Author: Snow Translator: Paine

Report Highlights

Restaking is a mechanism to increase yields by releasing liquidity and increasing leverage, mainly based on Ethereum's security framework. Although it can provide additional returns to stakers and improve the efficiency of fund use, it also brings a series of risks, including fines, liquidity, centralization, contracts, and smart contract risks. EigenLayer is a pioneer in this field, but with the participation of more and more competitors such as Symbiotic, Karak Network, Babylon, BounceBit and Solayer, the market funds are dispersed and may face more challenges in the future. Users need to carefully consider the risks and benefits of participating in the restaking agreement and configure corresponding contract monitoring to ensure the safety of assets.

Background

Staking and Liquid Staking

Ethereum staking refers to users locking their ETH in the Ethereum network to support the operation and security of the network. In Ethereum 2.0, this staking mechanism is part of the Proof of Stake (PoS) consensus algorithm, replacing the previous Proof of Work (PoW) mechanism. Stakers become validators by staking ETH and participate in the creation and confirmation of blocks. In return, they can receive staking rewards.

Liquid Staking Derivatives (LSD) was born to solve the liquidity problem in traditional staking. It allows users to obtain liquidity tokens representing their staked shares (such as Lido's stETH or Rocket Pool's rETH) while staking tokens. These liquidity tokens can be traded, loaned, or used for other financial activities on other platforms, which can not only participate in staking to obtain rewards, but also maintain the flexibility of funds.

Trust network broken

Since its inception, the Bitcoin network has introduced the concept of decentralized trust and is designed to be a peer-to-peer digital currency system based on UTXO and scripting language. However, its ability to build various applications on the network is limited. Later, Ethereum, through a highly programmable virtual machine (EVM) and modular blockchain concepts, allowed developers to build permissionless decentralized applications (DApps) on its consensus layer, providing trust and security for all DApps built on it. However, there are still many protocols or middleware that fail to fully utilize Ethereum's trust network.

For example, Rollup effectively improves Ethereum's performance by separating transaction execution from EVM and returning Ethereum only when the transaction is settled. However, these transactions are not deployed and verified on EVM, so they cannot fully rely on Ethereum's trust network. In addition to Rollup, other systems based on new consensus protocols such as sidechains, data availability layers, new virtual machines, oracles, and cross-chain bridges also face similar challenges. They all need to build their own trust layer to ensure security and prevent malicious behavior, namely active verification services (AVS).

Liquidity Fragmentation

As the largest proof-of-stake (PoS) blockchain, Ethereum relies on staking to ensure its security for many projects, such as cross-chain bridges, oracles, data availability layers, and zero-knowledge proofs. Therefore, whenever a new project is launched, users must lock up a certain amount of funds, which will cause different projects to compete for a limited pool of funds. As the staking yields offered by different projects continue to rise, the risks borne by the projects themselves also increase accordingly, forming a vicious circle. On the other hand, users can only stake limited funds to limited projects and obtain limited returns, resulting in low capital utilization. With the increase in public chains, applications, and various projects, liquidity is becoming more and more fragmented.

Market demand for staking services

With the passage of the Bitcoin spot ETF and the successful Ethereum Cancun upgrade, Ethereum has regained new vitality. As of July 15, 2024, more than $111 billion of Ethereum (ETH) has been staked, accounting for 28% of the total supply. The amount of staked ETH is called Ethereum's "security budget" because these assets are punished by the network in the event of double-spending attacks and other violations of protocol rules. Users who stake ETH contribute to enhancing the security of Ethereum and are rewarded through protocol issuance, priority tips, and MEV. Users can easily stake ETH through liquid staking pools without sacrificing the liquidity of assets, which leads to an increasing demand for staking.

Against this backdrop, the market demand for shared security has emerged, requiring a platform that can use user staked assets for security assurance across multiple projects, which is the context for the emergence of restaking.

What is restaking?

Today, modular expansion of blockchains has led to the birth of many new protocols and supporting middleware. However, each network needs to build its own security mechanism, usually using a variant of the Proof of Stake (PoS) consensus, but this approach results in each security pool becoming an isolated individual.

Restaking is the process of using the economic and computational resources of one blockchain to protect multiple blockchains. In PoS blockchains, restaking allows the staked weight and validator set of one chain to be used on any number of other chains. Liquid staked tokens that have already been staked on Ethereum are used to stake again for validators on other blockchains to gain more benefits and improve the security and decentralization of the new network. The result is a more unified and efficient security system that can be shared by multiple blockchain ecosystems. This concept extends Ethereum's existing economic trust to protect other distributed systems, such as oracles, bridges, or sidechains.

The concept of re-staking has been around in the industry for many years, and the Polkadot ecosystem tried it in 2020. Cosmos launched a re-staking model called "Replicated Security" in May 2023; in June of the same year, Ethereum introduced a similar model through EigenLayer. The main value of the re-staking protocol comes from the staked funds locked in Ethereum, making Ethereum, as a PoS blockchain, the most economically secure.

An important difference between the re-staking mechanism and the liquidity staking mechanism is that while both mechanisms can help ETH that has been staked on Ethereum to gain more benefits, the re-staking mechanism fully follows the trust consensus of the staking mechanism and expands it, enabling validators to make credible commitments to more applications, infrastructure, or distributed networks, thereby improving the overall economic security of the Ethereum ecosystem.

How Re-staking Works

The core of re-staking is to use the assets of the liquidity staking token to stake on validators of other blockchains, gain more benefits, and establish a shared security pool to improve the security and decentralization of the new network. Specifically, the Liquidity Staking Token (LST) represents the tokenized form of staked ETH and accumulated rewards, while the Liquidity Re-staking Token (LRT) represents the tokenized form of re-staking ETH and accumulated rewards. Re-staking is built on the security framework of Ethereum and aims to optimize the efficiency of capital utilization in the cryptocurrency ecosystem. Stakers are not only able to support the security of one network, but also provide verification services for multiple networks, thereby earning additional rewards.

The main problem facing re-staking is still liquidity. Similar to PoS staking, the re-staking assets are locked in the node, resulting in limited liquidity. To solve this problem, Liquid Restaked Token (LRT) was introduced. LRT is a synthetic token issued for re-staking ETH or other LST, used by multiple active verification services (AVS) to ensure the security of applications and networks, and distribute multiple different types of additional rewards. It enables the staked assets to provide security support in multiple services while bringing additional rewards and returns to stakers. Therefore, although there are some detailed risks in the re-staking process, it brings important liquidity and benefits to stakers and DeFi.

Track Analysis

Competitive Projects

EigenLayer

EigenLayer is a leader in the re-staking field and currently has no direct competitors of scale. As an innovative concept, there are relatively few direct competitors in the market. However, EigenLayer may face the following potential competition and challenges:

Other LSD protocols may develop their own re-staking functions, such as Lido Finance and Rocket Pool.

Other data availability and governance service protocols may develop their own LSD functions, such as The Graph and Aragon.

Other Layer 2 or cross-chain protocols may develop their own security and trust networks, such as Polygon and Cosmos.

Since EigenLayer mainly uses LSD as collateral, LSDFi projects on the market may also compete for LSD's market share.

Karak Network

Karak Network operates similarly to the EigenLayer protocol, but its AVS service is called Distributed Security Service (DSS), and it has launched its own Layer 2 network K2. Unlike EigenLayer, Karak aims to support re-pledge of any asset. Currently, the re-pledge assets supported on the platform include ETH, various LST and LRT assets, and stablecoins such as USDT, USDC, DAI, and USDe. In addition, Karak has been deployed on Ethereum, Arbitrum, BSC, Blast and Mantle, and users can choose to re-stake according to their asset distribution.

Babylon

Babylon is a Bitcoin-based re-staking protocol that introduces a staking function to Bitcoin, enabling BTC holders to trustlessly stake their assets to other protocols or services that require security and trust, and obtain PoS staking benefits and governance rights. Babylon covers two aspects: first, BTC holders can stake BTC to provide security and credibility for other protocols and gain benefits from them; second, new protocols in the PoS chain or Bitcoin ecosystem can use BTC stakers as verification nodes to improve security and efficiency.

Solayer

Solayer is a re-staking protocol for the Solana ecosystem, supporting SOL holders to stake their assets in protocols or DApp services that require security and trust within the Solana ecosystem to obtain more PoS staking income. Solayer has completed the builder round of financing, and investors include Solana Labs co-founder Anatoly Yakovenko, Solend founder Rooter, Tensor co-founder Richard Wu, Polygon co-founder Sandeep Nailwal, etc. Solayer supports users to deposit native SOL, mSOL, JitoSOL and other assets. As of July 15, 2024, the total locked value (TVL) on the Solayer platform exceeded US$105 million, of which SOL accounted for about 60%.

Picasso

Picasso is a general-purpose re-staking blockchain built on the Cosmos SDK. It connects to the base chain through the IBC protocol and handles the details of the deposited assets, and then allocates the funds to AVS. Picasso's re-staking solution is similar to EigenLayer, which allows subsets of the network to join to protect AVS weight. This architecture has been replicated on multiple base chains and unified on Picasso. Picasso's node operators are selected by a governance mechanism. Currently, Picasso's re-staking layer only accepts assets deposited from Solana through SOL LST and native SOL as re-staking collateral. Picasso's roadmap plans to expand to Cosmos chains and other assets after launching AVS on Solana. Currently, the re-staking products supported on Picasso include LST assets such as SOL, JitoSOL, mSOL, and bSOL.

Universal Re-Pledge Protocol

Universal Re-Pledge is a system that enables the centralization of native assets on multiple chains for re-pledge. This approach is agnostic to specific assets and base chains, allowing many pledged assets to be centralized across multiple chains. Universal Re-Pledge relies on an additional layer between the economic security source chain and AVS, or a series of contracts across multiple blockchains.

Overview

The re-pledge field is currently developing rapidly. Although EigenLayer is a pioneer in this field, more and more competitors and innovators are joining in, constantly expanding the application scenarios and technical boundaries of re-pledge. Re-pledge not only brings new revenue models, but also promotes the security and liquidity of the blockchain ecosystem.

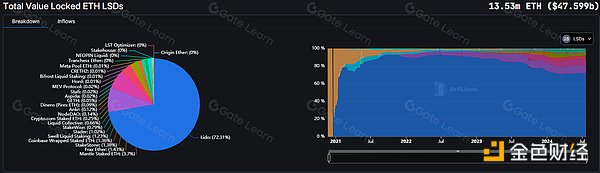

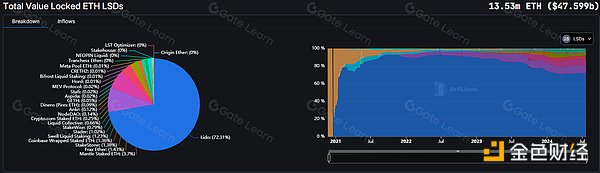

Market size

According to DeFiLlama, as of July 21, 2024, the total locked value of the global ETH liquidity staking market is US$47.599 billion. Lido is the largest participant, with a locked value share of up to 72.31%. Lido provides a liquidity staking solution that allows users to stake ETH to the Ethereum 2.0 network and receive an equivalent value of stETH tokens, which can be used or re-staked in the DeFi market. Major re-staking protocols include EigenLayer and Tenet, among others.

Source: https://defillama.com/lsd

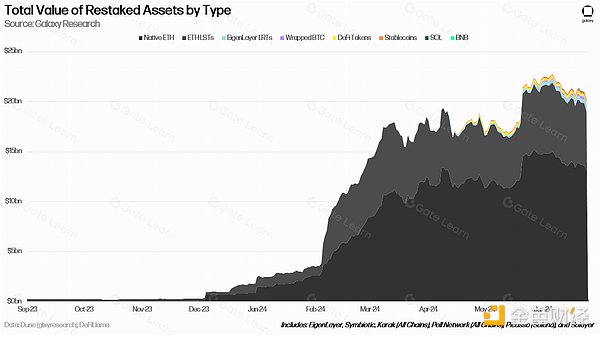

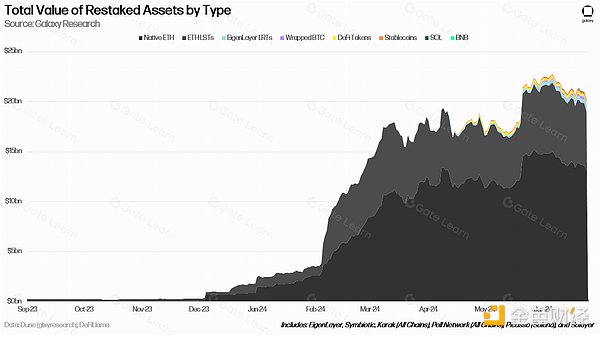

As of June 25, 2024, the total locked value of assets in the global re-pledge market has reached US$20.14 billion. At present, most re-pledge protocols are deployed on the Ethereum chain, and the total locked value of ETH and derivative assets re-pledged has reached US$19.4 billion; in addition, through the re-pledge protocol on the Solana chain, for example: Picasso and Solayer pledged assets worth US$58.5 million; through Pell Network and Karak on various chains (including Bitlayer, Merlin and BSC, etc.) , BTC worth US$223.3 million has been re-pledged.

The chart below shows the total locked value of re-staked assets for the leading re-staked solutions (EigenLayer, Karak, Symbiotic, Solayer, Picasso, and Pell Network) by total locked value. Overall, the total amount of assets re-staked is over $20 billion. Most of it comes from natively re-staked ETH and ETH LST, and the top three categories of re-staked assets by TVL are all centered around ETH.

Source: https://x.com/ZackPokorny_

Core Competitive Factors

Asset Scale

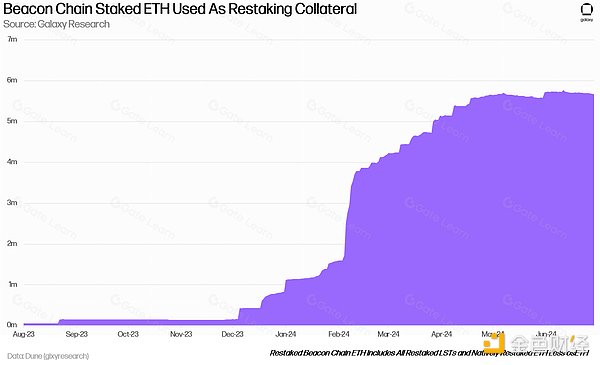

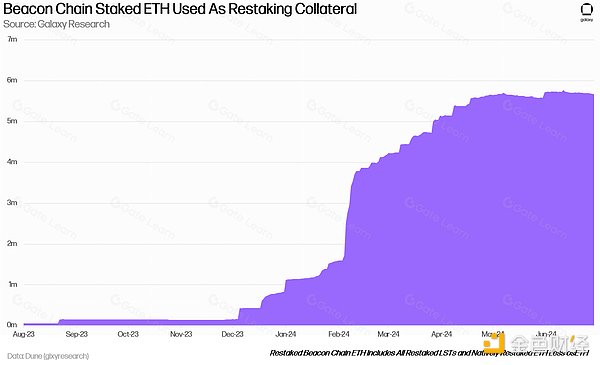

Asset scale is the total amount of pledged assets in the pledge platform. A high-quality pledge platform should have large-scale assets to demonstrate its stability and credibility. For example, EigenLayer currently has 5,842,593 Ethereum pledged, with a total TVL of more than 18 billion US dollars, becoming the largest protocol in the re-staking field.

Source: https://dune.com/hahahash/eigenlayer

Yield

Re-staking projects should provide higher yields than single staking to attract user participation. To this end, it is necessary to optimize staking strategies, reasonably allocate income and rewards, and use compound interest effects to improve users' capital efficiency and rate of return. For example, in the re-staking plan proposed by Eigenlayer, in addition to staking Ethereum to obtain income, liquidity tokens can also obtain income in other cross-chain bridges, oracles, LP staking, etc.

Staking Ethereum income. Such as stETH obtained through liquidity pledge protocols such as Lido;

Token rewards for node construction and verification by cooperative project parties;

LP rewards for DeFi staking liquidity tokens.

Liquidity

Re-pledge projects need to solve the liquidity problem of pledged assets so that users can easily join or exit pledges, or transfer assets to other protocols or platforms. Therefore, it is necessary to provide services such as liquidity pledge tokens, liquidity mining, and lending markets to enhance user liquidity and flexibility.

Security

Protecting the security of user assets is the primary goal of pledge projects. Re-pledge projects must ensure that user assets will not be damaged due to smart contract vulnerabilities, validator misconduct, or hacker attacks. Therefore, high-level security measures and risk management mechanisms are essential, such as multi-signature, firewall, insurance and penalty mechanisms. For example, EigenLayer becomes a verification node by staking Ethereum-related assets, and borrows the security of the main network through the penalty mechanism.

Ecosystem

Re-staking projects need to build a strong ecosystem to support verification services for multiple PoS networks and protocols, thereby enhancing the security and decentralization of the network and providing users with more choices and opportunities. To achieve this goal, cooperation and integration with other blockchain platforms, DeFi applications and Layer 2 protocols are needed.

What risks does re-staking bring?

Slashing Risk

There is a 50% slashing risk in Ethereum's staking mechanism, as well as in the re-staking protocol. This means that users' funds may be at risk of being slashed, although this risk will be spread across multiple nodes.

Liquidity Risk

Many re-staking protocols lock up a large amount of Liquid Re-Staking Tokens (LST). If a large portion of LST is locked up in the re-staking pool, it could lead to increased volatility in the price of LST relative to ETH. This situation increases users' risk exposure because the security of AVS is directly related to the liquidity of LST. When a certain type of LST is too concentrated in AVS, liquidity risk is further increased.

Centralization Risk

Centralization risk may cause DAO hacker attacks. For example, if one-third of ETH is concentrated in a single AVS, exceeding the traditional Byzantine fault tolerance security threshold, this part of ETH may be fined for not submitting fraud proofs, rather than due to technical issues such as double signing. Centralization risk means that the degree of coupling in the system increases, increasing the overall vulnerability of the system.

Contract Risk

Participating in re-staking requires interaction with the project party's contract, so users need to bear the risk of contract attacks. Project funds are ultimately stored in contracts of protocols such as EigenLayer. If the contract is attacked, the user's funds will also suffer losses.

LST Risks

LST tokens may be decoupled, or their value may deviate due to LST contract upgrades or attacks.

Exit Risk

Except for EigenLayer, most of the mainstream re-pledge protocols on the market do not support withdrawals. If the project fails to implement the corresponding withdrawal logic through contract upgrades, users will not be able to withdraw assets and can only exit liquidity through the secondary market.

How to mitigate these risks?

Re-pledge is an emerging concept. Neither the contract layer nor the protocol layer has been tested by time. In addition to the risks listed above, there may be other unknown risks. How to reduce risks is particularly important.

Fund Allocation

For users who use large amounts of funds to participate in re-staking, directly participating in EigenLayer's Native ETH re-staking is an ideal choice. Because in Native ETH re-staking, the ETH assets recharged by users are not stored in the EigenLayer contract, but in the Beacon chain contract. Even if the worst contract attack occurs, the attacker cannot immediately obtain the user's assets.

Source: https://x.com/ZackPokorny

(Currently, 33.4 million ETH are staked on Beacon Chain (including ETH in the entry/exit queue).)

For users who want to use large amounts of funds to participate but are unwilling to wait for a long redemption time, they can choose the relatively safe stETH as a participating asset and invest directly in EigenLayer.

For users who want to earn additional income, they can invest part of their funds in projects built on EigenLayer, such as Puffer, KelpDAO, Eigenpie and Renzo, according to their own risk tolerance. However, it should be noted that these projects have not yet implemented the corresponding withdrawal logic. Participants need to consider the exit risk at the same time and pay attention to the liquidity of the relevant LRT in the secondary market during the investment process.

Monitoring Configuration

The currently mentioned projects all have the ability to upgrade and suspend contracts, and the multi-signature wallet of the project party can perform high-risk operations. For advanced users, it is recommended to configure the corresponding contract monitoring system to monitor the upgrade of relevant contracts and the execution of sensitive operations of the project party.

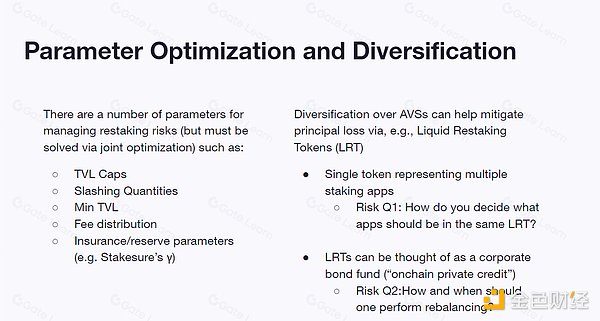

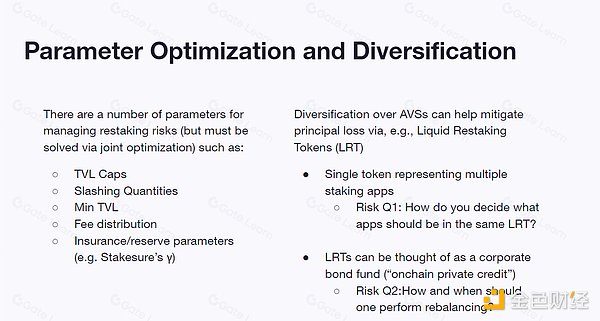

Optimize Parameters

Optimize re-pledge parameters (TVL cap, slashing amount, fee allocation, minimum TVL, etc.) and ensure the diversification of funds between AVS. The re-pledge protocol allows users to choose different risk profiles when re-pledge deposits. Ideally, each user will be able to evaluate and choose which AVS to re-pledge without delegating this process to the DAO.

Source: https://docs.google.com/presentation/d/1iIVu6ywaCqlTwJJbbj5dX07ReSELRJlA/edit?pli=1#slide=id.p23

Challenges

From the perspective of application chains, re-staking applications represented by EigenLayer can meet the needs of small and medium-sized application chains to reduce node deployment costs. However, these application chains cannot fully meet their security requirements, and the sustainability of their needs is relatively weak.

From a competitive perspective, although the re-staking track has a huge amount of funds, as more and more re-staking applications are launched, market funds will be dispersed. If the profits of re-staking applications such as EigenLayer decline, for example, in a bear market downturn, the demand for application chains will drop sharply, will it lead to a run on funds?

From the perspective of partners, EigenLayer initially developed 14 AVS partners. Although AVS may be attracted by potential returns in the early stage, the security risks of the re-staking mechanism may affect the willingness of subsequent AVS operators to join.

From the user's perspective, users may not be able to obtain rich staking returns in the short term. The uncertainty of staking yields may have a negative impact on the growth of the number of users in the future.

Alex

Alex