Golden Web3.0 Daily | Binance Inscription Market integrates ARC-20 tokens

Golden Finance launches Golden Web3.0 Daily to provide you with the latest and fastest news on games, DeFi, DAO, NFT and Metaverse industries.

JinseFinance

JinseFinance

Culture is the foundation of the value consensus of digital cryptocurrency, and the dissemination of value consensus is inseparable from the own culture of cryptocurrency. Value consensus is Meme. Cryptocurrencies cannot escape the Meme phenomenon. BTC is the earliest and largest Meme. BTC reprinted its core culture through a news piece and directly implanted the culture into the genesis block, ultimately achieving the bootstrapping of BTC.

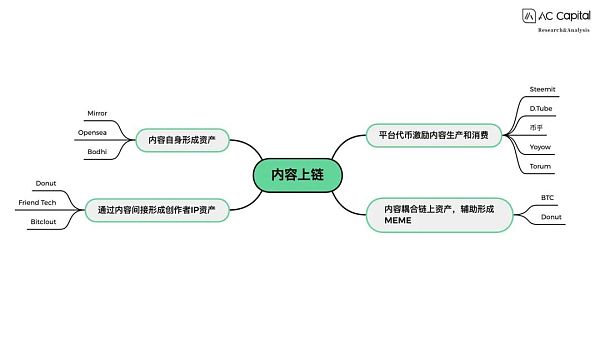

Restoring the tradition of on-chain culture and decentralized culture is a feasible way to return to the spontaneous bootstrapping of BTC. The emergence of Ordi and Sats inscriptions, inscription code information is directly implanted into the BTC community, is the spontaneous starting point of the BTC Renaissance. The integration of encryption culture and technology, the conscious realization of the binding of encryption assets and culture through content on the chain, will be one direction of the development of Inscription 2.0.

January 3, 2009, 6 pm At around 1:15, on a small server in Helsinki, Finland, the genesis block of Bitcoin was born. In this genesis block, Satoshi Nakamoto recorded a news item from The Times that day in the script area:

"January 2009 On the 3rd, the Chancellor is on the verge of implementing a second round of emergency bank aid"

Thus, the era of great navigation in the encryption world has begun. Adventurers, careerists, and capitalists are chasing the treasures of the crypto world and setting sail to find where they belong.

13 years have passed by, Satoshi Nakamoto has ascended to the throne of God, and his physical body is missing. The script area of BTC once again ushered in a highlight moment. Because of the upgrade of BTC's segwit and Taproot, the space recorded by BTC has returned to everyone's field of vision again. The appearance of the inscription unearths the value of the storage space on BTC: this is a storage space protected by a computing power network of more than 400 million TH/s to protect data security. Using this space as a ledger, the security is stronger than any blockchain. The route of Inscription technology is the exploration of the technical route of BTC chain as a multi-asset financial certificate platform. The existence of the inscription value is to demonstrate the value of the BTC script space under this architecture.

And this is just the starting point of BTC's revival. Members of the crypto community began to reflect on the original understanding of BTC: BTC can not only serve as the ledger of BTC, but also Ledgers of other assets! What follows is a reflection on Satoshi Nakamoto’s behavior. What is the significance of reprinting news from a paper newspaper in the storage space of BTC? What’s the point of repeatedly loading off-chain human-readable content on-chain?

Being able to answer this question will solve the product motivation for uploading social content to the chain.

Friends who are new to the currency circle, especially those who have transferred to the blockchain circle, often have a good experience with advanced technologies like EOS, but Projects with crappy valuations are full of confusion. And this is because there is no clear distinction between technical consensus and value consensus.

The value of BTC is also created from scratch, and ultimately the value is bootstrapped. In the process of realizing value bootstrapping, the community must not only reach a consensus on technology, but also reach a consensus on value. Just achieving technical consensus does not mean having a strong value consensus.

Take EOS as an example. The valuation of EOS has troubled many technicians: Although the technology is very good, why has the price plummeted? Even today, EOS technology is not backward. The experience interaction and even ecological applications on the chain were once no worse than ETH. But all technical barriers and ecological advantages cannot stop people from the foundation from selling EOS and buying BTC and ETH. This kind of cool operation makes EOS a tool for the team to cut leeks in the eyes of community members. When an asset forms a stereotype in the eyes of investors, reversing the consensus requires the power of capital. Without capital support and the departure of core members, no matter how good the product is, it cannot support the valuation of EOS.

The EOS ecological panorama in 2018: I was richer back then

Looking at Doge, the originator of Meme coins, there were not even any developers left before Musk ordered it. Musk's call for orders has made most investors believe that with the blessing of Musk's social influence, Doge will be seen, recognized, liked and even owned by more people. The consensus diffusion of tokens will be even more powerful if it relies on Musk as a source of communication. This kind of community consensus has raised the price of Doge from 0.014 to 0.8 US dollars.

Two cases, EOS has good technology and good products, but does not have a good price. Doge is a pure Meme, with no ecology and no technology, but high valuation: technical consensus is not the same as value consensus.

BTC's technical consensus ensures that each account can fully control its own permissions and there is no double spending. As for the technical consensus, from the moment BTC was born, BTC’s technical white paper has assumed the obligation of publicity. It took a year and a half for BTC to go from having no price to having a price, and from someone mining it to actually realizing payment. Over the past year and a half, BTC community members have been constantly reflecting on themselves, not just as a chain, but whether BTC is safe enough. Moreover, what lingers in the minds of these pioneers is whether BTC is valuable and how much it is worth. And this is a consensus of value. Consensus of value is always subjective. The foundation for the BTC value consensus is "Denationalization of Currency" and FUD on currency centralization. This piece of news written into the genesis block is the seed and trigger of FUD. Without the reprint of this Genesis Block, this news would have been buried in the vast archives of The Times.

Satoshi Nakamoto is the master of attention. Reviewing the successful launch of BTC, Satoshi Nakamoto has been making excuses for crypto giants in the crypto community. For example, he showed David that BTC had realized the B-cash concept proposed by David, and received David's support off-chain. This kind of call directly establishes a brand for BTC in the community, thereby gaining community attention. On January 12, 2009, Hal Finney received 10 Bitcoins from Satoshi Nakamoto when he was testing Bitcoin transfers, and became the first recipient of Bitcoin transfers. After that, Satoshi Nakamoto often transferred the mined BTC to friends in the crypto community, gaining the attention of community members through this behavior. And this behavior later evolved into one of the unique ways to build attention for crypto projects: airdrops!

Going back to the first real-life BTC transaction, Laszlo Hanyecz purchased two pizzas with 10,000 BTC. In this exchange, BTC had a price for the first time. Both parties to the transaction know about BTC. The prerequisite for both parties to reach a consensus on the purchasing power of BTC is that both parties agree on the value narrative of BTC. The prerequisite for agreeing with the value narrative is to be able to notice the value narrative of BTC. Satoshi Nakamoto engraved meaningful news headlines on the genesis block, which allowed every BTC evangelist to automatically tell the value narrative of BTC when explaining the history of BTC. And this is the most direct and efficient value capture.

Everything is Meme

Most coins are Meme coins. Looking back at other tokens in the currency circle, there are many mainstream tokens (UNI, ARB, OP) without clear value capture support. With more assets, rights and obligations are difficult to distinguish, and even effective value capture is difficult to find. The valuation of the currency circle cannot be explained using monetary theory, nor can it be explained using financial assets. BTC claims to be a peer-to-peer cash payment system. Today, how many people actually use BTC to pay? Let’s be bold, BTC is the biggest Meme. The issue of currency price is the issue of Meme. It is precisely because of the Meme attribute that the assets in the currency circle have an attribute that is different from traditional finance, namely attention. Its fluctuation cycle is also very different from traditional finance.

Even the value of utility tokens contains elements of Meme. The pricing of financial assets ultimately depends on supply and demand. Supply and demand originate from changes in people's decision-making, which are influenced by emotions influenced by information. Behavioral finance has long been a consensus in the investment industry. The traditional financial value represented by tokens and memes are not mutually exclusive. Memes can either increase or decrease the value of utility tokens.

Therefore, what we say about currency prices is about memes.

In the short term, currency prices can be manipulated by patterns, but in the long term, the size of the community holding tokens and their willingness to hold currencies depend on the output of values. whether succeed. Just like Apple mobile phones, even if the price/performance ratio is low, users still buy it. Only long-term believers and long-term currency holders are the value support of the token. And these believers and currency holders are inspired by culture.

2.4 Reaching consensus requires cultural communication

Tokens The technical consensus and the value consensus of the token are formed through different paths. Technical consensus helps form a consensus on the value of tokens. Whether it is technical consensus or value consensus, there is a perceptual part, and there are people who are lazy with intuitive thinking. Therefore, unlike copying cold code in different computers, consensus must be spread among people by using warm content as a carrier. These contents that are warm and spread among people are what we usually define as social content.

All Crypto project parties have no differences in their understanding of building brands and establishing value consensus through social media and social content. Almost all the project parties I know have various social accounts and social spaces for private communication. From community operations to group mods, the project team will form its own community echelon. Social accounts have become the source of communication, and communities or a series of encrypted small circles have become channels of communication.

BTC's technical white paper is calm and objective, but the news engraved in the genesis block is warm. This news reflects the value orientation that Satoshi Nakamoto wants to promote to BTC followers. The genesis block has been deployed around the world with full nodes. As long as BTC still exists, this digest advocating the value orientation of BTC will not stop its spread. Every time we read this excerpt, we are reminded again and again that the end of centralized central banks is approaching. If we regard BTC as a religion, then "Bailout" is the doomsday prophecy of that religion. And BTC is Maitreya, Messiah, and Noah’s Ark in the doomsday.

The currency circle has always understood cultural communication best. Don’t look at the past, just look at the inscriptions, various small pictures, and various slogans to let more people understand the Meme culture represented by the four letters. Unfortunately, the communication area is still dominated by Web2 social media. Meme itself does not have a strong value orientation like BTC. Many inscriptions cannot find their own position in the process of dissemination. Successful inscriptions, on the one hand, occupy the orthodox seat of inscriptions, and on the other hand, they form a unique culture in terms of narrative, such as "1 sats=1 sats" in the Sats community.

In summary, cultural content is the carrier of value orientation. This understanding coincides with the Meme theory. Meme is an information unit in cultural communication. Culture here generally refers to thoughts, concepts, customs, art forms, etc. In order to support the price of tokens, designers must consider the relationship between culture and currency prices during the process of cultural dissemination. The memes contained in BTC made a good start for the crypto community. Unfortunately, many subsequent tokens known as "memes" often only pursue the cost of spreading "memes" and abandon the relationship between "memes" and token value. relation. This is also the reason why after BTC, there will only be a coin name with memes, and there will no longer be a narrative of memes.

Content uploading to the chain to capture the native attention on the chain is currently a very rare content uploading strategy. Other tracks have not formed a sustained economic cycle, and most of them are in the experimental stage.

To reach a consensus on value, we first need to have access to information. In modern society, the cost of content creation is almost zero. Compared with the surging content, attention has become a scarce commodity since a hundred years ago. From the placement of mainstream media to the pit of KOL, from Web2 to Web3, the operation of the project will not ignore the importance of attention. Since the emergence of the first generation of print media, attention has been the media’s primary trading commodity. In the Web2 era, those platforms that hold the traffic throat regard traffic distribution as the source of platform monopoly profits.

In the traditional business world, advertising of products is to let consumers know about the product itself, as well as to promote its product attributes and value proposition. But the most high-end advertising often uses values output. Multinational giants such as Apple and Huawei are often well versed in this as long as they provide brand-differentiated products. There is no difference between this value output and the value output of digital crypto assets.

In the traditional field, the methods of capturing attention in the currency circle are also similar. There is event marketing where an NFT is auctioned for tens of millions of dollars at Sotheby's, there is activity marketing where a party is included in a cruise, and there is brand marketing where the naming rights of a stadium are secured.

The currency circle also has information channels on the chain. For example, although the inscription on BTC is only 4 characters long, it directly injects Meme information into the core of the BTC community. Whether for or against the inscription. The appearance of the inscription requires members of the BTC community to take a stand. The information on this chain is eternal and open. Inscriptions that comply with the rules can be engraved on the BTC blockchain and read by others. The process of casting inscriptions is regarded as a certain address liking the piece of information, which is a public announcement of attitude. However, the information on the chain of traditional inscriptions is too sparse, and the attitude expressions of community members are too single.

It is undeniable that Satoshi Nakamoto’s content selection is exquisite. Perhaps nothing else can pierce the fragility of centralized finance like this piece of news. In this unprecedented marketing, we see the value of social content recorded in the genesis block. It is the eternal creation space on BTC that has pushed this exquisite narrative material into the spotlight of the cryptocurrency circle’s attention, and it has become more prominent as the consensus between blockchain and BTC grows.

On-chain media is different from traditional media. It not only has different technical routes and business logic, but also covers different groups of people.

In the history of blockchain, many projects have considered doing business similar to traditional media on the blockchain, but due to efficiency issues. Whether it is text media, multimedia, or short video, it is difficult to collect the same attention as in the Web2 world. Whether it is the product form or the content stored in the product, Web3 media products lag behind Web2 media by no means. Including financial token subsidies, Web3 media products cannot compete with Web2 products for the attractiveness of content. The content algorithms of Douyin, Instgram, YouTube and other products have already reached their peak.

Web3 media can only find another way to challenge Web2. BTC inscription is an alternative content on the chain. Although there are only 4 characters on the chain, these 4 characters are indeed rooted in the BTC community. Taking the inscription Sats as an example, the casting of the inscription cost tens of millions of dollars in total. The community demonstrates the value of Sats culture by burning real money. According to current Unisats market data, there are less than 1,800 BTC inscriptions included. Compared with traditional web2 media, a large amount of content is filtered out. From this perspective, inscription-based content uploading is a content filter with price-to-earnings ratio as the core. Only cultural memes that can afford to spend money and think they have potential can occupy a place in the inscription market.

Content filters are also attention focussers. While the attention remains unchanged, we reduce the total amount of content by increasing the cost, and the same content can receive more attention.

As mentioned earlier, compared to Web2, the content on the chain is like a password, boring and boring. Can on-chain content really compete with Web2 media content for scarce attention resources? The answer is yes.

The content on the chain is like a password, but it is a password for wealth. Thousands of times the price increase is like a hook for attention, catching the attention of those who are willing to get rich. If a person wants to find the wealth code in the inscription, he can try to change his destiny. Instead of searching hard in traditional media, you can directly follow the lists and pictures on these inscription exchanges to get more information. Trading volume and the rise and fall of floor prices are the secret words of the industry. Those who are interested will join various web2 media and various offline circles according to the code of the inscription in the inscription selection, and conduct a more detailed investigation of the culture, community, and even the distribution of personnel chips corresponding to the inscription.

The success of Inscription Ecology tells us that on-chain content can gather attention through revenue orientation. The same is true for BTC. The higher the price of BTC, the more people will pay attention to BTC, and then understand the genesis block and the dilemma of the British Finance Minister in 2009, thus having a vivid understanding of the urgency of decentralization.

Profit-oriented attention has another meaning. The value of attention should be related to its wealth control, not to heads. Assume that an on-chain media can only reach 1% of the world’s population, but these people can control 50% of social wealth. Then the advertising value of such media must be far greater than media advertising that can reach 50% of the world's population but only affect 10% of social wealth. High-end circle marketing takes this path. On-chain content media takes full advantage of this advantage. When a person's interests are more bound to an asset on a certain chain, then he or she will care more about the content information related to this asset.

There is a certain degree of closure in the content on the chain. Look at Unisats and OK Wallet users are dedicated users. Their attention will not be diverted elsewhere by interesting videos or texts. In the closed space on the chain, the content is extremely limited. Even though the attention is not as good as traditional Web2, different attention guidance methods determine that these attentions are relatively closed. Life on the chain is in a gradual development process, and more and more people are beginning to open Web3 accounts and enter the Web3 world. This attention will grow with massive adoption. One is closed attention, and the other is growing attention traffic. The competition for attention of on-chain content can be expected in the future.

Closing is also reflected in the fact that the content space on the chain is independent and cannot be tampered with. When a lot of media information has been flooded by the information tide, only the information on the chain is relatively clear and can be checked without fear of being deleted or tampered with. This attribute is particularly suitable for maintaining the core attributes of Meme culture.

By putting the content on the chain through inscriptions, the content will be entangled with the token transaction and difficult to separate. This data structure ensures that content and assets are close enough in space. This point goes back to the success theory of BTC and BTC inscriptions. It is precisely the digest of The Times that is engraved in the genesis block of BTC, so that believers in BTC can be charged with centralized fragile faith again and again. It is by implanting the inscription json code like "dust" into the BTC script that the Meme culture of the inscription can be connected to the BTC community. This is a kind of content placement targeted at communities and assets, and the attention pursued is also precisely targeted.

To sum up, on-chain content can challenge Web2’s attention capture from the perspective of value, closure and user accuracy. Thus, content on-chain is not only feasible, but has been successful in the era of BTC bootstrapping. During the subsequent on-chain ICO period, Meme, which was continuously incubated, also repeated the success of content on-chain. It’s just that we are addicted to learning the content uploading method of traditional web2 media, and turn a blind eye to the continuous successful content uploading cases.

If a token is to form a consensus on its value, in addition to its utility In addition to directly forming an economic closed loop, tokens must also spread through culture and form Meme. Whether it is a utility token or a non-utility token, cultural communication is an indispensable part. Unlike other later tokens that established Meme through off-chain media and communities, BTC also uses on-chain space as a media space. A piece of news sent centralized currencies to the gallows of history.

Such a sophisticated design, the result is, how many people in the currency circle can escape the baptism of this PUA mass? The development history of BTC tells us that the low-level content related to the currency is to transmit information, and the high-level content is to output value. This is no different from traditional brand strategy. Content must carry culture, and culture must support value. After Satoshi Nakamoto, there is no such master.

Since the end of 2023, the industry has been shouting for the renaissance of Bitcoin. The narrative is biased toward a confrontation with ETH’s orthodoxy monopoly. Let’s not talk about culture, where did the Renaissance come from?

Social inscription focuses on the establishment of community culture, coupling assets and community culture, and is a revival of a way to build value consensus.

Social inscription is a brand new inscription concept. By adding attribute strips in json, it gives inscriptions more space on the chain to display unique culture. With each casting, each caster can write what he or she deems important to the inscription. By increasing the display space of on-chain content, perhaps social inscriptions can replicate the successful case of building FUD on the BTC chain. Although social inscriptions are still being explored as an emerging species, and their rules, mechanisms, even gameplay and token dynamics are all in the exploratory stage, as long as there is hope for the success of BTC, the cost of various experiments will be worthwhile.

On the other hand, Social Inscription inherits Inscription’s attitude towards the BTC script space. And this attitude is the biggest squeeze on the value of BTC inscription space. I believe that with the emergence of various layer2s that are compatible with the BTC mechanism. We can see that in the case of asynchronous consensus, the blockchain impossible triangle that plagues the Web3 industry can be solved. This is one direction of development of encryption technology.

Social Inscription will be a triumphant meeting of encryption culture and technology after 16 years, and it may bear fruitful results.

Social inscription is a brand new thing, and the direction of exploration is the combination of human nature and technology. In this new perspective, imagination is very important. If there is high-quality content and a culture that matches the meme can be created, social inscriptions may subvert the current value creation model of meme tokens.

Most of the world's religions have doomsday theories, because in the doomsday, religion is the only way to salvation. So for believers, religion is a necessity. The British Chancellor of the Exchequer's bailout is the doomsday set by the BTC religion. Therefore, the cultural structure of BTC is very different from other Meme, and it has also achieved a height that other Meme can hardly reach.

In addition to the cultural perspective focused on in this article, Social Inscription is also considering the possibility of social graphs on the chain. Transactions on the chain reflect the relationship between accounts. The reasonable financialization of these relationships is also an angle that social inscriptions can explore.

Social inscription realizes the possibilities of technology, but whether it can create content that carries culture determines the height of social inscription. Although the ecology on BTC to which Social Inscriptions belongs is supported by the BTC consensus, it is also subject to the constraints of BTC technology. The space resources on the BTC chain are scarce, and the limit of content on the chain will restrict the culture formed.

The Web3 industry encourages innovation and inspires explorers . Social Inscription continues the successful case of BTC and explores a more comprehensive path to Meme construction. Therefore, I call it the BTC Renaissance. In the context of a bull market, this innovative currency issuance mechanism with case studies has the opportunity to obtain excessive market rewards.

《Attention Economy , How to Turn Public Attention into Business"

"Introduction to Communication"

"How does the meme culture of the cryptosphere change the supply and demand model to create consensus? 》

"Bitcoin Renaissance: Changes and Changes in Value and Consensus"

"Analysis of the importance of attention in the crypto-economy"

Golden Finance launches Golden Web3.0 Daily to provide you with the latest and fastest news on games, DeFi, DAO, NFT and Metaverse industries.

JinseFinance

JinseFinanceShiba Inu launches SHEboshis NFTs on ERC-404, enhancing liquidity and ownership, despite a minting bug resolved by increasing supply.

Sanya

SanyaDue to the complexity and novelty of the inscription protocol, various security issues arise frequently. This not only threatens users’ asset security, but also has a negative impact on the healthy development of the entire Inscription ecosystem.

JinseFinance

JinseFinanceInscription, BRC-20, Binance Web3 wallet officially launched the Inscription market. Which ecological projects are worthy of attention? Golden Finance has been waiting for a long time. Can the Inscription Track start its second spring?

JinseFinance

JinseFinanceFrom the generation and transmission of inscriptions to unique computing capabilities, to the creation of open virtual worlds through `BRC-420`, and the decentralized identification system of the `BRC-137` protocol, each protocol presents its own unique technology Characteristics and application areas.

JinseFinance

JinseFinanceSo far, I feel that the Ethereum inscription ecosystem is far inferior to the Bitcoin inscription ecosystem in both creativity and development.

JinseFinance

JinseFinanceAs the inscription ecology becomes stronger and stronger, I think the risk of the "modification" plan for the inscription will only become smaller and smaller, so you don't have to worry too much about this risk for the time being.

JinseFinance

JinseFinanceHit 10 billion MOVEs in three days! Is the MRC-20 "Smart Inscription" a hit? Does the inscription open a new narrative?

JinseFinance

JinseFinanceThe philosopher Wittgenstein once said, "The limits of language are the limits of the world." In the same data chain, the Chinese word "inscription" is infinitely more advanced than the three-letter abbreviation of NFT.

JinseFinance

JinseFinanceFollowing Luke’s public statement boycotting Bitcoin Inscription on December 6, Bitcoin godfather Adam Back put forward a different view on December 17.

JinseFinance

JinseFinance