Author: Shenchao TechFlow

This year’s re-staking track is getting more and more complicated.

Not only are there a large number of re-pledge agreements related to EigenLayer, but infrastructure projects that are not directly related now will not let go of this hot spot with full traffic and income, trying to take advantage of the interest-earning characteristics of re-pledged assets. , injecting more liquidity into your chain.

On February 23, zk-Rollup ---Zircuit, endorsed by Pantera and Dragonfly, announced a new activity method on social media: Zircuit Staking, staking and re-staking native ETH or liquidity Deposit tokens, etc. into Zircuit to receive points for the project and native rewards for re-staking.

This also means that the liquidity mortgage doll There are many fish to eat, and there is a new place to go.

If you have actively participated in EigenLayer-related re-pledge projects before, you can make the best use of the LRT on hand and deposit it into Zircuit to maximize your income and win Zircuit’s airdrops.

Considering Zircuit’s background of being endorsed by top VCs and its cooperation with many LRT projects, participating in this staking activity may become the next hot topic in the LRT track.

To help everyone understand Zircuit, this article will introduce it A brief introduction to the business and how to participate in staking and earn points are given.

What is Zircuit?

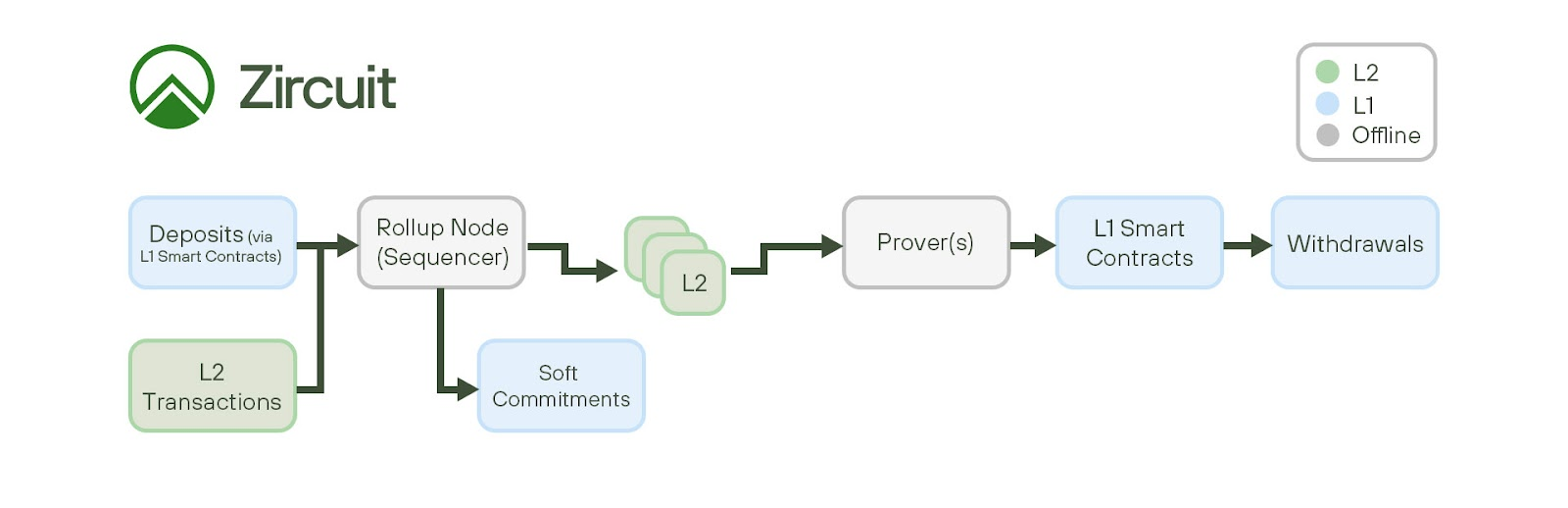

Zircuit is a zk Rollup that is fully compatible with EVM and is currently in the testnet stage.

The concept of Zk Rollup will not be described in too much detail here. It can be generally understood as Ethereum L2 using zk technology. In essence, it is to solve the performance and efficiency problems of Ethereum itself and help transactions. Better and faster execution.

The architecture can be divided into 3 blocks:

Sequencer that processes transactions to build L2 blocks

The provergenerates validity proofs for these blocks

< strong>Smart ContractInteraction with L1 system

Compared with the OP architecture, the result Zircuit can achieve is the fast consistency of zkEVM Rollup, without the need for withdrawals A challenging period for trading.

Zircuit uses parallel proof generation to quickly generate proofs, Proof aggregation is also utilized to generate a single proof that can be verified on-chain. By breaking circuits into specialized parts and aggregating evidence, Zircuit achieves greater efficiency and lower operating costs. The final generated validity proof is an aggregation of proofs from a batch of L2 blocks.

It is also worth mentioning that Zircuit also has a major feature of preventing malicious transactions/hacking attacks using its Serializer Level Security (SLS). Since this part involves many technical points, it will not be expanded upon here. Interested readers can visit the project document to learn more. detail.

Another point that everyone is more concerned about is:

Zircuit uses native ETH and currently has no governance token (doesn’t mean there won’t be one in the future).

Therefore, how to participate in interactions to win future airdrops has become a more practical topic at this stage.

Earn points by staking again, and get more fish in a new place

As we all know, the biggest pain point of harvesting wool is the opportunity cost---with limited funds, it is difficult to harvest again after harvesting A. B.

In a situation where airdrops are becoming increasingly involved and major protocols are increasingly competing for users’ attention and liquidity, if one fund can eat more than one fish, it is naturally the most popular choice.

Zircuit has also taken this to the extreme and officially announced its points earning activity today, and the way of earning does not require additional investment:

Will Users who have already played and thenpledgethe tokens are deposited into Zircuit to achieve the effect of eating more from one fish.

First we can take a look at the rules of Zircuit points.

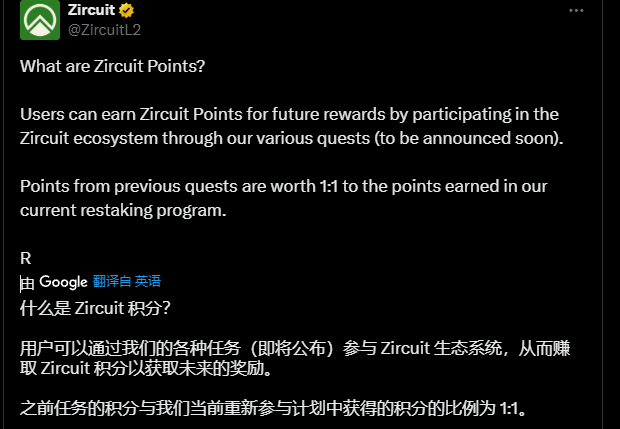

The official statement is that users can Participate in the Zircuit ecosystem with various tasks to earn Zircuit Points for future rewards. Designed to reward participating users and communities and help guide Zircuit to gain more native liquidity. Users can earn Zircuit Points by staking,but those who choose to migrate their assets to the Zircuit mainnet when it comes online will receive the most rewards.

In other words, earning points by staking is only the current activity, and there may be cross-chain asset rewards in the future.

So focusing on the current point-earning activities, the first question that needs to be paid attention to is "What assets can be deposited to earn points?"

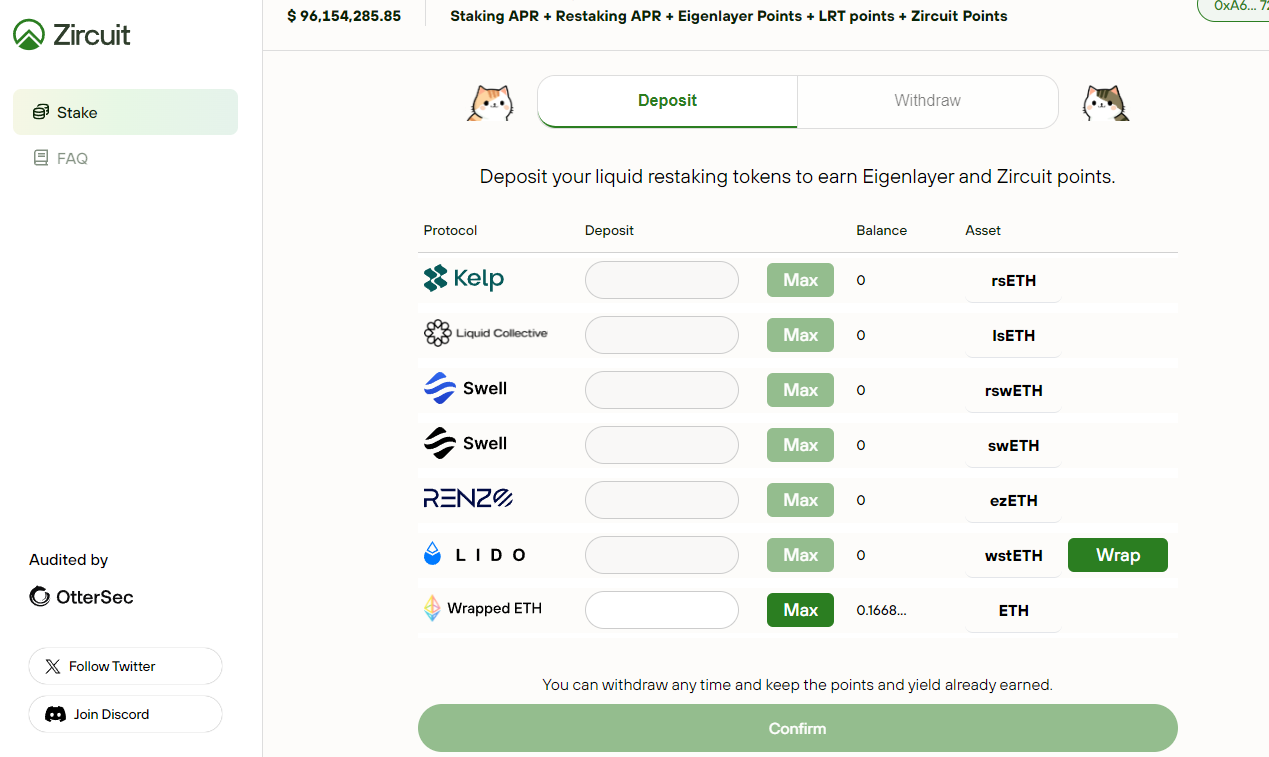

Zircuit divides the deposited assets into two Class:

Native ETH, subsequent withdrawals will be returned in the form of wETH.

Various LST/LRT tokens, supporting various re-investments on Swell, Renzo, KelpDAO, EtherFi, Liquid Collective, Lido Staking ETH

But it should be noted that Zircuit encourages you to deposit LST/LRT, because the efficiency of obtaining Zircuit points by depositing different assets is different:

-

Deposit ETH, the multiplier is 0.5 times

Deposit LRT/LST, the multiplier is 1x

Also In other words, the efficiency of earning points by depositing native ETH is only half that of depositing LST/LRT.

Secondly, the author believes that Zircuit’s points activity is more friendly to small businesses.

There is no minimum deposit requirement to earn Zircuit points, and regardless of the deposit amount, the above-mentioned multiplier of the assets will not change; at the same time, there is no release period, you can release it if you want, and it will be easier to take away the assets. flexible.

Staking Operation Guide

The following will demonstrate in detail how to participate in staking.

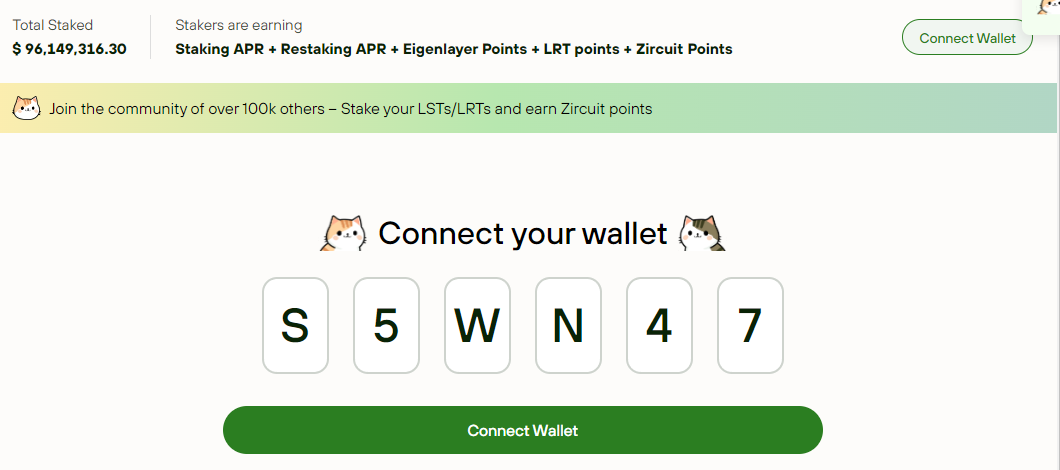

First, Go here Enter Zircuit’s official staking page, enter the invitation code S5WN47 to register and link the wallet. If you fill in the invitation code, you can get an additional 15% OG recommendation points reward when staking.

In the subsequent interface, deposit any token supported by the LST/LRT protocol.

Enter the amount to be pledged, then click Confirm below, pull up the wallet and sign to successfully pledge.

The detailed rewards for staking can be broken down into:

StakingTotal rewards = Staking APR + Re-staking APR + Eigenlayer points + LRT points (such as ezETH, rswETH, rsETH) + Zircuit’s own points (future rewards)

It is easy to achieve the effect of eating more than one fish. .

However, places with huge profits and low barriers to entry also mean that it is easy to get together.

As of press time, there is not much content introducing Zircuit in the Chinese area; as time goes by, more people will inevitably participate in the process of staking to earn points.

Competition means smaller expected returns, but at the same time more people also mean greater certainty of returns.

In the year of airdrops, active interaction and participation are the lower limit; as for the upper limit, it is left to more dispersed strategies and time.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Wilfred

Wilfred JinseFinance

JinseFinance Joy

Joy JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph