Author: 0XSMAC Source: X, @0xsmac Translation: Shan Ouba, Golden Finance

I tend to think that the "wisdom of the crowd" is mostly a farce.

Admittedly, it is important in some ways, but humans often behave irrationally when faced with money (especially when it comes to money), or they simply don't understand that they will fall into cognitive biases.

More specifically, I mean that this applies to smaller groups that are prone to overconfidence/irrationality.

For example, participants in financial markets.

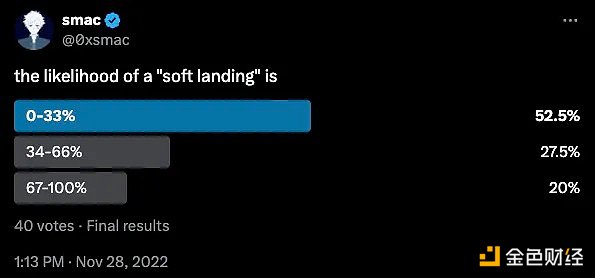

After the FTX crash in November 2022, the QQQ index fell about 30% from its all-time high. At that time, I was curious about what people thought about the possibility of a so-called "soft landing." Needless to say, only one in five people were reasonably confident of a soft landing.

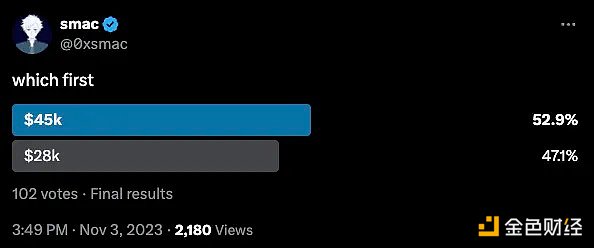

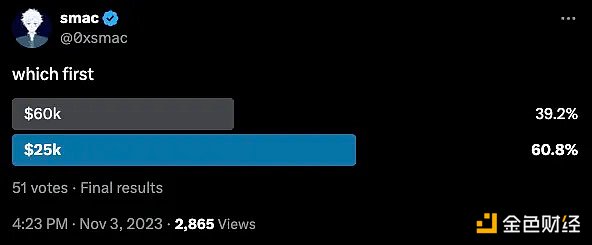

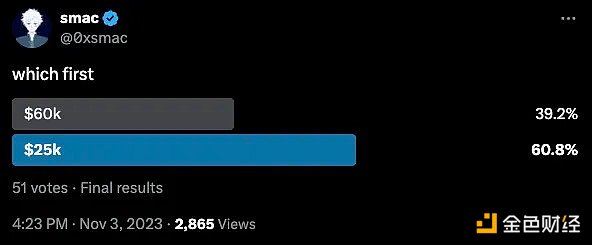

A year later, with Bitcoin having doubled in price (to around $35k) and in an undeniable uptrend, I was again curious about how people felt. I typically use these types of polls to gauge market positioning. It’s just one data point, but I’ve found that most people respond based on what they hope will happen — especially on Twitter. So it’s not surprising to see that only half of people think a 30% rise is more likely than a 20% drop.

There are even fewer people who expect prices to continue to rise

At the time, I was pretty sure that Bitcoin would hit the $45,000 and $60,000 mark first for a number of reasons. Now, I am less confident about short-term price action, and to some extent, more cautious about what will happen over the next 6 months or so. However, many people keep asking “where in the cycle are we?” This question itself is a bit of a trap because it presupposes something that is not necessarily true. But I will share my feelings anyway so that whenever I am inevitably asked this question again in the future, I can point them directly to this article.

The common view is that we are in the middle of the cycle. Anecdotally, the most common answer people hear is the 5th or 6th inning. Even if this is true, this seems like a bit of an evasive answer to me. You only say this when you don’t have an opinion of your own and want to avoid taking a stand. This may be true, but if I really believed this, I wouldn’t be writing this article.

So, where are we in the cycle? In which inning? Is the cycle over or just beginning?

Let me refer back to a tweet from November 2022. I mention it to illustrate that price and time are two very different things in the context of “this cycle.” If you look at it separately, from a purely time perspective, we’re in about week 70 of the bull run. But I think that actually exaggerates the true length of this run because I can count on my fingers how many people were jitsu ni (actually) bullish in November and December 2022. If I’m being very generous, most people didn’t start to realize what was going on until late Q1/early Q2 last year. So, let’s say it’s been a little over a year.

From a price perspective, Bitcoin and Ethereum have risen about 3x and 2.5x, respectively, from their bottoms.

My sense is that veterans of multiple crypto cycles think we’re closer to the end of the cycle than the beginning. That’s largely because their usual playbook didn’t work this time.

We wrote a bit about this dynamic in our annual report…

Previous crypto cycles experienced a logical flow where market participants believed in a new narrative as money flowed up the risk and speculation curve, BTC → ETH → long tail crypto assets (where VC and token investing happens). The narrative often revolved around the fundamental transformation that crypto could achieve, creating a wave of new believers who either converted for life or exited as prices fell back after the speculation subsided.

This cycle has been very different so far, and many of those who had the previous heuristics have been either slow or unwilling to adapt. To put it bluntly, this unwillingness can lead to psychological defense mechanisms kicking in. We are all human, so we can’t help but look around and judge our performance (of the assets we hold) by relative standards - it’s not enough that the assets we hold are up 3-5x because the assets we don’t hold are up 10-20x. This is especially true when we don’t like the assets that are up 10-20x. In my opinion, this is the key to why many people feel we are either in the middle or the back half of the cycle. They watched assets like Solana go from under $10 to over $200. They watched a wave of meme coins surge 100-1000x and screamed inwardly but could do nothing about it.

“This isn’t the right sequence!”

“Why didn’t my asset skyrocket like this?!”

“This shouldn’t be happening now!”

People just plain don’t like things not going the way they expected. It’s not that they’re necessarily wrong, but the market isn’t going the way they thought it would. Maybe the cycle is compressing, or financial nihilism is being pushed to the extreme.

I am not ruling out all of these possibilities, but there seems to be very little self-reflection.

Let me add some context, I know of many cases where junior analysts working at other funds recommended Solana at prices below $30, but they were repeatedly dismissed and ignored. It is almost laughable to see how many people rushed to buy locked FTX tokens at much higher prices a few months later.

All of this shows that people’s collective experience of rising markets affects the stage they think we are in. Entering this cycle, most people were overexposed to the Ethereum ecosystem and had little understanding of all other areas. This positioning has distorted people’s overall perception of cryptocurrencies in this cycle and distracted many people from assessing where we actually are.

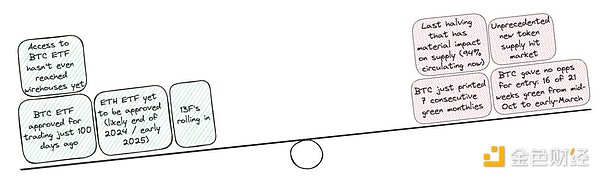

Now let’s weigh the arguments for both ends of the cycle - early vs. late.

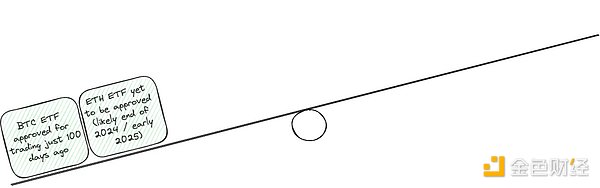

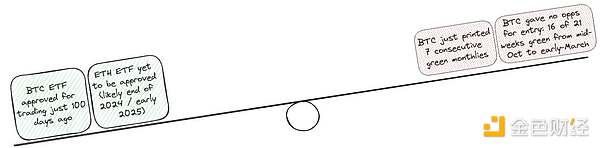

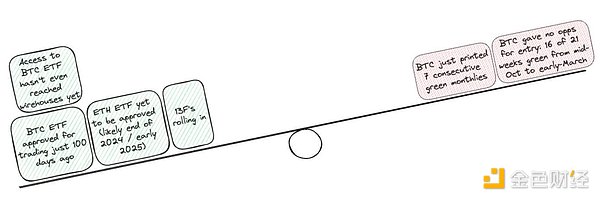

Just 100 days until Bitcoin ETF approved for trading Ethereum ETF not yet approved (maybe in late 2024/early 2025)

I often talk, write, and tweet about crypto market structure, and why such a boring concept actually has a big impact. It’s a bit of an exaggeration, but I think of it a bit like plate tectonics - huge, slow-moving plates that form the base of the market. It’s hard to understand how much of a seismic effect the movement of these plates can have, and what kind of impact the aftershocks will have. But imagine being in crypto for 8, 9, 10+ years and reaching this critical moment…

Bitcoin ETF approved.

A large new pool of institutional capital can now legally enter this asset class.

Initial inflows were significantly stronger than the market expected.

Then you predict a cycle top 100 days later.

“But markets are forward-looking, the ETF has been approved, and inflows are already priced in!”

Markets are forward-looking, yes. But they are not omnipotent. They just got it wrong on ETF inflows. People who understand crypto simply don’t understand how traditional market structure works, and people who understand traditional market structure rarely have the time to study crypto. Ethereum ETF approval was inevitable, and the time lag between Bitcoin ETF approval and Ethereum ETF approval was actually very healthy in my opinion. This allowed some time for digestion, learning, and post-election clarity. The structural changes in the crypto market cannot be overstated.

Bitcoin has just been up for 7 consecutive months, and Bitcoin offers no entry opportunities: 16 of the 21 weeks from mid-October last year to early March this year were green

Bitcoin has been up almost exclusively for the past year and a half. Before April, 12 of the past 15 months were up, and from the middle of last year to the beginning of this year, 16 of the 21 weeks were up. It's really unstoppable. Although it's fair to say that few people expected this to happen in the first half of 2023. Would it be shocking if we were to oscillate for a while now? I don't think so. Markets will trend, but it feels like people are still scared of the crash in the last cycle.

I also feel more and more like I am repeating the conversations of late 2022/early 2023, only now Bitcoin is at around $60k instead of $18k. Of course, the two are not exactly the same, but the skepticism is mainly centered on the following aspects: Bitcoin has risen sharply, there is no new narrative to drive it further up, and meme coins have already gone crazy.

But I think none of these are real reasons why Bitcoin should fall.

BTC ETFs Have Not Yet Entered Offline Trading Centers

Now let's talk about some esoteric banking issues. When I talk about financial advisors not being fully exposed to Bitcoin ETFs, I mean that they currently have no motivation to recommend such products to their clients.

When financial advisors recommend trades, they are categorized as "active sales" and "non-active sales." Unsolicited sales pitches are trades that a broker recommends to a client (“you should buy ABC”), while unsolicited sales pitches are trades that a client proposes to a broker (“I want to buy XYZ”). The main difference here is that commissions are only paid on unsolicited sales pitches.

Currently, none of the major wealth management firms allow active allocations to Bitcoin ETFs in their client portfolios. In short, these advisors don’t really have any incentive to recommend these products to their clients. It’s only a matter of time though - all these firms are waiting and watching, and once one firm starts, the others will quickly follow.

The 13F reports are also rolling in. An important point that Eric Balchunas made a week or two ago is that IBIT reports about 60 holders (a number that will increase as more reports are filed), but they only represent about 0.4% of the total shares outstanding. This means that “most of the buyers are small, but there are a lot of buyers.” The record so far belongs to a financial advisor in Kansas, who put $20 million, or about 5% of his portfolio, into Fidelity’s Bitcoin ETF.

The last halving had a material impact on supply (currently 94% in circulation)

To be honest, these two metaphors feel like we repeat them every cycle. But they are worth mentioning regardless - Bitcoin currently has about 94% of its supply in circulation, and the recent halving is likely the last meaningful halving. On the other hand, the market continues to be waterboarded by new token supply — new L2s, the Solana ecosystem, bridges, LRT, SocialFi, carry trade arbitrage. The list goes on and the total FDV of these projects is both shocking and unimaginable. As with every cycle, most tokens will trend towards zero as insiders unlock and sell. Enough has been written and discussed about this issue, though.

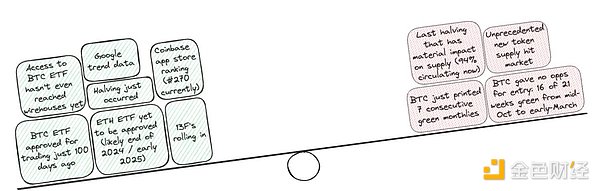

The halving just happened

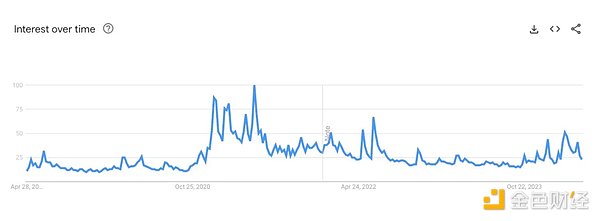

The halving did just happen, supply reduction, simple as that. Personally, I don't think these last two reasons are very convincing on their own, but they are different from where people think we are, which is interesting. If we look at the recognized Google Trends data for BTC, ETH, SOL, NFT, etc., we will find that there is a common point.

It’s still a long way from the true bull market peaks we’ve experienced in the past.

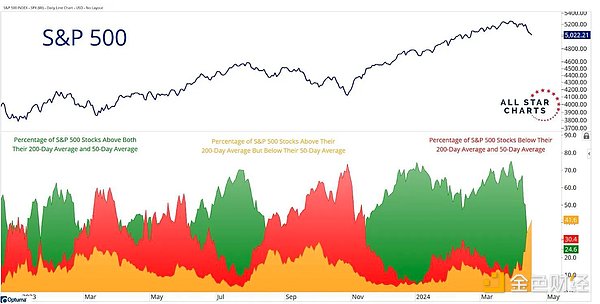

The same goes for Coinbase app store rankings (currently ranked #270). I’ll get to the controversial issue of retail investor participation later, but suffice it to say that there’s still a lot of room for growth in the usage of crypto-native apps. I agree that the AI narrative saved the market, unemployment is only going up, and traditional financial market breadth is weakening. Without the launch of ChatGPT at that time, traditional markets might have collapsed instead of finding solace in new innovative models. But there is no way to prove the counterfactual, so we can only face the current situation. Indeed, the labor market is showing incredible strength and unemployment is only going up. It is also true that overall breadth in traditional markets is narrowing…

I don’t think we’ve seen the kind of jaw-dropping surge that would have been seen in breaking out to new all-time highs. During my long bull run, people have been trying to convince me of all the reasons why it would take a long time to repair the damage in 2022. Now, most of the same people are trying to tell me all the reasons why we can’t go much higher. That doesn’t mean they are wrong this time, but the evidence I am interpreting today suggests that we have a lot of room to run.

I also think the delay in the Ethereum ETF is positive for the extended cycle from both a timing and price perspective. Here’s another counterfactual, but I think if it had been approved in May (15), it would have been too close to Bitcoin’s approval. Market participants have short attention spans, and if the approval and subsequent trading of these products are tied together, it will lead to cannibalization of market share. To what extent, no one can say. But it is important that BTC money continues to flow into the market as the only cryptocurrency ETF. It is the gateway drug. Ethereum ETFs will have their moment to shine, and in fact, Bitcoin’s performance will be their best marketing campaign. Baby boomer managers are being forced to treat Bitcoin as an asset class. They can no longer ignore it, and if they are lagging behind competitors with Bitcoin exposure, they need answers. Calling it a scam is no longer a legitimate view.

This is what a healthy market looks like. An asset gets oversold, and then slowly rises as more and more people realize they can’t buy it at a lower price. There is a period of consolidation as the market digests, and then the asset continues to climb. If you expect the bull market to continue, that kind of pump top is not what you want to see.

This time it’s different

“This time it’s different” – that’s a scary phrase.

You can say it to yourself occasionally, or you can say it to a friend in private “what ifs”. But if you say it in public, be prepared to be laughed at.

We’ve all been there. When someone says this, we can self-righteously parrot “This time it’s different” to show how smart and mean we are. We laugh at them on Twitter, call them stupid, and suggest that this might be their first time going through a cycle, as if it matters.

Yet if you’re still here, it means that deep down you actually believe that “One time it will be different”.

If you say this and it turns out to be wrong, everyone will laugh at you and call you a fool for thinking it would be different.

That’s not a big deal. These people are unlikely to form independent opinions anyway, so why expect them to react differently?

But who are the real fools if you see enough evidence that “this time might be different” and do nothing?

Flows are growing, but where are they going?

The big question in my mind is how much of these passive flows will end up on-chain. The most boring scenario for crypto is that Bitcoin is a new asset class that is incorporated into a small part of institutional investors’ portfolios, while all other cryptocurrencies are relegated to a niche of online subculture. However, it is difficult to determine how much of the ETF inflows will end up on-chain, either directly or indirectly.

You might be thinking - Smac, how stupid are you, no one buying a Bitcoin ETF will use their Bitcoin for on-chain activities. Of course, this is true today, but it is not the point. We all know that the wealth effect is real in crypto, and that ETFs are going to be a gateway drug for some. The question is just one of scale, and I don’t think we’ll have a good answer for that in the short to medium term. But we can try to find directional clues…

If we look at stablecoin activity, we find some intriguing data. The chart below shows that last November was the first time in about 18 months that stablecoin supply turned positive. The continued net capital inflows through stablecoins suggests that we are earlier in the cycle than people realize. This is particularly telling given how violent the inflows were in the last cycle.

We can also look at the total stablecoin supply on exchanges, which has more than halved since the peak to trough, but is now clearly starting to trend upwards. The hardest thing to translate is whether and how this activity is transferred to the chain. Please take the following with caution. The figure below shows the total active addresses (blue line) and stablecoins on exchanges. Depending on your own sentiment, you may come to some different conclusions, but here’s how I read this:

After we saw a big spike in active addresses during the last bull run and then a big drop as people rage-exited, activity levels have remained relatively stable since Q3 2021. We haven’t seen a new wave of activity, which in my opinion suggests that retail activity is far from recovering.

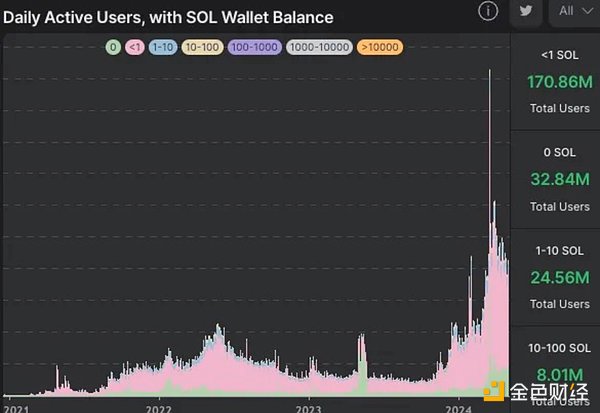

It’s also worth mentioning here that retail activity is likely coming from Solana. There has been a clear increase in activity on Solana over the past 6-9 months, and I personally expect this trend to continue.

SOL with DAU of 0 or less than 1 is not worth paying attention to (Source: hellomoon)

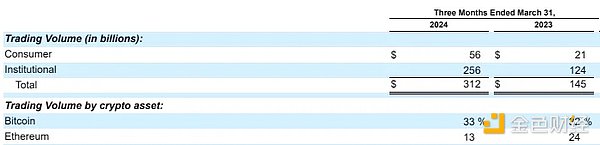

Q1 2024

Q1 2024

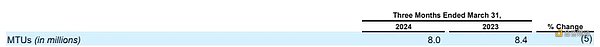

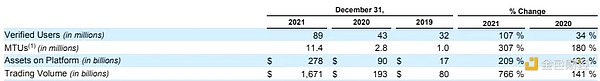

How does this compare to what we’ve seen from Coinbase users over the past few years? First, we’re still over 40% below the 2021 high in MTUs (11.4 million) and below where we were at the end of 2022. For all the talk of memes and retail metamorphosis, I just don’t see a credible argument that this is happening at scale. Is this happening on a small scale for users who are very familiar with cryptocurrencies? Of course, this is another sign that people are caught up in the crypto bubble and missing the broader picture. If you log on to Twitter to see what's going on about crypto and treat the discourse there as a kind of gospel, you're going to have a bad time.

End of 2021

End of 2023

The last point I want to make here is about altcoins outside of BTC and ETH. As early crypto investors, we obviously have strong convictions that this space will continue to grow, beyond just the majors. The easiest way to measure that activity is to use TOTAL3, which tracks the top 150 altcoins outside of BTC and ETH. I think it’s instructive to look at the cycles from highs to lows that we’ve seen before. Looking at the 2017 cycle and the recent cycle, it’s clear that relative upside is compressing (although still astronomical), which is what we expect as the space expands. The base is larger, so high upside is intuitively more difficult. But even if there’s plenty of room for further compression, I don’t think enough people realize there’s a lot of upside left in this space. TOTAL3 is only $640 billion, which may sound like a big number, but is almost insignificant in the grand scheme of financial markets. If we believe this is a $10 trillion space in the next 24 months, and BTC accounts for 40%-50% of that, there’s a ton of value left to be created.

2017-18

2020-21

2024-25?

I myself don’t think this space will be dominated by memecoins. Some people I admire disagree, and that’s okay. I think memecoins have their place and will continue to be a relevant part of crypto (and traditional finance, to be honest), but I’m also optimistic about a new wave of founders emerging. They are thinking deeply about solving real problems and they care about 10-year outcomes. Those are the types of founders we’re interested in working with.

If you can’t tell already, I still think we’re early in this cycle.

My guess is that we’re only about a third of the way there. While many people cynically think it’s all about memecoins, there are other areas that are actually being developed and built as well.

Social Finance (SocialFi) is starting to see more creativity, the ERC-404 standard is still not fully explored, the application scenarios of DeFi lending protocols are expanding outside the crypto circle, real world assets (RWA) are slowly being put on the chain, and we are also seeing more exploration of how distributed systems affect the "real world". We are still adding new arguments to the public database and are always happy to talk to builders who are experimenting in strange, novel and ambitious intersections.

Despite many problems, I remain extremely optimistic about this field.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance nftnow

nftnow Others

Others Future

Future Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph