In the past month, the price trend of pstake has attracted widespread attention from the market. Especially on March 7, its single-day increase reached an astonishing 25.82%, and the price was updated to 0.1549 USDT. During this period, pstake gained an overall 253%, highlighting its strong performance in the market.

It is worth noting that on March 5, pstake launched an automatic validator delegation strategy for stkATOM and launched an incentive plan containing 770k PSTAKE in February. These initiatives have enhanced the market’s interest in pstake. interest.

Below, we take a closer look at pstake and its potential impact on the cryptocurrency market.

pSTAKE Overview: Obtained strategic investment from Binance and focuses on providing staking services for POS public chain users

pSTAKE Finance, as a liquidity staking agreement, currently mainly serves Ethereum, BNBchain, Cosmos and other ecosystems. In the BNBchain ecosystem, pSTAKE competes with several other liquidity staking service providers such as Ankr and Stader, and is positioned with a medium fee rate. Although it ranks third in the number of BNB pledges, it is especially favored by large-scale traders due to its diversified ecological cooperation and low transaction slippage.

pSTAKE’s main competitive advantage comes from Binance’s strategic investment, which not only enhances the application breadth of its stkBNB products in the BNBchain ecosystem, but also meets the on-chain financial needs of most users and maintains Excellent liquidity. This comprehensive ecological support provides a solid foundation for pSTAKE's staking services and future business expansion.

In terms of service targets, pSTAKE focuses on providing pledge services for users holding POS public chain tokens, ensuring security through the verifier scoring system. Currently, pSTAKE has covered the pledge of ATOM, XPRT, ETH, BNB and other assets, and plans to expand to more public chains. In terms of verifier cooperation, pSTAKE has chosen well-known partners such as Figment and Chorus One to ensure the reliability of the service.

pSTAKE not only provides multi-chain staking services, but its liquidity staking model also extends to multiple DeFi application scenarios. For example, stkBNB certificates are widely used, from Beefy Finance to OpenLeverage, and the application of pSTAKE staking certificates demonstrates that it can not only provide staking services, but also bring more financial options and value-added opportunities to users. Although cooperation in application scenarios for certain assets such as stkATOM and stkETH has been slow to advance, its comprehensive services and cooperation models still demonstrate strong business expansion capabilities and market competitiveness.

Implementing the automatic verifier delegation strategy for stkATOM, pSTAKE strengthens the comprehensive binding with the Cosmos ecosystem

pSTAKE implemented the automatic verifier delegation strategy for stkATOM on March 5, marking the It is an important step towards enhancing decentralization and security. This strategy aims to promote the widespread adoption of ATOM and expand its application in the DeFi field by selecting high-quality validators, while ensuring the decentralization and enhanced security of the network. This change reflects pSTAKE’s view of decentralization as a core value and a community-driven approach to electing validators to ensure the health and security of the network.

Choosing the right validator is crucial to ensuring the security and integrity of the Proof of Stake (PoS) ecosystem. The challenge faced by pSTAKE is how to make the best choice among many validators to avoid concentration of power and keep the network decentralized. To address this challenge, pSTAKE adopts a governance-driven approach to simplify and automate the validator selection process by deciding the addition or removal of validators through community proposals. This strategy not only promotes decentralization, but also increases the transparency and trustworthiness of the network, laying the foundation for long-term scalability.

pSTAKE’s automatic validator equity delegation strategy uses a weighted scoring mechanism to optimize validator selection and equity distribution. By transparently collecting and analyzing on-chain data, and performing regular stake rebalancing, this strategy maintains consistency with the Cosmos Hub validator set and effectively reduces the risk of centralization. In addition, this automated and data-driven process not only increases operational transparency, but also minimizes potential risks and ensures the security of the network and its participants by spreading bets and dynamically adjusting staking allocations.

By incentivizing validators to maintain high standards of performance and governance, pSTAKE further facilitates coordination with the Cosmos Hub, supporting the construction of a more secure, efficient and decentralized ecosystem. Currently, pSTAKE not only has the support of Cosmos Hub, but also successfully attracted 600,000 ATOM for liquidity staking in 2023 and provided stkATOM liquidity for DEX in Cosmos. This cooperation greatly promotes the growth of pSTAKE and ensures the alignment of goals between ATOM holders, Cosmos Hub and pSTAKE.

In 2024, pSTAKE will cover more mainstream chains and corresponding assets, and provide stronger liquidity

In the past few years, through PSTAKE governance, pSTAKE has continuously launched new products such as stkBNB, stkATOM and stkOSMO, and have conducted multiple successful protocol upgrades based on market demand. These efforts have promoted the rapid growth of pSTAKE. As of now, its TVL has exceeded US$16 million, covering multiple assets such as ATOM, BNB, OSMO and DYDX.

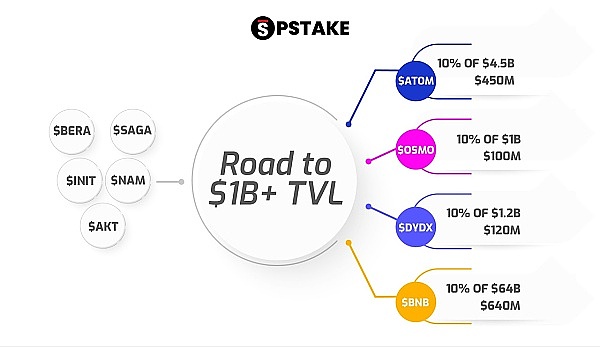

In 2024, pSTAKE has a clear goal: to become the most famous liquidity staking provider for TVL in the Cosmos ecosystem and BNB chain. Currently, stkToken products have been integrated with more than 15 leading DeFi protocols, providing more than $12 million in liquidity and meeting the real needs of Stake AND DeFi. As the Cosmos ecosystem continues to grow and new application chains are added, pSTAKE faces a unique opportunity to capture a significant share of the liquid staking market.

pSTAKE has played a key role in driving DeFi adoption and blockchain decentralization through its innovative liquidity staking solution. In 2024 and beyond, pSTAKE will continue to explore new growth opportunities and further solidify its leadership in the DeFi space by staking 10% of the total supply to existing assets such as ATOM, OSMO and DYDX through its platform. For the BNB chain, although it is still in its infancy, its liquidity staking market has huge potential. With its early market entry advantage, pSTAKE is expected to play a central role in the development of the BNB chain’s DeFi ecosystem.

In short, pSTAKE is on the threshold of becoming a leader in liquidity staking, not only in the Cosmos ecosystem, but also in the BNB chain. Through continuous innovation and improvement, pSTAKE is committed to shaping the future of cryptocurrency liquidity staking and contributing to the development of the DeFi ecosystem.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Miyuki

Miyuki Cheng Yuan

Cheng Yuan Brian

Brian JinseFinance

JinseFinance Sanya

Sanya Catherine

Catherine Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist