at the specific differences in the funders between the two. After Biden attracted the support of billionaires such as Michael Bloomberg and LinkedIn founder Reid Hoffman, Harris himself has also won the support of many wealthy people, including Hoffman, Netflix co-founder Reed Hastings, former Meta COO Sheryl Sandberg and philanthropist Melinda French Gates (Bill Gates' wife). On July 31, more than 100 venture capitalists signed a letter supporting Harris' candidacy and promised to vote for her, including wealthy people such as entrepreneur Mark Cuban, investor Vinod Khosla and Lowercase Capital founder Chris Sacca. Trump's core supporters include banker Timothy Mellon, wrestling tycoon Vince McMahon's wife Linda McMahon, energy industry executive Kelcy Warren, ABC Supply founder Diane Hendricks, oil tycoon Timothy Dunn, and well-known conservative donors Richard and Elizabeth Uihlein, and of course Tesla founder Elon Musk. But from this list, it can be seen that Harris' supporters are more emerging technology industries, while Trump's supporters focus on traditional industries. In the dimension of online promotion, Harris undoubtedly has a stronger advantage, but fortunately Musk acquired Twitter. This helped Trump alleviate this disadvantage, so you will find that after Trump returns to Twitter, his online marketing position will undoubtedly revolve around the platform.

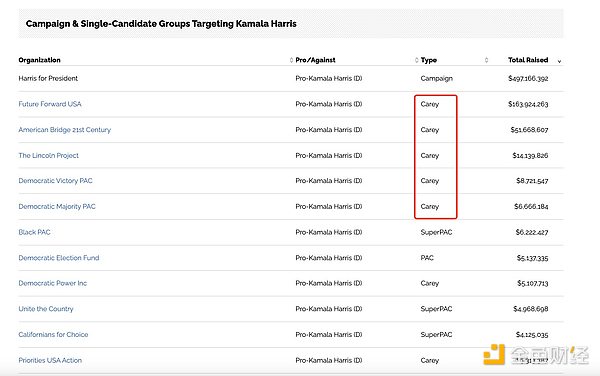

From the perspective of specific funding channels, Harris's external funding channels are mainly through Carey Committee, while Trump's are mainly through SuperPAC. Both organizations belong to the 527 organization just introduced, which has the advantage of unlimited funding donations. However, in terms of funding expenditures, the former has greater flexibility. Carey Committee has two independent funding accounts: one account is used for traditional restricted donations (which can be donated directly to candidates and political parties), and the other account is used for unlimited independent expenditures (for advertising, publicity, etc.). However, Super PAC cannot directly coordinate with the candidate's campaign team or political party, nor can it directly donate to the candidate. This makes the Trump team far less efficient in the use of funds than the Harris team.

This will break everyone's traditional impression that Trump is a wealthy businessman and should have more advantages in terms of funds. However, the situation is just the opposite. Harris' team currently has a clear financial advantage, and this advantage has a tendency to expand further. Then at this time, it is easy to understand that taking the risk to launch such an immature encryption project, which also shows that it is hoped that more and more flexible fundraising channels can be found through the encryption field. This can also be used to a certain extent as a practical expression of currying favor with previous encryption enthusiasts. So it is worth taking some risks for this. Of course, this also explains why the project is based on the explanation that WLFI will follow the terms of Regulation D to raise funds without a detailed roadmap, which is also a guarantee to control the risk within an acceptable range. This is the crux of the matter.

So for the Trump team, there are actually many ways to benefit from this project, in addition to the direct ICO sales. There is also an interesting project, which is to cash out using the lending platform. Remember the problem that Donald Trump Jr. just mentioned about his family suffering from debanking? Assuming that World Liberty Financial is successfully launched as a lending agreement and attracts a certain amount of funds, the team will be able to use the large amount of WLFI tokens controlled as collateral to lend real money from the platform without having a significant impact on the secondary market price, just like the founder of Curve. This can indeed alleviate the problems it encounters.

So after considering these, I have no doubts about the launch of this project, because the essence of investing in WLFI tokens is a bet on Trump's election and a political donation. This plan will be loved by many wealthy people in the crypto field. And its future growth depends on the result of this game. If Trump is successfully elected, such a resource-driven project will easily find the direction of specific business. If it fails, there is no doubt that the Trump family will have no time to care about it in an environment where they are busy dealing with various lawsuits. As small investors, we still need to be cautious about the relationship between China and the United States and participate in it with caution.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance WenJun

WenJun JinseFinance

JinseFinance ZeZheng

ZeZheng JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph