BTC has recently fluctuated and fallen to around $56,000. In July, the US asset management company VanEck predicted that the price of BTC will reach $2.9 million in 2050. In comparison, this is indeed a very amazing data.

So what should be the reasonable price of Bitcoin? $0, $50,000 or $1 million? Or even higher? In this article, Biteye will explore 4 Bitcoin valuation methods to help everyone understand the value of Bitcoin more comprehensively.

Bitcoin Valuation Methods

Traditional assets such as stocks and bonds have established a variety of mature and effective valuation methods. However, assessing the value of Bitcoin faces more challenges, and there is currently no single valuation method that is significantly better than other methods. The following are 4 more common Bitcoin valuation methods: production cost model, stock-to-flow model, Metcalfe's law, and AHR999 hoarding indicator.

Production cost model: Mining not only consumes a lot of electricity, but also requires other resources, so the mining cost can be regarded as the basic value of Bitcoin.

Stock-to-flow model: A higher stock-to-flow ratio usually means a higher scarcity of Bitcoin, which may drive its price up.

Metcalfe's law: This theory emphasizes that the increase in the number of network users has an exponential impact on the growth of value.

AHR999 hoarding indicator: Created by Weibo user ahr999, it assists Bitcoin fixed investment users to make investment decisions in combination with timing strategies.

Production cost model

Unlike fiat currencies such as the euro or the dollar, which are generated at almost no cost, Bitcoin is produced through a complex mining process. Therefore, the production cost of Bitcoin mainly refers to the mining cost.

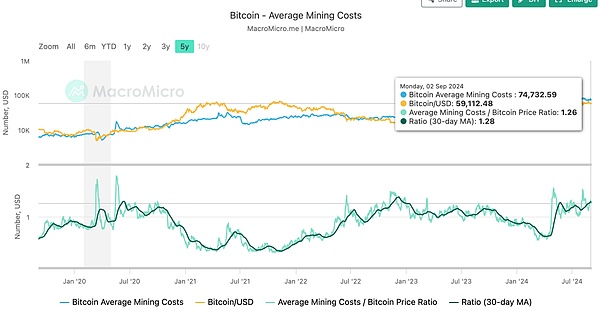

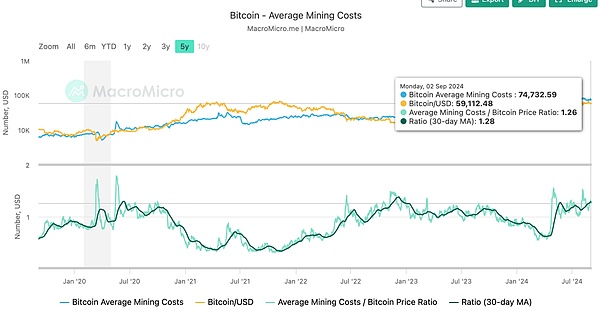

In the long run, the cost of mining one Bitcoin is usually close to the market price of Bitcoin.Mining costs can be regarded as a floor for Bitcoin prices, because historically Bitcoin prices have rarely been below mining costs for long periods of time. This phenomenon is partly due to the correlation between Bitcoin prices and the total computing power used for mining (i.e., hash rate), as well as the impact of the mining competitive environment, where less efficient miners are often forced to stop operations. The following figure shows the average mining cost of Bitcoin:

Data source: https://en.macromicro.me/charts/29435/bitcoin-production-total-cost

According to the MacroMicro website,As of September 2, 2024, the average mining cost of one Bitcoin is approximately $74,000, which is also the current valuation of Bitcoin calculated based on the production cost model.

Since the current price of Bitcoin is lower than this mining cost (the valuation calculated by the production cost model), this means that one of the following two situations may occur in the near future: one is that the number of miners decreases, and the other is that the price of Bitcoin rises to a level that exceeds the mining cost.

Stock-to-Flow Model

The stock-to-flow model, also known as S2F (Stock-to-Flow), is a method commonly used to assess the value of commodities. Specifically, "stock" refers to the current total supply of an asset, while "flow" refers to the annual increase in supply

The higher the ratio of stock/flow, the more scarce it is, because it takes longer to reach the current stock level. For example, if the stock of a commodity is 100 times the flow, it will take 100 years to replenish the current stock. In contrast, if the stock of a commodity is only 10 times the flow, it is not so scarce, because it only takes 10 years to replenish the current stock. Therefore, the stock-to-flow model provides us with a simple and effective way to measure the scarcity of commodities. This scarcity is an important factor affecting prices.

Bitcoin's Stock-to-Flow Ratio

As of August 2024, the number of bitcoins currently in circulation is about 19,750,000 (stock). Based on the current block reward of 3.125 bitcoins received by miners, a block is mined every ten minutes, and about 164,359 BTC are produced each year. Therefore, the stock-to-flow ratio of Bitcoin is:

19,750,000 / 164,359≈ 120.1

This ratio shows that at the current growth rate (flow), it will take about 120 years to reach the current circulation (stock).

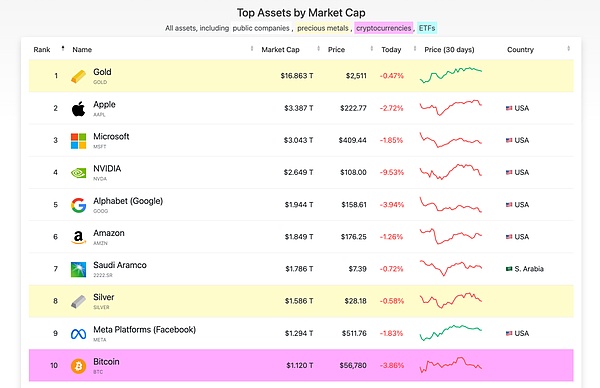

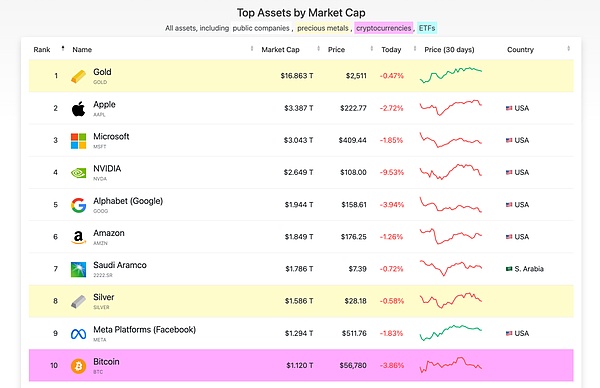

Next, let's look at the world's most important reserve asset - gold. According to the World Gold Council's data for 2023, the stock-to-flow ratio of gold is: 209000 / 3500≈ 59.7. Referring to the previous article, a higher stock-to-flow ratio means that the asset is more scarce. According to the stock-to-flow model, Bitcoin is about twice as scarce as gold! However, in August 2024, the total market value of gold is about 16.8 trillion US dollars, while the total market value of Bitcoin is about 1.1 trillion US dollars, which is only one sixteenth of the former.

Data source: https://companiesmarketcap.com/assets-by-market-cap/

Therefore, through the stock-to-flow model, it can be calculated that Bitcoin is twice as scarce as gold. If we simply and roughly count the market value of Bitcoin as twice that of gold, the result will be 33.6 trillion US dollars. In this way, the valuation of Bitcoin will reach an astonishing 1.708 million US dollars, which is 30.5 times the current value.

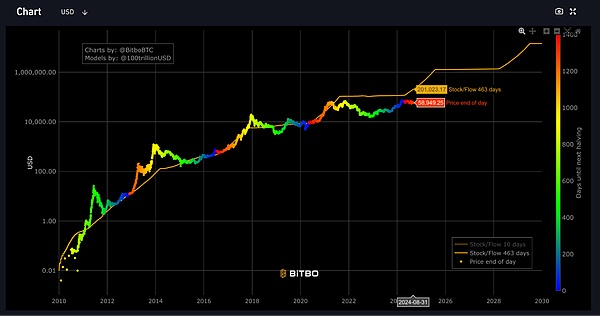

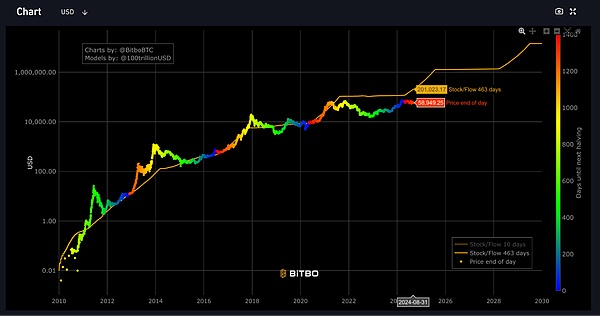

Of course, such a calculation lacks certain basis, after all, scarcity cannot be quantified. Therefore, we can also refer to the "Bitcoin Stock-to-Flow Ratio Real-time Chart", which calculates the valuation of Bitcoin in more detail. In the figure below, the yellow line represents the Bitcoin price calculated by the model, and the colored line represents the actual price of Bitcoin in the market. It should be noted that this indicator has begun to deviate since 2022, and the model predicts prices that are continuously higher than the actual price of Bitcoin. It is for reference only.

According to the "Bitcoin Stock-to-Flow Ratio Real-time Chart", the current valuation of Bitcoin should be $210,000.

Data source: https://charts.bitbo.io/stock-to-flow/

Metcalfe's Law

Metcalfe's Law is mainly used to evaluate the value of communication networks, but it also applies to blockchain technologies (such as Bitcoin).

According to this theory, the more users a network or technology has, the more attractive and valuable it is, and the value of the network is proportional to the square of the number of users. For example, if a network has 10 users, then the value of the network is proportional to the square of the number of users, that is, 10 * 10 = 100. If the number of users increases to 20, the value of the network will increase to 20 * 20 = 400. This shows that the value of the network grows exponentially with each new user, rather than linearly.

As of September 4, 2024, the number of Bitcoin addresses has doubled from about 26 million to 54 million in the past five years, about 2.076 times. According to Metcalfe's Law, the square of the growth of Bitcoin holders is proportional to the change in market value, so the market value of Bitcoin should be 4.3 times that of five years ago, and now one Bitcoin is valued at about $41,000.

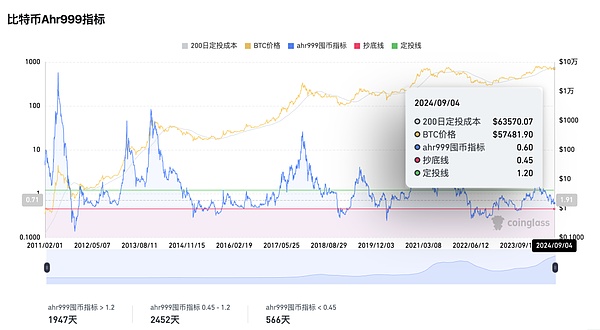

AHR999 Hoarding Index

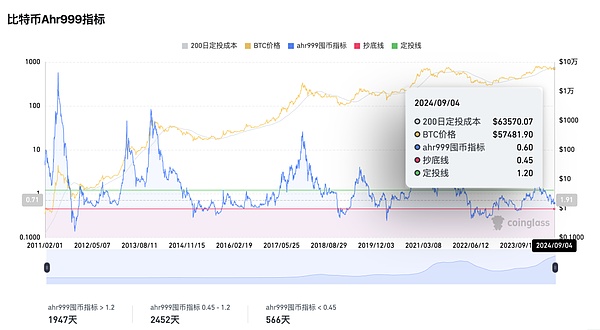

This index implies the rate of return of short-term fixed investment in Bitcoin and the deviation of Bitcoin price from expected valuation.

When ahr999 index < 0.45, you can buy at the bottom;

When ahr999 is between 0.45-1.2, it is suitable for fixed investment;

When ahr999 >1.2, the price of the currency is already relatively high and is not suitable for operation.

In the long run, the price of Bitcoin and the block height show a certain positive correlation. At the same time, with the advantages of fixed investment, users can control the cost of short-term fixed investment, so that most of them are below the price of Bitcoin.

ahr999 indicator = (Bitcoin price/200-day fixed investment cost) * (Bitcoin price/index growth valuation)

Calculated according to the Bitcoin price of $57,481.9 on September 4:

0.6 = (57,481.9/63,570.07) * (57,481.9/index growth valuation)

The conclusion is that the BTC index growth valuation is $86,628

Although this index growth valuation changes every day, it can be seen that Bitcoin is almost above 80,000.

Summary

These valuation methods have their own characteristics, which help us understand the value of Bitcoin more comprehensively. However, the final price change of Bitcoin still needs time to observe and verify, so be cautious in using this as a basis for investment.

JinseFinance

JinseFinance