Multicoin: Pipe Network, the first dCDN on Solana

MULTICOIN CAPITAL, Multicoin: The first dCDN Pipe Network on Solana Interpretation Golden Finance, No license required dCDN can exceed licensed cCDN

JinseFinance

JinseFinance

Author: Alex Xu, Mint Ventures

If you were to ask which L1 has the best business development in this bull market cycle, most people would answer: Solana.

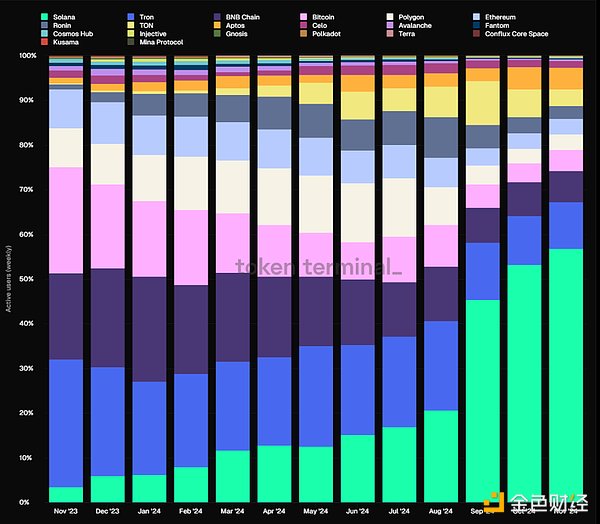

Whether it is the number of active addresses or fee income, Solana's market share in L1 has expanded rapidly:

Number of active addresses: Solana's share of active addresses increased from 3.48% to 56.83%, a year-on-year increase of 1533%;

L1 monthly active address market share, data source: tokenterminal

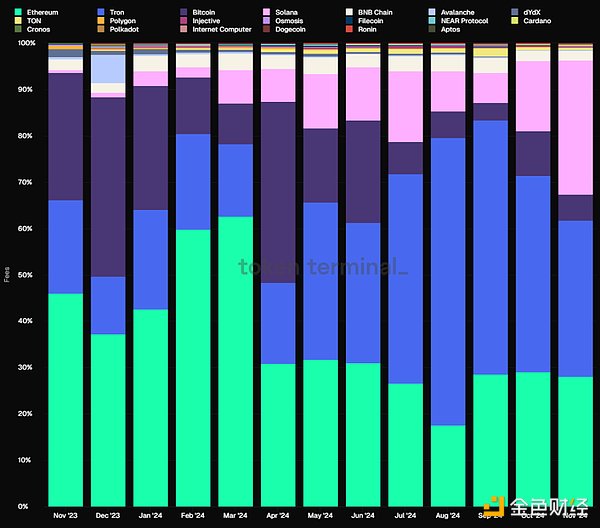

Fees: Solana's Fee revenue share increased from 0.62% to 28.92%, a year-on-year increase of 4564%.

L1 monthly Fee revenue market share, data source: tokenterminal

The Meme wave is the core driving force for the rapid growth of various core indicators of Solana during this cycle. In addition to Solana, Dex such as Raydium also benefited from the Meme wave. The active Meme transactions contributed a huge amount of transaction and protocol revenue to it, and its price has also reached a new high in this round recently.

In this article, I will focus on another project that benefits from Solana's massive asset issuance: @metaplex.

This article will present and discuss the following 4 questions:

What is Metaplex's business positioning and business model? Does it have a moat?

What are Metaplex's business data and how is its business developing?

Metaplex's team background and financing situation, how do you evaluate the project team?

What is the current valuation level of Metaplex, and is there a safety margin?

This article is the author's interim thinking as of the time of publication, which may change in the future, and the views are highly subjective, and there may be errors in facts, data, and reasoning logic. Criticism and further discussion from peers and readers are welcome, but this article does not constitute any investment advice.

The following is the main text.

The Metaplex protocol is a digital asset creation, sales and management system built on Solana and blockchains that support SVM (Solana Virtual Machine). It provides developers, creators and enterprises with tools and standards for building decentralized applications. The types of crypto assets supported by Metaplex include NFT, FT (homogeneous tokens), real world assets (RWA), game assets, DePIN assets, etc.

Metaplex has also recently expanded its business horizontally to other basic service areas of the Solana ecosystem, such as data indexing (Index) and data availability (DA) services.

In the long run, Metaplex is expected to become one of the most important multi-field basic service projects in the Solana ecosystem.

Metaplex is an asset issuance, management and standard system. The asset objects it serves include both NFTs and homogeneous tokens. The following products constitute a comprehensive matrix that serves Solana's ecological assets.

Core

Core is the next generation of NFT standards on the Solana blockchain. Core adopts a "single account design", which greatly reduces the casting cost and computing power, and supports advanced plug-ins and mandatory payment of royalties.

Background knowledge: Solana's account model

In order to understand the advantages of the "single account design" architecture, you need to first understand the account model of the Solana blockchain and the storage method of traditional NFTs.

On the Solana blockchain, all state storage (such as token balances, NFT metadata, etc.) is associated with a specific account. Each account can store a certain amount of data, but the size of the account is limited, and rent needs to be paid to maintain the storage of this data. Therefore, how to efficiently manage accounts and store data on the chain is a key issue that developers on Solana need to consider.

Design of Traditional NFTs

In traditional NFT design, each NFT usually has multiple accounts to store different information. For example, a typical NFT may involve the following accounts:

Main Account: Stores NFT ownership information (such as who is the current holder).

Metadata Account: Stores NFT metadata (such as name, description, image link, etc.).

Royalty Account: Stores information related to creator royalties.

Although this multi-account design is relatively flexible, it will bring some problems in actual operation:

Complexity: The management and interaction of multiple accounts increases the complexity, especially when frequent queries and updates of data are required.

Fee: Each account needs to pay rent to maintain its storage status, and more accounts mean higher fees.

Performance: Because multiple accounts are involved, more blockchain resources may be required during operation, affecting performance and transaction speed.

Advantages of "Single Account Design"

Metaplex Core has proposed the "single account design" standard to address the above issues. The single account design stores all NFT-related information (such as ownership, metadata, royalties, etc.) in one account, which simplifies the account structure, reduces account costs, improves interaction efficiency, and enhances the scalability of NFTs. This design is particularly suitable for implementing large-scale NFT projects (such as games, Depin, etc.) on high-performance, low-cost blockchains such as Solana.

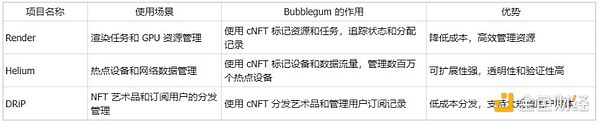

Bubblegum

Bubblegum is a program used by Metaplex to create and manage compressed NFTs (cNFTs). Through compression technology, creators can mint a large number of NFTs at a very low cost. The minting cost of 100 million NFTs is only 500 SOL (compared to the traditional minting method, the cost has been reduced by more than 99%), providing unprecedented scalability and flexibility. It is precisely because of the launch of Bubblegum technology that large-scale and low-cost NFT minting has become possible. DePIN projects including Render and Helium have begun to migrate to Solana, and innovative NFT platforms such as DRiP have been born. The following table is an example of the application of Bubblegum by these three representatives.

Token Metadata

The Token Metadata program allows additional data to be attached to homogeneous and non-homogeneous assets on Solana. Token Metadata is naturally important for information-rich NFTs, but in fact, most homogeneous token projects on Solana also need to use Token Metadata.

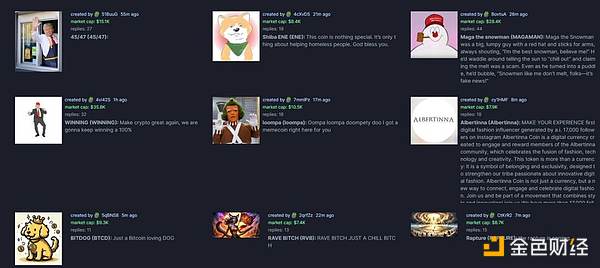

What most people don’t know is that all tokens created on Pump.fun, the largest Meme issuance platform on Solana, rely on Metaplex’s metadata service. Now the biggest demand for Token Metadata is no longer from NFTs, but from massive Meme projects.

For Meme projects, the benefits of using the Token Metadata program when issuing tokens are very obvious:

First, it ensures the standardization and compatibility of the tokens it issues. Using Metaplex’s Metadata service, these tokens will be more easily recognized by mainstream wallets (such as Phantom, Solflare), and more easily displayed by trading platforms with their names, icons and other additional information, as well as seamlessly integrated by other Solana applications.

The second is to provide on-chain storage and transparency. The Metaplex Metadata service stores the metadata of the token on the chain, making the information and data of the token easier to verify and preventing tampering.

The additional additional information such as pictures and texts provides multi-dimensional materials for Meme speculation, making meme no longer just a name and a string of contracts, and providing materials for the dissemination, secondary creation and narrative of Meme.

New Meme tokens are constantly being refreshed on pump.fun, source: pump.fun

As the Meme craze on Solana continues to heat up, more than 90% of Metaplex's protocol revenue has already been contributed by homogenous tokens (Meme). This actual situation is inconsistent with the public perception that "Metaplex is an NFT base protocol for the Solana ecosystem", and there is a serious cognitive gap.

Candy Machine

Metaplex's Candy Machine is the most commonly used NFT casting and issuance program on Solana, which can launch NFT collections efficiently, fairly and transparently.

Other product arrays

Other Metaplex services include:

MPL-Hybrid: A hybrid NFT storage and management solution that aims to combine the advantages of on-chain and off-chain storage to provide an efficient and economical storage method for NFTs. It is particularly suitable for storing large files (such as high resolution) or NFT projects that need to be dynamically updated.

Fusion: The NFT merging function allows users to merge multiple NFTs into a new NFT, which can be used to enhance the user's interactive experience and provide more gameplay for NFT projects. It can be used in games, collections, and art projects.

Hydra: An efficient, scalable, large-scale NFT minting solution designed specifically for projects that need to mint a large number of NFTs (such as games, social platforms, or loyalty programs).

……

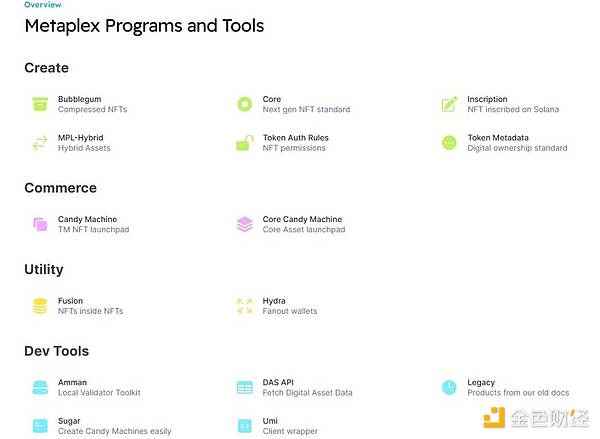

Metaplex's existing product list (asset service category) is as follows:

Image source: Metaplex developer documentation

Aura

In addition, in September, the Metaplex Foundation officially announced the launch of Metaplex Aura, a decentralized indexing and data availability network (testnet) serving Solana and SVM. Through the indexing and data availability services provided by Aura, Solana and other blockchain projects that adopt the SVM standard can read asset data more efficiently, support batch operations at a lower cost, and reduce the cost of their operations by more than 99%, as shown below:

Comparison of the cost of large-scale asset operations after adopting Aura, source: Metaplex official push

When the product preview was released, Metaplex also listed the cooperation agreements supporting the product. Many of them are well-known projects in the Solana ecosystem, and they will also be potential users of Aura in the future.

Source: Metaplex Official Push

From asset service systems to data indexing and data availability service protocols, with the horizontal expansion of services, Metaplex is developing into a full-stack basic service platform for the Solana ecosystem.

Metaplex's business model is simple and easy to understand, that is, charging by providing services related to on-chain assets. Some of the services in the product array mentioned above are free, and some are charged.

Although Metaplex's direct partners are other projects on Solana, like a TOB expansion business, most of its fees come from small projects or retail users using large B-side projects, including project parties that create various types of homogeneous tokens, and individual users of Mint NFT.

In my opinion, charging decentralized users is a better business model than charging large-scale cooperative projects on the B side (such as Pump.fun), because:

Small project users or retail users make decisions more emotionally and are not as price sensitive as B-side users. Because the price of Metaplex's services accounts for a very low proportion of their total cost, the absolute fee paid by each small user is not high, but when the number is large enough, the total fee is very considerable

B-side projects can become distribution channels for their services, helping Metaplex's services reach more decentralized users, and Metaplex itself does not need to spend extra energy and costs on marketing and channels

The user group is more decentralized and less centralized, and it is difficult for Metaplex to bargain with basic service providers such as Metaplex. Ability to maintain product profit margins and even raise prices when appropriate

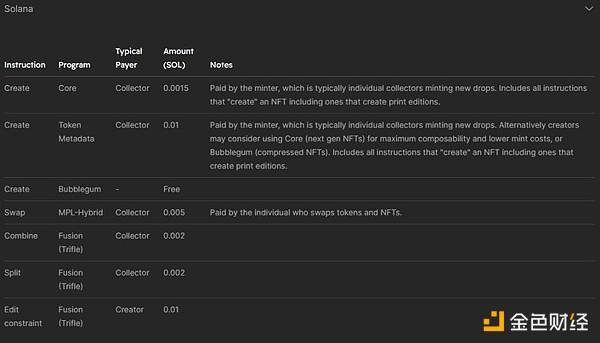

Specifically, the charging standards for Metaplex products on Solana are as follows:

Image source: Metaplex developer documentation

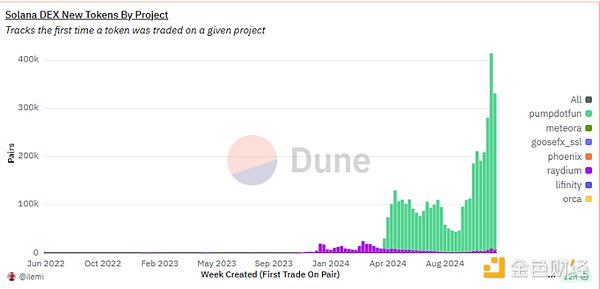

It can be seen that in fact, the absolute charge for a user to call Metaplex's product service alone is not expensive. For example, the cost of a user minting an NFT is only 0.0015 SOL; a Meme issuer issues a project and uses Token Metadata to add graphic and text introductions to its own Meme project, which only costs 0.01 Sol at a time. Such costs are negligible or basically negligible compared to the user's expected benefits. Of course, it should be noted that the issuance of a large number of homogeneous tokens represented by Meme has brought income to Metaplex on the one hand, but the sustainability of the Meme craze is questionable on the other hand, which will also affect the sustainability of Metaplex's income. As strong as Solana is, its Meme popularity fluctuates greatly. In the coldest week of September, the number of new tokens on Dex was only about 1/3 of the hottest week in May, and this number doubled 10 times in mid-November.

The number of new token varieties added to Solana Dex every week, source: Dune

In the business world, the moat of an enterprise or project may come from many advantages, such as cost advantages brought by scale and geographical location, value accumulation brought by network effects, high user stickiness and premium ability brought by brand effects, and competitive barriers brought by administrative franchises and patents.

Projects with strong moats are reflected in the competitive landscape as later competitors entering the same track find it difficult to catch up, or the comprehensive cost of catching up is very high, so high that it is far greater than their expected returns, so that there are relatively few competitors in this track; financially, it is reflected in the project's steady and gradually increasing profitability, and the proportion of marketing and development costs relative to revenue is not high.

In the Web3 field, there are not many projects with strong moats, such as Tether in the stablecoin field and Aave in the centralized lending field.

In my opinion, Metaplex is also a project with a moat, and its moat comes from "high switching costs" and "setting standards".

First, when developers and users rely deeply on Metaplex's tools and protocols for asset issuance and management, they will inevitably face high time, technical and economic costs if they want to switch the project's assets to other protocols for management.

Second, when Metaplex's asset format (including NFT and FT) becomes the standard in the Solana ecosystem and becomes the consensus for compatible design of various infrastructures and applications in the ecosystem, it will also become a priority for new developers and projects to choose Metaplex asset formats with stronger ecological compatibility when choosing asset service platforms.

Thanks to Metaplex's moat, there is currently a lack of projects in the Solana ecosystem that can compete with it, which ensures Metaplex's strong profitability, and this part will be analyzed in the next section.

In addition to asset services, Metaplex's data indexing and data availability services, which are being tested, are also expected to create a second business growth curve for Metaplex in the future. Considering that the objects of this service are highly overlapped with Metaplex's original customer base, its new expansion business may also be more easily accepted and experienced by existing cooperative customers.

Metaplex’s current core business is to provide asset-related services. We can observe the core indicators such as the number of active users of its services, the number of asset-minting projects, and protocol revenue.

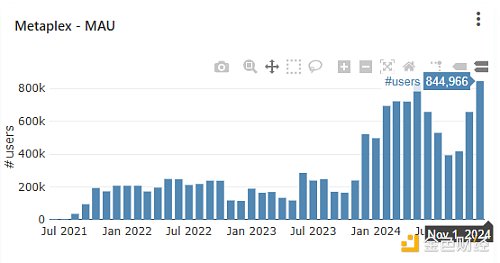

Metaplex monthly active users refer to independent addresses that have conducted transactions with the Metaplex protocol every month

Metaplex monthly active addresses, data source: Metaplex Public Dashboard, the same below

We can see that as of the date of this writing (2024.11.30), Metaplex’s latest monthly active user number is 844,966, a monthly record high, a year-on-year increase of 253%.

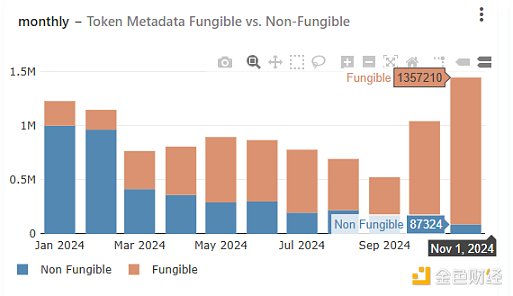

The number of assets minted by the protocol refers to the types of assets minted through the Metaplex protocol

Metaplex Monthly Number of Asset Minting Types

As of the date of this writing (2024.11.30), Metaplex's data also hit a record high, with a total of more than 1.44 million types of minted assets in November.

What is more noteworthy is that 94% of the assets are homogeneous tokens, and only 6% of the assets are NFTs. In January this year, this data was still 18.6% to 81.4%, which means that from the perspective of business volume, Metaplex's main business is now homogeneous token asset services, not NFT services. Most of the minting and issuance of homogeneous assets come from the Meme craze.

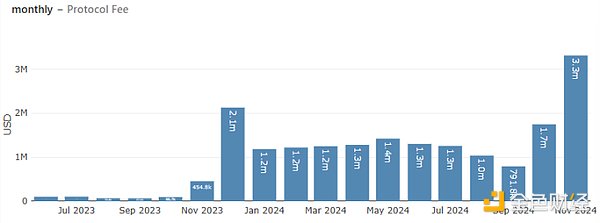

Protocol revenue refers to the payment received by Metaplex for providing services.

Metaplex Monthly Protocol Revenue

As of the date of this writing (2024.11.30), Metaplex's monthly protocol revenue is as high as 3.3 million US dollars, which also set a record high.

It should be noted that, unlike many projects in the Web3 world that rely on token subsidies to drive product demand and spend project tokens in exchange for protocol revenue, Metaplex's business revenue is quite organic and does not conduct direct token subsidies. It is a typical project that has achieved PMF (product-market fit).

Through the data in this section, we can see:

As the underlying asset protocol, Metaplex directly benefits from the ecological development of Solana, and its core indicators rise in tandem with Solana's core indicators, especially protocol revenue

Metaplex benefits from the activeness of both NFT and FT. It is not just an "NFT asset service protocol". After Meme, if Solana can emerge with more active tracks, such as Depin, games, and RWA, the demand space for Metaplex will be further opened up

Metaplex's business needs are organic, and it can generate revenue without relying on token subsidies

Next, let's take a look at the team behind the Metaplex project and the situation of the project's tokens.

Metaplex Team: Ecological OG Close to Solana's Core Circle

Stephen Hess

The founder of Metaplex is Stephen Hess, who is also the chairman of the Metaplex Foundation. He founded Metaplex Studios in November 2021.

As a graduate of Stanford's symbolic systems major (which focuses on the design of human-computer interaction systems), Stephen Hess was also one of Solana's earliest employees (Solana had just been launched for a year when he joined), when Solana co-founder Raj invited him to join Solana as head of the product department. During his tenure, he was involved in the development of Solana Stake Pools (Solana's staking system), SPL governance system, and Wormhole. He was also a member of the team that developed the first version of the Solana NFT standard, which eventually evolved into Metaplex.

In January 2022, shortly after Metaplex was founded, Metaplex received $46 million in strategic investment from institutions such as Multicoin, Jump, and Alameda. If the 10.2% share corresponding to the strategic round of financing in the token allocation table is used, it can be estimated that the $46 million financing of Metaplex at that time had a corresponding valuation of about $450 million, which was a very high first-round valuation even during the bull market.

And just as Metaplex was about to complete a year of establishment, in November 2022, FTX collapsed due to huge financial bad debts. Although Metaplex's financial situation was not directly affected by the collapse of FTX, Stephen Hess quickly announced the layoffs on Twitter, preparing for the impending Solana ecosystem depression. In retrospect, his approach at the time was very correct. He had a clear understanding of the future and did not have the habit of spending money lavishly like many Web3 teams in cost control.

According to Metaplex's current Linkedin information, the team size is more than 10 people, which is still quite lean, but judging from the project work reports it releases monthly, this lean team has strong delivery capabilities and aggressiveness in products, and is very efficient in product iteration and new product development.

Metaplex's monthly work report, source: official blog

Looking back at the work experience and project development history of Metaplex's founder, Metaplex basically meets the author's comprehensive conception of an excellent Web3 team:

Core members have education, work skills and experience backgrounds that match the entrepreneurial project, and have no bad credit

Close to the core circle of the public chain ecosystem, with smooth dialogue channels, and product concepts recognized by the public chain ecosystem community

Good product sense (fewer detours), hard work, and good delivery of results

Has cost control awareness and does not spend money indiscriminately

Got top VC investment in the industry and has excellent comprehensive business resources

In addition, on September 9, 2024, The Block disclosed that well-known institutions including Pantera Capital and ParaFi Capital purchased a large number of Metaplex (MPLX) tokens from Wave Digital Assets this year. These tokens were originally held by FTX, and the comprehensive cost of the purchase was roughly US$0.2-0.25 (with certain lock-up terms).

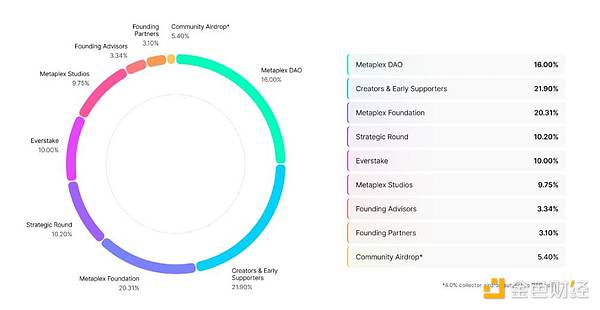

Metaplex’s protocol token is MPLX, with a total supply of 1 billion.

Image source: Project White Paper

The specific token distribution is as follows:

Creators and early supporters 21.9%, of which 50% will be distributed in the form of airdrops within one year (the first airdrop will start in September 22), and the remaining 50% will be released monthly in the following year;

Metaplex DAO 16%, no lock-up, distributed according to DAO proposals;

Metaplex Foundation 20.31% , no lock-up;

Strategic round 10.2%, of which 50% will be issued one year after the first airdrop (September 22), and the remaining 50% will be unlocked monthly in the following year;

Partner Everstake 10%, locked for two years (locked until September 2024), linearly released in one year, unlocking;

Metaplex Studios 9.75%, locked for one year (locked until September 2023), linearly released in two years, unlocking;

Community airdrop 5.4%, released immediately;

Founding consultants account for 3.34% , locked for one year, linearly released in one year, all unlocked;

Founding partners 3.1%, locked for one year, linearly released in one year, all unlocked.

According to the current official circulation data, the circulation rate of MPLX is 75.6%, most of which are already in circulation, especially the investors' shares, which have basically been circulated, and the unlocking selling pressure is relatively small.

The "uncirculated" part of the total amount mainly comes from the shares controlled by Metaplex DAO and Metaplex Foundation, the tokens held by the treasury, and the unlocked parts of Everstake and Metaplex Studios.

At present, the utility of MPLX is mainly governance voting. In addition, Metaplex announced in March 2024 that it will use 50% of the protocol revenue to repurchase tokens (including historically accumulated protocol revenue), and the repurchased tokens will enter the treasury to develop the protocol ecosystem. The protocol officially began to repurchase tokens in June 24, and since then, 10,000 SOL has been used to repurchase the token MPLX every month, which has lasted for 5 months so far. Due to the rapid increase in protocol revenue, Metaplex will increase the monthly amount of protocol repurchase from 10,000 SOL to 12,000 SOL next month. In addition to governance and repurchase, the next scenario of MPLX will be activated by the Aura function mentioned above. After the Aura function is officially launched, MPLX is expected to become the pledged asset of the Aura node and capture the income generated by Aura.

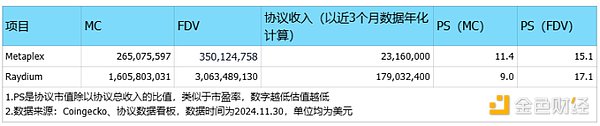

When measuring the valuation of Metaplex, we still use the comparative valuation method, but considering that Metaplex has no competing projects in the same track as Solana, the author finally chose Raydium, which belongs to the Solana ecosystem and has also benefited from the Meme craze this year and has greatly increased its protocol revenue, and also has a repurchase mechanism, as a reference for comparative valuation.

From the comparison of protocol revenue and market value of the protocol, Metaplex's valuation is higher.

However, it should be emphasized that although the two projects have some commonalities, they are still two tracks of the same ecosystem with very different business positioning. The above valuation comparison only has a certain reference value.

Overall, Metaplex’s advantages are obvious:

It is located in the upstream ecological niche of the asset service track, has the right to formulate asset standards, and directly benefits from the prosperity of the Solana ecosystem

The product PMF has been fully verified, and it can achieve positive cash flow without relying on token subsidies, and has a relatively clear business moat

On the basis of existing business, actively expand the second growth curve

The team has good overall quality, is very close to the core circle of the ecosystem, is diligent and enterprising, and has a sense of cost control

The token has a repurchase mechanism, and the absolute market value of the project is relatively low (circulating market value of 260 million +, FDV350 million +), the plate is relatively light

The potential upward drivers of Metaplex's market value in the future are:

In addition to Meme, the Solana ecosystem has other active tracks, further expanding the market for asset issuance, whether it is Depin, games, RWA, or NFT, which has been cold for a long time

Metaplex can be listed on larger trading platforms, such as Binance or Coinbase, to obtain better liquidity premiums (in terms of project quality and lower market value, I think it is worthy of consideration for the coin listing team, and projects with real business needs and positive cash flow are scarce in the market)

Directly increase payment service charges. The current charging base is low, and the project has the ability to raise prices. Even if the price is increased by 100%, the asset creation fee paid to Metaplex is still extremely low for users and can be ignored. Of course, Metaplex also faces some potential risks and challenges, such as: The Solana Meme craze has subsided, causing the number of asset castings to decline rapidly and business revenue to decrease. Metaplex’s current revenue is charged in one lump sum according to the type of assets created. Projects with relatively fixed asset types cannot bring sustained income to Metaplex in the long term. Conclusion Different from the impression of most investors that "Metaplex is an NFT asset protocol", Metaplex is actually a basic protocol that serves all types of assets in the Solana ecosystem, and it has continued since the beginning of the year. A direct beneficiary of the Meme craze.

If we continue to be optimistic about the Solana ecosystem in the future, then Metaplex, which occupies the "upstream niche" of "asset issuance and management", is worthy of our long-term attention.

MULTICOIN CAPITAL, Multicoin: The first dCDN Pipe Network on Solana Interpretation Golden Finance, No license required dCDN can exceed licensed cCDN

JinseFinance

JinseFinanceCollectibles are big business, and we can create a whole new market design specifically for collectibles traders, called "Blockchain-Enabled Collectibles Marketplaces" (BECM).

JinseFinance

JinseFinanceOn March 6, Solana ecological DePIN protocol io.net announced the completion of a $30 million Series A financing. io.net stated that the funds raised will be used to build the world's largest decentralized GPU network and solve the AI computing shortage problem.

JinseFinance

JinseFinanceRobert Kiyosaki, the author of "Rich Dad Poor Dad," claimed on social media that Bitcoin will reach $100,000 by June 2024.

JinseFinance

JinseFinanceFilecoin DeFi basic primitive GLIF completed a round of financing of US$4.5 million, led by Multicoin Capital

JinseFinance

JinseFinanceValue focus theory, social networks for NFT collectors, stablecoin remittances in emerging markets, cryptocurrencies moving from products to supporting products, on-chain data, new forms of token distribution, zero-knowledge proofs, etc. are all crypto ideas worth paying attention to. .

JinseFinance

JinseFinance JinseFinance

JinseFinanceDitching the traditional 60/40 stock-bond mix for a blend of gold, silver, Bitcoin, and other assets. Amid Federal Reserve tightening and possible SEC crypto ETF approval, Robert Kiyosaki offers a bold hedge against financial turmoil.

YouQuan

YouQuanEven with Bitcoin, Ether and altcoins in a bear market, venture funding for the blockchain industry continues to grow.

Cointelegraph

CointelegraphDecentralized autonomous organizations continue to gain traction. In the case of Delphia, retail traders will be rewarded for contributing their personal data.

Cointelegraph

Cointelegraph